Gold Prices Test $2,665 Resistance: Can XAU/USD Rally Further?

Geopolitical Risks, Inflation, and Bond Yields Drive Gold’s Momentum in 2025 | That's TradingNEWS

Gold Prices Surge Amid Geopolitical Risks and Market Uncertainty

Geopolitical and Economic Drivers Elevate Gold (XAU/USD)

Gold prices (XAU/USD) have sustained a second consecutive day of gains, trading near $2,665. This comes amid heightened geopolitical tensions and economic uncertainty. President-elect Donald Trump's potential declaration of an economic state of emergency to justify universal tariffs has created a safe-haven appeal for gold. The Institute of Supply Management (ISM) Services Prices Paid index jumped to 64.4 in December, underscoring inflationary pressures, which further support gold’s bullish sentiment. These developments come as U.S. bond yields touch a nine-month high, with the 10-year Treasury yield at 4.697%, reflecting elevated market volatility.

The Impact of Tariffs and Bond Market Activity on Gold

Trump's rumored tariff plans and potential geopolitical escalations have bolstered gold’s position as a hedge against uncertainty. Meanwhile, the Federal Open Market Committee (FOMC) minutes, due later today, are expected to shed light on the Fed’s monetary policy stance. Strong economic data, including higher-than-expected job openings and the ISM Services PMI at 54.1, suggest the Federal Reserve may slow its interest rate cuts. This narrative has propelled U.S. Treasury bond yields, which often inversely affect gold prices, creating a tug-of-war in market sentiment.

