Gold Takes a Hit as Ceasefire Hopes and Treasury Optimism Shift Markets

Gold tumbles to $2,635 amid easing tensions in the Middle East and U.S. Treasury stability. Will central bank demand and geopolitical risks spark a rebound? | That's TradingNEWS

Gold Prices Retreat Amid Geopolitical Tensions and Dollar Weakness

Gold (XAU/USD) experienced a sharp correction today, dropping over 3.2% to trade around $2,635 per ounce as market dynamics shifted against the precious metal. This decline came amidst optimism about a potential ceasefire agreement between Israel and Lebanon, easing geopolitical tensions in the region. Concurrently, the announcement of Scott Bessent as the U.S. Treasury Secretary under President-elect Donald Trump added to a "risk-on" sentiment, driving investors away from safe-haven assets like gold.

The ceasefire between Israel and Hezbollah, rumored to be finalized within 36 hours, has deflated some of the geopolitical risk premium that had bolstered gold prices in recent weeks. While this development led to selling pressure on gold, rumors of potential escalation in the Russia-Ukraine conflict persist. Discussions led by the UK and France about deploying military personnel to Ukraine could reignite safe-haven demand if realized, providing a potential floor for gold's current downward trend.

U.S. Treasury Nomination Sparks Market Optimism

The confirmation of Scott Bessent as Treasury Secretary has provided markets with a sense of stability. Bessent, known for his Wall Street expertise, is expected to advocate balanced policies that support deregulation, energy production, and privatization to stimulate economic growth. His nomination reassured markets, with U.S. 10-year Treasury yields falling to 4.3%, reflecting confidence in his approach. However, this easing of Treasury yields, coupled with a softer dollar, did little to support gold, which remained under pressure from improved risk sentiment.

Economic Data and Federal Reserve Implications

Gold's selloff comes in the wake of key U.S. economic data releases. The Personal Consumption Expenditures (PCE) price index—a critical measure of inflation—showed a slight uptick, with the core PCE rising to 2.8% year-over-year in October. Meanwhile, third-quarter GDP growth was revised upward to 2.8%, driven by strong consumer spending. Weekly jobless claims also beat expectations, falling to 213,000. These indicators underscore the resilience of the U.S. economy, limiting the Federal Reserve’s flexibility for aggressive interest rate cuts in 2025.

The Federal Open Market Committee (FOMC) minutes scheduled for release tomorrow could offer further insights into the Fed's outlook under Trump’s administration. Despite Fed Chair Jerome Powell’s insistence that monetary policy remains independent of political influence, Trump’s pro-growth policies could pressure the central bank to adjust its stance, influencing gold prices indirectly.

