NASDAQ:RGTI Stock: Quantum Leap or Speculative Gamble?

Rigetti Computing (NASDAQ:RGTI), a pioneer in quantum computing, has witnessed a meteoric rise in 2024, with its stock surging over 637.76% year-to-date. The recent quantum computing breakthrough by Alphabet’s Google, which unveiled its Willow chip, acted as a catalyst for the entire sector, propelling Rigetti's shares from $4.46 to a staggering $7.46 in just two trading days, marking a 67.3% leap. However, Rigetti’s rally is not solely tied to Google’s news. The company has established itself as a formidable player in quantum computing, supported by critical partnerships, innovative breakthroughs, and a compelling technological roadmap.

Understanding Rigetti Computing’s Quantum Edge

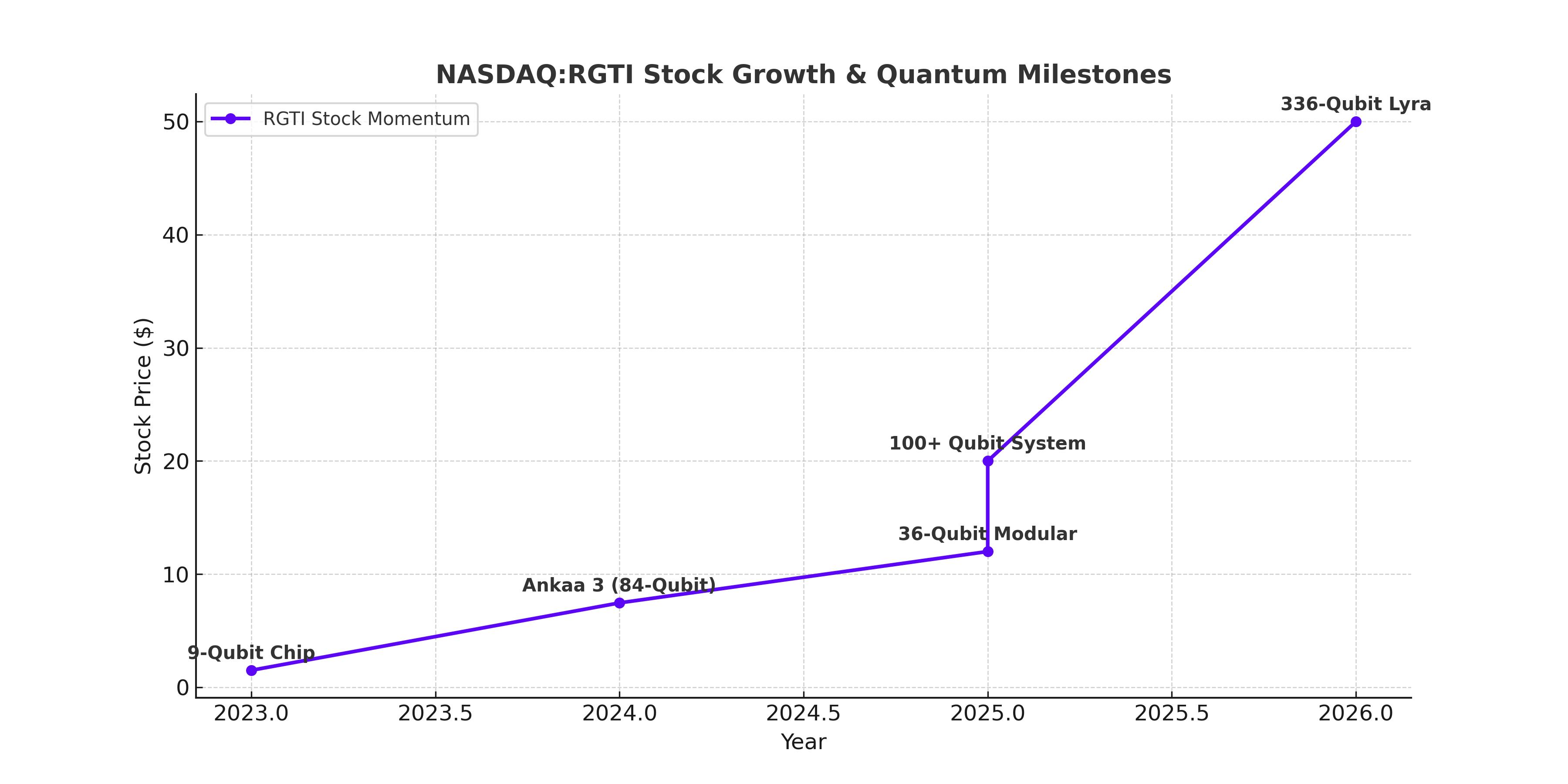

Rigetti Computing specializes in building quantum processors and quantum computing systems, offering cloud-based access to its hardware via its proprietary platform, Forest. Quantum computing, which uses qubits capable of existing in multiple states simultaneously, has the potential to revolutionize industries like AI, finance, logistics, and cybersecurity. Rigetti’s strategic focus lies in developing scalable quantum systems, with its roadmap targeting a 336-qubit Lyra processor in the future.

The company recently achieved a significant milestone by tiling 9-qubit chips without performance degradation, boasting 99.4% median 2-qubit fidelity. This accomplishment enables scalable chip architecture, crucial for achieving high-qubit systems like the planned 84-qubit Ankaa 3, expected by the end of 2024. Rigetti’s advancements position it as a serious contender in the quantum race against giants like IBM and Google.

Financial Metrics: A Mixed Picture

Despite its technological strides, Rigetti’s financials present a challenging narrative. The company reported a $17.3 million operating loss in its most recent quarter, with R&D expenses of $12.8 million overshadowing its $2.4 million in revenue. Cash reserves stand at $92.6 million, providing a runway until Q1 2026. However, Rigetti has raised $51.7 million through equity issuance this year, and further dilution seems likely to sustain its ambitious development roadmap.

Technological Roadmap and Key Catalysts

Rigetti’s technological milestones are pivotal to its growth story:

- 2024 Milestone: Launch of the 84-qubit Ankaa 3 system with over 99% 2-qubit fidelity.

- Mid-2025 Target: Validation of modular architecture through a 36-qubit system, paving the way for scalable quantum systems.

- Late-2025 Goal: Delivery of a 100+ qubit system with a targeted 99.5% fidelity.

- Future Vision: Development of the 336-qubit Lyra processor for addressing real-world problems at scale.

