Gold Prices Stabilize at $2,700 Amid Market Anticipation for Trump’s Policies

Gold prices have been oscillating near $2,700 per ounce as markets brace for potential volatility tied to U.S. President-elect Donald Trump’s inauguration. The precious metal, often seen as a safe-haven asset, has captured the attention of traders amid geopolitical shifts, Federal Reserve monetary policy expectations, and broader economic uncertainties.

Trump’s Policies and Their Influence on XAU/USD

Donald Trump’s return to the White House has placed gold under the spotlight, with his anticipated economic policies expected to drive significant market reactions. Historically, gold has benefited from safe-haven demand during times of uncertainty, and the incoming administration’s stance on tariffs, interest rates, and global trade could amplify this effect.

Trump’s potential executive orders on tariffs, energy policies, and trade agreements are expected to influence the U.S. dollar’s trajectory. A stronger dollar typically exerts downward pressure on gold prices by making the metal more expensive for non-dollar buyers. Conversely, dovish trade and monetary policies could weaken the dollar, providing support for XAU/USD.

Federal Reserve’s Monetary Stance and Its Impact

The Federal Reserve’s monetary policy remains a key determinant of gold’s performance. Recent signs of easing inflation have raised market expectations for a potential pause or reduction in interest rates. Lower rates reduce the opportunity cost of holding non-yielding assets like gold, providing a bullish foundation for XAU/USD. However, a minority of traders believe the Fed could surprise markets by maintaining or even increasing rates, which would present downside risks for gold.

Inflationary pressures are another critical factor. Fed Governor Christopher Waller’s comments on easing inflation have been welcomed by gold bulls, as a more accommodative policy stance could emerge later in the year. Inflationary concerns stemming from Trump’s potential fiscal policies, including tariffs and infrastructure spending, could further drive gold’s appeal as a hedge.

Technical Outlook for XAU/USD: Consolidation or Breakout?

