Gold’s Unstoppable Momentum: Will Central Banks and Global Uncertainty Fuel $3,000?

Unprecedented central bank buying, looming trade wars, and inflation fears signal a seismic shift in gold’s trajectory. Here’s why 2025 could redefine the metal’s true value | That's TradingNEWS

Gold Price Analysis: XAU/USD Poised for New Highs in 2025 Amid Central Bank Buying and Geopolitical Risks

Central Bank Buying and Geopolitical Catalysts

Gold prices have been on a steady rise, with 2024 marking a 27% annual increase, closing near $2,650 per ounce. This growth, the strongest since 2010, underscores gold's role as a safe haven amid global uncertainties. Central banks have aggressively accumulated gold reserves, with purchases from India (77 tonnes), Turkiye (72 tonnes), Poland (69 tonnes), and China (30 tonnes) dominating the year. Central banks' heightened interest reflects a shift in monetary strategies, especially in regions facing strained ties with the West, as seen with Russia's pivot away from dollar-based assets post-sanctions. This demand is expected to sustain bullish momentum, with price targets from institutions like UBS and Deutsche Bank hovering around $2,900 per ounce by the end of 2025.

The Chinese Market and Its Influence on Global Trends

China, the world's largest gold consumer, exerts a profound influence on global gold dynamics. After a tumultuous year marked by both premiums and discounts in domestic gold pricing, December 2024 saw a resurgence in Chinese demand, with domestic prices exceeding global benchmarks by $4.4 per ounce. This recovery signals renewed buyer confidence as seasonal demand ahead of the Lunar New Year coincides with a slight dip in prices from record highs of $2,790 per ounce in October. The premium recovery is bolstered by concerns over the incoming Trump administration's trade policies, further heightening gold’s safe-haven appeal.

Seasonality and Price Volatility

The Chinese market’s fluctuation between premiums and discounts throughout 2024 underscores its price sensitivity. Premiums peaked at $85.6 per ounce in April during the Lunar New Year, only to swing to a $40.6 per ounce discount in October as global prices soared. Seasonal demand patterns, coupled with geopolitical and economic uncertainties, suggest a continuation of this trend into 2025. Analysts point to the upcoming Chinese New Year as a critical period for gold, with potential spikes in buying activity likely to push premiums higher and influence global pricing.

Interest Rates and Inflation Hedge Dynamics

The Federal Reserve’s anticipated easing cycle in 2025 is another key factor driving gold’s trajectory. As interest rates decline, the opportunity cost of holding non-yielding assets like gold diminishes, increasing its attractiveness. Inflationary pressures further enhance gold's appeal as a hedge, with analysts at JPMorgan and Goldman Sachs projecting prices to approach $3,000 per ounce. Historical trends support this bullish outlook, with gold posting an average annualized gain of 30% during the stagflation of the 1970s. Current macroeconomic parallels suggest a similarly favorable environment.