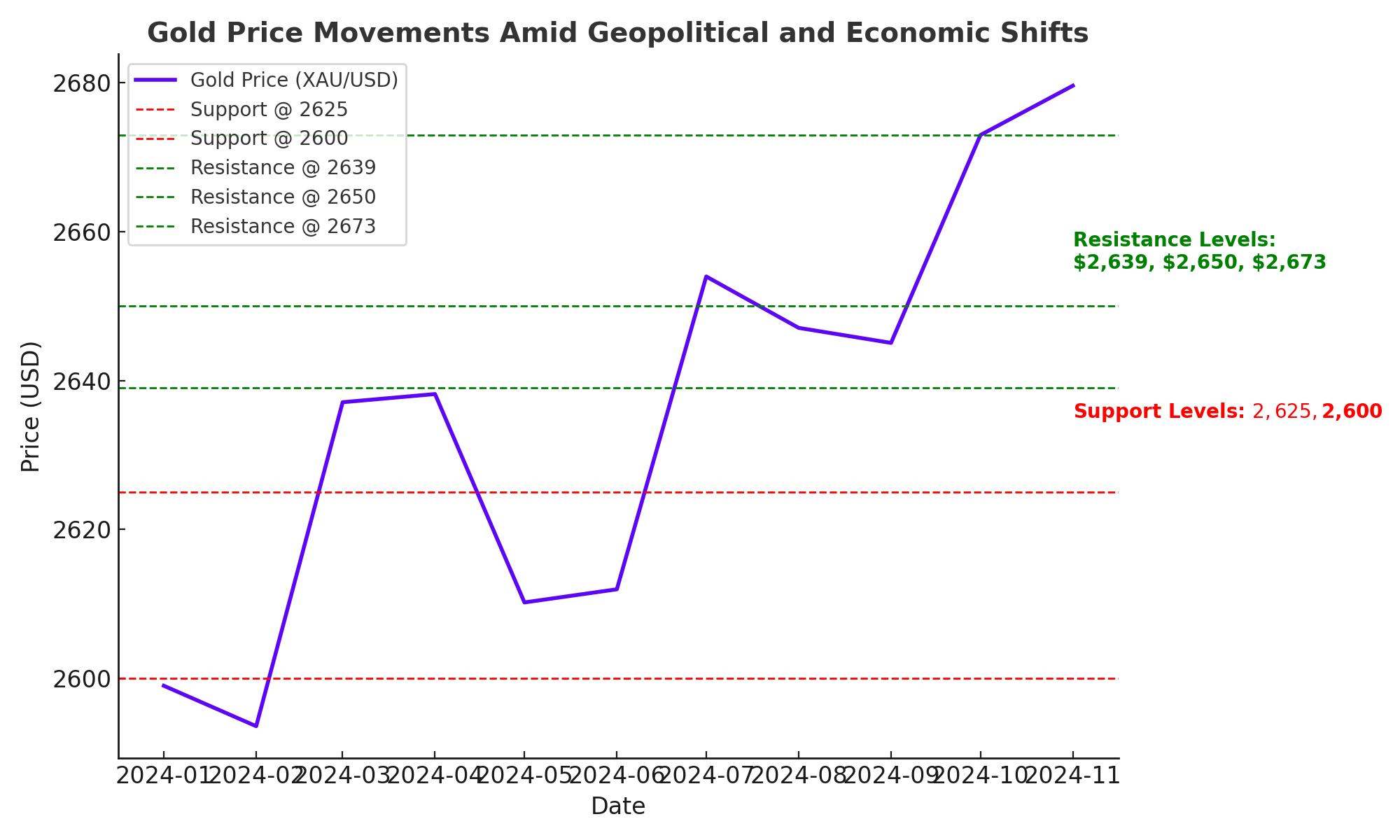

Technical Analysis: Gold Faces Key Resistance and Support Levels

Gold's decline today saw it breach the 50-day EMA, with immediate support levels at $2,625 and $2,600. A deeper retracement could push prices toward the 23.6% Fibonacci retracement level near $2,596. Resistance levels remain at $2,639, $2,650, and $2,673. A break above these levels could signal renewed bullish momentum, though the broader trend remains bearish. The RSI indicator reflects a neutral stance, while the MACD suggests potential for further downside in the short term.

Geopolitical and Central Bank Buying Trends

Despite the current selloff, long-term support for gold persists, driven by central bank purchases across Asia and concerns over global economic instability. Central banks, particularly in China and India, have increased their gold reserves, viewing the metal as a hedge against inflation and currency devaluation. These structural drivers suggest that any significant dip in gold prices could be seen as a buying opportunity for long-term investors.

Potential Scenarios Moving Forward

The interplay between geopolitical events and U.S. economic policies will likely dictate gold's trajectory in the coming weeks. Should the Israel-Lebanon ceasefire hold, gold may face additional pressure, especially if the dollar continues to stabilize. Conversely, any escalation in the Russia-Ukraine conflict or renewed trade tensions involving China could quickly revive gold's safe-haven appeal.

Market participants will closely monitor tomorrow’s FOMC minutes for clues about the Fed’s future actions. Additionally, developments surrounding Trump’s proposed tariff policies and geopolitical uncertainties could inject further volatility into gold prices. Immediate focus remains on whether gold can defend the $2,600 support level or if bearish momentum will extend toward $2,570.

Outlook: Buy on Dips or Caution Ahead?

While the short-term outlook for gold appears bearish, long-term fundamentals remain strong, supported by robust central bank demand and ongoing macroeconomic uncertainties. Traders should watch for a sustained break below $2,600 as a potential signal for deeper losses. However, any recovery above $2,650 could open the door to a test of $2,700 in the near term. Gold's role as a hedge against inflation and geopolitical risks ensures its continued relevance in diversified portfolios, though caution is warranted amid the current volatility.