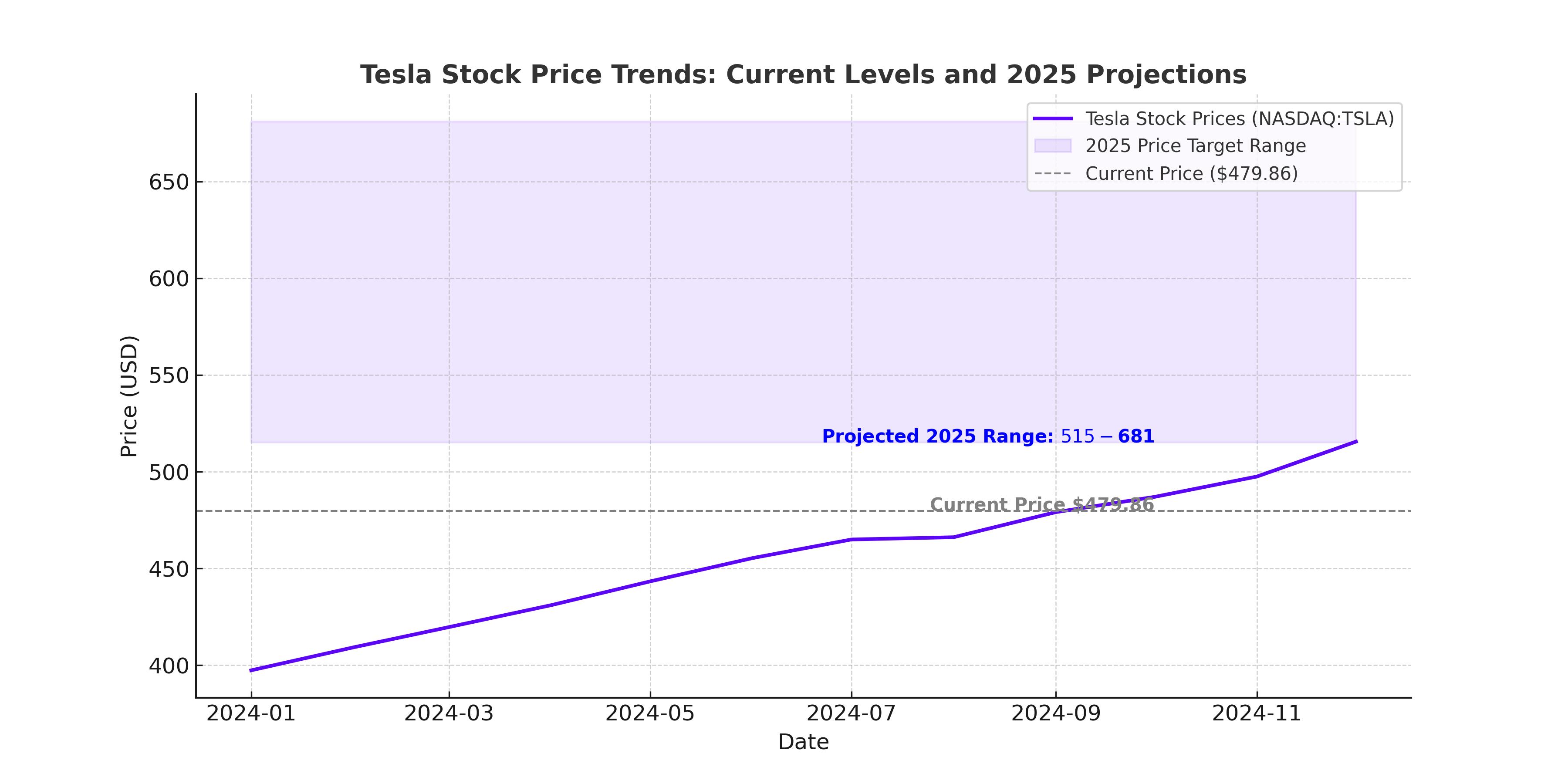

Is Tesla (NASDAQ:TSLA) Stock ($479.86) on Track for Even Bigger Gains in 2025?

With a 93% surge in 2024, Tesla Inc. (NASDAQ:TSLA) eyes the future with self-driving tech, robust China growth, and ambitious revenue targets—are more record highs ahead? | That's TradingNEWS

Tesla's Explosive Growth: Can NASDAQ:TSLA Sustain Its $1.4 Trillion Valuation?

Tesla Inc. (NASDAQ:TSLA) has captured global attention as its stock continues to surge, fueled by a perfect storm of innovation, political tailwinds, and unmatched execution in the electric vehicle (EV) sector. Closing at an impressive $479.86 on Tuesday, Tesla’s year-to-date performance represents a staggering 93% increase, with 85% of that growth realized since the November 5 U.S. presidential election. This meteoric rise has added more than $735 billion to Tesla’s market value, now exceeding $1.4 trillion. The real question is whether this rally has room to run as the market braces for an even more transformative 2025.

Optimism surrounding regulatory changes under a pro-business Trump administration, robust growth in China, and Tesla’s leadership in autonomous technology have prompted Wall Street analysts to raise their targets. Both Mizuho Securities and Wedbush have issued bullish projections, setting price targets at $515, with an upside bull case of $681, driven by autonomous driving technology and robotics innovations. However, is Tesla’s current valuation sustainable, or does it risk overheating in the face of intensifying competition and market saturation?

Tesla's Performance by the Numbers: Momentum or Overvaluation?

