Oil Prices Under Pressure: Examining the Influences of Geopolitical Tensions and Economic Policies

A Comprehensive Look at How Middle East Ceasefire Efforts, Federal Reserve Rate Cut Uncertainty, and Hurricane Beryl Are Shaping Brent and WTI Crude Markets | That's TradingNEWS

Oil Market Dynamics: A Comprehensive Analysis

Oil Prices React to Middle East Ceasefire Talks and Fed Policy Uncertainty

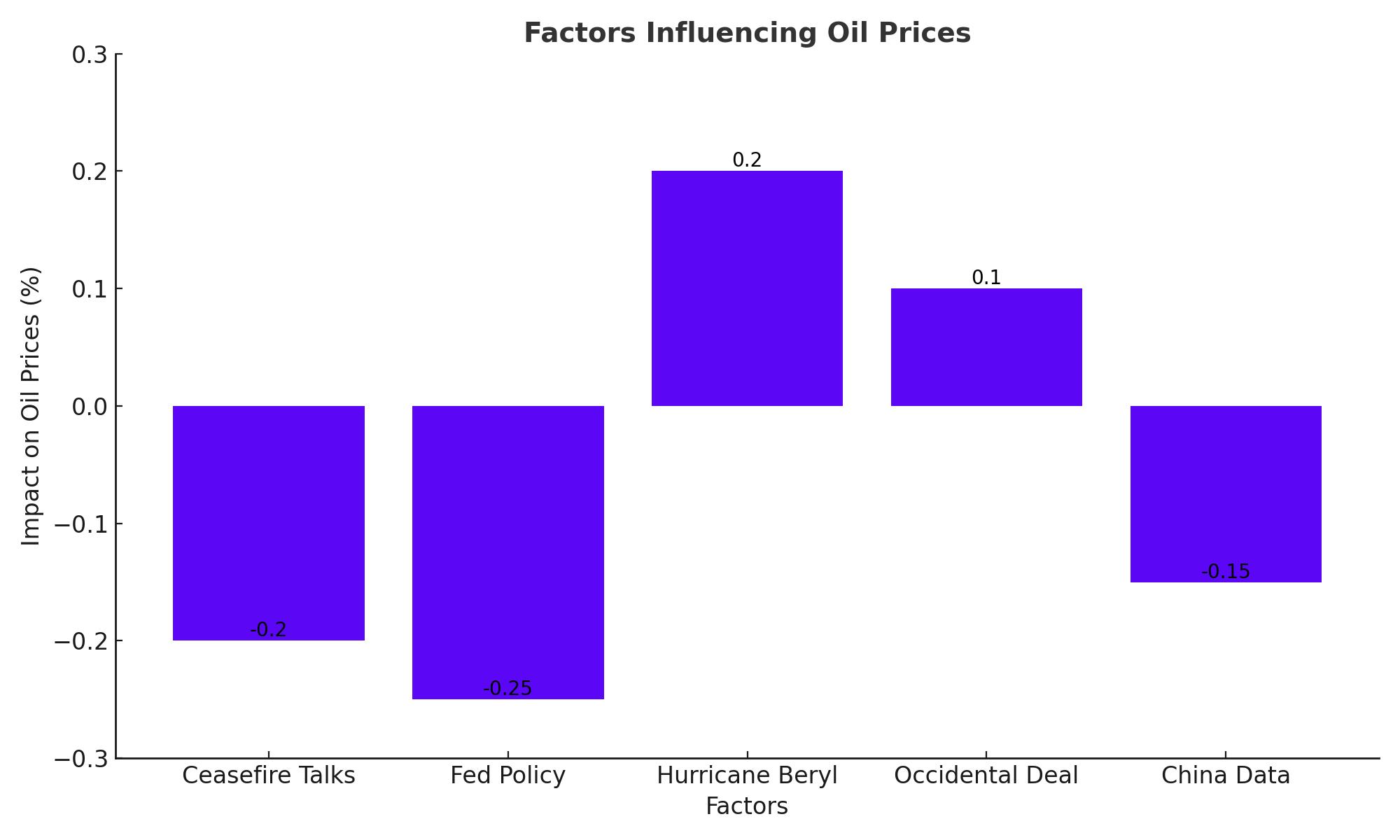

Oil prices experienced a decline on Tuesday amid ongoing diplomatic efforts to broker a ceasefire agreement in Gaza and uncertainty surrounding the timing of the US Federal Reserve's (Fed) interest rate cut. Despite this, the potential impact of Hurricane Beryl on oil production in the Gulf of Mexico limited further price declines.