Technical Analysis: Gold Testing Critical Resistance Levels

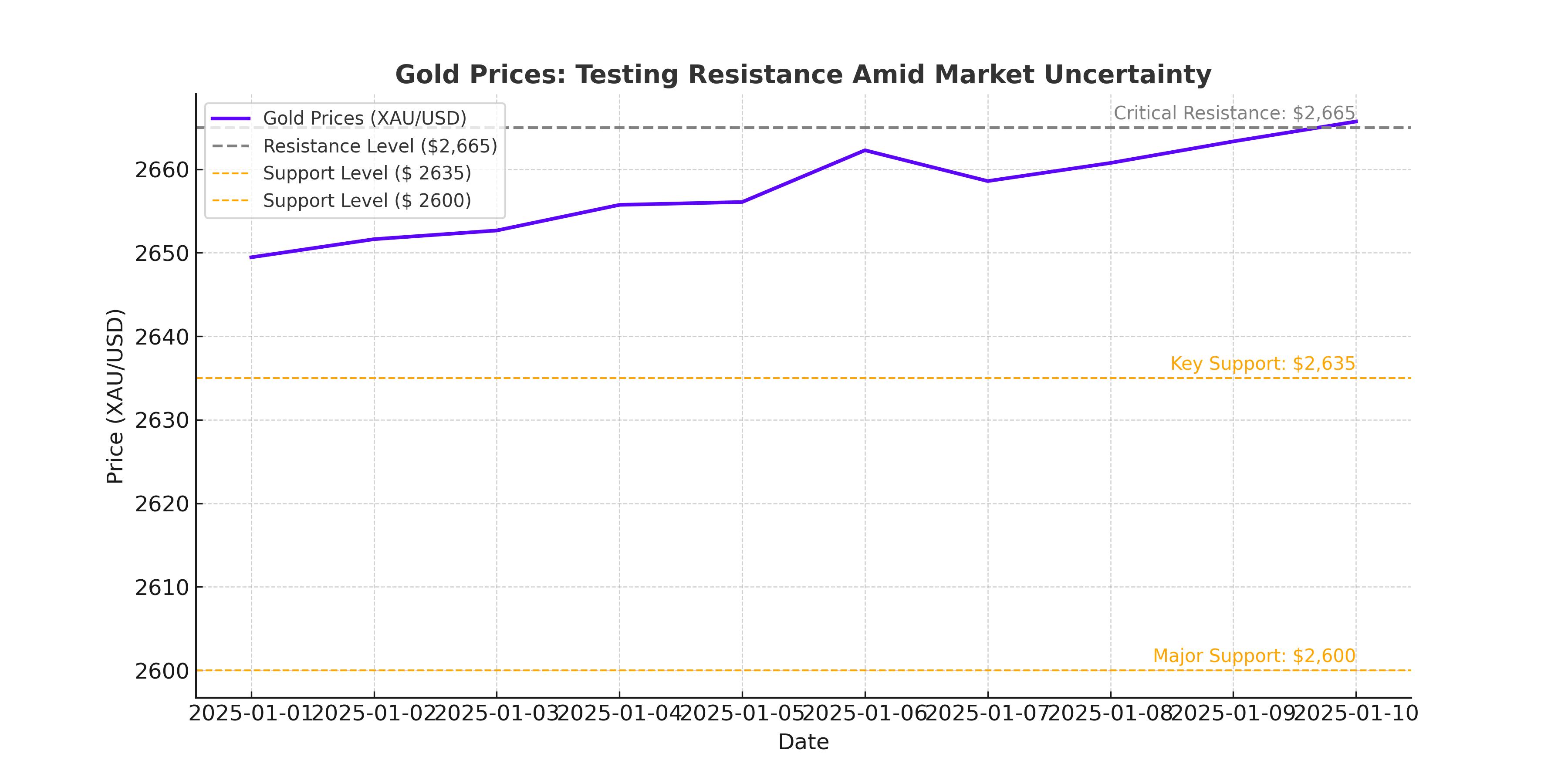

Gold prices are testing significant resistance at the $2,665 level, a pivotal zone that has capped upward momentum recently. A breakthrough above this level could pave the way to intermediate resistance at $2,681-$2,683 and ultimately the $2,700 mark. Oscillators on the daily chart are entering positive territory, signaling potential for further gains. However, a failure to break this resistance may see gold retrace to support zones near $2,635 and $2,600, where the 100-day EMA provides structural backing.

Broader Market Trends: Safe Haven Status Strengthened

The broader market context has also lent support to gold prices. Global central banks continue to increase their gold reserves, a trend highlighted by predictions of rising prices through 2025. Analysts like Dmitry Puchkarev forecast gold climbing to $2,900 per ounce this year, driven by ongoing purchases from institutions and central banks. Ivan Efanov projects gold prices could hit $3,000 per ounce by year-end, supported by geopolitical instability and the U.S. Federal Reserve’s easing monetary stance.

USD and Yield Dynamics Influence Gold's Trajectory

Despite a strong U.S. Dollar Index (DXY), which has climbed by over 9,300 points in two months, gold prices have shown resilience. Typically, a strong dollar puts downward pressure on gold, but its ability to hold steady highlights underlying demand. Similarly, U.S. Treasury yields, which have surged from 3.6% to 4.6% in three months, pose challenges for gold’s non-yielding nature. However, the market's belief in stable real interest rates has kept gold buoyant, reflecting confidence in its safe-haven appeal amidst rising inflation expectations.

Analysts’ Perspectives on Gold's Future Performance

Expert projections remain optimistic for gold in 2025. UBS forecasts gold will reach $2,900 per ounce, while others anticipate $3,000 as a realistic target. The ongoing geopolitical risks and fiscal uncertainties, including potential disruptions from Trump’s tariff regime, are likely to sustain investor interest in gold. Additionally, gold-backed ETFs and central bank purchases continue to provide structural support for prices.

Key Levels to Watch in Gold Markets

The $2,665 level remains critical for immediate price action, with a potential breakout leading to significant upside. However, downside risks persist, with support zones at $2,635, $2,615, and $2,600 acting as safety nets. A break below these levels could push gold towards $2,583, where bearish momentum might intensify.

Conclusion

Gold’s current trajectory reflects a market grappling with geopolitical uncertainty, inflation fears, and fluctuating interest rate expectations. Its ability to hold near $2,665 underscores investor confidence in its role as a hedge. While resistance and support levels will dictate short-term movements, the broader narrative suggests a bullish outlook, with gold poised to benefit from continued demand amidst economic and political turbulence. For investors, gold remains a compelling asset, balancing near-term volatility with long-term growth potential.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex