How will Microsoft’s (NASDAQ:MSFT) $80 billion AI infrastructure investment impact its stock performance and long-term growth?

As Microsoft’s stock trades at $427.85, its $80 billion AI bet raises critical questions about profitability, growth, and its path toward a potential $475 valuation | That's TradingNEWS

Microsoft Corporation (NASDAQ:MSFT): A Comprehensive Analysis of Growth, Challenges, and Strategic Positioning

Microsoft's Strategic AI Investments and Stock Performance

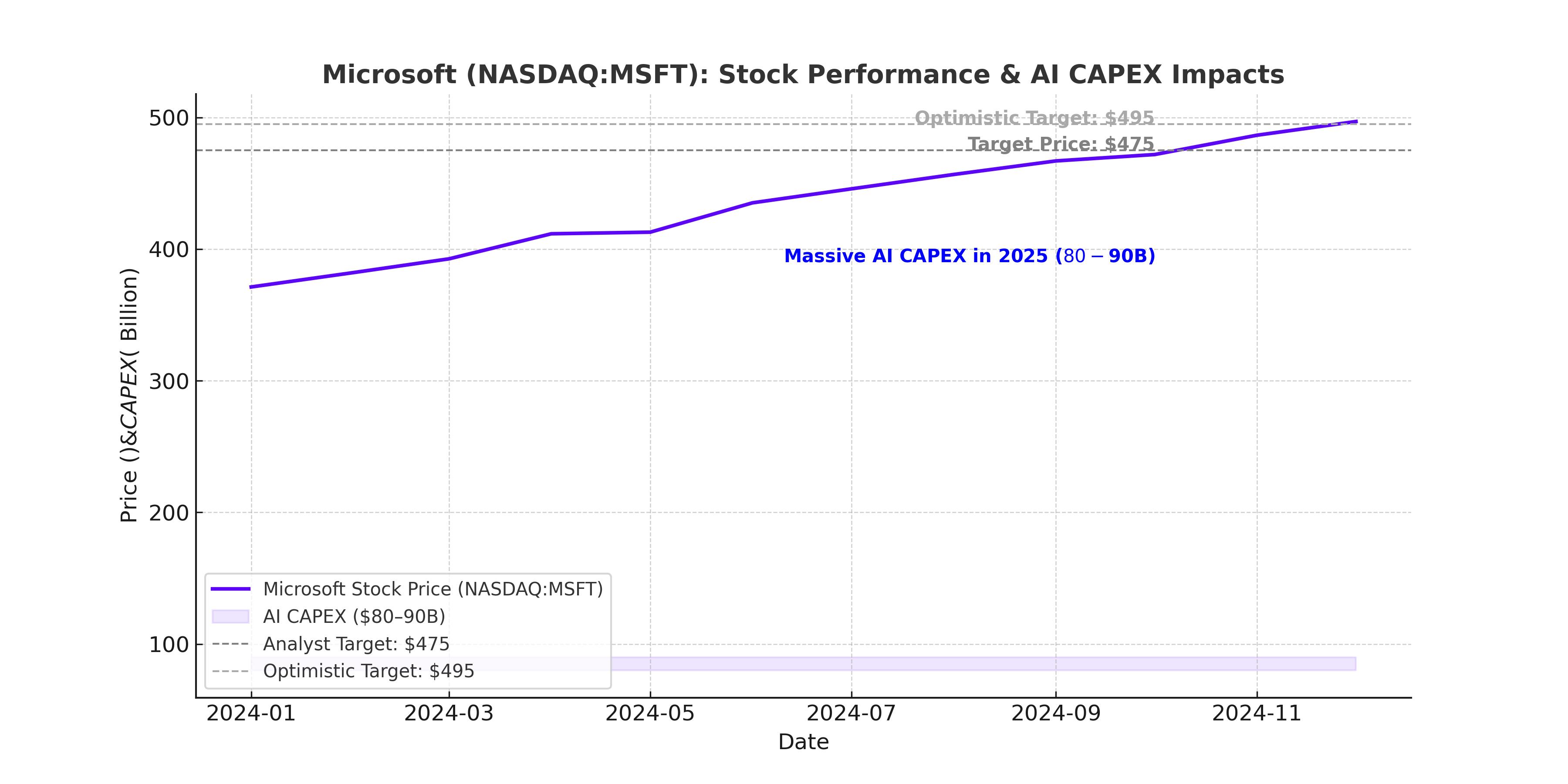

Microsoft Corporation (NASDAQ:MSFT) is navigating a transformative phase, driven by an $80–90 billion capital expenditure plan to expand its AI data center capacity. With its stock currently trading at $427.85, Microsoft remains one of the most influential players in the technology sector. However, this significant investment comes with questions about profitability, free cash flow, and valuation. Its forward P/E ratio of 32.46 reflects high market expectations, placing pressure on the company to deliver consistent and substantial results.

