How does TSMC’s (NASDAQ:TSM) $87.52 billion revenue growth shape its valuation at $475–$495?

How TSMC’s (NYSE:TSM) AI leadership and $65 billion Arizona investment secure its dominance amid geopolitical risks and Big Tech’s AI surge | That's TradingNEWS

TSMC (NYSE:TSM): An In-Depth Analysis of Its AI-Driven Growth and Strategic Positioning

Dominance in AI and Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has firmly established itself as the global leader in semiconductor manufacturing, capitalizing on the surging demand for advanced chips driven by AI and high-performance computing (HPC). In 2024, TSMC reported a remarkable $87.52 billion in revenue, a 33.9% increase year-over-year, showcasing its resilience and ability to adapt to a rapidly evolving tech landscape. High-performance computing now accounts for 51% of TSMC’s revenue, up from 42% in the prior year, reflecting the company's pivotal role in AI's exponential growth.

The company’s cutting-edge 3nm technology has rapidly gained traction, contributing 20% of wafer revenue in Q3 2024, up from 15% in Q2. Advanced nodes, including 5nm (32%) and 7nm (17%), now represent 69% of TSMC's total wafer revenue, cementing its technological leadership in delivering chips essential for AI-driven applications. These advancements are critical as major players like Nvidia (NVDA), AMD (AMD), and Apple (AAPL) rely on TSMC’s manufacturing prowess to maintain their competitive edge.

