Gold Prices Surge: Fed Rate Cut Speculation and Geopolitical Tensions Drive Market

Analyzing the Recent Trends and Future Prospects for Gold Amid Market Dynamics | That's TradingNEWS

Gold Prices and Federal Reserve Rate Cuts

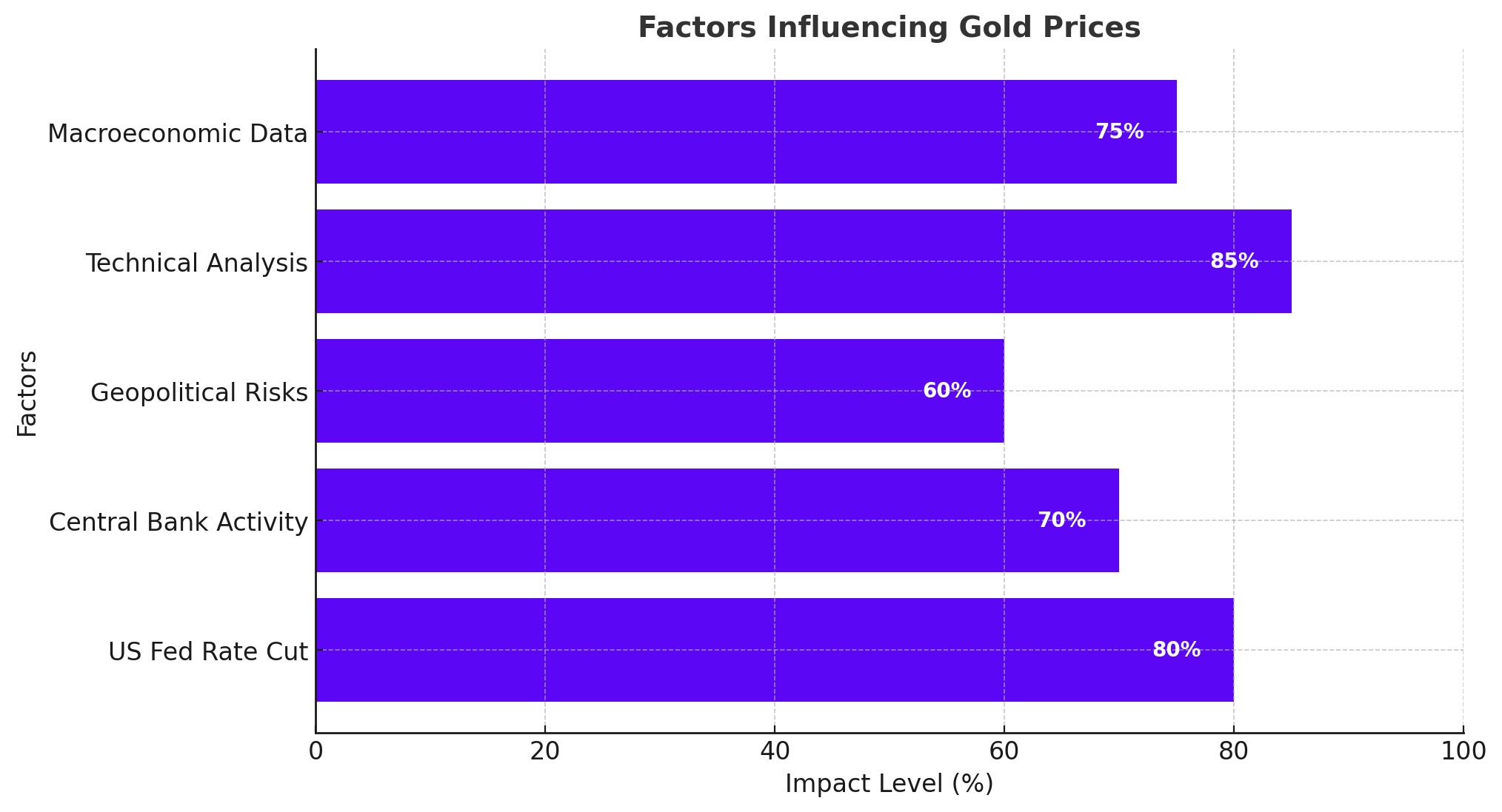

Gold prices have been climbing higher as market participants increasingly expect the U.S. Federal Reserve to begin cutting interest rates later this year. Recent U.S. labor market data and comments from Fed Chair Jerome Powell have fueled these expectations. The chances of a rate cut in September are high, with another potential cut in December. The probability of rising rates seems minimal unless there is a significant and unexpected surge in inflation data.

