Is NVIDIA's Stock Ready for Another Surge? Here’s What Could Trigger the Next Move

As NVIDIA (NASDAQ:NVDA) dominates the AI landscape, investors are eyeing its upcoming earnings report for clues on whether the stock’s recent dip is a buying opportunity or a warning sign | That's TradingNEWS

Nvidia’s AI Domination Faces New Challenges and Opportunities NASDAQ:NVDA

The Rise and Fall of Nvidia's Stock: A Deeper Look

Nvidia's stock surged to an all-time high earlier this year, driven by the unprecedented demand for its AI chips, particularly the H100 GPU, which has set the standard for data center operations. However, since mid-July, the stock has seen a significant correction, dropping over 22% from its peak. This decline raises questions about whether Nvidia's growth has peaked or if this dip represents a strategic buying opportunity.

The Role of AI in Nvidia's Growth

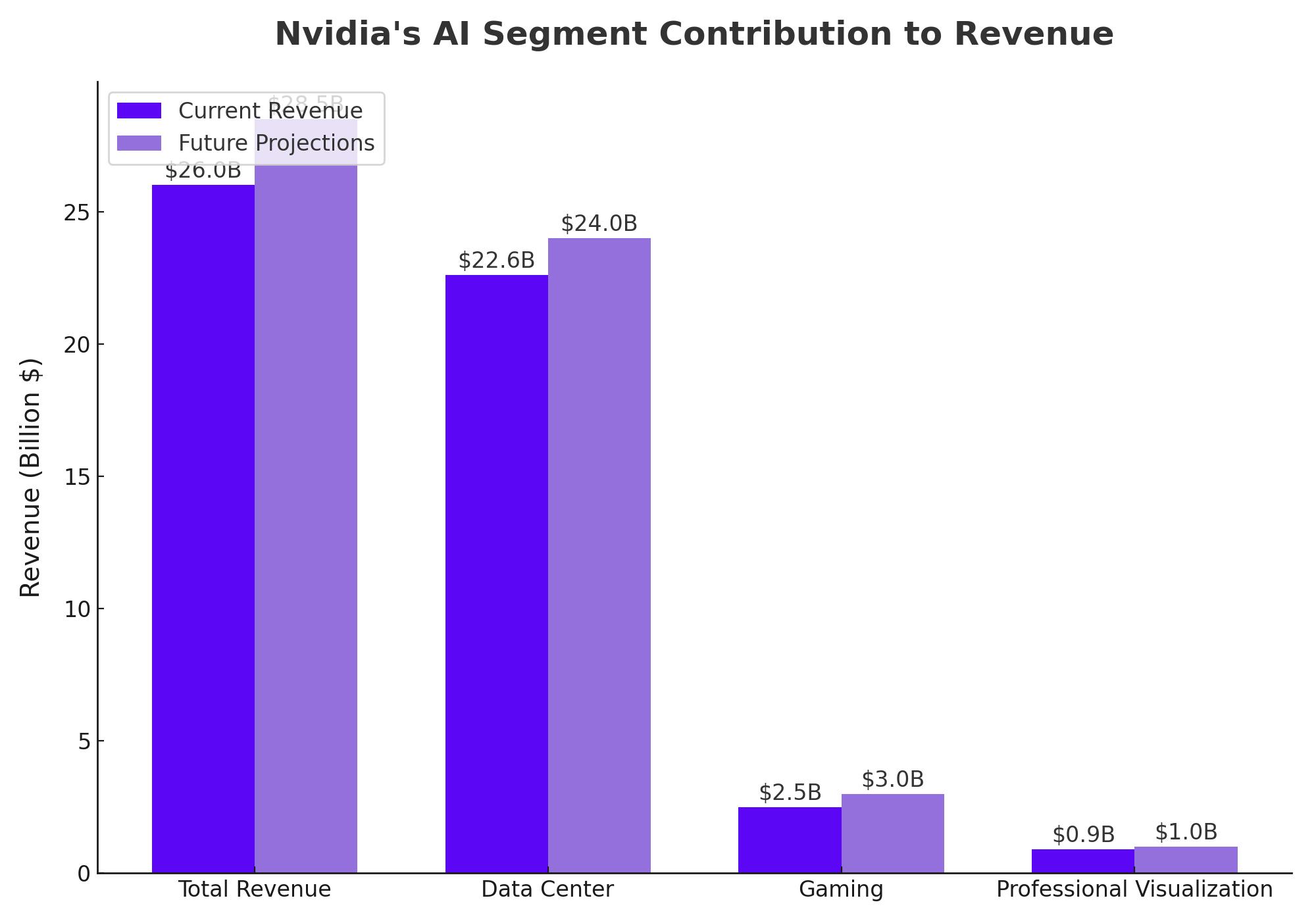

Nvidia’s rapid ascent has been fueled by its dominance in AI and data center GPUs. The company’s revenue for the fiscal 2025 first quarter reached a record $26 billion, a 262% increase year-over-year, primarily driven by the booming demand for AI capabilities across industries. The data center segment alone contributed $22.6 billion, reflecting a 427% surge, as companies globally replace traditional CPU infrastructure with Nvidia’s GPUs.

