IBM (NASDAQ: IBM) Takes Off as AI and Cloud Strategy Hit Full Speed

From lagging tech giant to AI powerhouse, IBM’s latest moves are igniting growth—investors can’t afford to ignore this shift | That's TradingNEWS

IBM (NASDAQ: IBM) Stock Analysis: AI Integration and Strong Q2 Performance Drive Growth

International Business Machines Corporation (NASDAQ: IBM) has undergone a remarkable transformation, capitalizing on its strategic investments in artificial intelligence (AI) and hybrid cloud platforms. While the tech giant may have lagged behind competitors in previous years, recent quarterly earnings reveal a resurgence in its business, primarily fueled by its AI capabilities and consulting services. Let's dive into how IBM is positioning itself for long-term success and why its stock may represent a strong buying opportunity.

Q2 Financial Performance Overview

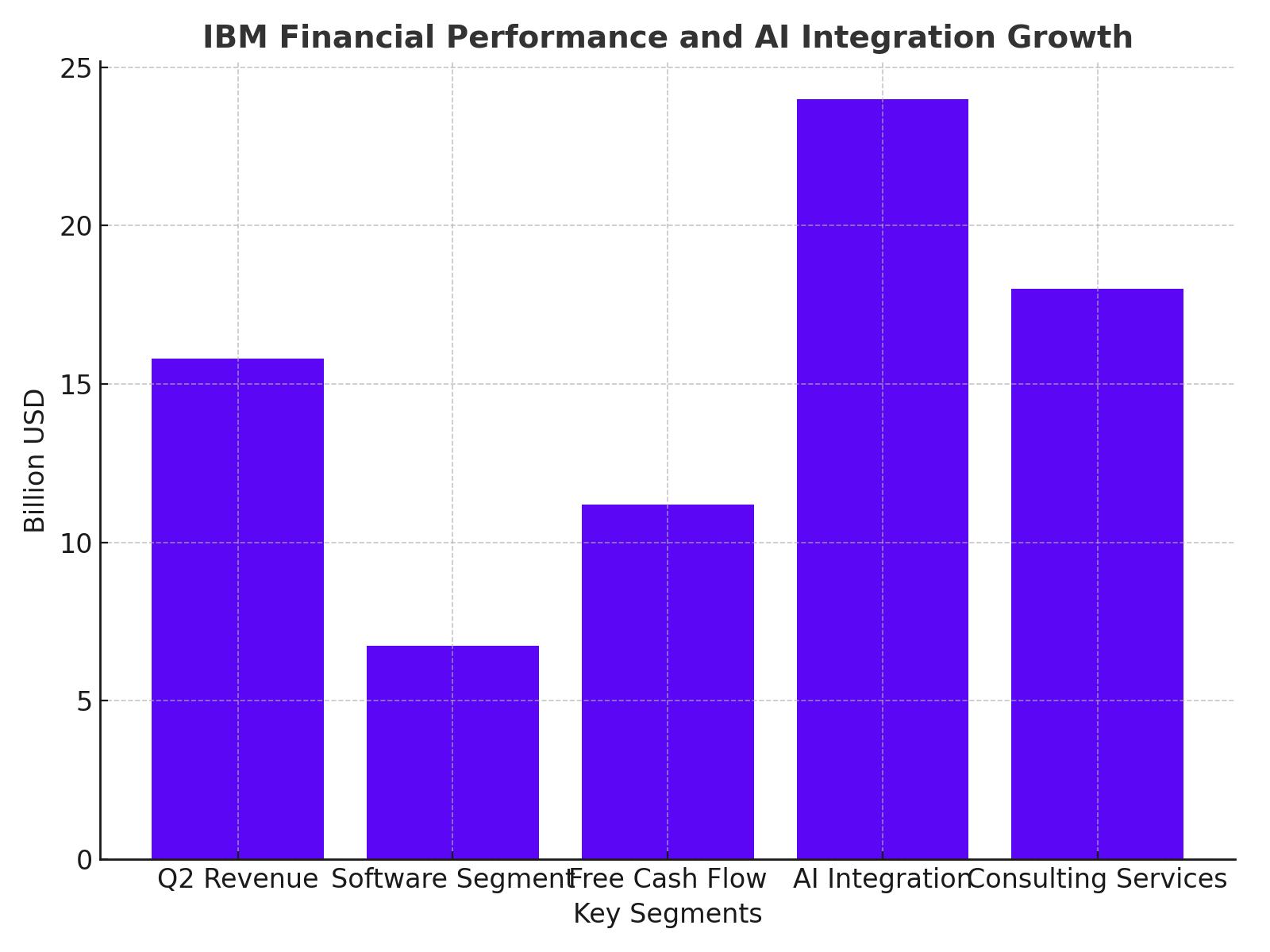

IBM’s second-quarter financial results exceeded market expectations, reporting a total revenue of $15.8 billion, a year-over-year increase of 4%. The software segment, in particular, was a standout performer, generating $6.74 billion in revenue. This growth was driven by the increasing adoption of AI and hybrid cloud platforms, reflecting the company's pivot towards cutting-edge technology solutions.

