Intel Stock (NASDAQ: INTC) Plummets 60% YTD— A 35% Upside Potential

Backed by Strong Financials, Intel's Turnaround Strategy Could Drive a Significant Rebound | That's TradingNEWS

Intel Corp (NASDAQ:INTC): A Critical Juncture Amid Strategic Revisions and Challenges

A Tumultuous Year for (NASDAQ:INTC)

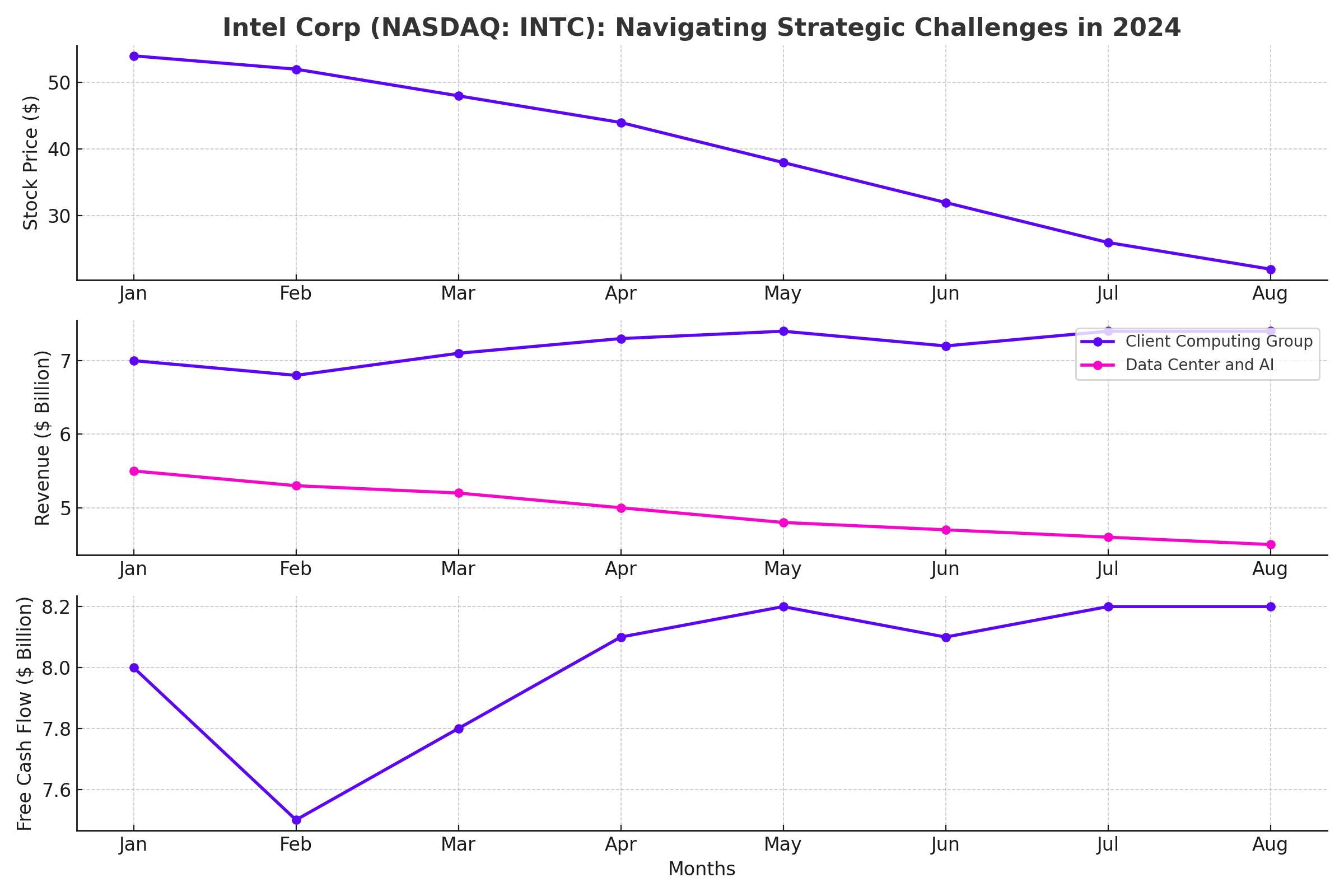

Intel Corp (NASDAQ:INTC) has faced a dramatic year, with its stock plummeting by 60% in 2024, marking it as one of the worst-performing stocks on the S&P 500. This decline follows a series of disappointing financial results, strategic missteps, and increasing competition in the semiconductor industry.

