Gold Prices Soar to $2,463 on Fed Rate Cut Speculation

Precious Metal Gains Momentum with Market Anticipation of Federal Reserve Policy Shift and Rising Middle East Conflicts | That's TradingNEWS

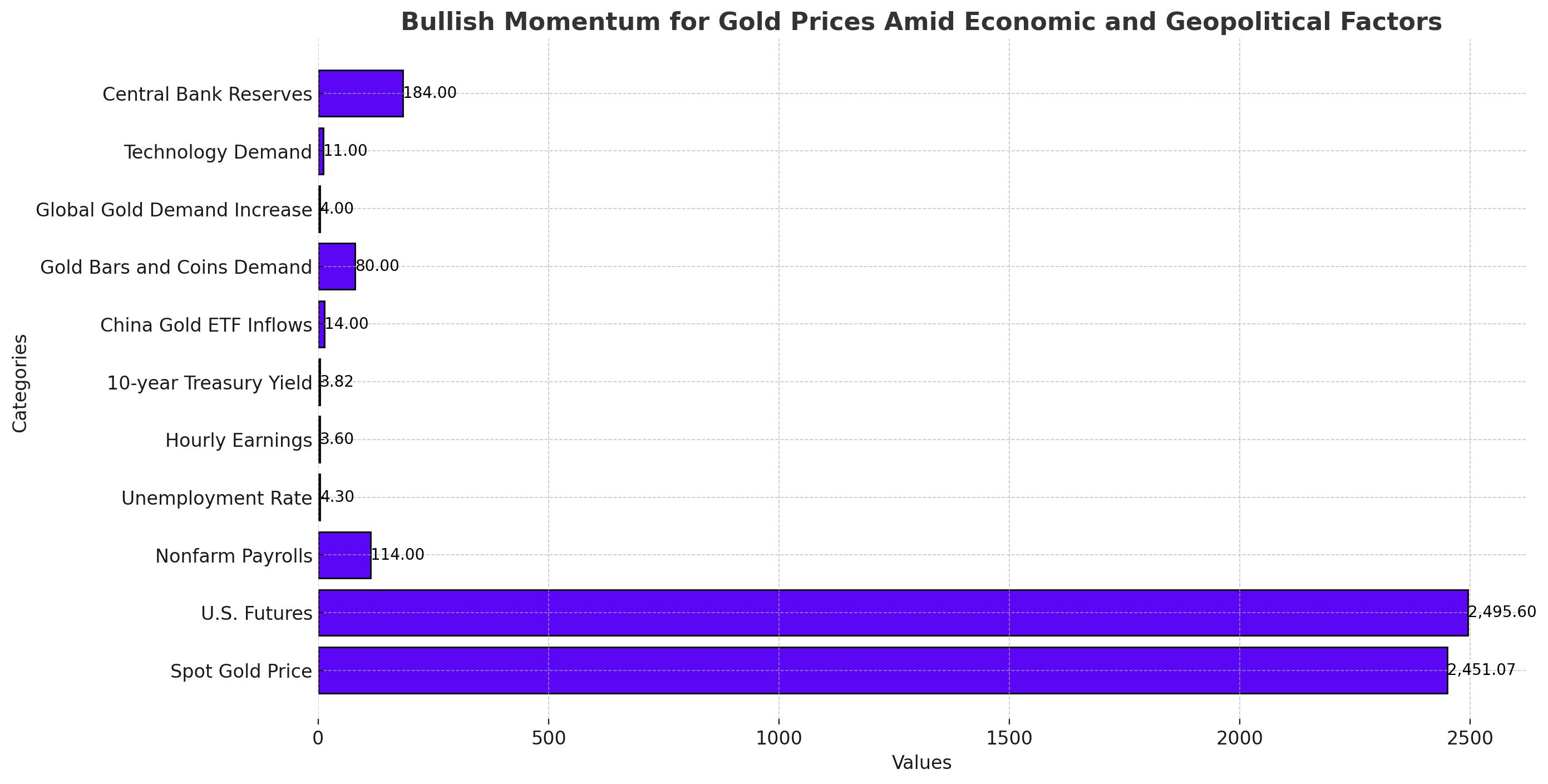

Bullish Momentum for Gold Prices Amid Economic and Geopolitical Factors

Federal Reserve Expectations and Gold Prices

Gold prices have surged, with spot gold reaching $2,451.07 per ounce, reflecting a weekly gain of over 2%. This uptick is driven by the anticipation of a Federal Reserve rate cut in September. U.S. futures climbed 0.6% to $2,495.60. Federal Reserve Chair Jerome Powell indicated potential interest rate reductions, contingent on the U.S. economy’s performance. Lower interest rates decrease the opportunity cost of holding non-yielding assets like gold, making it an attractive investment.

Impact of U.S. Economic Data

The U.S. Nonfarm Payrolls (NFP) report for July showed a significant slowdown in labor market conditions, with fresh payrolls at 114,000, below the expected 175,000. The Unemployment Rate rose to 4.3%, and Average Hourly Earnings data grew at a slower annual pace of 3.6%. These indicators suggest a weakening labor market, which supports the likelihood of a Fed rate cut. Consequently, U.S. bond yields have nosedived, with the 10-year Treasury yield hitting a six-month low of 3.82%, further boosting gold's appeal.

Geopolitical Tensions and Safe-Haven Demand

Deepening geopolitical tensions, particularly between Iran and Israel, have bolstered gold’s safe-haven appeal. Iran has vowed retaliation for the killing of Hamas leader Ismail Haniyeh by an Israeli air strike in Tehran, raising fears of broader conflict in the Middle East. Historically, gold prices benefit from such geopolitical uncertainties, as investors seek to protect their assets.

Global Gold Demand and Chinese Market Dynamics

