Is Qualcomm NASDAQ:QCOM Stock Positioned for a Breakout?

At $155, Qualcomm leverages AI, automotive, and IoT growth to drive value, making it a potential buy | That's TradingNEWS

NASDAQ:QCOM Stock: A Strategic Pivot Toward Growth with Undervalued Potential

Strong Financial Performance and Earnings Momentum

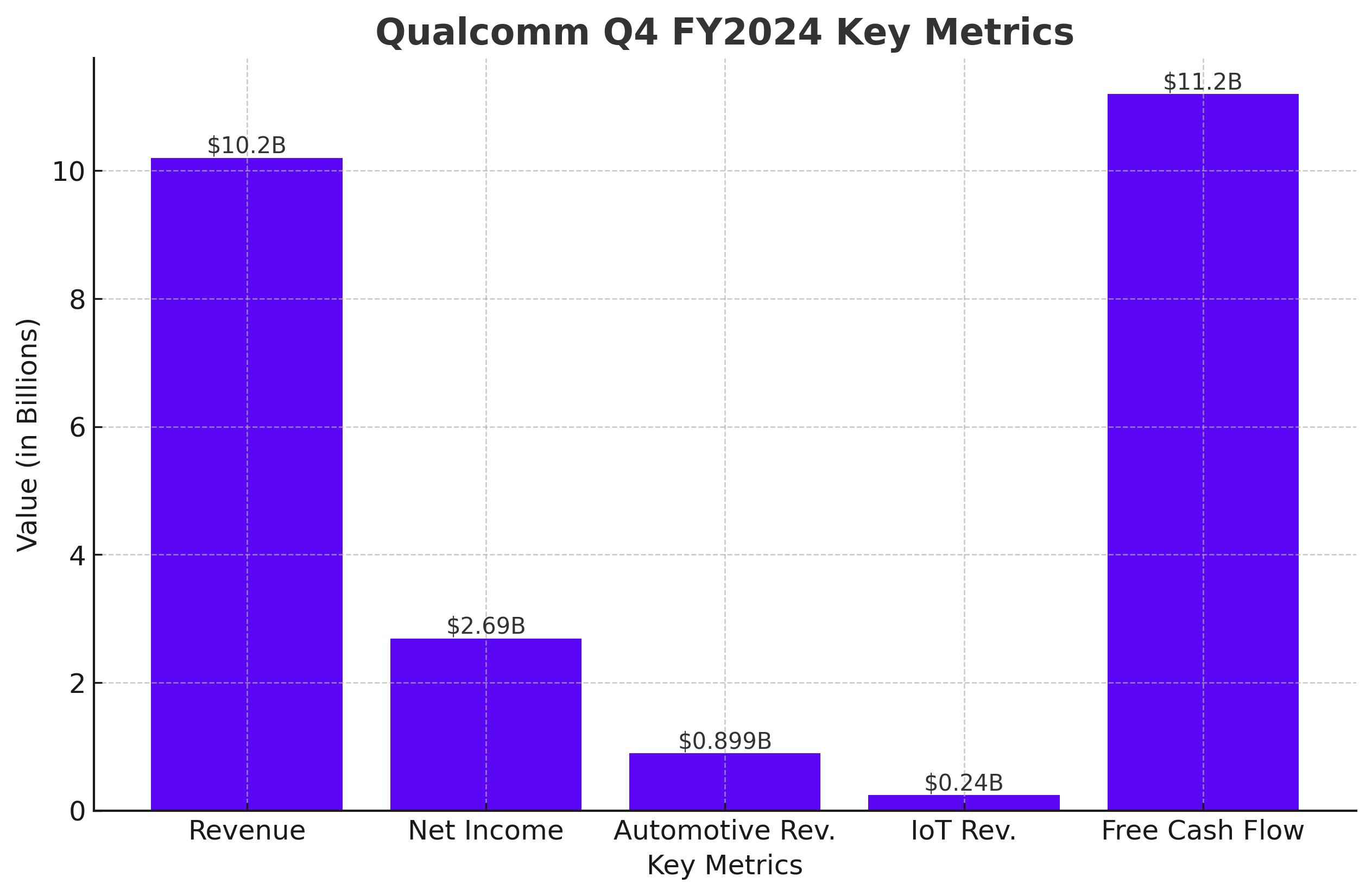

Qualcomm (NASDAQ:QCOM) recently delivered a robust Q4 FY2024 performance, demonstrating solid financial resilience and strategic growth across segments. Revenues surged by 19% year-over-year to $10.2 billion, driven by strength in its core QCT segment, which generated $8.7 billion (+18% YoY). Non-GAAP EPS came in at $2.69, reflecting an impressive 33% YoY growth and exceeding market expectations by $0.20.

Handset revenues, a major component of the QCT segment, climbed 12% YoY to $6.1 billion, supported by the introduction of the Snapdragon 8 Elite platform. The automotive segment shone brightly, with revenues skyrocketing by 68% to $899 million, fueled by demand for Snapdragon Cockpit Elite and Ride Elite platforms. IoT revenues also delivered strong sequential growth of 24%, signaling normalization of channel inventory and robust demand for Qualcomm’s IoT Solutions Framework.