With the upcoming release of Nvidia’s second-quarter results on August 28, the market is bracing for another potential spike in the stock price. Wall Street analysts are predicting Nvidia will exceed its own guidance of $28 billion in revenue, with some estimates reaching as high as $28.5 billion.

Nvidia’s Strategic Vision: AI Hardware Evolution

Under the leadership of co-founder Jensen Huang, Nvidia continues to push the boundaries of AI hardware development. Huang’s vision is to evolve Nvidia’s AI chips rapidly, moving from the current H100 Hopper to the upcoming B-100 Blackwell and, eventually, the R-100 Rubin by 2026. These advancements, Huang believes, will not only sustain Nvidia’s market dominance but also revolutionize computing across various sectors.

However, this vision is not without its challenges. The energy consumption of Nvidia’s advanced AI chips, like the Hopper, is raising sustainability concerns. As Nvidia prepares to release even more powerful chips, such as the B-100 and R-100, the energy demands are expected to increase, prompting discussions around the environmental impact and the need for more sustainable energy solutions.

Market Competition and Technological Hurdles

While Nvidia currently holds an estimated 98% market share in AI data center GPUs, competition is on the horizon. Companies like Advanced Micro Devices (AMD) are ramping up their efforts to capture a slice of the market, which could lead to a reduction in Nvidia’s market share over time. Furthermore, the limitations of current AI software, particularly the issues with large language models (LLMs) like ChatGPT, present a significant challenge. These models, while groundbreaking, have shown limitations such as generating inaccurate results, which could impact the overall demand for AI technologies.

Gary Marcus, a prominent AI scientist, has voiced concerns about the sustainability of the current AI boom, suggesting that the industry may face a slowdown if these software issues are not addressed. This could potentially impact Nvidia’s growth trajectory, especially if the hardware outpaces the development of effective software solutions.

