Intel (NASDAQ:INTC) at a Crossroads – Can It Survive or Will a Takeover Reshape the Future?

Intel (NASDAQ:INTC) Struggles to Keep Up – Is a Breakup the Only Solution?

Intel Corporation (NASDAQ:INTC) has been at the center of Wall Street speculation, with its stock surging over 20% last week after reports emerged that Taiwan Semiconductor Manufacturing Company (TSMC) and Broadcom (NASDAQ:AVGO) are exploring potential buyouts of key Intel business segments. The chip giant is at a critical juncture, facing stiff competition in AI, weakening margins, and a struggling foundry business that has been hemorrhaging cash.

Intel’s valuation remains appealing, trading at just 16.2x forward earnings, significantly below NVIDIA (NASDAQ:NVDA) at 29.3x and AMD (NASDAQ:AMD) at 17.1x, but its revenue growth is stagnant, and investors are demanding change. The big question is: Can Intel execute a successful turnaround, or will it be forced to break apart?

Chip Wars: Can Intel (NASDAQ:INTC) Catch Up in AI, or Is It Already Too Late?

The AI boom has left Intel (NASDAQ:INTC) behind, with competitors like NVIDIA and AMD dominating the space. While Intel’s Gaudi 3 AI accelerators were meant to be a game-changer, they have failed to gain significant traction. NVIDIA currently holds an estimated 80% market share in AI chips, while AMD is quickly closing the gap with its MI300 series.

Intel recently announced that it scrapped its Falcon Shores AI GPU, once expected to challenge NVIDIA, signaling a lack of confidence in its ability to compete in the high-performance computing space. The company is also trailing in data centers, with weak demand for its Xeon processors forcing price cuts.

Despite these setbacks, Intel has one major asset—its foundry business. The U.S. government has allocated $8 billion under the CHIPS Act to support domestic chip manufacturing, and Intel has positioned itself as America’s best hope for semiconductor independence.

But can Intel Foundry turn profitable, or will it continue to drag down Intel’s financials?

Intel Foundry Faces Heavy Losses – Is a TSMC Takeover the Best Path Forward?

Intel Foundry was supposed to rival Taiwan Semiconductor (NYSE:TSM) and provide a domestic alternative to offshore chip production. Instead, it has been a financial black hole. Intel Foundry posted a staggering $2.3 billion operating loss in Q4 2024, adding to the $5.8 billion loss from the previous quarter.

The foundry division’s inability to secure major clients beyond Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) has fueled speculation that Intel may need to sell part of its foundry business to TSMC.

Reports indicate that TSMC is exploring a joint venture to take control of Intel’s U.S. chip plants, but political and regulatory barriers remain. The Trump administration has voiced support for Intel maintaining domestic control, but a potential partnership with TSMC could accelerate the U.S. semiconductor industry.

If Intel offloads its foundry operations, it could significantly reduce cash burn and allow the company to refocus on CPU and AI chip design. However, it would also mean surrendering a crucial strategic advantage in the semiconductor race.

Broadcom Eyes Intel’s Design Assets – A Strategic Exit for INTC?

While TSMC is interested in Intel’s manufacturing capabilities, Broadcom (NASDAQ:AVGO) is reportedly looking to acquire Intel’s chip design division, which includes client computing, data center, and AI businesses.

Broadcom CEO Hock Tan is known for his aggressive acquisition strategy, and buying Intel’s processor design unit could strengthen Broadcom’s position in AI, networking, and enterprise computing.

If Intel sells off design assets, it would mark a historic shift, effectively transforming the company into a pure-play foundry operation. This could be appealing for Intel shareholders as it would streamline operations, eliminate struggling product lines, and potentially boost profitability.

But is Intel ready to give up on its core business?

