How Upcoming Central Bank Decisions Impact EUR/USD

An expert breakdown of the EUR/USD pair's response to the Fed and ECB's latest monetary policy shifts, with a focus on interest rates, market sentiment, and key technical indicators | That's TradingNEWS

Understanding the Current Dynamics of EUR/USD Amidst Central Bank Decisions

Central Bank Decisions: A Catalyst for Currency Movements

The financial markets are on the edge of their seats as a series of central bank decisions loom over the horizon, poised to shape the future trajectory of major currency pairs, especially EUR/USD. Among these, the Federal Reserve (Fed) and the European Central Bank (ECB) hold the keys to potential shifts in currency strength, influenced by their respective stances on interest rates amidst varying economic landscapes.

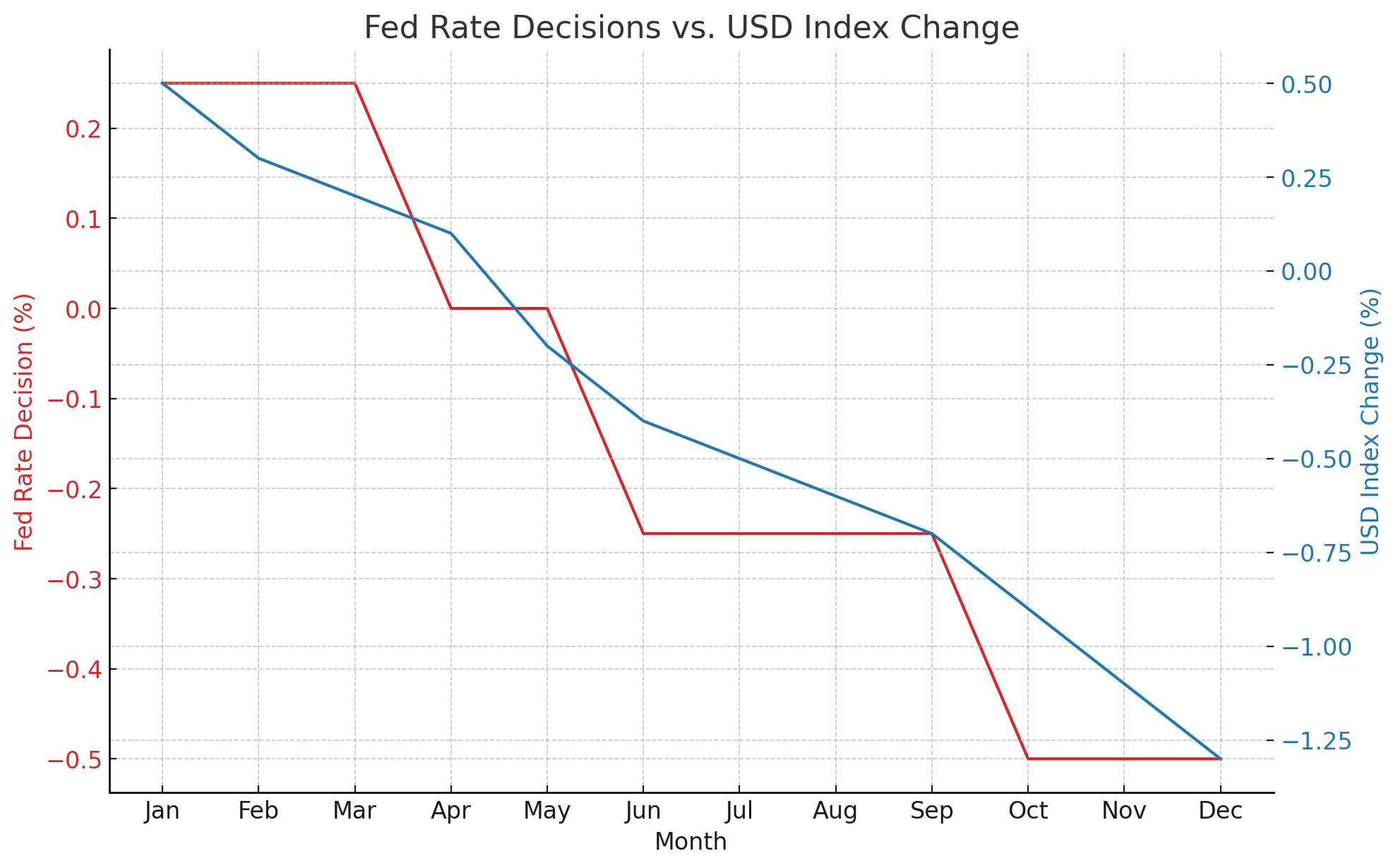

The Fed's Stance and its Impact on USD

As anticipation builds for the Fed's upcoming policy meeting, market participants are speculating on the potential outcomes and their implications for the USD. With the Fed expected to maintain rates at current levels, the focus shifts to the so-called "dot plot" and Chair Jerome Powell's remarks for clues on future rate-cut paths. A deviation from the expected reduction in rate cuts for 2024, from three to two, could signal a less dovish stance than anticipated, potentially bolstering the USD's position against its counterparts. This scenario underscores the intricate dance between monetary policy signals and currency valuations.

