Is Micron (NASDAQ:MU) at $108 Set to Soar Above $140 in 2025?

AI-driven DRAM and HBM demand positions Micron for massive upside. Will its undervalued stock capitalize on this growth and deliver? | That's TradingNEWS

Micron Technology (NASDAQ:MU): AI Demand, HBM Leadership, and Undervalued Upside

Micron (NASDAQ:MU): Positioned at the Forefront of AI-Driven Memory Demand

Micron Technology (NASDAQ:MU) is capitalizing on a structural shift in AI infrastructure, where post-training inference models are driving memory-intensive workloads. Unlike the pre-training phase of AI models, where computational power dominated GPU demand, the rise of multi-step reasoning has significantly boosted the need for DRAM—a market Micron dominates. NVIDIA’s (NVDA) Blackwell series GPUs, which demand substantially higher memory, illustrate this evolving dynamic. The narrative is straightforward: as AI models transition from one-shot responses to complex reasoning, memory consumption accelerates. Micron is uniquely positioned to benefit from this trend, solidifying its place as one of the largest DRAM suppliers globally.

The AI-driven need for memory extends across data centers, cloud applications, and edge computing, creating multiple revenue streams for Micron. Recent data shows Micron’s AI DRAM chips for FY 2025 are already sold out, reflecting unprecedented demand. In addition, Micron’s strategic partnerships with GPU leaders like NVIDIA and AMD ensure its memory modules remain central to the AI ecosystem. As AI deployments continue to scale, demand for memory is not cyclical but structural, and Micron is primed to ride this wave.

Post-Training Inference: A Game Changer for Micron’s DRAM

Large Language Models (LLMs) are undergoing a shift from pre-training compute to post-training inference, where multi-step reasoning replaces zero-shot responses. This change transforms GPU clusters into memory-heavy systems. Micron’s high-performance DRAM, crucial for inference workloads, ensures these AI models function efficiently while delivering accurate, step-by-step outputs. NVIDIA’s CEO Jensen Huang recently underscored the importance of memory, stating that the GPU ecosystem requires greater capacity to support multi-step reasoning.

This memory-intensive approach directly benefits Micron’s DRAM business. NVIDIA’s latest Blackwell GPUs utilize far more memory than previous architectures, aligning perfectly with Micron’s AI-optimized products. As a result, Micron’s DRAM sales surged 152% YoY in the Compute and Networking segment in Q4 FY24, marking its strongest growth in nearly a decade.

High-Bandwidth Memory (HBM): Micron’s Path to Leadership

Micron’s push into High-Bandwidth Memory (HBM) is a key growth catalyst. HBM, an advanced form of DRAM, is essential for AI GPUs, enabling faster and more efficient data processing. The HBM market, projected to grow from 5% of DRAM output in 2024 to over 10% by 2025, presents a $25 billion opportunity for manufacturers. SK Hynix currently leads with ~50% HBM market share, but Micron is rapidly closing the gap.

In FY24, Micron achieved a 260-basis-point market share expansion in the DRAM space, the largest gain among memory chip manufacturers. Management has ambitious plans to capture HBM market share equal to its overall DRAM position. Micron’s HBM3e chips, which power NVIDIA’s Blackwell GPUs, deliver superior performance and efficiency, positioning the company as a critical supplier for next-generation AI workloads.

To fuel its HBM growth, Micron has committed to substantial CAPEX investments for FY25, allocating approximately 35% of projected revenues to technology transitions and production capacity. Historically, CAPEX increases have signaled robust revenue growth and share price appreciation for Micron. With demand for HBM accelerating and ASPs (Average Selling Prices) on the rise, Micron’s revenue trajectory appears highly favorable.

Q1 FY25 Earnings Preview: Strong Growth Signals

Micron’s upcoming Q1 FY25 earnings, scheduled for December 18, are poised to reflect continued momentum. The consensus revenue estimate is $8.71 billion, representing an 85% YoY increase. Analysts forecast EPS of $1.77, marking a significant improvement from $1.18 in the previous quarter. These estimates have been revised upward 16 times, reflecting heightened confidence in Micron’s performance.

Key areas to watch include commentary on DRAM supply to AMD, further AI-driven demand insights, and updates on HBM production ramps. Micron’s ability to secure diversified partnerships with AMD and other GPU players will be pivotal in sustaining its growth.

Valuation: Micron Shares Are Deeply Undervalued

Despite strong earnings growth and increasing AI memory demand, Micron trades at a significant discount relative to its peers. The stock currently holds a forward P/E of 11.68, more than 55% below the sector median of 26.25. This valuation is incongruent with Micron’s fundamentals, given its projected revenue and EPS growth far outpace the industry average.

Micron’s forward revenue is growing 703% faster than the sector median, while forward EPS growth exceeds the sector median by over 235%. If shares re-rate to a modest forward P/E of 18—still below industry norms—it would imply 54% upside, taking the stock above $150.

With analysts forecasting FY25 EPS of $9.50 and FY26 EPS of $13, Micron trades at just 10x FY25 earnings and 7.6x FY26 estimates. Such a valuation presents a compelling entry point for investors seeking exposure to AI-driven semiconductor growth.

Insider Transactions: Aligning with Long-Term Growth

Micron’s insider transactions provide further confidence in its growth outlook. Investors can monitor real-time insider activity here. Management’s significant insider purchases underscore their confidence in Micron’s ability to execute its AI strategy and deliver long-term value.