Gold, which yields no interest, benefits from lower interest rates as it reduces the opportunity cost of holding non-yielding assets. Additionally, gold is often viewed as an inflation hedge, maintaining its appeal despite easing global price pressures. Geopolitical risks, such as conflicts in Ukraine and Gaza, further enhance gold's safe-haven status.

Current Price Levels and Technical Analysis

Gold prices reached record highs above $2,400 per ounce in May, with the London Bullion Market Association price hitting $2,427.30. Currently, the metal trades around $2,372.06 per ounce, reflecting a solid technical backdrop. Recent trends indicate a possible advancement towards a Q1 2025 target of $2,475 an ounce as projected by TD Securities.

On the charts, gold prices have bounced back from retracement support levels, now offering robust support at $2,342. Bulls aim to surpass the July 5 peak of $2,391.78 to challenge the psychological resistance at $2,400. Despite the solid technical setup, some caution is warranted as prices are nearly $200 above their 200-day moving average, even though the Relative Strength Index (RSI) does not indicate overbuying.

Central Bank Activity and Market Sentiment

Central bank buying continues to support gold prices. While the People's Bank of China paused its gold purchases for a second consecutive month in June, other central banks such as the Reserve Bank of India, the National Bank of Poland, and the Czech National Bank have been active buyers. This sustained demand from the official sector suggests ongoing interest in using gold to diversify foreign exchange reserves.

Moreover, increased clarity on U.S. interest rate cuts is likely to drive further investment into gold. Spot gold previously hit a record high of $2,450.06 an ounce in May due to increased safe-haven demand amid geopolitical tensions. Although prices briefly fell to $2,280, they have since recovered, supported by expectations of lower U.S. interest rates.

Influence of Macroeconomic Data

Recent economic data, such as the U.S. Consumer Price Index (CPI) and Producer Price Index (PPI), will play a critical role in shaping market expectations. The CPI is expected to fall to 3.1%, while the core CPI remains steady at 3.3%. These figures will provide insights into the Fed's rate cut trajectory, influencing gold price dynamics.

The U.S. Dollar Index (DXY) has risen by 0.14% to 105.15, reflecting the greenback's strength. A stronger dollar generally makes gold more expensive for foreign investors, potentially capping further gains in gold prices. However, if U.S. inflation data comes in below expectations, it could bolster gold prices further.

Technical and Fundamental Analysis

From a technical perspective, gold's breakout above the 50-day Simple Moving Average (SMA) and sustained movement beyond the $2,365 supply zone have triggered bullish sentiment. Oscillators on the daily chart suggest that the path of least resistance for gold is upward, with potential targets at $2,400 and beyond.

On the downside, support levels at $2,360-2,358 and the 50-day SMA at $2,345 are critical. A break below these levels could shift the near-term bias towards bearish traders, potentially dragging prices to $2,319-2,318 and further down to the $2,300 mark.

Conclusion

In summary, gold prices are poised for further gains amid expectations of Fed rate cuts, continued central bank buying, and geopolitical uncertainties. While the technical and fundamental outlook remains positive, investors should remain vigilant for potential reversals and monitor key support and resistance levels closely. As always, the interplay between macroeconomic data and market sentiment will be crucial in determining gold's next move.

That's TradingNEWS

WTI & Brent Crude Prices Face Major Setback: How Will Trump's Tariffs and OPEC+'s Output Boost Impact Oil Markets?

Gold Price Surges to Record Highs Before Retreating: How Will Tariff Uncertainty Affect XAU/USD?