Gold Prices Soar to $2,650 as Inflation and Global Risks Fuel Safe-Haven Demand

With projections reaching $3,000 by 2025, gold continues to thrive on geopolitical tensions, central bank purchases, and inflationary pressures under the Trump administration | That's TradingNEWS

Gold Prices Surge Amid Uncertainty and Inflationary Pressure

Rising Gold Prices Reflect Global Economic Dynamics

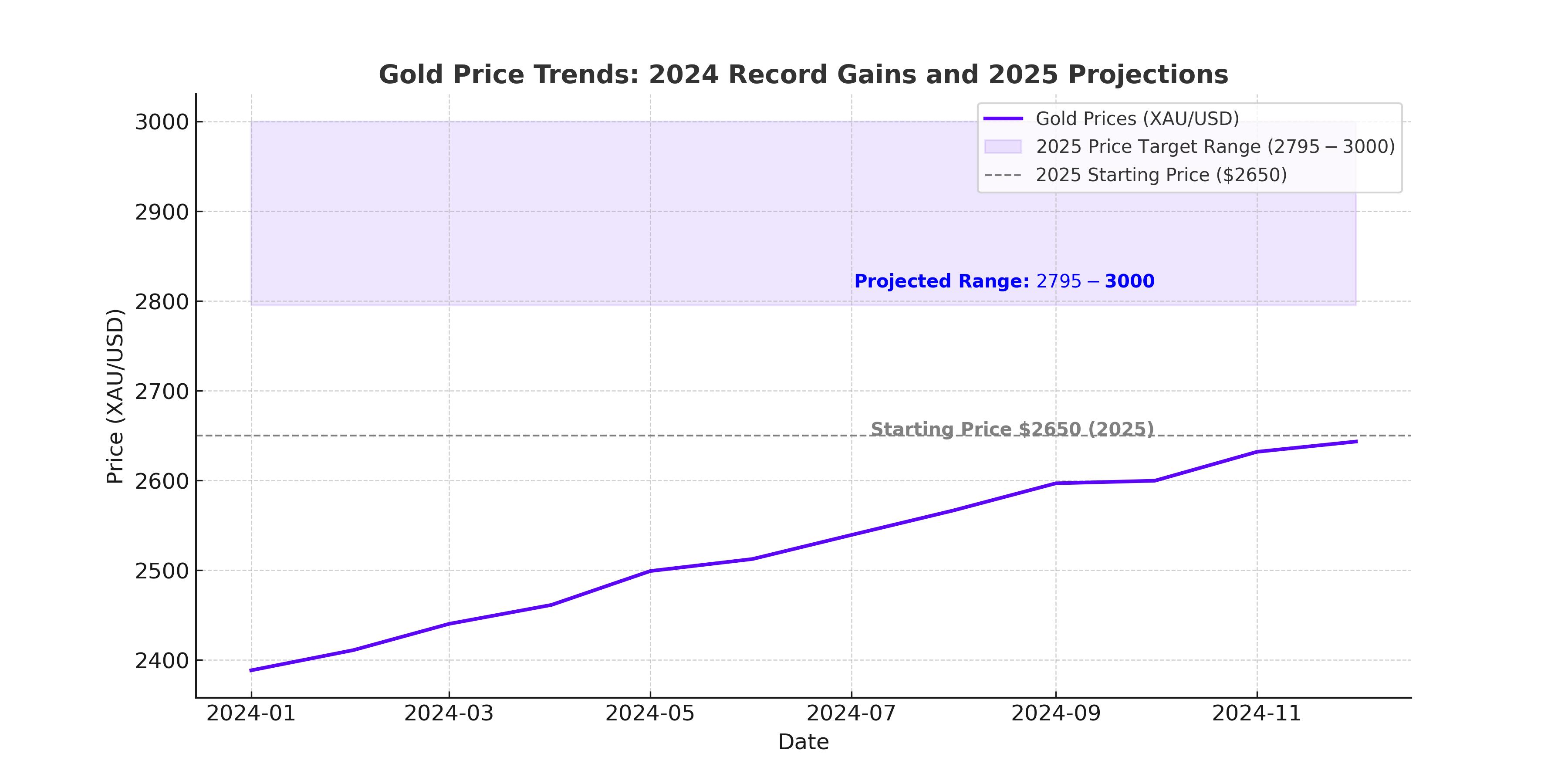

Gold prices (XAU/USD) surged to $2,650 per ounce in early 2025, supported by growing demand from central banks, geopolitical uncertainties, and concerns over inflation under the new Trump administration. This marks a continuation of gold's impressive 27% rally in 2024, its best performance since 2010, driven by global macroeconomic factors and heightened demand for safe-haven assets.

