Gold Price Smashes $2,775 – Is a Break Above $2,800 Inevitable?

XAU/USD is testing a critical resistance level after hitting a fresh weekly high. Will gold bulls push past $2,800, or is a pullback coming before the next big move? | That's TradingNEWS

Gold Price (XAU/USD) Poised for a Breakout: Will $2,800 Hold or Collapse?

Gold (XAU/USD) Breaks Above $2,775: Is a New Record on the Horizon?

Gold prices have surged past $2,775, riding a wave of bullish momentum driven by a weakening U.S. dollar, falling Treasury yields, and rising geopolitical tensions. Investors are now watching the critical $2,800 resistance level, with speculation mounting over whether gold can sustain its rally or if a pullback is imminent.

Federal Reserve’s Policy and Interest Rate Outlook Keep Gold on the Move

The Federal Reserve's decision to maintain interest rates has reinforced the gold market’s strength, as expectations of a rate cut later in 2025 grow. Fed Chair Jerome Powell’s cautious tone on inflation and the economic outlook suggests that interest rates will remain elevated for an extended period, keeping pressure on the U.S. dollar and supporting gold’s uptrend.

The market is now pricing in a potential rate cut by mid-2025, which would weaken the dollar further and push gold toward new highs. However, if inflation data surprises to the upside, the Fed may maintain a hawkish stance, creating short-term resistance for gold.

Bond Yields Decline, Fueling Gold’s Upside Momentum

The U.S. 10-year Treasury yield has struggled to gain traction, currently sitting around 4.5%, after briefly spiking post-FOMC meeting. Historically, lower yields reduce the opportunity cost of holding gold, increasing its appeal. If yields continue their downward trend, gold could find itself in a position to test $2,800 and beyond.

Trump’s Trade Tariffs and Economic Uncertainty Drive Safe-Haven Demand

Gold has benefited from rising uncertainty surrounding Donald Trump’s proposed trade tariffs, which have stoked fears of inflation and economic disruptions. Trump’s stance on imposing a 10% tariff on all imported goods has markets on edge, with investors flocking to safe-haven assets. This uncertainty has fueled gold’s rally, as traders seek protection from potential market instability.

Additionally, gold shipments from London to New York have surged, indicating a shift in demand toward U.S. markets amid concerns over economic fallout from these proposed tariffs. The premium on COMEX gold futures over London spot prices has widened, signaling increased buying pressure and a potential supply squeeze in the U.S. market.

Gold Price Faces Key Resistance at $2,800 – What’s Next?