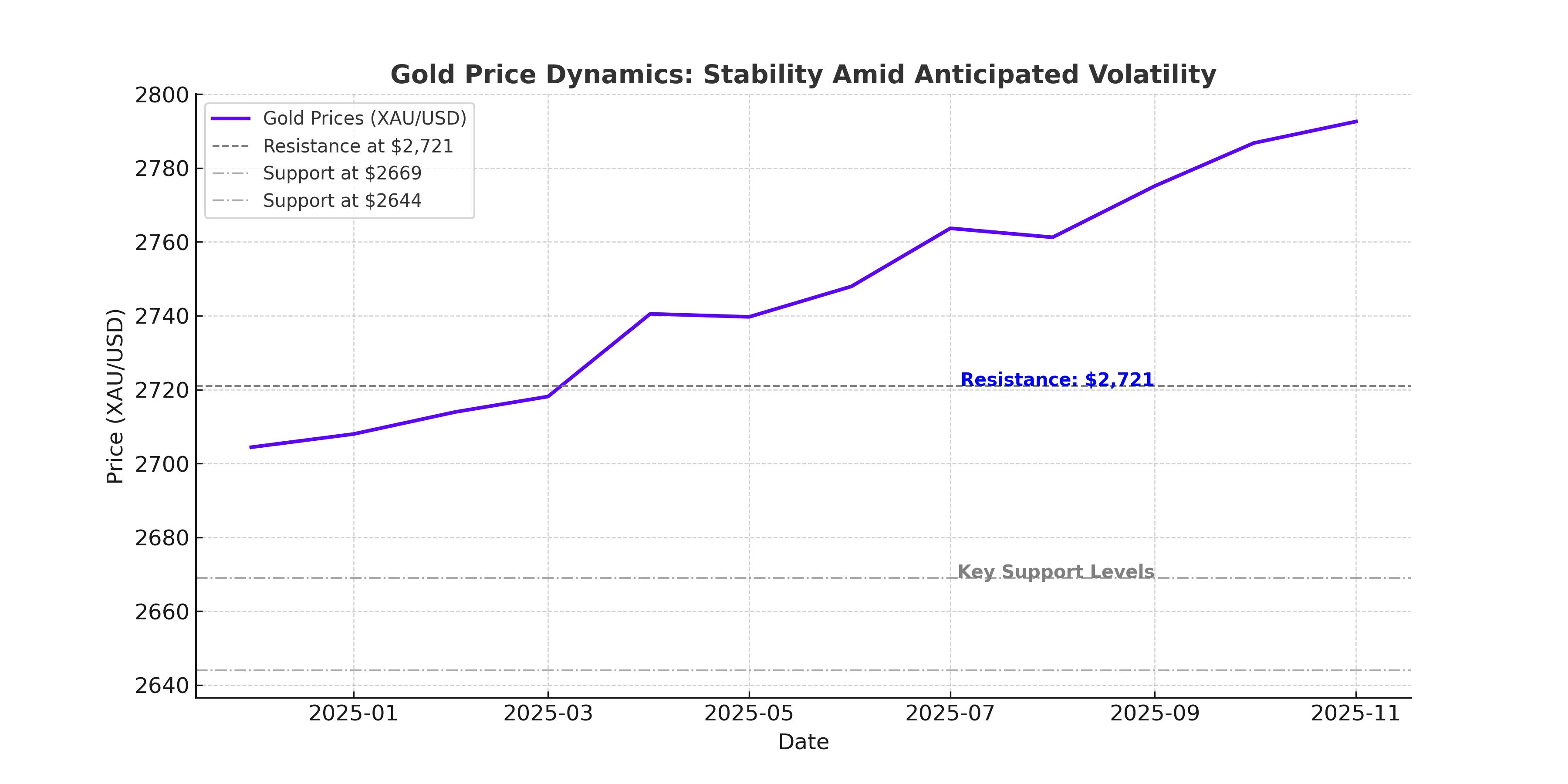

From a technical perspective, gold’s recent consolidation near $2,700 reflects a "wait-and-see" sentiment among traders. Resistance lies at $2,721, a level that has acted as a double top in previous months. Breaking above this threshold could pave the way for a retest of the all-time high at $2,790, a level reached in October 2024. On the downside, support at $2,669 and the 100-day moving average near $2,644 could provide stability in case of bearish momentum.

Short-term momentum indicators suggest a neutral to slightly bullish bias, with oscillators gaining traction. A sustained push above $2,715 could signal a broader rally, while failure to hold $2,700 may lead to increased selling pressure.

Geopolitical Dynamics and Safe-Haven Demand

Geopolitical factors continue to play a pivotal role in shaping gold prices. The recent ceasefire agreement between Israel and Hamas has somewhat eased tensions, reducing immediate safe-haven demand. However, the ongoing Russia-Ukraine conflict remains a wildcard, with any escalation likely to bolster gold’s appeal.

China’s strong demand for physical gold and its continued economic engagement with Russia have also influenced global gold flows. Rising imports from Russia have offset declines from traditional suppliers like Saudi Arabia, further stabilizing demand for the yellow metal.

Market Sentiment and Hedge Fund Activity

Commitment of Traders (COT) data reveals increasing bullish positioning among hedge funds, with net long positions reaching a five-week high. This suggests that institutional players are betting on further upside in gold prices, driven by favorable macroeconomic conditions and geopolitical uncertainties.

Long-Term Outlook for Gold Prices

Gold’s long-term trajectory remains supported by its dual role as a hedge against inflation and a safe-haven asset. The metal’s strong performance in 2024, marked by a 14-year record annual gain, underscores its resilience in uncertain economic environments. Analysts from State Street Global Advisors project that gold prices could reach $3,100 per ounce in 2025, driven by sustained demand and favorable macroeconomic conditions.

Conclusion: XAU/USD Positioned for a Critical Year

Gold’s current position at $2,700 represents a pivotal point, with the potential for significant upside or downside depending on Trump’s policies and the Federal Reserve’s actions. The interplay between geopolitical tensions, inflationary pressures, and global economic dynamics will define XAU/USD’s path in 2025. While risks remain, gold’s role as a safe-haven asset continues to make it an attractive investment for both traders and long-term investors.