Is Kingsoft Cloud (NASDAQ:KC) Poised to Hit $12.50?

Strong AI demand and strategic partnerships drive Kingsoft Cloud’s revenue growth. Analysts project significant upside—learn why $12.50 could be within reach | That's TradingNEWS

Kingsoft Cloud’s Strategic Evolution and Growth Prospects

Insider Confidence and Institutional Support

Kingsoft Cloud Holdings Limited (NASDAQ:KC) has witnessed significant insider and institutional activity, signaling robust confidence in the company’s growth trajectory. CEO Tao Zou and other executives have underscored this sentiment through consistent investments in their holdings, reinforcing their belief in the company’s AI-driven future. Institutional investors such as Renaissance Technologies LLC and Headlands Technologies LLC have increased their positions in KC, signaling long-term faith in the stock’s potential. For instance, Renaissance Technologies raised its stake by 4%, owning 460,400 shares valued at $1.156 million by the end of Q3 2024. Similarly, SG Americas Securities LLC initiated a new position in KC, further highlighting institutional confidence in the company’s strategic direction. These moves reflect growing optimism that KC’s AI and cloud offerings will drive sustained growth in a competitive market. For detailed insights on insider transactions, visit Kingsoft Cloud’s stock profile.

AI-Led Revenue Surge

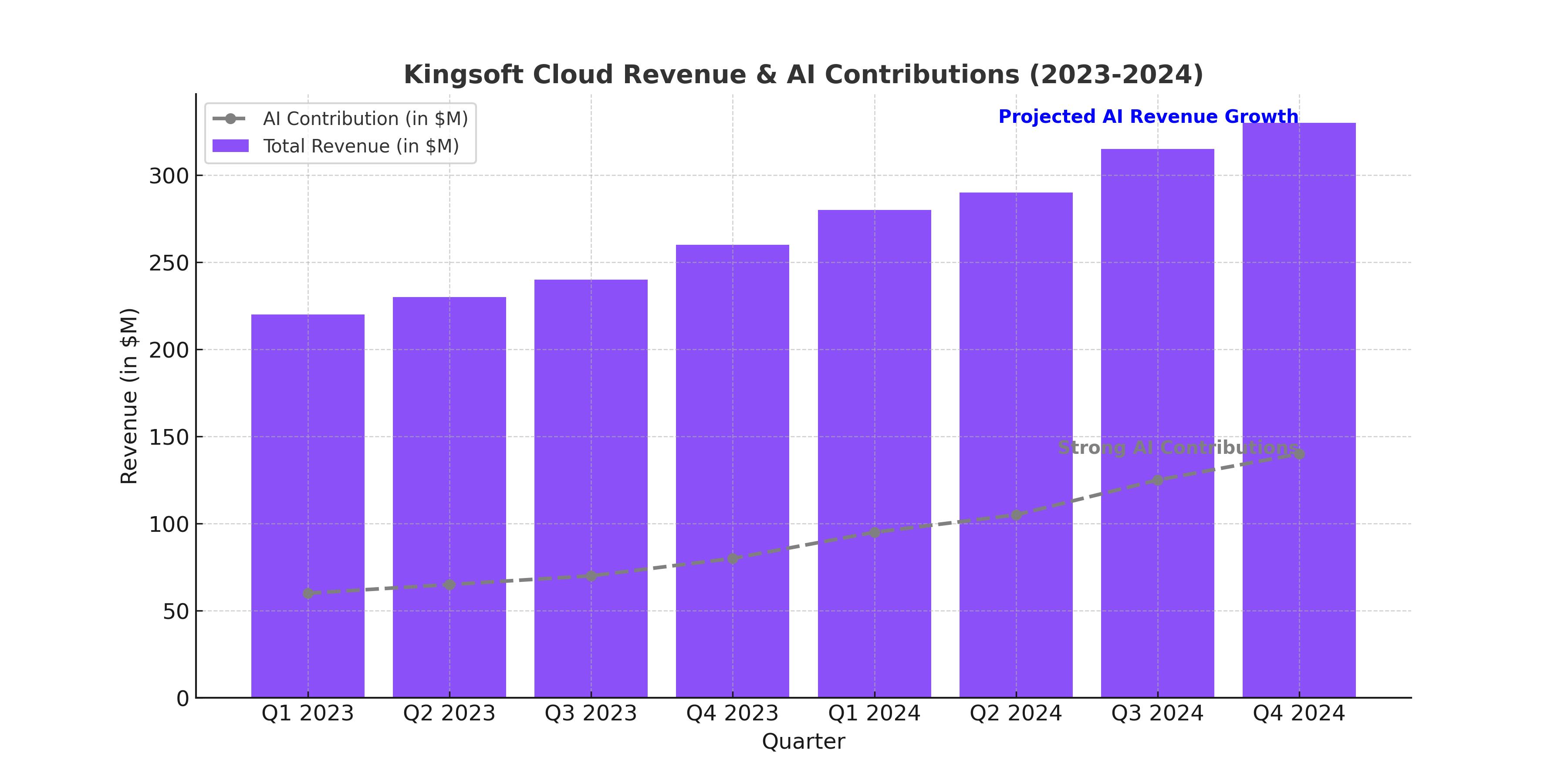

The core of Kingsoft Cloud’s recent performance lies in its robust AI and ecosystem-driven revenue growth. In Q3 2024, the company posted a 16% year-over-year revenue increase, reaching RMB 1.886 billion ($263.6 million). Public cloud revenue saw a 15.6% growth, driven by increased demand for AI-related services, contributing $167.5 million, while enterprise cloud revenue surged 16.7%, adding $101.2 million. Notably, AI services accounted for an impressive 31% of public cloud revenues, illustrating the increasing reliance on AI-driven solutions in the company’s portfolio. Analysts expect this momentum to continue as Kingsoft Cloud leverages partnerships and investments to expand its AI offerings.

AI Expansion: Partnerships and Ecosystem Contributions

Kingsoft Cloud’s strategic partnerships with Kingsoft Corp and Xiaomi have been pivotal in driving its AI-led growth. UBS estimates that revenue contributions from Kingsoft Corp and Xiaomi will exceed 40% by 2027, compared to approximately 20% in 2024. Xiaomi’s financial support, potentially covering RMB 2-3 billion annually for AI server costs and related services during 2025-2027, underscores the strength of this alliance. Additionally, the company’s focus on integrating AI with its existing infrastructure has enabled it to cater to diverse industries, including mobile internet, e-commerce, and enterprise cloud services for finance and public healthcare.

Improved Analyst Sentiment and Upgraded Price Targets

The bullish sentiment among analysts reflects optimism about Kingsoft Cloud’s trajectory. UBS upgraded KC from “Neutral” to “Buy,” significantly raising its price target from $4.20 to $12.50. This upward revision represents a 50% upside from its last close, driven by anticipated revenue acceleration and margin recovery. Similarly, Nomura Securities raised its rating to “Strong Buy,” highlighting KC’s undervalued status compared to its peers in the Chinese cloud market. These upgrades are underpinned by projections of a 13% compound annual growth rate (CAGR) in revenue during 2025-2027, a substantial turnaround from the -5% CAGR observed between 2021 and 2024.

Competitive Landscape and Market Risks

Despite its strengths, Kingsoft Cloud faces formidable competition from major players such as Alibaba Cloud and Tencent Cloud in the Chinese market. Furthermore, as global hyperscalers like Amazon Web Services (AWS) and Microsoft Azure expand their footprint in Asia, KC must continually innovate to retain and grow its market share. Economic challenges, including inventory corrections and slowing global growth, pose additional risks that could impact near-term performance. Nonetheless, KC’s focus on AI-driven differentiation and strong partnerships with Xiaomi and Kingsoft Corp provide a competitive edge.

Valuation and Financial Metrics

Kingsoft Cloud currently boasts a market capitalization of $2.43 billion, with a beta of 2.49, indicating significant volatility. The company’s 50-day moving average stands at $5.52, while its 200-day moving average is $3.63, highlighting recent stock price momentum. Despite its PE ratio of -7.98, indicative of prior losses, analysts project robust earnings growth as KC capitalizes on its AI investments and ecosystem partnerships. Institutional ownership of 13.4% underscores strong backing from hedge funds and asset managers.

AI’s Role in Shaping Future Growth

The company’s investment in AI infrastructure, including plans for expanded AI server capacity, positions it for long-term success. UBS analysts believe that Kingsoft Cloud has entered a new phase of development, with its undervaluation presenting an attractive opportunity for investors. As the company scales its AI operations, supported by Xiaomi and Kingsoft Corp, its ecosystem-driven strategy is expected to deliver sustained revenue and margin growth through 2027.

Conclusion

Kingsoft Cloud (NASDAQ:KC) is rapidly emerging as a leader in China’s cloud services market, fueled by its strong focus on AI and strategic ecosystem partnerships. The company’s impressive revenue growth, bolstered by contributions from Kingsoft Corp and Xiaomi, positions it for continued success in a competitive landscape. With a revised price target of $12.50 and anticipated revenue growth of 13% CAGR from 2025-2027, KC offers a compelling investment opportunity. As the company builds on its AI strengths and expands its cloud services portfolio, it is well-positioned to capitalize on the increasing demand for cutting-edge digital solutions. Investors can track real-time updates on Kingsoft Cloud’s performance.