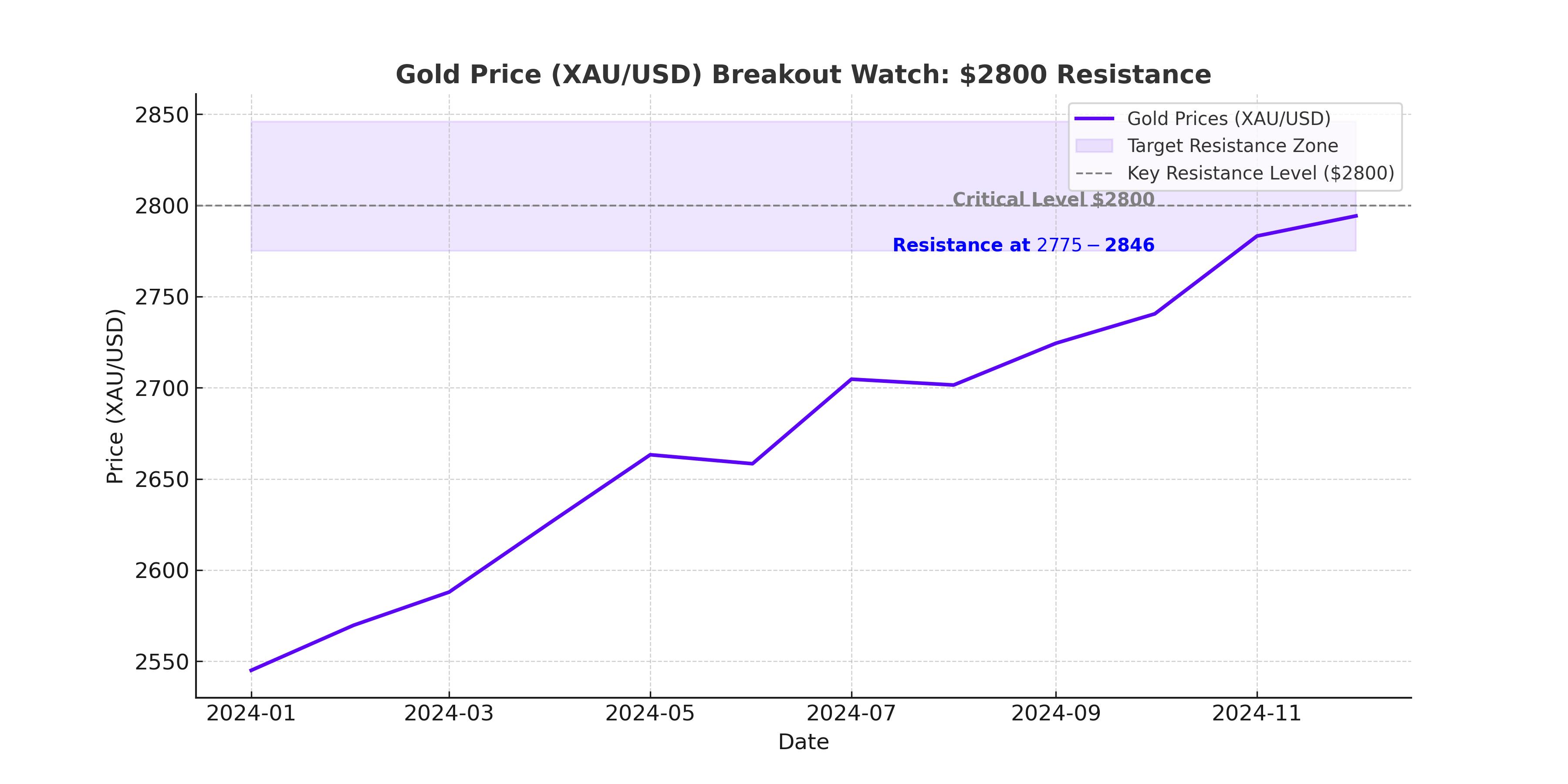

From a technical perspective, gold has decisively broken above the $2,775 resistance level, and bulls are now eyeing the next major hurdle at $2,800. A sustained move above this level could open the door for a test of $2,846, the all-time high from 2024.

However, if gold fails to hold above $2,772-2,775, a correction toward $2,745-2,750 could occur, with further downside risk extending to $2,707. Any dip is likely to attract buyers, given the strong long-term bullish trend.

Gold’s Liquidity and ETF Inflows Signal Strong Market Support

The SPDR Gold Trust (NYSEARCA: GLD) has seen a 0.6% increase in holdings this week, bringing its total bullion backing to 860 tonnes—the highest level since last Wednesday. This rise in ETF inflows reflects growing investor confidence in gold’s long-term trajectory.

In contrast, the iShares Gold Trust (IAU) has remained unchanged, suggesting that institutional demand is primarily driving the rally. Meanwhile, silver prices have also surged, with March silver futures hitting $32.08, reinforcing the strength of the precious metals market.

Is Gold a Buy, Sell, or Hold at These Levels?

The gold market remains firmly bullish, with technical and fundamental factors supporting further gains. However, the key question remains: Can gold break above $2,800 and sustain its rally, or will we see a pullback before the next leg higher?

With the Federal Reserve maintaining its current stance, falling bond yields, and Trump’s trade policies increasing uncertainty, the case for higher gold prices remains intact. If gold holds above $2,775 and breaks $2,800, a run toward $2,846 and beyond becomes a strong possibility. However, any failure to sustain these levels could trigger a retracement, offering buying opportunities for long-term investors.

At this stage, gold remains a strong buy, with $2,800 as the key level to watch. A confirmed breakout above this threshold could push gold toward $2,846-2,850, while a dip to $2,750-2,720 would likely be seen as a buying opportunity before another rally.