These milestones, if achieved, could cement Rigetti’s position as a leader in the quantum sector and potentially drive its stock price into double digits.

Strategic Partnerships and Government Funding

Rigetti has fostered strategic collaborations with industry leaders like NVIDIA and academic institutions like Fermilab and Oak Ridge National Laboratory. Its co-location of the Novera QPU at the Israeli Quantum Computing Center, alongside NVIDIA’s Grace-Hopper Superchip, underscores its efforts to integrate quantum and classical computing for real-world applications.

Government support also plays a critical role. The anticipated reauthorization of the National Quantum Initiative Act in 2025 could boost U.S. quantum funding from $500 million to $2.5 billion, with Rigetti well-positioned to benefit. Additionally, Rigetti is vying for a share of the $300 million DARPA benchmarking contract, which could further solidify its financial footing.

Competitive Landscape and Risks

Rigetti faces stiff competition from established players like IBM, Google, and emerging companies such as IonQ. IBM’s cloud-based quantum platform provides robust access to quantum systems, presenting a significant challenge to Rigetti’s market share. Technological risks, including scalability and error correction, also loom large. Rigetti’s ability to maintain high fidelity and execute its roadmap will be critical to its success.

The stock’s speculative nature is underscored by its valuation, trading at over 100x projected 2025 revenues. While the potential rewards are high, so are the risks, particularly for investors wary of dilution and cash burn.

Insider Transactions and Market Sentiment

Insider transactions reflect a mix of confidence and caution. Rigetti’s insider transactions reveal both acquisitions and sales, suggesting varied sentiment among executives. The recent rally has spurred heightened trading activity, with over 26.73 million shares changing hands, compared to a three-month daily average of 21.68 million.

Future Outlook: Buy, Sell, or Hold?

Rigetti Computing (NASDAQ:RGTI) stands out with groundbreaking strides in quantum computing, positioning itself as a potential game-changer in this rapidly growing sector. Despite surging 637% year-to-date to $7.46, its speculative nature and $92.6 million cash runway warrant investor caution. Analysts previously set an average price target of $3.50, but the recent rally may push upward revisions. For risk-tolerant investors, Rigetti presents high-reward potential, particularly with its 84-qubit Ankaa 3 milestone due in 2024. Stay updated with real-time NASDAQ:RGTI chart analysis as Rigetti navigates a path to industry disruption.