Investment sentiment in China towards gold has risen significantly, with gold ETF inflows reaching approximately 14 billion yuan ($2 billion) in the second quarter, marking a record high. Investment in gold bars and coins surged to 80 tons last quarter, a 62% year-on-year increase, the strongest performance since 2013. However, demand for gold jewelry in China hit a second-quarter low not seen since 2009, due to high gold prices and slower economic growth. The World Gold Council reports that global gold demand in the second quarter increased by 4% year-on-year to 1,258 tons, with the average gold price for the quarter at $2,338 per ounce.

Technological and Central Bank Gold Demand

Gold used in technology jumped 11% year-on-year in the first half, driven by the AI trend. Central banks globally increased their gold reserves by 184 tons in the second quarter, a 6% rise year-on-year. Although China’s central bank maintained its gold reserves at 2,264 tons in May and June, the World Gold Council anticipates continued global central bank purchases over the next 12 months.

Market Sentiment and Price Outlook

Gold prices have seen their best week since April, supported by safe-haven demand and expectations of Federal Reserve rate cuts. Spot gold was up 0.7% at $2,463.46 per ounce, nearing the record peak of $2,483.60. U.S. gold futures rose 1.1% to $2,508.00. Analysts predict that if U.S. economic data continues to show weakness, the year-end target of $2,500 could be reached sooner. Geopolitical tensions, rising debt concerns, and renewed demand from central banks and ETF investors also contribute to the bullish outlook for gold. UBS expects central bank gold purchases to remain robust, potentially reaching 1,000 tons this year.

Other Precious Metals

Spot silver increased by 1.5% to $28.97 per ounce, platinum rose 1.4% to $969.52, and palladium gained 0.6% to $910.25, with all three metals heading for weekly gains.

Gold’s current bullish trend is underpinned by a complex interplay of economic indicators, geopolitical tensions, and strategic market moves, making it a focal point for investors seeking stability and growth.

That's TradingNEWS

Kazakhstan's Record Oil Production: How Will It Affect Global Oil Prices?

WTI and Brent Oil Surge Amid Geopolitical Risks – What’s Driving Prices Above $70?