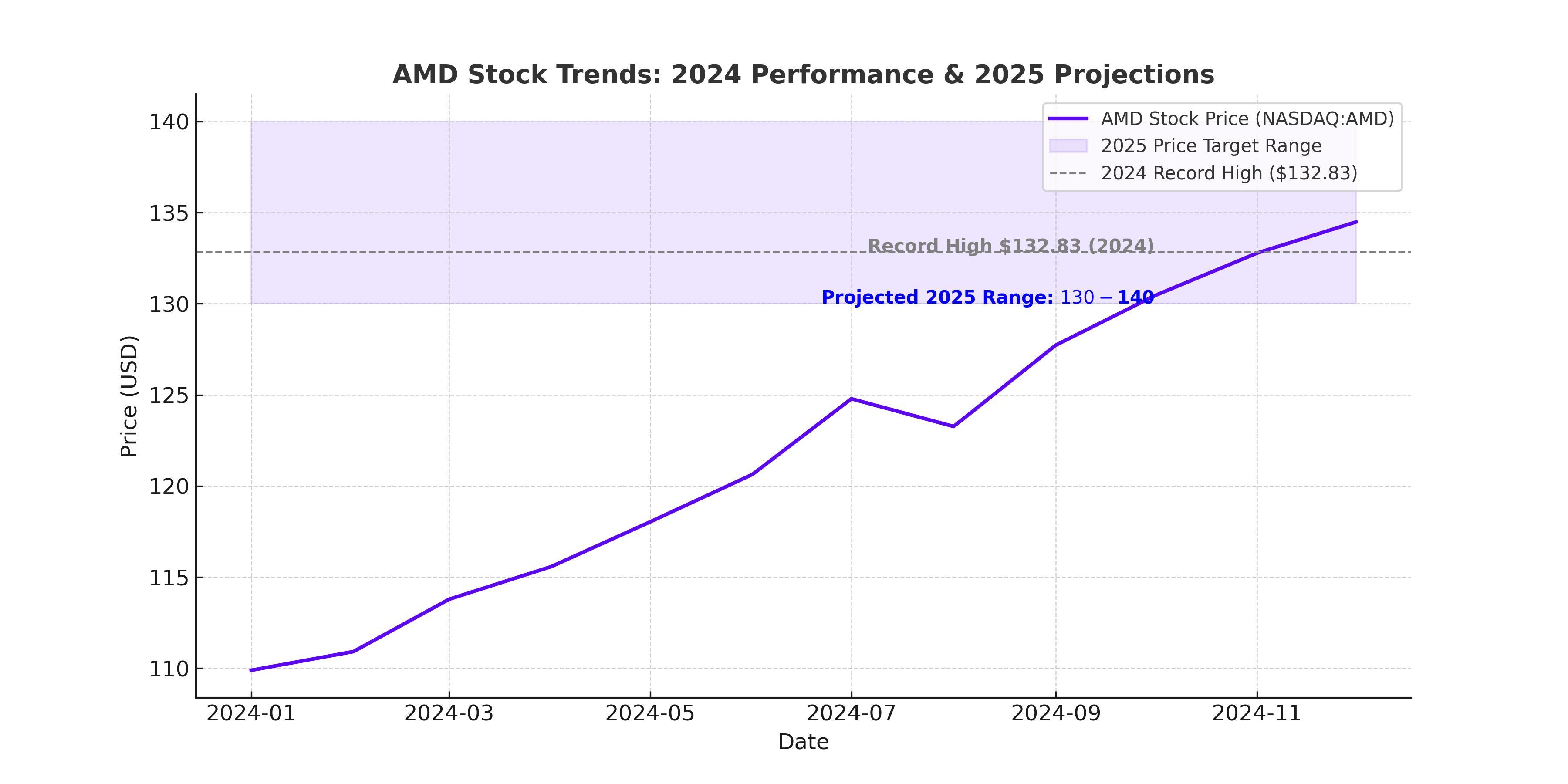

Is AMD Positioned to Hit $135 by 2025? Key Factors Driving Growth

AMD’s AI and CPU strategies, combined with insider and institutional confidence, could fuel its climb to $135 by 2025 | That's TradingNEWS

Advanced Micro Devices (NASDAQ:AMD): A Deep Dive into Stock Potential Amidst AI and Market Dynamics

AMD Stock Performance: Struggling Momentum in 2024

Advanced Micro Devices (NASDAQ:AMD) has faced significant challenges in 2024, with its stock price declining approximately 15% year-to-date, underperforming the S&P 500 and many of its semiconductor peers. After peaking earlier in the year, AMD stock has faced corrections tied to concerns over its AI growth trajectory and broader semiconductor market dynamics. Trading at $110.50, the stock is now well below its 52-week high of $132.83, sparking debates over its valuation and growth potential.

Despite market skepticism, AMD's forward price-to-earnings (P/E) ratio of 24x for fiscal 2025 and its price-to-earnings growth (PEG) ratio of 0.9 suggest potential undervaluation relative to its growth prospects, particularly in the AI and data center markets.

Leadership Under Lisa Su: A Strategic Edge

CEO Lisa Su has been pivotal in AMD's transformation, steering the company from near irrelevance to a prominent position in the semiconductor industry. Since assuming leadership in 2014, AMD stock has surged over 50x, underscoring the effectiveness of its strategic pivots. Unlike Intel (NASDAQ:INTC), which has struggled with leadership transitions and execution on its foundry business, AMD has successfully focused on its core markets, including data center CPUs and AI accelerators. AMD’s agility and ability to anticipate market trends, such as the explosive growth of AI, have been instrumental in its resurgence.