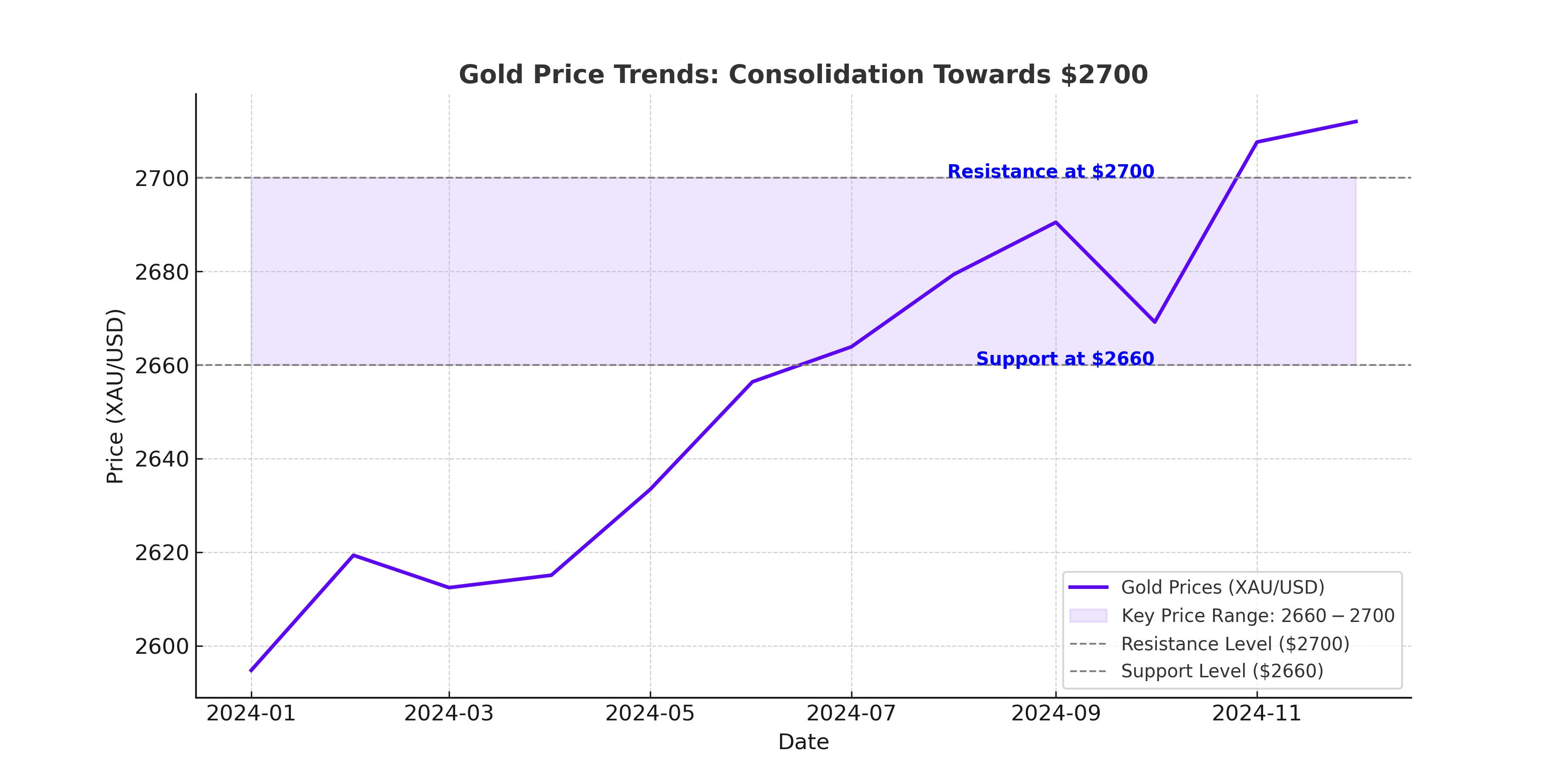

Technical Analysis and Resistance Levels

Gold’s technical chart shows a consolidation phase around $2,630, with key resistance at $2,665, aligning with the 50-day moving average. A breakout above this level could target the psychological $2,700 mark, with further resistance at $2,726. Conversely, support levels are identified at $2,607 and $2,583, with significant downside risk if these levels fail to hold. The Relative Strength Index (RSI) near neutral territory indicates room for upward momentum, provided geopolitical and economic catalysts align favorably.

Impact of the Strong Dollar and Treasury Yields

The US Dollar Index (DXY) and Treasury yields pose near-term headwinds for gold. A stronger dollar, trading above 108.00, makes gold more expensive for foreign buyers, dampening demand. Additionally, rising 10-year yields, currently at 4.641%, increase the opportunity cost of holding non-yielding assets. However, subdued Treasury bond yields and cautious Federal Reserve policy could mitigate these pressures, providing a supportive backdrop for gold prices.

Long-Term Outlook: A Safe-Haven Asset in an Uncertain World

Gold’s role as a safe haven remains pivotal in 2025, with geopolitical tensions in the Middle East, ongoing conflicts in Ukraine, and potential US-China trade disputes under the Trump administration likely to sustain investor interest. Analysts expect central bank buying and inflationary concerns to drive prices higher, with projections of $2,900 to $3,000 per ounce by mid-2025. Gold's limited industrial use compared to other commodities like silver and platinum further shields it from demand shocks tied to economic slowdowns.

Conclusion

Gold (XAU/USD) enters 2025 with strong tailwinds, supported by central bank accumulation, geopolitical uncertainties, and a favorable macroeconomic environment. While near-term resistance and dollar strength may limit immediate gains, the long-term outlook remains bullish, with potential for prices to surpass $3,000 per ounce as key economic and geopolitical catalysts unfold. For investors seeking a hedge against inflation and uncertainty, gold continues to offer a compelling value proposition.