In-Depth Analysis of Recent Oil Market Developments and Future Projections

Exploring the Cedar LNG Project, U.S. Market Trends, Geopolitical Influences, and Global Oil Production Dynamics | That's TradingNEWS

Analysis of Recent Developments in the Oil Market

Haisla Nation and Pembina Pipeline's Cedar LNG Project

The Haisla Nation and Pembina Pipeline Corporation have taken a significant step forward with the Cedar LNG project, a floating LNG export facility on Canada’s West Coast. This project, noted for being the world’s first indigenous majority-owned LNG project, is set to have a nameplate capacity of 3.3 million tons per year. Powered by renewable electricity from BC Hydro, Cedar LNG aims to be one of the lowest emitting LNG facilities globally. The project, estimated to cost approximately $4.0 billion, is expected to commence operations by late 2028.

U.S. Oil Market Dynamics

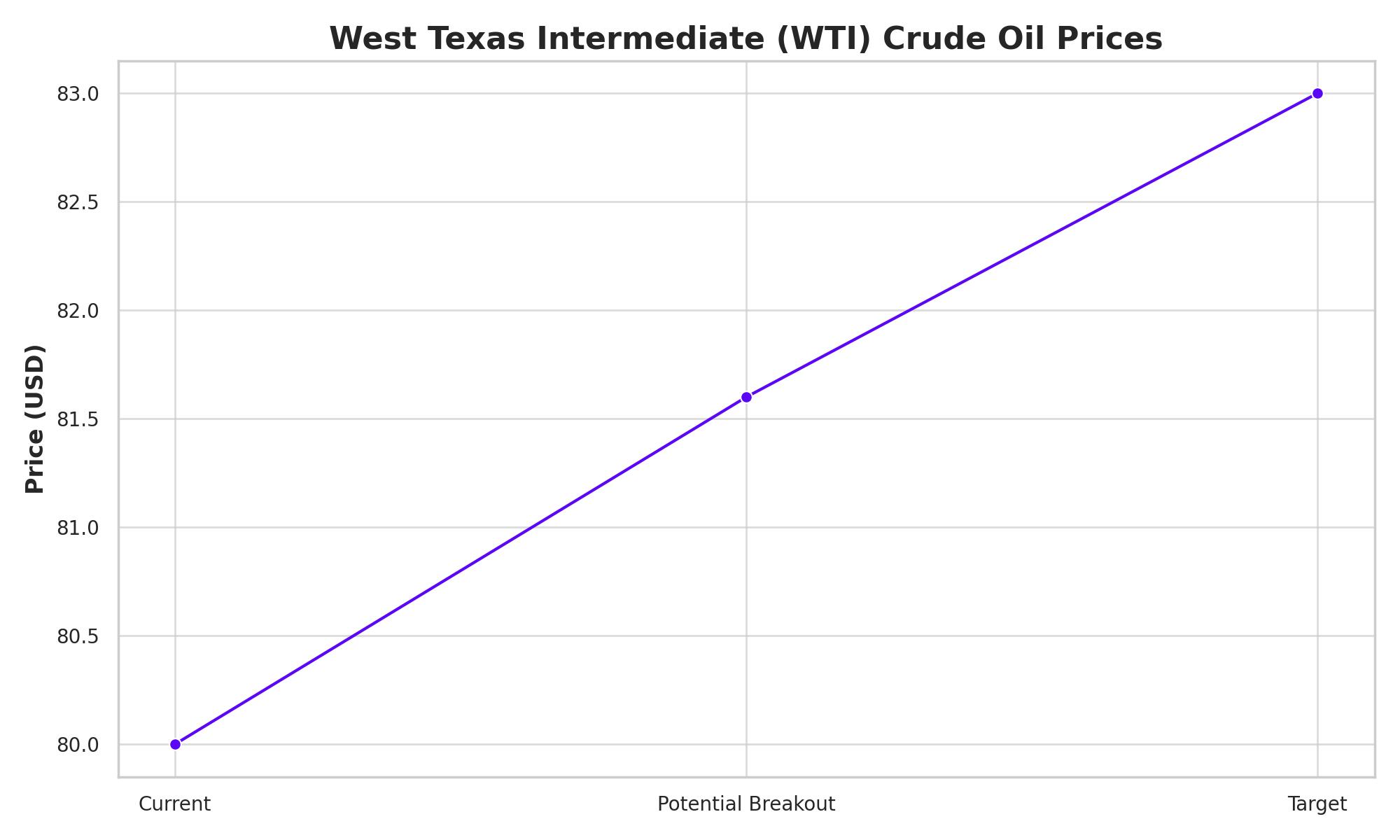

West Texas Intermediate (WTI) Crude Oil Technical Analysis

West Texas Intermediate Crude Oil has shown signs of consolidation around the $80 mark, a psychologically significant level that has previously acted as resistance. The market shows a potential to rise towards $83 if it breaks above $81.60. However, the situation remains choppy, with dips often seen as buying opportunities in this grade of oil.

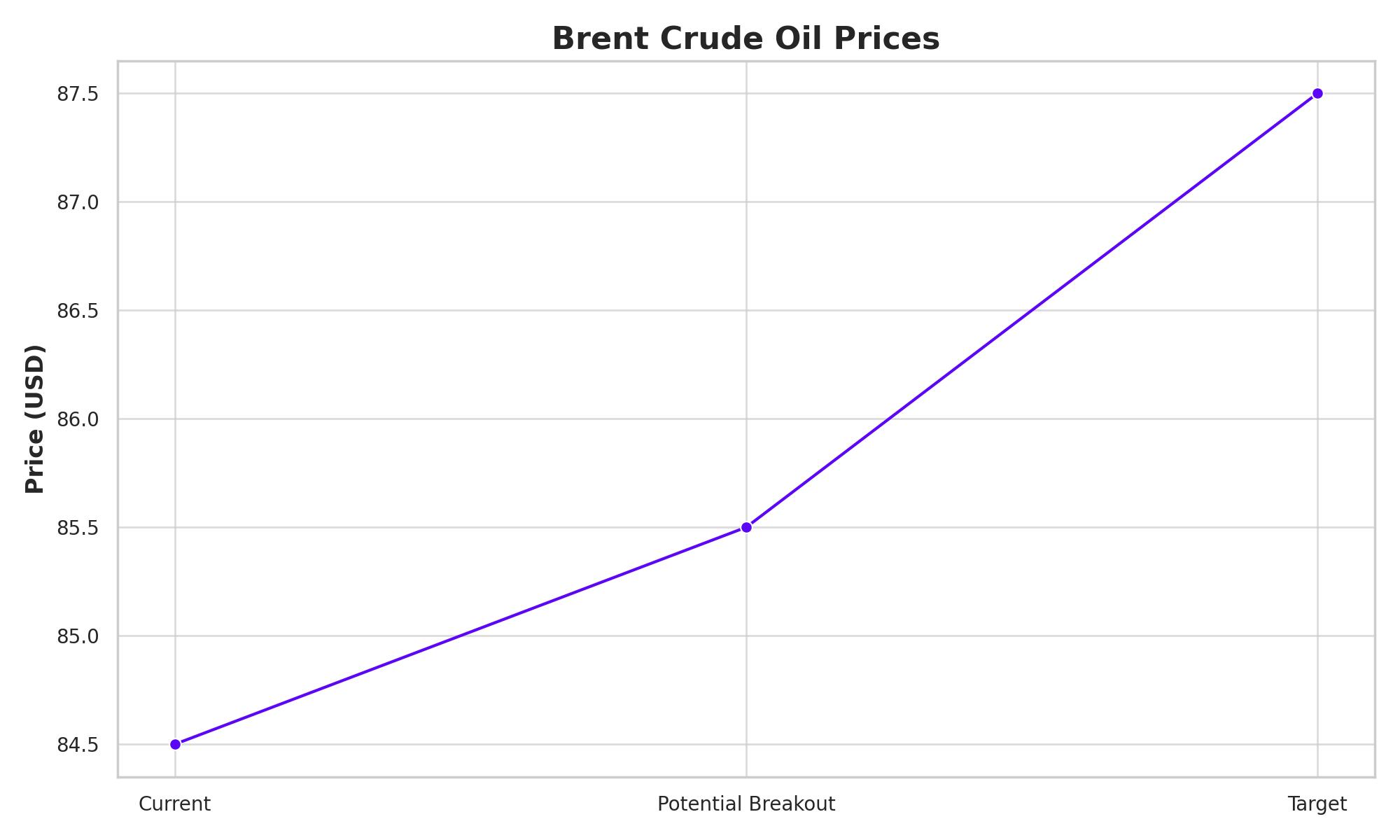

Brent Crude Oil Technical Analysis

Similarly, the Brent crude market exhibits volatility around the $84.50 level. Breaking above $85.50 could push prices towards $87.50, a historically significant level. The cyclical nature of crude oil demand, particularly in the travel-heavy summer season, supports this upward momentum.

Geopolitical Influences and Inventory Data

Middle East Tensions and Geopolitical Risks

Geopolitical tensions, particularly involving Israeli strikes on Gaza and Ukrainian attacks on Russian refineries, have added a risk premium to oil prices. These events, coupled with the ongoing conflict between Israel and Hezbollah, continue to influence market dynamics, maintaining a floor on prices.

U.S. Inventory Data and Import Patterns

Recent data from the American Petroleum Institute (API) showed an unexpected build in U.S. oil inventories, rising by approximately 0.9 million barrels in the week ending June 21. This contrasts with expectations of a 3 million barrel draw, suggesting sluggish fuel demand despite the summer season. However, U.S. crude oil imports surged to a nearly two-year high in May, reaching 3.1 million barrels per day. This increase in imports, primarily from Canada and Latin America, supports refining activities for the summer driving season, potentially boosting demand in the third quarter.

Market Valuation and Future Projections

Brent Hits "Summer Peak"

Analysts at Goldman Sachs project that Brent crude prices have reached their "summer peak" of $86 per barrel, supported by strong summer travel activity and robust global jet demand. Despite this, concerns over high U.S. interest rates and a strong dollar have capped overall gains, with traders cautious about the Federal Reserve’s future actions on interest rates.

Rate Fears and Dollar Strength