Risks: Competition and Cyclical Concerns

While the outlook for AI-driven memory demand is robust, risks remain. Competitors like SK Hynix and Samsung continue to invest heavily in HBM production, posing a threat to Micron’s market share ambitions. Additionally, macroeconomic uncertainties and potential oversupply in the DRAM market could pressure margins. However, Micron’s technological edge, strong relationships with GPU vendors, and strategic CAPEX investments mitigate these risks.

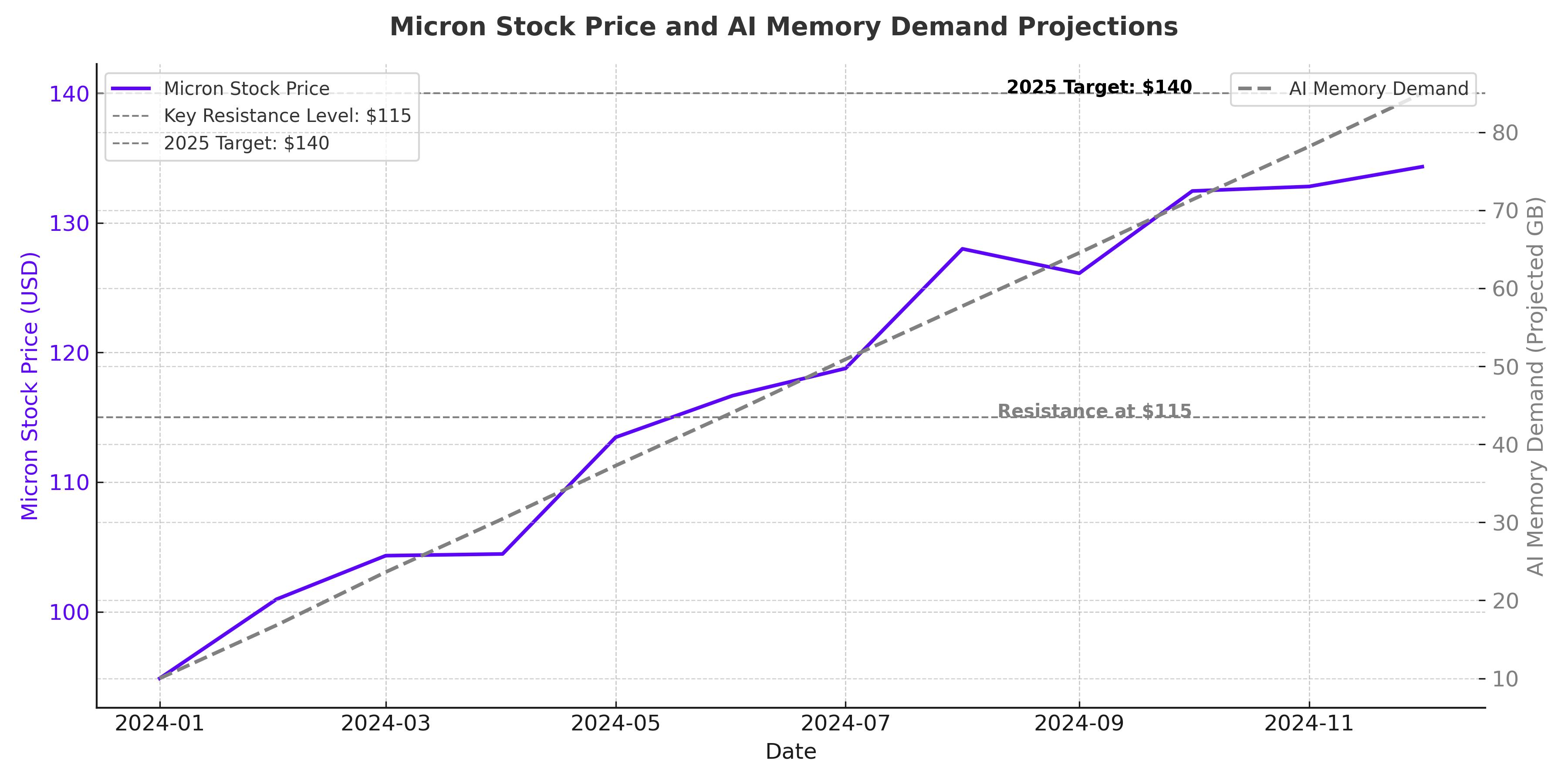

Technical Outlook: Inflection Point for MU Stock

Micron’s stock has consolidated between $95 and $115, forming a strong support level at $90. A breakout above $110-$115 would open the door for significant upside, with technical momentum likely driving shares toward $140-$150 over the next 12 months. Given Micron’s improving fundamentals and robust demand environment, the stock is well-positioned for a breakout.

Final Analysis: Micron (NASDAQ:MU) Is a Strong Buy

Micron Technology stands at the intersection of AI-driven growth and memory innovation. The shift toward post-training inference, coupled with surging demand for HBM and DRAM, has created a structural tailwind for Micron. Despite delivering record growth, Micron trades at a substantial discount to peers, with a forward P/E below 12 and projected EPS growth exceeding 200%.

With upcoming Q1 earnings set to confirm continued momentum and ambitious CAPEX investments fueling future growth, Micron’s undervaluation presents a compelling opportunity. The stock has 54% upside potential based on forward P/E expansion, with a price target range of $140-$150 for FY25. Investors seeking exposure to the AI-driven semiconductor market should view NASDAQ:MU as a Strong Buy. For real-time price updates, track Micron here.