Massive Capital Outlays: Risks and Rewards

Microsoft's $80 billion data center initiative represents an 80% year-over-year increase in capital expenditures from FY 2024’s $44.5 billion. This investment signals its aggressive approach to securing AI leadership but raises critical concerns about its capital-heavy model's sustainability. Analysts predict Microsoft's operating cash flow for FY 2025 could reach $136 billion, up from $119 billion in FY 2024, assuming a 14% revenue growth year-over-year. Yet, post-CAPEX cash flow is expected to decline significantly, from $75 billion in FY 2024 to approximately $40 billion in FY 2025.

Such a fundamental shift from its historically asset-light model increases financial risk. Tying up vast resources in infrastructure with extended payback periods challenges Microsoft's flexibility and profitability. However, the potential rewards are equally significant, as AI adoption could enable long-term growth and reinforce its leadership in cloud and enterprise services.

Competitive Dynamics in the AI Ecosystem

Microsoft's aggressive spending reflects the escalating competition in the AI infrastructure race. Amazon is set to invest $96.4 billion in data centers in 2025, followed by Google at $62.6 billion and Meta at $52.3 billion. This "arms race" underscores the high stakes, as each company seeks to solidify its position. However, such intense competition diminishes the likelihood of any single entity gaining a sustained edge, creating a "prisoner’s dilemma" where overspending becomes the norm.

Despite this, Microsoft maintains a strategic advantage through its robust ecosystem. Azure's strong presence in cloud services and the widespread adoption of Microsoft 365 products provide a solid foundation for AI integration. Large Azure contracts exceeding $10 million highlight the enterprise sector's confidence in Microsoft's capabilities. Additionally, Microsoft's bundling strategies continue to lock in customers, further solidifying its market position.

Evaluating Valuation and Growth Potential

With a PEG ratio of 2.42, Microsoft trades at a premium compared to its peers, reflecting investor optimism about its growth trajectory. Wall Street analysts estimate the fair value of MSFT at $495.66, suggesting a 14% upside from current levels. However, a more conservative target of $475 balances growth potential with market realism. This price target aligns with options market data, where significant activity around the $475 level indicates strong investor confidence in this valuation.

Microsoft's revenue for FY 2025 is projected to grow 14% year-over-year, supported by increased AI adoption and enhanced infrastructure. The company’s Q4 2024 earnings report demonstrated its resilience, with EPS at $3.30 (beating estimates by $0.19) and revenue at $65.59 billion (up 16% year-over-year). Such performance underscores its ability to navigate macroeconomic challenges and maintain growth momentum.

The OpenAI Partnership: Strengths and Strains

Microsoft's early investment in OpenAI positioned it as a frontrunner in the AI race. However, this partnership has faced challenges as competition intensifies. OpenAI's rising compute demands and partnerships with other providers, such as Oracle, have highlighted the strain on its collaboration with Microsoft. Additionally, the competitive gap between OpenAI and other AI leaders has narrowed, diminishing the first-mover advantage Microsoft initially enjoyed.

Despite these challenges, Microsoft has diversified its AI strategy, working with multiple AI companies and strengthening its in-house capabilities. The $80 billion investment in AI data centers underscores its commitment to supporting diverse AI workloads, ensuring it remains a critical player in the evolving AI ecosystem.

Technical and Momentum Analysis

Microsoft (NASDAQ:MSFT), trading at approximately $427.85, has demonstrated remarkable technical resilience, consistently maintaining levels above its 200-week Simple Moving Average (SMA). This trend underscores the stock’s strong foundational support and its ability to weather market volatility. Periodic dips throughout 2024, including a multi-month pullback, presented compelling entry points for investors, with the stock regaining upward momentum since November.