Financial Outlook and Insider Activity

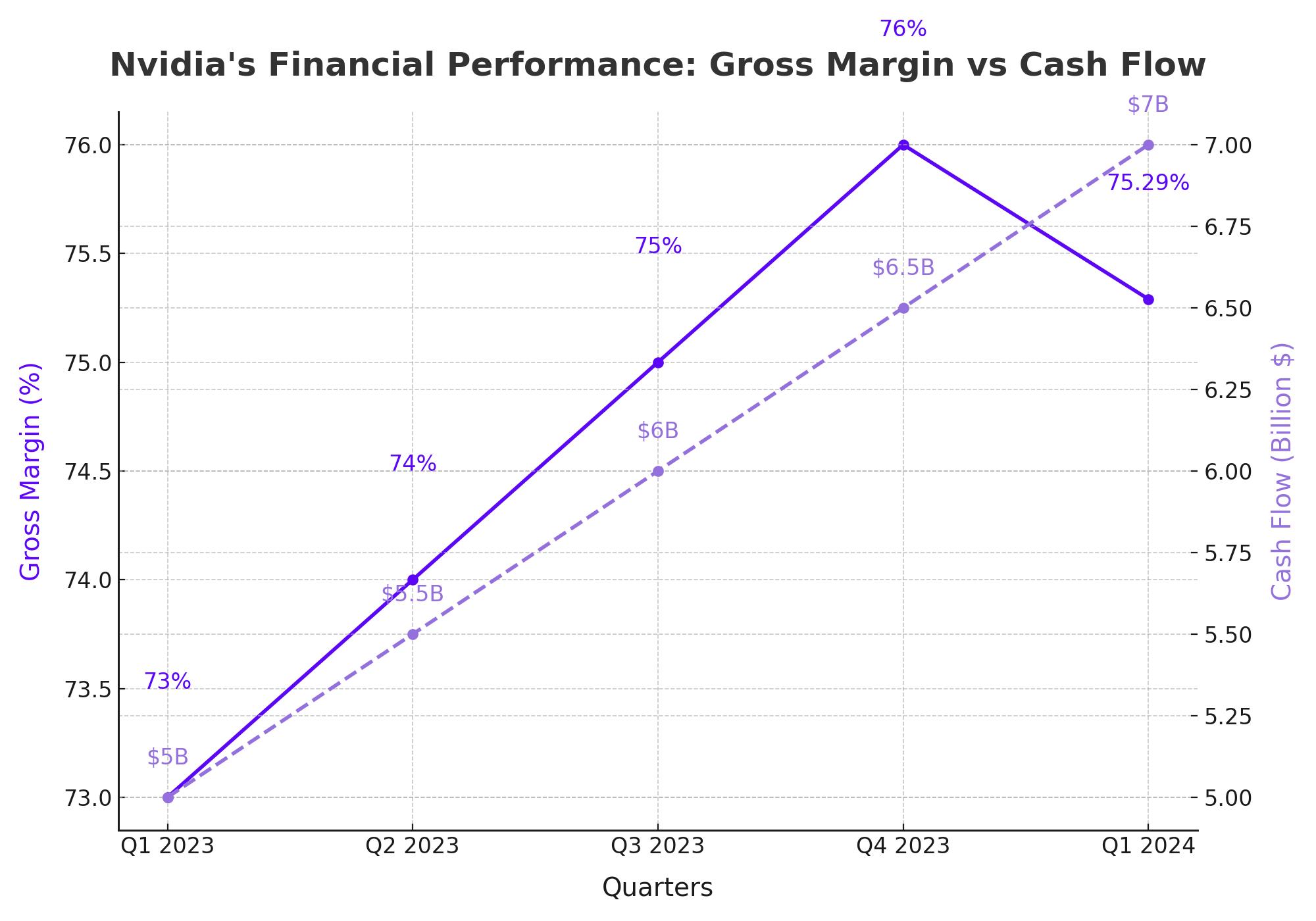

Despite the challenges, Nvidia’s financial outlook remains strong. The company’s gross margin stands at an impressive 75.29%, and it continues to generate significant cash flow from its operations. However, investors should note recent insider transactions, which can provide insights into the confidence levels of those closest to the company. To monitor insider activity and assess potential risks or opportunities, you can view Nvidia’s insider transactions here.

How Nvidia’s Next Surge Could Materialize: Key Catalysts to Watch

Nvidia Corporation (NASDAQ:NVDA) has been a dominant force in the tech world, particularly in the realm of artificial intelligence and data center technologies. While the stock has experienced some volatility, dropping over 22% from its mid-July highs, there are several key factors that could ignite the next major surge in Nvidia’s stock price, potentially propelling it to new record levels.

One of the most immediate catalysts could be Nvidia’s upcoming earnings report. The company has a track record of delivering blowout results that exceed Wall Street’s expectations, and this trend may continue with the fiscal Q2 2025 report due on August 28. Nvidia has guided for $28 billion in revenue, but analysts are already speculating that the company could surpass this figure, with some estimates reaching as high as $28.5 billion. Given Nvidia’s recent history, where its Q1 revenue soared by 262% year-over-year to a record $26 billion—driven largely by a 427% surge in data center sales—a strong earnings report could trigger a significant rally in the stock, potentially pushing it back toward or even beyond its all-time high.

Another factor that could fuel Nvidia’s next surge is the anticipated release of its next-generation AI chips, such as the B-100 Blackwell and the future R-100 Rubin. These new chips are expected to offer massive improvements in performance and efficiency, which could further solidify Nvidia’s market leadership in AI hardware. The H100 Hopper GPU, which has been the standard in data centers, could soon be eclipsed by these new models, potentially driving renewed investor enthusiasm. As these chips roll out and gain adoption among key industry players, the increased demand could push Nvidia’s stock to new heights, possibly surpassing its previous peak of over $130 per share.

Strategic partnerships and market expansion are also critical elements that could contribute to Nvidia’s growth. The company’s ability to enter new sectors or expand its presence in emerging markets, where AI adoption is accelerating, could unlock substantial new revenue streams. For instance, collaborations with other tech giants to integrate Nvidia’s AI technologies into their ecosystems could further enhance Nvidia’s market position, making the stock more attractive to a broader range of investors.

However, it’s not just about growth—addressing existing challenges could also play a significant role in driving Nvidia’s stock higher. One of the main concerns surrounding Nvidia’s advanced AI chips, particularly the Hopper series, is their high energy consumption. This issue has raised sustainability questions, especially as Nvidia prepares to release even more powerful chips like the B-100 and R-100. If Nvidia can introduce more energy-efficient models or invest in sustainable energy solutions, it could alleviate these concerns, making the stock more appealing to environmentally conscious investors and potentially sparking a new rally.

The Road Ahead: A Buy, Sell, or Hold?

Given the current market dynamics, the question remains: Is Nvidia a buy, sell, or hold? For long-term investors, particularly those with a strong belief in the future of AI, Nvidia’s stock might represent a valuable addition to their portfolios, especially during market dips. However, for those more cautious about the short-term volatility and potential challenges in the AI sector, it may be wise to adopt a more conservative approach.

As Nvidia prepares to release its Q2 results, the market will be closely watching to see if the company can continue its trajectory or if it will face headwinds from increased competition and technological hurdles. The outcome of this earnings report could very well set the tone for Nvidia’s stock in the coming months.

Stay updated on Nvidia’s real-time stock performance here as the market reacts to the latest developments.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback