Gold Stays Firm Above $2,500: Global Demand and U.S. Rate Decisions Shape Market Outlook

With inflation data on the horizon and strong demand from global powerhouses, gold prices are set for potential gains while traders brace for Federal Reserve's next move | That's TradingNEWS

Market Developments Fuel Strong Gold Prices

The gold market has held steady at the $2,500 mark, bolstered by strong geopolitical risks and expectations of interest rate cuts by the U.S. Federal Reserve. With inflation data from the U.S. and ongoing monetary policy decisions looming, investors continue to position themselves within gold’s safe-haven appeal, pushing the metal's price up by 0.44% to $2,514.15 per ounce as of today.

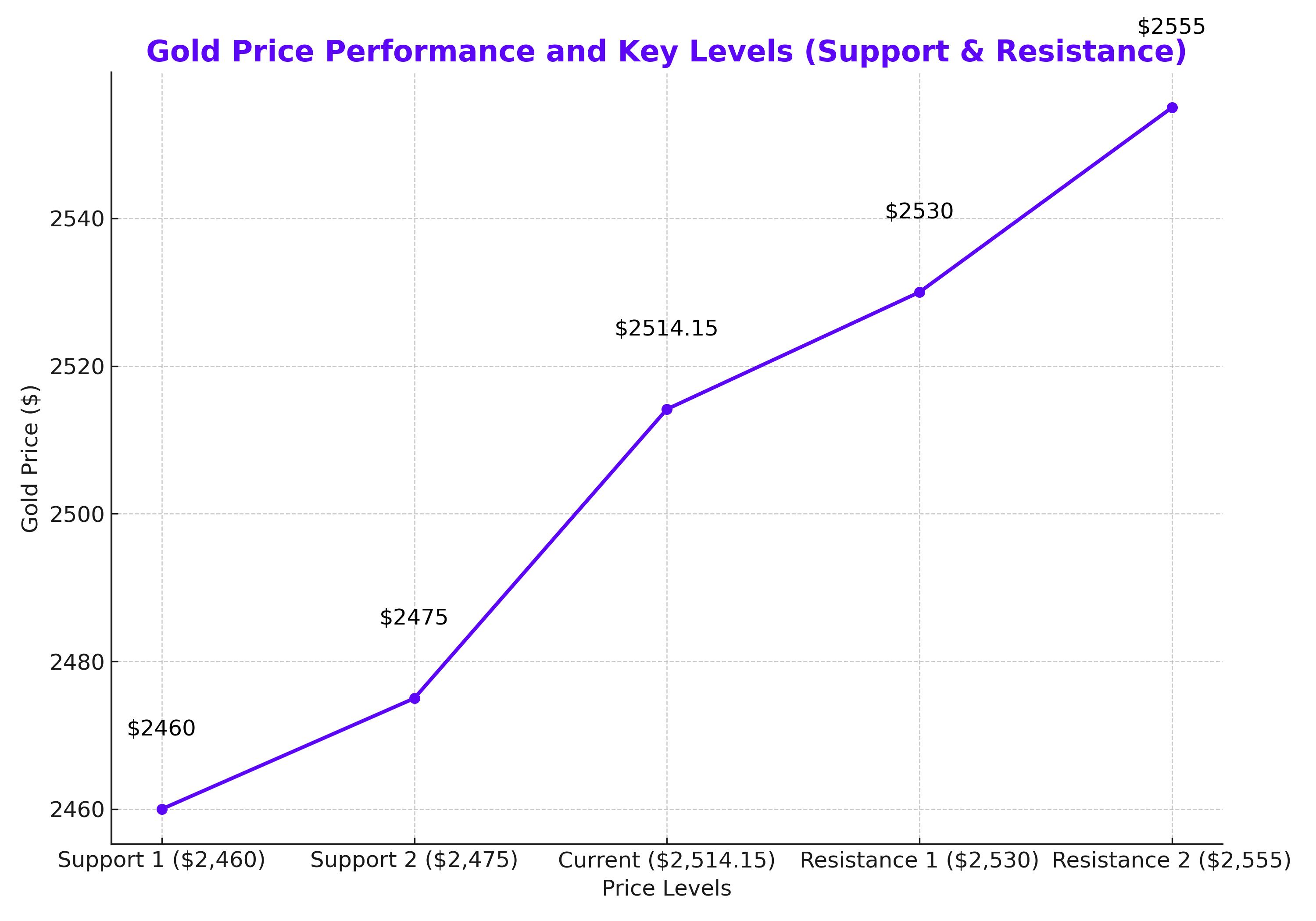

Gold’s Technical Performance: Testing Key Levels

Gold has been resilient, trading in a tight range around $2,500 as the markets assess upcoming economic indicators. The $2,500 psychological support remains intact, despite a brief pullback to $2,485 earlier in the week. Traders now look to $2,530 and $2,555 as potential resistance levels, while any significant move below $2,500 may see buyers stepping in to acquire what is perceived as “cheap gold” amid global uncertainty. Gold’s strong bullish trend continues, supported by key technical factors. The next short-term target appears to be $2,530, with an eventual move toward $2,600 on the horizon, contingent on the macroeconomic environment. Meanwhile, the downside risk remains minimal, with significant support levels at $2,475 and $2,460. Buying opportunities remain ripe on any further pullbacks.

Impact of U.S. Economic Data and Federal Reserve Action on Gold

Investors are closely watching for the release of the U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) reports this week. These figures will give more insight into inflation trends and influence the Federal Reserve's interest rate decisions at its upcoming meeting. Market participants are currently pricing in a 71% probability of a 25-basis-point rate cut, which would further support gold as lower rates reduce the opportunity cost of holding non-yielding assets like bullion. Should inflation continue to ease and the Federal Reserve adopt a more dovish stance, gold could gain additional upward momentum. Conversely, should inflation remain stubbornly high, it could force the Fed to delay more aggressive cuts, which could put short-term pressure on gold prices.

Geopolitical Factors Driving Gold Demand: Russia, China, and India Lead Global Buying

Beyond inflation, global geopolitical tensions continue to play a major role in driving demand for gold. Russia, China, and India remain significant buyers of the precious metal, utilizing it as a hedge against geopolitical risks and monetary instability. This growing demand, especially from central banks, further supports the notion that gold’s long-term trajectory remains bullish. The gold market is also benefiting from reduced trust in global paper currencies, with investors seeking safe-haven assets in uncertain times. As bond yields decline and geopolitical concerns escalate, gold retains its appeal as a reliable store of value.

Outlook for Gold Prices in 2024 and Beyond

RBC Capital Markets recently revised its long-term gold price forecast, raising it to $2,200 per ounce by 2029, up from $2,000 previously. The brokerage also increased its 2024 forecast by 2%, projecting gold to average $2,343 per ounce, with a further increase to $2,655 by 2025. Several major gold producers, including Agnico Eagle Mines (AEM), Barrick Gold (GOLD), and Newmont (NEM), have seen their price targets raised by RBC Capital as well. For example, Agnico Eagle Mines’ price target was increased from $80 to $87, while Barrick Gold’s target rose to $22. This bullish outlook on gold producers reinforces the broader optimism surrounding the metal.

Conclusion: Is Gold a Buy, Hold, or Sell?

Gold remains an attractive asset for investors seeking a hedge against inflation and geopolitical uncertainty. With strong technical support and a favorable macroeconomic backdrop, the metal is likely to continue its upward trajectory. While some volatility may be expected in the short term, particularly around the Federal Reserve’s upcoming decisions, the long-term outlook remains firmly bullish. For investors eyeing the gold market, the current pullback presents a potential buying opportunity, especially for those looking to diversify their portfolios amid ongoing global uncertainties. As long as key support levels hold and geopolitical risks persist, gold remains a strong buy in the near-to-long-term outlook.