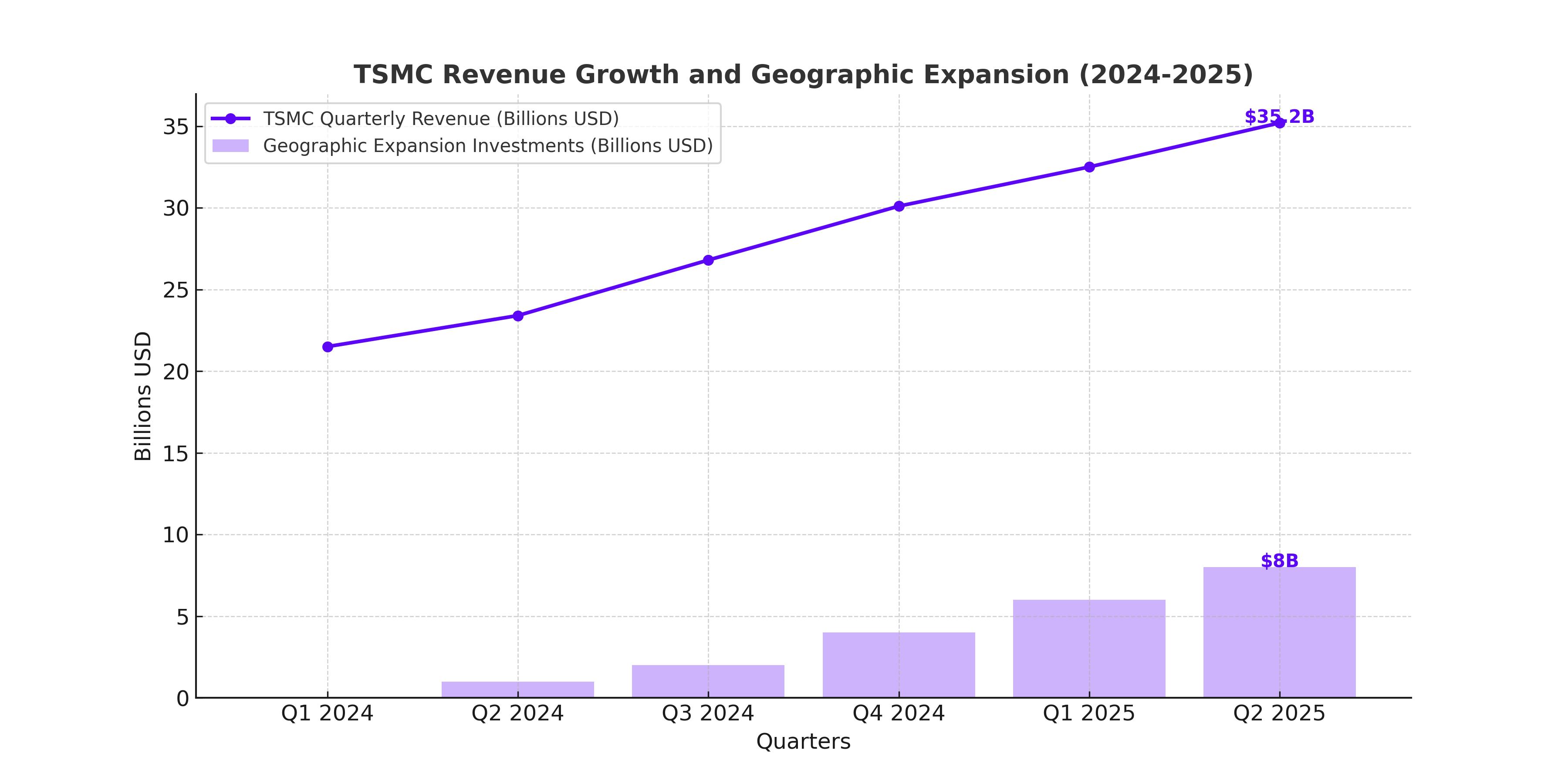

Strategic Geographic Expansion to Mitigate Geopolitical Risks

TSMC has been proactive in addressing geopolitical risks, particularly the tensions between China and Taiwan. Approximately 90% of TSMC’s most advanced manufacturing capabilities are based in Taiwan, posing a potential vulnerability. To mitigate this, TSMC has expanded globally, with key facilities in the United States and Japan.

The $65 billion investment in Arizona is a cornerstone of TSMC’s diversification strategy. The Arizona Fab 21, set to begin 4nm production in H1 2025, will cater to major customers like Nvidia, Apple, and AMD. Early reports indicate that this facility is already outperforming in chip yields, with 4% higher output compared to plants in Taiwan. Similarly, TSMC's $10 billion investment in Japan’s Advanced Semiconductor Manufacturing (JASM) has enabled it to diversify its revenue streams while maintaining its technological edge. The Japan facility, focusing on mature nodes (12nm and 28nm), is well-positioned to meet the growing demand for automotive and industrial applications.

AI-Driven Revenue Growth and Market Opportunities

Big Tech’s investment surge in AI infrastructure is a direct boon for TSMC. Microsoft (MSFT) announced an $80 billion capital expenditure for AI-enabled data centers in 2025, while Amazon (AMZN) is investing $22.6 billion. These massive investments highlight the growing reliance on TSMC’s advanced nodes to power AI GPUs and accelerators.

Nvidia’s adoption of TSMC’s 3nm technology for its next-generation GPUs, alongside Google’s (GOOG) use of TSMC’s chips for its TPU v6 and v7 accelerators, further underscores the company’s dominance. Broadcom (AVGO) has also leveraged TSMC’s technology to drive its AI chip revenue to $12.2 billion in 2024, with projections of $17–18 billion for 2025.

With a forward PEG ratio of 0.94, TSMC appears undervalued relative to its growth potential. Revenue estimates for 2025 suggest a 13.84% year-over-year increase, although this could be conservative given the 57.8% year-over-year growth reported in December 2024.

Valuation and Financial Performance

TSMC’s valuation has surged, with a forward P/E of 29.71x, just 2.26% below the sector median. The company’s gross margins have expanded to 57.8% in Q3 2024, driven by robust pricing power and high utilization rates. The introduction of 10–20% price increases for 3nm and 2nm wafers, with N2 wafers priced at $25,000–30,000, underscores its ability to command premium pricing.

While the stock has gained 39% since May 2024, it still offers significant upside. Wall Street estimates a fair value of $475–$495, supported by historical earnings surprises and strong growth projections.

Risks and Challenges

Geopolitical tensions remain the most significant risk, as any escalation between China and Taiwan could disrupt TSMC’s operations. Market cyclicality in non-AI segments, such as smartphones and PCs, also poses challenges, with Apple’s reduced demand for iPhone chips impacting revenue. Additionally, TSMC’s geographic expansion could dilute gross margins by 2–3%, although the strategic benefits outweigh these short-term pressures.

Conclusion: A Strong Buy for Long-Term Growth

TSMC’s dominant position in advanced semiconductor manufacturing, coupled with its strategic geographic expansion and robust financial performance, positions it as a clear leader in the AI revolution. The company’s ability to innovate, capture market share, and mitigate risks underscores its investment appeal. While near-term challenges exist, the long-term growth trajectory remains intact, making TSMC (NYSE:TSM) a compelling choice for investors seeking exposure to the burgeoning AI and semiconductor markets.

For real-time updates on NYSE:TSM, visit this link.