International benchmark Brent crude traded at $85.57 per barrel at 10.17 a.m. local time, marking a 0.20% decrease from the previous trading session. Similarly, the American benchmark West Texas Intermediate (WTI) fell 0.25% to $82.12 per barrel.

Middle East Ceasefire Efforts and Their Impact

Ceasefire negotiations in the Middle East, home to a significant portion of global oil reserves, have alleviated some supply concerns, putting downward pressure on prices. Barbara Leaf, the US assistant secretary of state for Near Eastern affairs, is visiting the region to discuss a ceasefire deal in Gaza, which could ease tensions and stabilize oil supply chains.

Federal Reserve Interest Rate Cut Speculation

The uncertainty over the Fed's interest rate cut also influenced oil prices. Despite macroeconomic data indicating a slowdown in the US economy, Fed officials remain cautious. The probability of a Fed rate cut in September is 81%, with a 78% chance in November and a 98% likelihood of a second cut in December. The strengthening US dollar, which rose by 0.02% to 105.02, further contributed to the decline in oil demand as it made oil more expensive for foreign currency users.

Hurricane Beryl’s Potential Disruption

Hurricane Beryl, which has caused power outages for over 1 million households and businesses, poses a threat to oil production in the Gulf of Mexico. The fear of port closures and disruptions in crude and liquefied natural gas exports has kept oil prices from falling further.

Occidental Petroleum and Carbon Capture Initiatives

Occidental Petroleum (NYSE: OXY) has signed a deal with Microsoft to sell 500,000 tons of carbon removal credits annually from its Stratos direct air capture facility in Texas. This facility is designed to capture 500,000 tons of carbon dioxide each year, positioning Microsoft as its sole client. This partnership highlights the increasing importance of carbon capture in meeting corporate decarbonization goals, especially as Microsoft and Google report significant emission increases due to their AI initiatives.

Brent Crude Oil Price Movements

Brent crude oil futures have been on a downward trend after reaching a two-month high of $87.71. The price has fallen through the June-to-July uptrend line, targeting the $84.72-to-$84.32 support range. Investors are closely watching Federal Reserve Chair Jerome Powell’s testimony for further direction.

China’s Economic Data and Its Implications

Disappointing Chinese economic data, including lower-than-expected consumer price index (CPI) figures, have raised concerns about consumer demand in the world’s largest oil importer. Despite this, oil prices received a boost from the American Petroleum Institute’s inventory report, which showed declines in both crude and fuel stocks.

Federal Reserve Testimony and Market Reactions

During his testimony before the US Senate Banking Committee, Fed Chair Jerome Powell indicated that the US economy was no longer "overheated" and that the labor market had balanced out. Powell's comments suggested a cautious approach to rate cuts, with potential cuts not expected before September. This outlook had a mixed impact on oil prices, providing a temporary boost that may be short-lived.

China’s Role in Global Oil Demand

China’s role as the world’s largest oil importer continues to influence global oil markets. Despite a slight decline in imports compared to last year, China's daily crude imports remain substantial. Concerns about China's economic growth and its impact on oil demand have been a recurring theme, with the real estate sector's slowdown and the rise of electric vehicles (EVs) contributing to these worries.

Conclusion

The oil market is currently navigating a complex landscape of geopolitical tensions, economic uncertainties, and natural disruptions. The interplay between Middle East ceasefire talks, Federal Reserve policy decisions, and potential production impacts from Hurricane Beryl is shaping short-term price movements. Meanwhile, long-term trends such as China's economic performance and technological advancements in carbon capture will continue to influence the market's trajectory. Investors should closely monitor these factors to make informed decisions in this dynamic environment.