Gold Prices Surge Past $2,653 Amid Dollar Weakness and Fed Speculation

XAU/USD recovers from a five-month low as traders eye core inflation data and December’s critical Fed meeting. With geopolitical risks and surging physical demand, the spotlight is back on gold’s breakout potential | That's TradingNEWS

Gold Prices Surge Amid Federal Reserve Uncertainty and Geopolitical Tensions

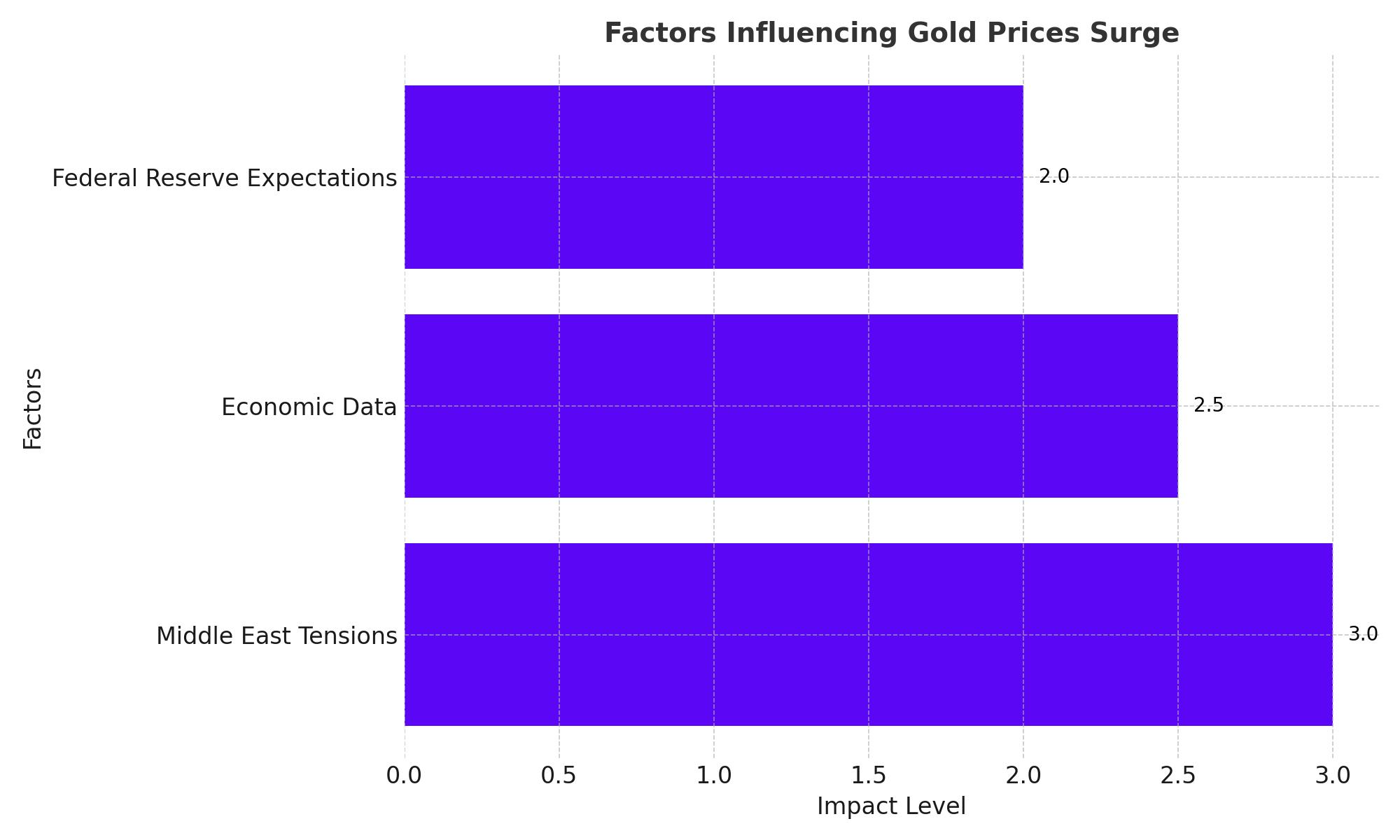

Gold prices, trading under XAU/USD, have rebounded strongly following a steep selloff earlier in the week, with spot gold climbing 0.8% to $2,653.20 per ounce and U.S. gold futures increasing 1.2% to $2,653.10. This recovery comes on the back of a weaker dollar, a critical factor in gold's rebound, as the dollar index dropped 0.6%, boosting the appeal of the precious metal to international buyers. The fluctuating gold prices reflect a market responding to dynamic geopolitical tensions, Federal Reserve policies, and shifts in economic expectations.

