Goldman Sachs (NYSE:GS): A Comprehensive Analysis of 2025 Outlook

Goldman Sachs Navigates Market Momentum with Optimism

Goldman Sachs (NYSE:GS) is a cornerstone of global financial markets, consistently shaping its trajectory through M&A leadership, strategic investments, and trading expertise. In 2025, the firm's outlook is buoyed by anticipated growth in deal activity, which CFO Denis Coleman recently highlighted at the Goldman Sachs Financial Services Conference. Despite broader market challenges, the bank sees 2025 as a pivotal year for capital market recoveries, supported by a strong Q3 earnings performance and improving client sentiment following the U.S. presidential election.

Earnings Recap: Surpassing Expectations in Q3

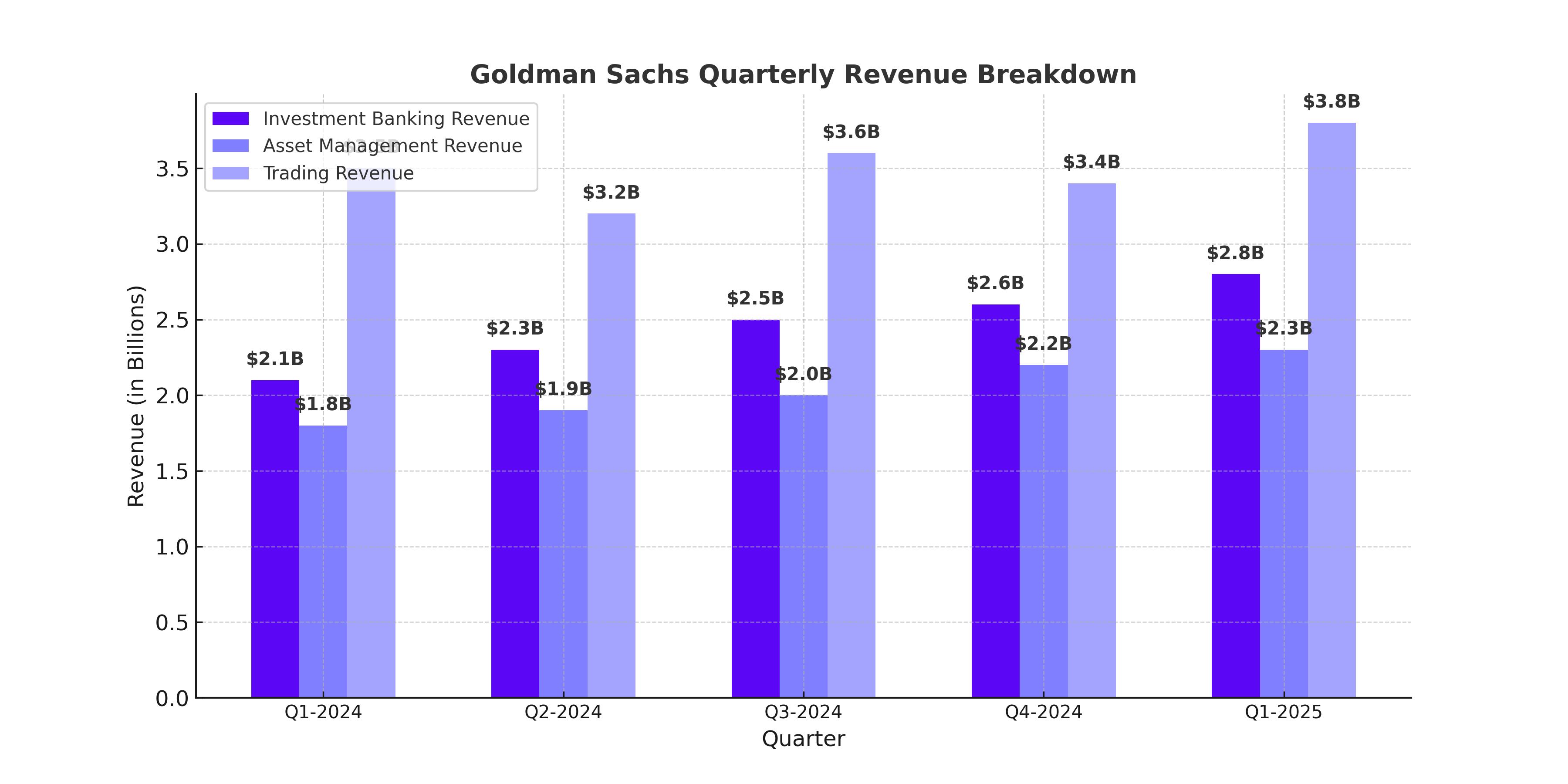

Goldman Sachs reported a stellar Q3, with earnings per share of $9.02, significantly beating analyst expectations of $7.31. This marks a 23% upside against consensus estimates. Revenue for the quarter grew by 7% year-over-year, reaching $11.82 billion. Key drivers included a 20% growth in Investment Banking fees and an 18% rise in Equities revenue, offsetting a 12% drop in Fixed Income, Commodities, and Currencies (FICC) revenue. Asset and Wealth Management saw a 16% year-over-year increase, supported by higher average assets under supervision, deposit balances, and private banking incentive fees.

Moreover, Goldman Sachs reduced operating expenses by 8%, improving its efficiency ratio to 64.3% compared to 74.4% in the prior year. These cost management efforts underline the firm's focus on enhancing profitability amid a volatile market environment.

Investment Banking Rebounds on Client Activity

Goldman’s confidence in 2025 M&A and IPO activity stems from improving client dialogue and a normalized regulatory environment. In his remarks, CFO Coleman noted that deal activity remains below the 10-year average but is poised for recovery. The firm expects significant acceleration in equity capital markets (ECM) activity, particularly IPOs, which were approximately 50% below their historical averages in 2024. As equity valuations stabilize and risk appetite among investors grows, Goldman Sachs anticipates an uptick in sponsor-driven IPO activity.

A Strategic Pivot: Focus on High-Growth Sectors