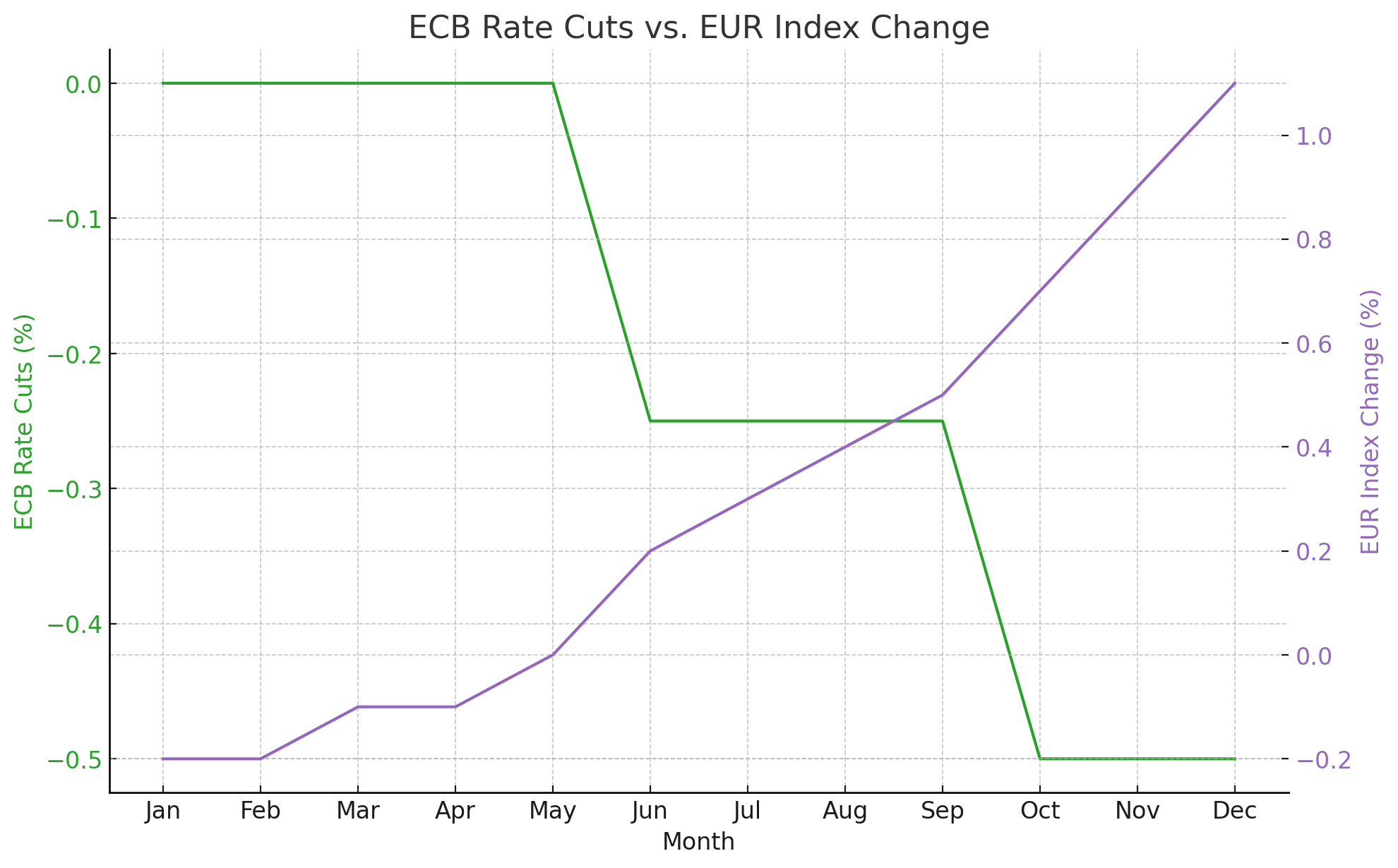

EUR's Path: Navigating Through ECB's Policy Shifts

Across the Atlantic, the ECB is navigating its own monetary policy adjustments, with signals pointing towards a readiness for rate cuts, beginning as early as June. Such a move could contrast sharply with the Fed's cautious approach amidst persistent inflation concerns. ECB policymaker Martins Kazaks' endorsement of market expectations for three rate cuts in 2024 further highlights the divergence in policy trajectories between the ECB and the Fed, potentially exerting downward pressure on the EUR.

Technical Analysis: A Closer Look at EUR/USD

From a technical standpoint, EUR/USD's recent pullback from its peak reveals critical support and resistance levels that traders are closely monitoring. The 1.0835 confluence, marked by the 200-day Simple Moving Average and the 50% Fibonacci retracement level, emerges as a pivotal point for the pair. A breach below this threshold could open the doors to further declines, underscoring the significance of technical markers in currency trading strategies.

Market Sentiment and the Road Ahead

As market participants digest the deluge of information from central banks, the sentiment surrounding EUR/USD appears to lean towards caution. The interplay between the Fed's forthcoming decisions and the ECB's rate cut plans paints a complex picture of potential currency movements. With the USD gaining strength ahead of the rate decision and the EUR facing headwinds from anticipated policy shifts, the stage is set for a nuanced analysis of the EUR/USD pair's future direction.

In this intricate financial landscape, where central bank decisions wield substantial influence over currency dynamics, understanding the nuances of policy announcements and technical thresholds becomes paramount. As traders and investors navigate these turbulent waters, the EUR/USD pair serves as a barometer of shifting monetary policy landscapes and their broader economic implications.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex