Is NASDAQ:AMD Positioned for a Breakout at $115?

AMD’s AI Challenges, Data Center Growth, and Market Strategy Explored | That's TradingNEWS

Why NASDAQ:AMD Remains a Compelling Buy Despite Challenges

Advanced Micro Devices (NASDAQ:AMD) continues to stand out as a top investment opportunity in the semiconductor space, with its stock currently trading near $115. This price reflects a significant discount from its early 2024 highs of $220, presenting an attractive entry point for investors willing to look beyond short-term market sentiment. The company's strengths in CPUs, GPUs, and data center technologies remain unmatched by most competitors, while its challenges in AI hardware and software development highlight areas of immense growth potential.

The Roadmap to AMD’s Dominance in CPUs and GPUs

AMD has solidified its position as a leader in the x86 CPU market, boasting a 24% market share in server processors, as per Mercury Research. The EPYC line has been a game-changer, allowing AMD to surpass Intel (NASDAQ:INTC) in data center revenues last quarter, with AMD reporting $3.55 billion compared to Intel’s $3.3 billion. Ryzen processors have also been instrumental in chipping away at Intel's dominance in the consumer market.

The gaming division, anchored by Radeon GPUs and semi-custom SoCs for consoles like PlayStation and Xbox, remains a vital revenue contributor. Although the segment's revenue has been cyclical, the upcoming console upgrades and new GPU releases could reignite growth in 2025.

AI Hardware: Opportunities and Setbacks

AMD’s Instinct MI300x GPU was initially hyped as a viable competitor to NVIDIA’s (NASDAQ:NVDA) dominant H100 and H200 GPUs. Priced to offer total cost of ownership advantages, the MI300x boasted higher memory capacity and bandwidth. However, the actual performance has lagged expectations due to an underwhelming software ecosystem. AMD's reliance on libraries derived from NVIDIA's CUDA has proven to be a bottleneck, resulting in suboptimal user experiences.

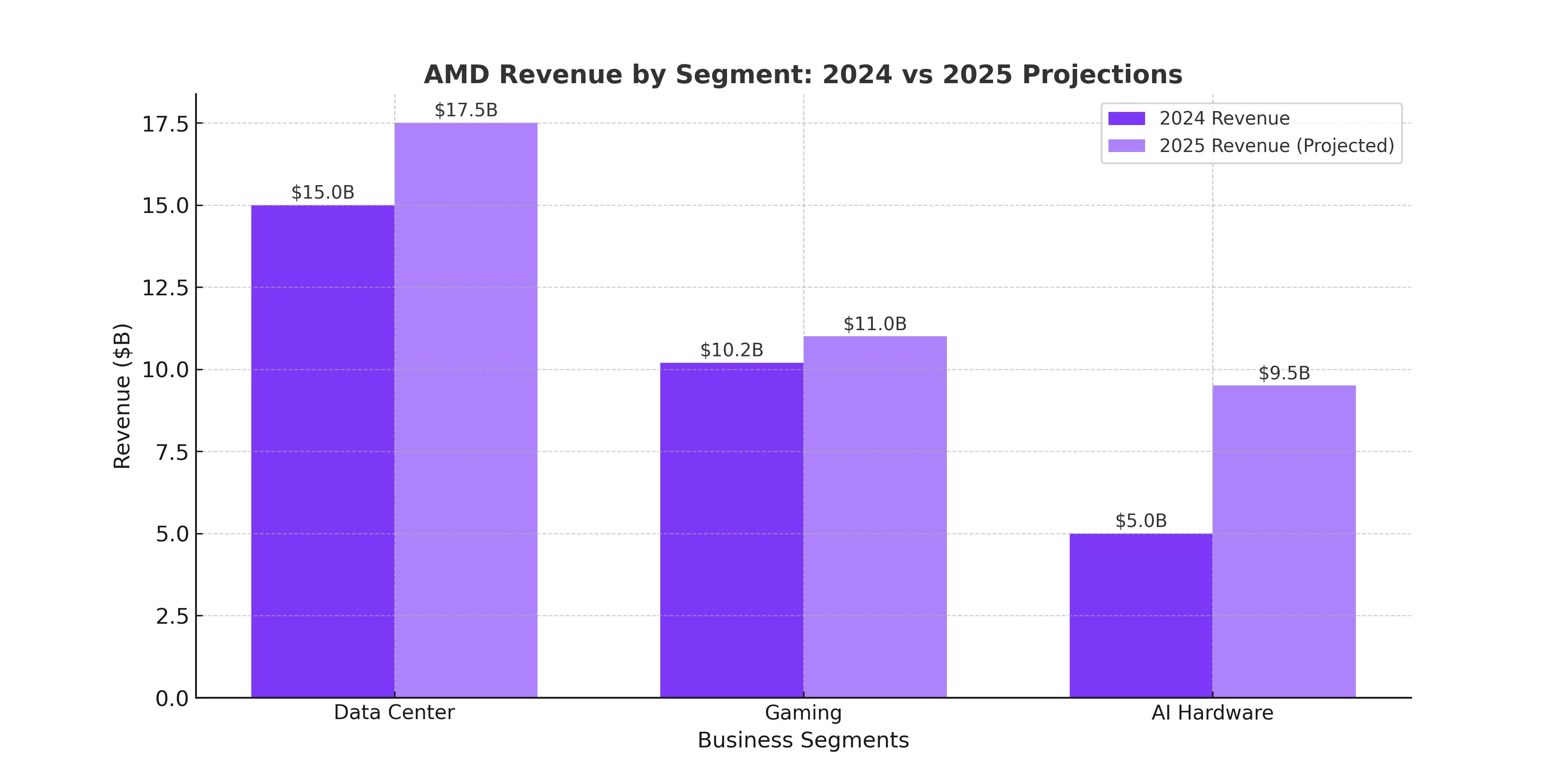

Despite these challenges, AMD projects $5 billion in AI GPU revenue for 2024, with CEO Lisa Su signaling continued growth into 2025. The company aims to capture 20% of the AI GPU market by 2028, potentially translating to $100 billion in annual revenues if successful. However, this ambition hinges on improving the software stack and accelerating adoption among hyperscalers like Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META), which have already purchased over 200,000 MI300X units combined.

Financial Metrics and Valuation

AMD's current valuation, with a forward P/E of 23x based on 2025 EPS estimates of $5.10, reflects both its growth prospects and challenges. The company's data center segment accounts for approximately 45% of total revenue and 55% of operating profit, underscoring its strategic importance. AMD’s recent acquisitions of Xilinx and ZT Systems are expected to enhance its AI inference and data center capabilities, further supporting its long-term growth trajectory.

AMD is targeting total revenue of $32.5 billion in 2025, driven by $9.5 billion in AI GPU sales and continued gains in server CPUs. Gross margins are projected to stabilize around 54.8%, while operating income from the data center segment alone could exceed $9 billion.

AMD’s Competitive Position Against NVIDIA and Intel

While NVIDIA remains the undisputed leader in AI hardware, AMD’s focus on cost-effective and energy-efficient solutions provides a competitive edge in certain segments. AMD also benefits from an open-source approach, which could foster greater adoption among developers over time. In the CPU market, AMD continues to outpace Intel with its innovative designs and superior performance metrics.

The growing presence of ARM-based processors poses an emerging threat, but AMD's expertise in high-performance computing and data center technologies positions it well to weather this competition. Additionally, AMD's robust cash position of $5.8 billion and manageable debt levels provide the financial flexibility needed to invest in R&D and strategic acquisitions.

Market Sentiment and Future Outlook

The semiconductor sector is notorious for its cyclical nature, and AMD’s stock price reflects the broader market's cautious sentiment. However, the company's focus on high-margin segments like data centers and AI hardware ensures that it remains well-positioned for long-term growth. As the broader economic environment stabilizes, AMD's ability to capture market share in key segments could lead to substantial stock price appreciation.

Conclusion: Is NASDAQ:AMD a Buy at $115?

At its current price of $115, AMD offers a compelling investment opportunity for those seeking exposure to the semiconductor sector. While challenges in the AI space and stiff competition from NVIDIA and Intel persist, AMD's proven track record of innovation, strategic investments, and strong financial metrics make it a buy for long-term investors. The potential for upside is significant, with a realistic path to $240 by 2026 based on projected EPS growth and expanding market share. For real-time updates on AMD's performance, view its live chart here.