Gold Price Outlook: XAU/USD Testing Critical Levels Amid Market Turmoil

Gold prices (XAU/USD) are navigating a volatile start to 2025, holding near $2,640 as traders weigh the impact of geopolitical risks, inflation concerns, and fluctuating bond yields. Despite modest upward movement, gold struggles to break higher as hawkish Federal Reserve policies and upcoming economic data loom large. The interplay between global uncertainty, inflation fears, and central bank actions has left the precious metal at a crossroads.

Geopolitical Tensions and Safe-Haven Demand for Gold

Gold prices continue to draw support from geopolitical developments. Persistent tensions from the protracted Russia-Ukraine war and escalating conflicts in the Middle East have driven safe-haven flows. The Ukrainian military’s offensive in the Kursk region and ongoing Israeli operations in Gaza and Syria underscore the geopolitical risks that make gold a preferred refuge for investors. These conflicts have bolstered gold’s appeal despite headwinds from U.S. monetary policy.

Adding to the uncertainty, U.S. President-elect Donald Trump’s proposed tariffs and protectionist policies are fueling concerns about inflation and trade disruptions. Trump's policy stance has reinforced gold’s role as a hedge against rising prices, keeping the yellow metal in focus for risk-averse investors.

Inflation and Federal Reserve Policy’s Impact on Gold Prices

The Federal Reserve’s cautious stance on rate cuts remains a key influence on gold prices. Recent projections from the Fed suggest a slower pace of interest rate reductions in 2025, with policymakers emphasizing concerns over reigniting inflation. Notably, the ISM Services PMI report highlighted a surge in the Prices Paid Index to 64.4, significantly above expectations of 57.5. This uptick in inflation metrics has fueled speculation that rate cuts may be delayed until later in the year, likely affecting the non-yielding gold market.

Elevated U.S. Treasury yields, with the 10-year yield climbing to 4.68%, add further pressure on gold prices. Rising yields make fixed-income assets more attractive, capping upside momentum for XAU/USD. The interplay between inflation expectations and monetary policy remains pivotal in shaping the gold market’s trajectory.

Central Bank Activity and Its Influence on Gold Prices

Global central banks continue to exert a profound impact on gold prices. The People’s Bank of China reported an increase in its gold reserves for the second consecutive month in December, highlighting ongoing demand from monetary authorities. Central banks’ purchases remain a crucial driver of long-term gold demand, even as ETF inflows and retail investment have shown mixed trends.

China’s gold holdings, valued at $191.34 billion at the end of December, reflect a strategic move to diversify reserves amid global economic uncertainty. These purchases are part of a broader trend among emerging markets seeking to reduce reliance on the U.S. dollar, further underpinning gold’s role as a store of value.