The firm’s pivot away from underperforming consumer banking ventures has allowed it to refocus resources on its high-margin Investment Banking and Asset Management segments. Goldman Sachs’ strong foothold in private credit is a prime example of its strategic evolution. As of Q3 2024, the firm managed $140 billion in private credit assets, benefiting from its full-suite offering of origination, underwriting, and distribution capabilities. This sector’s rapid growth, projected to expand into a $30 trillion market in the U.S., positions Goldman Sachs to capture significant value.

Valuation Insights: A Premium That Reflects Strength

Goldman Sachs currently trades at a price-to-earnings (P/E) multiple of 17.2x, above its 10-year historical average of 11.6x. While this valuation places it at a premium relative to historical norms, it remains competitive when compared to peers like Morgan Stanley, which trades at 19.5x earnings. Analysts project a price target of $629 for GS stock, implying a 7.4% upside from current levels. Despite the elevated multiple, the firm’s robust earnings trajectory and market leadership justify the premium, particularly in a recovering capital market environment.

Risks: Geopolitical and Regulatory Hurdles

While the outlook for M&A is promising, the firm faces risks from unpredictable geopolitical developments and regulatory shifts. Changes in fiscal policies under the new U.S. administration could alter market conditions. Furthermore, the trading segment, driven by FICC and equities, remains susceptible to volatility and external shocks, particularly if inflationary pressures prompt the Federal Reserve to reassess its interest rate strategy.

Goldman Sachs’ Competitive Edge in 2025

Goldman Sachs continues to set itself apart through its exceptional Investment Banking capabilities and a diversified revenue model that leverages its strengths in trading and asset management. The firm's aggressive approach to private credit and its dominance in global M&A ensure its leadership in capturing market opportunities. Moreover, strategic divestments from non-core consumer ventures and a renewed focus on high-margin services reinforce its position as a leading financial institution.

Conclusion: Buy or Hold?

Despite its premium valuation, Goldman Sachs presents a compelling case for long-term investors. The bank’s ability to navigate cyclical markets, coupled with its strategic focus on high-growth sectors, positions it as a formidable player in 2025. For investors seeking exposure to financial markets' resurgence, Goldman Sachs offers an attractive blend of growth potential and market resilience. With a $629 price target and strong earnings momentum, GS stock is a buy for those looking to capitalize on the next wave of deal-making and market recovery.