Trump Administration's Inflationary Policies Boost Gold

The incoming Trump administration has signaled increased fiscal spending, lower taxes, and higher import tariffs, all of which contribute to inflationary pressures. Historically, inflation and economic uncertainty have bolstered gold prices, as investors view the precious metal as a hedge against rising costs. Expectations of heightened geopolitical tensions and potential trade wars further enhance gold's appeal as a safe-haven asset.

Gold's Relationship with Interest Rates and Treasury Yields

Falling U.S. interest rates and declining 10-year Treasury yields, now near 4.54%, have reduced the opportunity cost of holding non-yielding assets like gold. Lower yields make gold more attractive to investors seeking stability during times of economic uncertainty. Analysts project additional rate cuts by the Federal Reserve in 2025, potentially amplifying gold's upward momentum.

Global Central Bank Gold Purchases Hit Record Levels

Central banks have been major contributors to the recent gold rally, with global purchases reaching 694 tonnes in the first nine months of 2024. The People’s Bank of China resumed gold acquisitions in late 2024, adding significant demand to the market. This trend underscores a broader shift among central banks to diversify away from the U.S. dollar amid geopolitical tensions, particularly following sanctions against Russia in recent years.

Geopolitical Tensions and Safe-Haven Demand

Ongoing conflicts in the Middle East and Ukraine, coupled with Russia’s aggressive actions, have intensified global uncertainty. These geopolitical dynamics support gold's position as a preferred store of value. Recent drone strikes in Kyiv and escalating military actions in Gaza further highlight the fragile state of global affairs, pushing investors toward safer assets like gold.

Technical Analysis: Key Levels to Watch

Gold prices recently broke out of a symmetrical triangle pattern on the daily chart, signaling potential volatility ahead. The 20-day EMA at $2,630 acts as a pivot point, reflecting the market's indecision. Key resistance lies at $2,726, the December high, while significant support rests at $2,537, the November low. A decisive move above $2,726 could propel gold toward the $3,000 mark, while a break below $2,537 may lead to a retest of $2,500, backed by the 200-day EMA.

Diverging Forecasts for 2025 Gold Prices

Analysts are divided on gold's trajectory in 2025. Goldman Sachs predicts prices could reach $3,000 per ounce by year-end, citing strong central bank demand and expected Federal Reserve rate cuts. Conversely, Barclays and Macquarie offer more conservative estimates, projecting prices near $2,500 due to potential dollar strength and moderating inflation. The average forecast from financial institutions places gold at $2,795, reflecting a 7% increase from current levels.

Challenges and Near-Term Risks for Gold

Despite bullish long-term projections, near-term risks remain. Profit-taking and reduced liquidity have caused recent pullbacks, with gold retreating from its December high of $2,726 to trade near $2,650. A stronger U.S. dollar, which hit a two-year high, may also weigh on gold prices, particularly if economic data supports the Federal Reserve's cautious approach to rate cuts. Additionally, a rise in 10-year Treasury yields could deter investors from allocating more capital to non-yielding assets like gold.

Long-Term Outlook: Gold as a Strategic Asset

With central bank purchases, geopolitical instability, and inflationary pressures showing no signs of abating, gold remains an attractive asset for diversification and wealth preservation. The proposed policies under the Trump administration, including higher fiscal spending and possible adoption of gold-backed reserves, may further bolster the metal's appeal. Analysts suggest that gold could consolidate gains early in the year before resuming its upward trend, potentially testing $3,000 by 2025’s end.

Gold’s position as a resilient store of value amid volatile economic conditions continues to attract institutional and retail investors. The current market dynamics, driven by geopolitical risks, central bank demand, and monetary policy, suggest that gold's bullish trajectory is likely to persist, offering opportunities for long-term portfolio growth.