The company announced a staggering $1.6 billion net loss in Q2 2024, with analysts projecting another $1 billion loss in the upcoming quarter. The result? A sharp 26% drop in Intel’s stock in a single day post-earnings release, driven by a massive bottom-line miss, poor guidance, and the suspension of dividends. This year, Intel also announced a 15% reduction in its workforce, signaling a major shift in its operational strategy.

Strategic Revisions and Cost-Cutting Initiatives

Amid these struggles, Intel is taking aggressive measures to streamline its operations and reduce costs. The company aims to save upwards of $10 billion by next year through a combination of capital expenditure cuts, operational cost reductions, and layoffs. These measures also include suspending dividends starting in the fourth quarter, a move that is expected to save an additional $2 billion in cash annually.

One of the more drastic strategies being considered is the potential spin-off or sale of its foundry business, which has been a significant drain on the company’s resources. Reports suggest that this move, along with other strategic options, will be presented at Intel’s September board meeting, with banks like Morgan Stanley and Goldman Sachs advising on the possible outcomes.

Challenges and Setbacks in the Foundry Business

Intel’s foundry business, despite being a key part of its strategic vision, has been fraught with challenges. The company has been slow to capitalize on the rise of AI and has struggled to keep pace with competitors like NVIDIA and AMD. Intel’s new foundry facilities, particularly those in Ireland, have incurred significant R&D and startup costs, contributing to the company’s dwindling operating margins.

Furthermore, the company’s progress on constructing two new chip fabrication facilities in Germany has reportedly stalled, casting further doubt on Intel’s ability to compete in the high-stakes semiconductor market.

The Case for Optimism: Strengths in Core Business Segments

Despite the doom and gloom surrounding Intel, the company still has significant strengths, particularly in its core business segments. Intel’s Client Computing Group (CCG) remains robust, generating $7.4 billion in revenue in Q2 2024, exceeding expectations by 9% year-over-year. The company is on track to ship more than 40 million "AI PCs" by year-end, showcasing the strength of its latest generation of CPUs designed for AI performance.

The Data Center and AI (DCAI) segment, while facing some revenue decline, remains strategically important. Intel is gearing up to launch its Sierra Forest Xeon 6 processor in September and its Gaudi 3 AI accelerator later this year, both of which are expected to bolster its position in the competitive AI chip market.

The Path Forward: Is There Upside for Intel Stock (NASDAQ: INTC) ?

Intel stock (NASDAQ: INTC) is down 60% year-to-date, trading at a significant discount with a price target of $30 per share, suggesting a potential upside of 35%. This steep discount presents a compelling opportunity for investors. If Intel successfully executes its turnaround strategy, the stock could see a substantial rally.

Intel's robust financials underscore this potential. The company generated $8.2 billion in free cash flow in the last quarter alone, a clear indicator of its ongoing profitability. Additionally, Intel boasts a strong cash reserve of $11.3 billion, providing ample liquidity to fuel its strategic plans. This financial foundation is further complemented by Intel’s current valuation. With a forward P/E ratio of 18x based on anticipated EPS growth, the stock is trading at a level that many analysts consider a bargain, especially if the company's turnaround efforts gain traction.

Looking ahead, Intel’s upcoming board meeting is a key event that could catalyze a significant revaluation of the stock. The potential spin-off or sale of its foundry business is not just a restructuring move—it could be a game-changer. Such a move would likely unlock substantial value for shareholders, providing the capital needed to double down on Intel’s core strengths in the rapidly evolving tech landscape.

Moreover, Intel's aggressive push into AI and next-generation computing, with new product launches on the horizon, positions the company to capture growth in these high-margin markets. If these initiatives are well-received by the market, they could propel Intel's stock significantly higher.

Conclusion

Intel Corp (NASDAQ:INTC) finds itself at a crucial crossroads, where its future is closely tied to the successful implementation of key strategic decisions. The challenges are undeniable—Intel’s stock has plummeted by 60% in 2024, trading around $22.04, significantly below its tangible book value of approximately $19.50 per share. This sharp decline reflects the market’s reaction to disappointing financial results, including a $1.6 billion net loss in Q2 2024, and the subsequent suspension of dividends, a move that underscores the severity of Intel’s current predicament.

However, there remains a pathway for recovery. Intel’s restructuring plans, which include potential spin-offs, cost reductions, and refocusing on core strengths like the Client Computing Group and upcoming AI-related products, offer a glimmer of hope. The company's ability to generate substantial free cash flow—$8.2 billion in the last quarter—along with a strategic shift that could include the sale of underperforming assets, might help stabilize its financials and reinvigorate investor confidence.