The rebound aligns with increased institutional interest, as software-focused investors reallocated funds toward Microsoft, recognizing its long-term growth potential. December marked a notable recovery phase, with MSFT outperforming the broader market index for technology stocks, driven by its leadership in cloud computing, enterprise software, and AI integration. Analysts suggest the multi-month weakness has likely reached its bottom, evidenced by technical indicators such as rising relative strength and improved momentum metrics.

Volume trends further validate the bullish sentiment, with sustained accumulation patterns reflecting strong confidence in the stock’s prospects. Microsoft’s ability to maintain this momentum hinges on its execution of strategic initiatives, including the $80 billion AI infrastructure investment. If the company continues to capitalize on its market position and convert these investments into tangible growth, the technical outlook remains robust, with analysts targeting a potential upside toward $475, representing a solid opportunity for long-term investors.

Key Risks and Outlook

One of the most pressing concerns for Microsoft (NASDAQ:MSFT), currently trading at $427.85, lies in its ability to effectively monetize its aggressive $80 billion investment in AI infrastructure. While initiatives like Copilot showcase significant promise, their adoption among enterprise and retail users remains limited, raising questions about the immediacy of revenue realization. This issue is compounded by the capital-intensive nature of AI ventures, which increases operational costs while the returns on these investments remain largely speculative in the short term.

Adding to the complexity is Microsoft’s valuation, which is trading at a forward P/E ratio of 32.46 and a PEG ratio of 2.42, placing it at a premium compared to its sector peers. These metrics underscore the high expectations baked into the stock price, leaving little room for underperformance. If AI adoption does not scale rapidly or profitably, Microsoft risks facing intensified scrutiny from investors concerned about its ability to justify its elevated valuation.

Despite these challenges, Microsoft’s diversified business model provides a buffer against market volatility. Its dominance in cloud computing through Azure, coupled with its expansive Microsoft 365 ecosystem, creates a dual advantage in capturing both enterprise and consumer markets. Furthermore, its willingness to invest in cutting-edge technology, while capital-intensive, reinforces its position as a leader in AI and cloud innovation. These factors highlight Microsoft’s resilience and capacity for long-term growth, even in a highly competitive environment.

Why Is Microsoft Betting $80 Billion on AI Infrastructure, and How Will It Impact Its Stock?

Microsoft’s bold decision to allocate $80 billion—an 80% increase from the previous year’s capital expenditure—toward AI data centers reflects its unwavering commitment to dominating the AI landscape. This substantial investment raises a critical question: how will this reshape the company’s financial and operational trajectory? With its stock currently valued near $427.85, the stakes are high as the company aims to deliver substantial returns from these expenditures.

The rationale behind this massive spending is clear: Microsoft seeks to solidify its competitive position against rivals like Amazon (AWS) and Google (GCP) in the hyperscale cloud and AI space. By enhancing its AI capabilities, including products like Copilot and advanced Azure integrations, Microsoft aims to meet the growing demand for AI-driven solutions across enterprise and consumer applications. However, this strategy is not without risk. If the adoption of AI tools and infrastructure lags behind projections, the company could face significant pressure on its margins and free cash flow, projected to drop to $40 billion post-CAPEX in FY 2025 from $75 billion in FY 2024.

The impact on Microsoft’s stock will hinge on its ability to transition these investments into profitable growth. If the company succeeds in driving AI adoption and monetizing its innovations, the current valuation could appear conservative, with potential upside toward analysts’ targets of $475–$495. However, if these initiatives falter, Microsoft risks eroding investor confidence, which could lead to a downward revaluation. Thus, the outcome of this $80 billion bet will be a defining factor in the company’s financial narrative for the foreseeable future.

That's TradingNEWS

Read More

-

SPYI ETF at $52.59: 11.7% Yield, 94% ROC and Near S&P 500 Returns

04.01.2026 · TradingNEWS ArchiveStocks

-

XRPI and XRPR Rally as XRP-USD Defends $2.00 on $1.2B XRP ETF Inflows

04.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Eyes $4.30 if Storage Draws Tighten

04.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X at 156.91: 157.75 Breakout Sets 160 Target as Fed Jobs Week Tests The Dollar

04.01.2026 · TradingNEWS ArchiveForex