Data Center Momentum: EPYC CPUs and Market Share Gains

The data center business remains a cornerstone of AMD's growth, contributing $3.5 billion in Q3 2024 revenue, a 122% year-over-year increase. The EPYC CPU series, including the latest Turin processors, has gained significant traction among hyperscalers and enterprise customers, helping AMD capture 33.9% revenue share in the server CPU market. This represents a 270 basis point increase year-over-year and reflects AMD’s ability to outpace Intel, leveraging TSMC's (NYSE:TSM) advanced foundry capabilities.

AMD’s server CPUs offer superior performance, energy efficiency, and core counts, positioning them as the go-to choice for data centers looking to optimize AI workloads. This trend is expected to continue as demand for compute power accelerates in tandem with AI adoption.

AI Accelerators: Closing the Gap with Nvidia

AMD's foray into the AI accelerator market, led by its MI300 and MI325 series, marks a strategic push to challenge Nvidia's (NASDAQ:NVDA) dominance. The MI325X, launched in late 2024, boasts 256GB of HBM3E memory, positioning it as a cost-effective alternative to Nvidia's H200 and B200 accelerators. AMD projects $5 billion in AI revenue for 2024, up from initial estimates of $2 billion, reflecting robust demand and the company's ability to scale production.

However, Nvidia remains the industry leader, with its CUDA ecosystem providing a significant competitive edge. While AMD offers flexibility and lower costs, its AI revenue—though growing—still pales in comparison to Nvidia’s $30.8 billion in the most recent quarter. AMD’s success in capturing hyperscaler clients like AWS will be critical to its AI growth story.

Financials and Valuation: A Bullish Case

AMD's financial outlook is solid, with analysts projecting 55% EPS growth in 2025 and another 38% in 2026, driven by increasing contributions from the data center and AI segments. This trajectory would bring EPS to $7.05 by fiscal year-end 2026, making AMD’s current valuation attractive for long-term investors.

The company’s revenue mix is also shifting toward high-margin segments, as evidenced by the 300 basis point expansion in operating margin in Q3 2024. With robust free cash flow generation—nearly $500 million in the latest quarter—AMD is well-positioned to invest in R&D and strategic acquisitions, such as the recent ZT Systems deal, to bolster its AI capabilities.

Insider Activity and Institutional Support

Recent insider transactions provide a glimpse into the confidence within AMD’s leadership regarding the company’s growth trajectory. CEO Lisa Su, who has been instrumental in transforming AMD into a major player in the semiconductor industry, has consistently increased her holdings. For instance, recent filings revealed her acquisition of additional shares, signaling her belief in the long-term potential of AMD. Beyond her, other top executives have also bolstered their positions, indicating alignment between management and shareholder interests. These insider purchases are particularly noteworthy given AMD’s pivotal moment in scaling its AI and data center businesses.

Institutional investors have also displayed strong confidence in AMD. BlackRock, one of the largest asset managers globally, holds a significant position in AMD, demonstrating faith in its growth story. Vanguard, another institutional heavyweight, has similarly maintained a robust stake. Together, these institutions account for a substantial portion of AMD’s ownership, underscoring the trust of long-term investors in the company’s strategy. Institutional support is often a stabilizing force, particularly during periods of market volatility, and the continued backing of these major players suggests that AMD is seen as a strong contender in the semiconductor space. Details on insider transactions and institutional ownership can be further explored on AMD's profile page.

Market Risks and Competitive Pressures

Despite its many strengths, AMD operates in a fiercely competitive and rapidly evolving industry, which brings its own set of challenges. One of the most immediate risks comes from Nvidia’s ongoing dominance in the AI accelerator market. Nvidia has begun scaling production of its Blackwell chips, which are expected to set a new benchmark for performance and could intensify pressure on AMD’s MI300 series. Nvidia’s ecosystem, particularly its CUDA software platform, remains a significant competitive advantage, potentially limiting AMD’s ability to capture hyperscaler clients like AWS at scale.

Additionally, Broadcom (NASDAQ:AVGO) and Marvell Technology (NASDAQ:MRVL) are making aggressive inroads into the AI space. Broadcom’s recent three-year AI revenue outlook stunned the market, with projections as high as $90 billion. Marvell, on the other hand, has forged strategic partnerships with major hyperscalers, including AWS, to advance its AI chip portfolio. These developments highlight the increasing competition that AMD must navigate, even as it scales its own AI offerings.

Economic conditions also pose risks. Slowing global growth could impact enterprise and hyperscaler spending, while ongoing inventory corrections in the semiconductor industry might weigh on AMD’s near-term results. The cyclical nature of the industry, combined with macroeconomic uncertainties, requires AMD to execute flawlessly to sustain investor confidence.

Conclusion: A Strategic Buy for Long-Term Growth

Advanced Micro Devices (NASDAQ:AMD) presents a compelling long-term investment opportunity despite its recent challenges. The company’s leadership in server CPUs, bolstered by the continued success of its EPYC processors, positions it as a key player in the data center market. Its growing presence in the AI accelerator space, while still lagging behind Nvidia, showcases its ability to close the gap with innovative offerings like the MI300 and MI325 series.

CEO Lisa Su’s leadership remains a cornerstone of AMD’s success, driving strategic decisions that have consistently outperformed market expectations. While competitive pressures from Nvidia, Broadcom, and Marvell are formidable, AMD’s ability to offer flexibility and cost advantages to hyperscalers remains a differentiating factor. The company's valuation, trading at less than 17x expected earnings for fiscal 2026, underscores its potential upside.

With a target price of $135 for 2025, AMD represents a strategic buy for investors seeking exposure to high-growth segments of the semiconductor industry. Real-time updates, insider activity, and detailed market data can be tracked here.