The dollar's strength, nearing two-month highs, has made oil more expensive for buyers using other currencies. This strength is driven by signs of resilience in the U.S. economy, which suggests that the Federal Reserve might keep rates high for longer. The focus remains on the PCE price index data, the Fed’s preferred inflation gauge, expected to influence the central bank's rate outlook.

Global Oil Production and Export Trends

Pemex and Mexican Oil Market

In Mexico, Pemex has received government support in the form of deferred tax payments, highlighting the state’s ongoing backing for the heavily indebted oil giant. Pemex's crude oil exports rose by 34% in May, reversing plans to curb exports due to fires at two refineries affecting local demand. The Mexican government’s continued support for Pemex, despite its significant debt burden, remains a critical factor in the country’s oil market dynamics.

Cedar LNG and Canadian Export Potential

The Cedar LNG project in Canada represents a significant development in the country’s energy sector. With its strategic location on the Pacific Coast, the project is poised to capitalize on proximity to key Asian markets. The project's design, powered by renewable energy, aligns with global trends towards more sustainable energy production, potentially setting a benchmark for future LNG projects.

Conclusion

The oil market is navigating a complex landscape shaped by geopolitical tensions, fluctuating demand, and strategic developments in key regions. Projects like Cedar LNG highlight the push towards sustainable energy solutions, while geopolitical risks and market dynamics in the U.S. and Mexico underscore the ongoing volatility in oil prices. Investors and stakeholders must remain vigilant, considering both the macroeconomic indicators and regional developments that continue to drive the global oil market.

Thta's TradingNEWS

WTI & Brent Crude Prices Face Major Setback: How Will Trump's Tariffs and OPEC+'s Output Boost Impact Oil Markets?

Gold Price Surges to Record Highs Before Retreating: How Will Tariff Uncertainty Affect XAU/USD?