Balance Sheet Strength and Shareholder Returns

Qualcomm's financial position remains solid, with $13.3 billion in short-term liquidity, up 17.4% YoY. The company generated a record free cash flow of $11.2 billion in FY2024, enabling $2.2 billion in shareholder returns during Q4. This included $1.3 billion in stock buybacks and $947 million in dividends, reflecting disciplined capital allocation.

To further enhance shareholder value, Qualcomm announced a $15 billion stock repurchase plan—equivalent to approximately 8-9% of its market capitalization. This move underscores the management's confidence in the company’s long-term growth trajectory and its undervaluation at current levels.

Valuation: Attractive Multiples Suggest Undervaluation

Qualcomm is trading at approximately $155 per share, with a forward P/E ratio of 18.1x and a forward EV/EBITDA multiple of 11.6x. These multiples are significantly below the median valuations of the semiconductor sector, which average forward P/E ratios of 25x or higher. The stock’s price-to-sales (P/S) ratio is currently 4.7, while its historical average stands closer to 6, highlighting a valuation disconnect.

With consensus EPS projected to grow at a compound annual rate of 8.15% over the next five years, Qualcomm’s PEG ratio remains under 1, emphasizing its undervaluation relative to its growth potential. The stock’s 2.09% dividend yield, backed by a low payout ratio of 35%, offers an additional layer of income stability for investors.

Automotive and IoT: Key Growth Drivers

Qualcomm’s strategic diversification into automotive and IoT markets is redefining its revenue mix. Automotive revenues, projected to grow at a CAGR of 22.5%, are expected to reach $8 billion by FY2029. Partnerships with industry giants like Mercedes-Benz and Li Auto further solidify Qualcomm’s leadership in this segment. In FY2024 alone, automotive revenues surged by 68% YoY, driven by the adoption of Snapdragon platforms.

IoT represents another significant growth area, with revenue expected to grow at 21% annually, reaching $14 billion by FY2029. Qualcomm's IoT Solutions Framework and its focus on industrial automation, smart homes, and energy management position the company as a leader in this high-growth market.

AI and Snapdragon Leadership

Qualcomm’s Snapdragon platform, with its cutting-edge AI capabilities, is at the forefront of the on-device AI revolution. This has driven increased adoption in flagship Android smartphones and expanded Qualcomm’s presence in AI-powered edge computing. Collaborations with Meta (META), Amazon (AMZN), and Microsoft (MSFT) further enhance Qualcomm’s growth prospects in AI.

The QTL (Qualcomm Technology Licensing) segment remains a cash cow, generating $1.5 billion in Q4 revenues (+21% YoY). Licensing agreements with top-tier OEMs ensure a steady income stream, while Qualcomm’s leadership in 5G and emerging 6G technologies secures its competitive edge.

Risks: Geopolitical and Market-Specific Concerns

Qualcomm's reliance on Apple and Samsung, which together account for over 40% of revenues, represents a significant concentration risk. Apple’s in-house modem development, targeted for 2027, could impact Qualcomm’s handset revenues in the long term. Furthermore, geopolitical tensions with China, which accounts for nearly 50% of Qualcomm’s revenues, pose risks to supply chains and demand stability.

The cyclical nature of the semiconductor industry remains another challenge. Potential slowdowns in smartphone and IoT markets could pressure revenue growth, particularly if global macroeconomic conditions weaken.

Market Sentiment and Trading Momentum

Qualcomm (NASDAQ:QCOM) has experienced notable trading momentum, with the stock recently hovering near a critical support level at $150 and testing resistance around $170. Over the past month, daily trading volumes have consistently exceeded the three-month average of 8.7 million shares, reflecting heightened investor interest. This surge in activity suggests growing confidence in Qualcomm’s medium-term recovery, particularly as market participants anticipate positive catalysts in the automotive and IoT segments.

Technical Indicators Signal Strengthening Momentum

Technically, Qualcomm is showing signs of building bullish momentum. The RSI has risen to 52, crossing the critical neutral level of 50, indicating that buyers are beginning to take control. Meanwhile, the stochastic oscillator has moved from the oversold zone, climbing above 30 and signaling a reversal in sentiment. The MACD line is on the verge of crossing above the signal line, a strong indicator of potential upside movement. These technical signals align with the stock’s historical Q1 performance, where Qualcomm has consistently shown strength over the last 15 years.

Conclusion: Qualcomm Offers an Attractive Risk-Reward Setup

Currently priced at $155, Qualcomm presents a compelling investment opportunity with a balanced risk-to-reward ratio. The company’s strategic diversification into high-growth sectors like automotive and IoT, combined with its leadership in AI and 5G technologies, underscores its long-term growth potential. While the semiconductor industry remains cyclical, Qualcomm’s valuation at 18.1x forward P/E and a robust free cash flow of $11.2 billion provide a strong margin of safety.

For investors seeking exposure to a market leader with promising growth catalysts, Qualcomm deserves a Buy rating. Keep an eye on the NASDAQ:QCOM real-time chart to monitor key price movements and volume trends.