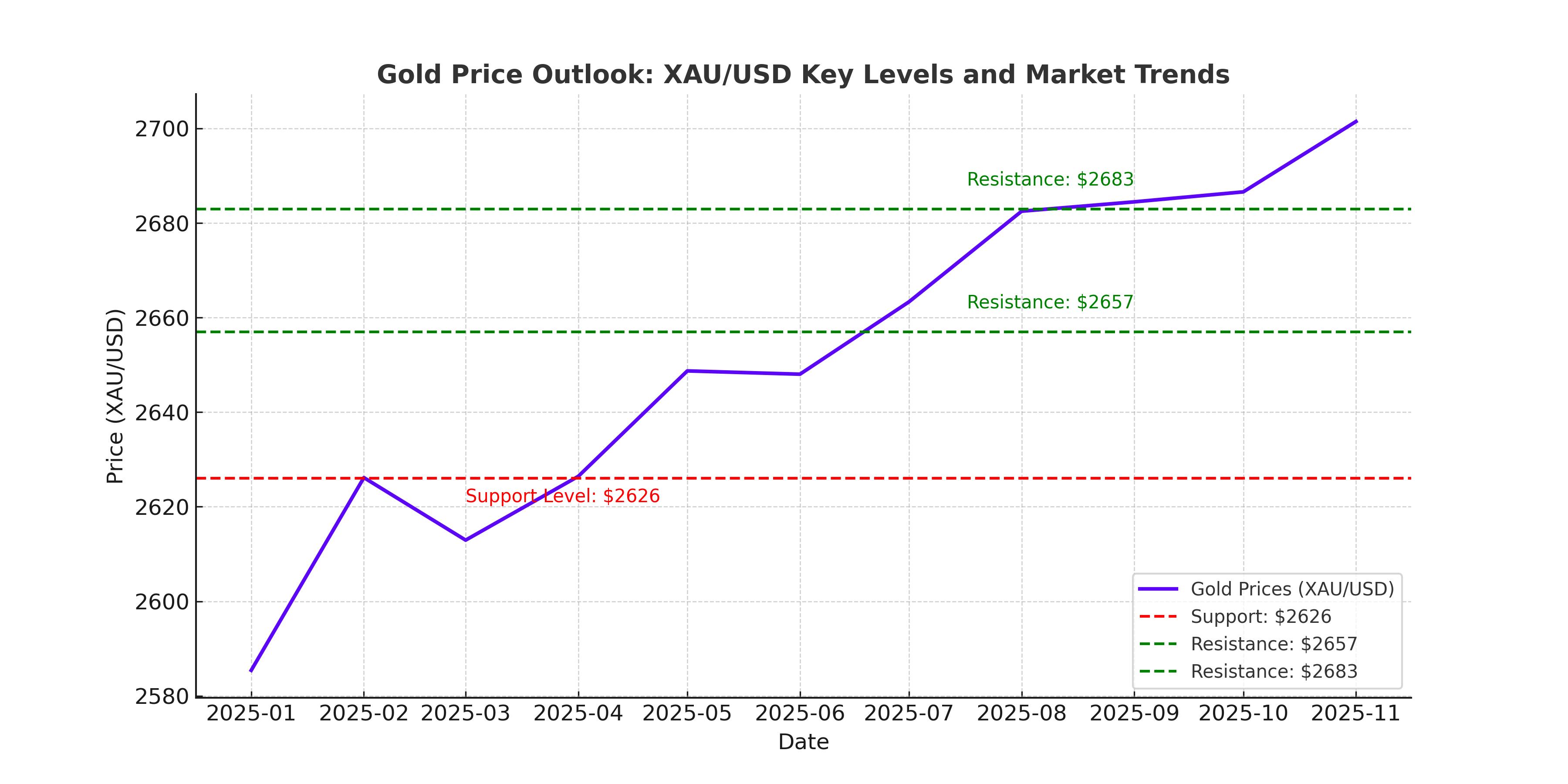

Technical Analysis: Key Support and Resistance Levels for XAU/USD

Technically, gold prices remain within a pennant formation, signaling potential consolidation before a breakout. The 100-day Simple Moving Average (SMA) at $2,626 has provided strong support, with repeated rebounds from this level reinforcing its significance. A break below this support could trigger a sharp decline toward $2,583, a level last seen in December 2024.

On the upside, resistance near $2,655-2,657 remains formidable. A successful breach of this zone could pave the way for a test of $2,681-2,683, with $2,700 serving as a critical psychological and technical milestone. Clearing this level would likely signal a resumption of the broader uptrend, targeting new highs.

Market Outlook: Key Events and Risks for Gold Prices

Gold’s near-term direction will be shaped by pivotal economic releases, including the FOMC meeting minutes and the U.S. Nonfarm Payrolls (NFP) report. Strong labor market data could bolster the case for a hawkish Fed, weighing on gold prices. Conversely, any signs of economic softness may reignite rate cut expectations, providing a tailwind for XAU/USD.

Geopolitical risks and trade policies under the Trump administration will remain in focus, influencing market sentiment and gold’s safe-haven demand. Inflation dynamics, particularly the trajectory of U.S. consumer prices, will also play a critical role in determining gold’s attractiveness relative to other asset classes.

Conclusion: Is Gold a Buy at Current Levels?

Gold’s performance hinges on a complex mix of factors, including geopolitical uncertainty, central bank activity, and economic data. Trading at $2,640, XAU/USD offers both opportunities and risks. While inflation fears and central bank buying support the bullish case, headwinds from elevated yields and Fed policies temper the outlook. Investors seeking diversification and protection against volatility may find gold an appealing choice, particularly if geopolitical tensions escalate or inflation persists. However, navigating this market requires close monitoring of key support and resistance levels, as well as macroeconomic developments.