The recent downturn in gold earlier this week, the most significant single-day drop in five months, was attributed to Israel’s tentative ceasefire agreement with Hezbollah in Lebanon. However, renewed tensions in Gaza have kept investors wary, reintroducing safe-haven demand for gold. Despite these geopolitical shifts, the market remains focused on the Federal Reserve’s upcoming December meeting, where a potential rate cut could reshape gold’s trajectory. Markets currently assign a 66.5% probability to a quarter-point rate reduction, a likelihood that has grown from 55.7% earlier this week.

Geopolitical Shocks and the Resilience of XAU/USD

Geopolitical events have been central to gold’s recent volatility, with the Israeli ceasefire announcement initially dampening demand for safe-haven assets. However, the escalation of Israeli strikes in Gaza has created uncertainty, leading to a resurgence in gold buying. Meanwhile, potential tariffs under President-elect Donald Trump, targeting imports from Mexico, Canada, and China, are seen as inflationary, potentially fueling further interest in gold as a hedge against economic turbulence. These geopolitical risks align with increased interest in gold by central banks globally, a trend that is expected to sustain bullish momentum in the long term.

Gold Supported by Physical Demand and Central Bank Activity

The drop in gold prices earlier this month has spurred physical buyers, including central banks, to step into the market, capitalizing on lower prices. According to Goldman Sachs, central bank demand is expected to add an additional 9% to gold prices by December 2025, aligning with their forecast of $3,150 per ounce. This heightened demand highlights gold’s status as a critical reserve asset amid broader market instability.

Physical gold markets have also seen increased activity, with buyers taking advantage of the pullback in prices. In India, the world’s second-largest gold consumer, demand has risen sharply, supported by seasonal factors and lower local prices. This trend is further bolstered by China's continued import activity, despite a year-on-year decrease of 43% in October via Hong Kong.

Federal Reserve Policy and Inflation Data Weigh Heavily on Gold Prices

The Federal Reserve’s policy direction remains a pivotal factor for gold markets, with investors closely monitoring key economic indicators, such as the core Personal Consumption Expenditures (PCE) index. Softer-than-expected PCE inflation data could support gold, potentially driving XAU/USD above its current resistance levels of $2,663.51, targeting $2,693.40. Conversely, hotter-than-expected inflation could strengthen the dollar and pressure gold prices, highlighting the metal's sensitivity to macroeconomic conditions.

The Fed’s latest meeting minutes revealed cautious optimism about inflation trends, with officials signaling confidence in achieving their 2% target over time. This sentiment aligns with recent statements from Chicago Fed President Austan Goolsbee, who anticipates further rate reductions barring significant economic overheating.

Technical Levels and Market Sentiment

Gold’s technical chart suggests key resistance at $2,663.51 and further targets at $2,693.40, with immediate support near $2,629.13. A break below this support level could expose gold to further declines, potentially testing the $2,607.35 range. The bullish scenario hinges on weaker-than-expected U.S. economic data, particularly core PCE inflation, which could solidify market expectations of a December rate cut.

Market sentiment remains mixed, with traders balancing the potential for lower rates against the strength of the U.S. dollar and geopolitical developments. The interplay of these factors will likely dictate gold's near-term direction, making the coming weeks critical for price action in XAU/USD.

Outlook: Buy, Hold, or Sell?

Considering the convergence of factors affecting gold prices, the precious metal appears poised for cautious optimism. With the Federal Reserve likely to cut rates in December, coupled with strong physical and central bank demand, gold is a compelling Buy at current levels. However, investors should remain vigilant to geopolitical and macroeconomic shifts, which could introduce significant volatility to XAU/USD in the near term.

That's TradingNEWS

WTI and Brent Oil Surge Amid Geopolitical Risks – What’s Driving Prices Above $70?

Gold Prices Surge to $3,128: What’s Fueling the Historic Rally in XAU/USD?