Free cash flow surged by 24%, reaching $11.2 billion, with IBM now forecasting a robust $12 billion in free cash flow for the full fiscal year. This increase in free cash flow underscores the company’s ability to efficiently manage capital expenditures while generating consistent returns for shareholders.

AI and Hybrid Cloud: A Key Driver for (NASDAQ: IBM)

IBM is strategically positioning itself as a leader in AI, specifically in enterprise-level AI solutions. The company's watsonx platform is the cornerstone of this strategy, offering businesses the opportunity to adopt AI with enhanced data privacy and security features. What sets IBM apart is its ability to integrate AI within existing enterprise infrastructure, an essential factor for large organizations that prioritize data control.

Moreover, IBM's integration of Meta’s Llama 3 AI model into the watsonx platform has expanded its AI capabilities, enabling the company to offer more customized, scalable AI solutions for enterprises. The open-source nature of Llama 3, combined with IBM’s proprietary tools, provides enterprises with flexibility and security that few competitors can match. IBM has also solidified partnerships with key tech players like Meta Platforms (META), Microsoft (MSFT), and Amazon (AMZN) to expand its AI ecosystem.

Consulting Services: A Competitive Edge

IBM’s consulting business plays a pivotal role in its overall AI strategy. With its vast experience in enterprise-level software solutions, IBM’s consulting arm helps businesses navigate the complexities of AI implementation. This hands-on approach, which customizes AI to fit specific client needs, has allowed IBM to forge deeper relationships with enterprises, driving demand for their consulting and software services.

IBM Consulting recently expanded its AI services portfolio, including a library of role-based AI assistants, designed to help enterprises scale their operations more efficiently. This business model of combining consulting with proprietary AI tools is proving highly successful, enabling IBM to leverage its AI expertise while maintaining a high level of client engagement.

Growth Outlook for IBM Stock

The integration of AI and cloud services has been a catalyst for IBM’s resurgence, and its recent quarterly performance is a testament to the company's ability to adapt to market trends. As enterprises continue to prioritize AI-driven transformation, IBM is well-positioned to capture a significant share of this growing market.

IBM’s software business is expected to maintain high single-digit growth rates, driven by continued demand for hybrid cloud solutions and the expansion of its AI portfolio. With revenue projections for 2024 estimated to reach $65 billion, IBM is on track for sustained growth.

Investors have responded favorably to these developments, with IBM stock rising over 19% in recent months. Analysts expect further upside, particularly as IBM continues to capitalize on AI’s growing importance in the enterprise space.

Valuation and Dividend Potential

IBM’s strong financial performance, coupled with its aggressive push into AI, makes it an attractive stock for both growth and income investors. Despite its solid profitability, with a gross profit margin of 56.09% and an EBITDA margin of 23.45%, IBM trades at a relatively modest forward price-to-earnings (P/E) ratio of 19.58, which is below the sector median.

This presents a potential upside of approximately 20.42% if IBM’s valuation were to align with the sector median. Additionally, IBM offers a stable dividend, with a payout ratio of 72%, providing investors with consistent returns even as the company transitions into a high-growth phase.

Risks and Challenges

While IBM is making significant strides, it is essential to note potential risks. One of the key challenges lies in the non-deterministic nature of large language models (LLMs) such as Llama 3, which can sometimes produce inconsistent outcomes. This limitation could hinder broader AI adoption in highly regulated industries like finance and healthcare, where accuracy and reliability are critical.

Moreover, the macroeconomic environment could also pose challenges, particularly with IT discretionary spending remaining under pressure. However, IBM’s diversified business model, strong balance sheet, and focus on consulting and AI should help mitigate these risks.

Conclusion

IBM (NASDAQ: IBM) is at the forefront of the AI revolution, backed by solid financial performance, strategic partnerships, and a strong consulting business that provides a competitive edge. With its robust AI offerings and hybrid cloud capabilities, IBM is positioned for sustained growth as enterprises increasingly adopt AI-driven solutions.

Given the company's improving revenue growth, expanding free cash flow, and undervalued stock price, IBM is a strong buy for investors looking to capitalize on the AI wave. As the stock continues to climb, supported by key insider transactions and long-term AI potential, IBM offers a compelling investment case.

For real-time insights into IBM’s stock performance, visit the IBM Real-Time Stock Chart.

That's TradingNEWS

Read More

-

SMH ETF: NASDAQ:SMH Hovering at $350 With AI, NVDA and CHIPS Act Fueling the Next Move

16.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: Can $1B Inflows Lift XRP-USD From $1.93 Back Toward $3.66?

16.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Falls to $3.80–$3.94 as Warm Winter Kills $5.50 Spike

16.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Slides, BoJ 0.50% Hike, Fed Cut and NFP Set the Next Big Move

16.12.2025 · TradingNEWS ArchiveForex