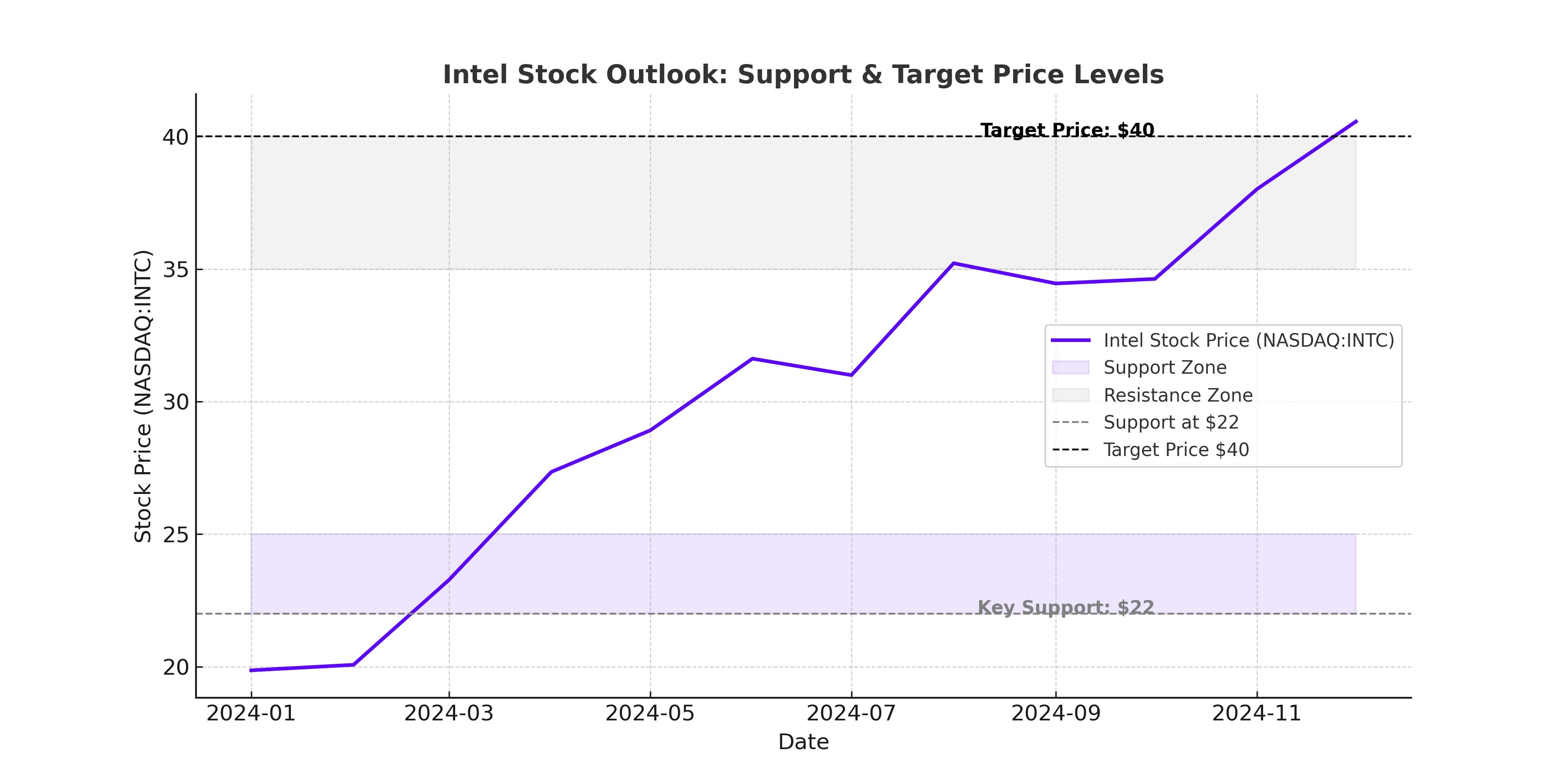

Intel (NASDAQ:INTC) Stock Outlook – Buy, Sell, or Hold?

Intel stock has rebounded strongly on takeover speculation, but the underlying business remains weak. The company reported a 7% year-over-year revenue decline in Q4 2024, and its profit margins have been shrinking.

Despite its struggles, Intel still holds value:

- Current stock price: $25.55 (up 8.26% today)

- Market Cap: $102.19 billion

- Forward P/E Ratio: 16.2x (cheaper than AMD and NVIDIA)

- Projected 2025 EPS: $0.49, up from a -0.13 EPS loss in 2024

Intel is still a major player in the semiconductor space, but its future depends on strategic decisions in the next 12 months. Investors should watch for developments in takeover talks with TSMC and Broadcom, as well as the company’s AI strategy.

If Intel offloads its foundry business or restructures under new leadership, the stock could surge past $40. If management fails to execute a turnaround, shares could drop below $20.

Verdict – Is Intel (NASDAQ:INTC) a Buy, Sell, or Hold?

Intel remains a high-risk, high-reward stock. The potential TSMC and Broadcom deals could unlock massive value, but execution risks remain.

Bullish case: If Intel successfully partners with TSMC or divests its struggling foundry business, shares could rally to $40+.

Bearish case: If the company fails to gain ground in AI or continues burning cash, shares could sink below $20.

Final recommendation: Hold for now, but closely watch takeover developments and upcoming earnings reports. If Intel announces a strategic shift, it could be a strong buy opportunity.

Check Real-Time INTC Stock Performance