Tesla’s recent price surge has been nothing short of historic. The stock has not only shattered previous highs but is trading far above the average Wall Street price target of $290. Year-to-date, Tesla has outperformed the S&P 500 by over 90%, and since the election, it has outpaced its EV peers and major indices alike. Analysts are split on whether this incredible momentum is justified by fundamentals or whether it reflects speculative overexuberance.

Tesla’s current valuation implies a forward price-to-sales (P/S) ratio of 14x based on an estimated $100 billion in 2025 revenues. While this multiple dwarfs those of rivals like Rivian Automotive (3.1x sales) and traditional automakers, Tesla’s profitability, scale, and technological edge arguably justify the premium. Tesla’s third-quarter gross margin of 19.8% continues to lead the industry, reflecting its ability to maintain pricing power and efficiency despite increased competition and price cuts in China.

Deregulation: A Game-Changer for Tesla's Self-Driving Technology

One of the most significant catalysts driving Tesla’s stock price is the anticipated deregulation of autonomous vehicles under the incoming Trump administration. Tesla’s Full Self-Driving (FSD) software, a cornerstone of its long-term growth strategy, has faced regulatory scrutiny, with over 1,500 crashes reported to the National Highway Traffic Safety Administration (NHTSA). Proposed federal reforms aimed at easing restrictions on autonomous vehicle testing and deployment could fast-track Tesla’s plans to launch a robo-taxi fleet by late 2025.

Elon Musk has consistently stated that the future of Tesla hinges on autonomous technology, which he views as a trillion-dollar market opportunity. Analysts have valued Tesla’s FSD program at $176 per share, with significant upside if the company can deliver on its promises. Wedbush has highlighted Tesla’s AI-driven autonomous platform as a critical driver of its $650 bull-case target, emphasizing the company’s first-mover advantage in scaling FSD deployments.

Tesla’s Dominance in China: A Key Growth Engine

China, the world’s largest EV market, remains pivotal to Tesla’s growth story. November saw Tesla achieve 78,856 insurance registrations in China, representing a 12% year-over-year increase. Weekly insurance registrations have consistently exceeded 21,000, signaling robust demand even amid fierce competition from local players like BYD.

In the third quarter, Tesla produced 469,796 vehicles, delivering 462,890 units, reflecting a 6.4% year-over-year increase. These results align with Tesla’s guidance of 20-30% delivery growth in 2025, which analysts expect will be driven by sustained momentum in China. Beijing’s recent fiscal and monetary stimulus measures further support a positive outlook for Tesla’s performance in this critical market.

Despite growing competition, Tesla’s market share in China remains resilient, thanks to its innovative Model 3 and Model Y offerings. With plans to introduce a more affordable EV in 2025, Tesla is well-positioned to capture additional market share and expand its customer base.

Innovations Beyond EVs: Robotics and Energy Storage

Tesla’s long-term valuation increasingly depends on its ability to diversify beyond EVs. The company’s advancements in energy storage and robotics, particularly the Optimus humanoid robot, have the potential to unlock new revenue streams. Analysts at Mizuho have attributed $135 per share of Tesla’s valuation to its robotics initiatives, emphasizing the transformative potential of these technologies.

Tesla’s energy storage business, which includes Powerwall and Megapack systems, is also scaling rapidly. As the world transitions to renewable energy, Tesla’s integrated ecosystem of solar panels, battery storage, and EVs positions it as a leader in sustainable technology.

Risks to Tesla’s Valuation: Competition and Profit-Taking

Despite Tesla’s strong fundamentals, risks remain. The stock’s explosive rally has left it vulnerable to profit-taking, especially as it trades near all-time highs. Investors sitting on substantial gains may be tempted to lock in profits, potentially triggering a correction.

In addition, Tesla faces growing competition in the autonomous and EV markets. Waymo, backed by Alphabet, continues to advance its self-driving technology, while Chinese competitors like NIO and XPeng are rapidly scaling their operations. Regulatory setbacks, such as delays in autonomous vehicle approvals, could also impact Tesla’s growth trajectory.

Analyst Sentiment and Future Price Targets

Wall Street remains optimistic about Tesla’s future, with Mizuho and Wedbush both issuing price targets of $515. Analysts are particularly bullish on Tesla’s ability to monetize its FSD platform, with some projecting a $1 trillion market opportunity. However, Tesla’s current price of $479.86 already reflects high expectations, leaving little room for error.

Technical analysts are also bullish, citing strong upward momentum and historical patterns that suggest Tesla could reach $700 by late 2025. The stock recently broke through key resistance levels, with a projected swing high in the $475-$523 range. Any pullback is likely to be viewed as a buying opportunity, given Tesla’s long-term growth potential.

Conclusion: Why Tesla (NASDAQ:TSLA) Is Poised for Continued Growth

Tesla Inc. (NASDAQ:TSLA) has once again proven its dominance in the market, navigating the shifting landscape of innovation, regulation, and market sentiment. As of today, Tesla’s stock is riding high at $479.86, an impressive 93% surge this year, reflecting the company's massive growth trajectory. With a market cap of $1.4 trillion, the stock has surged past previous highs, leaving analysts and investors eagerly watching its next moves.

What sets Tesla apart from its competitors is its combination of cutting-edge technology, operational efficiency, and strong political backing. Tesla’s expansion into autonomous driving with its Full Self-Driving (FSD) technology could unlock a trillion-dollar market, further supported by regulatory changes under a pro-business Trump administration. Tesla’s ambitious plans to launch its robo-taxi service in 2025, coupled with growing production in China and a new low-cost EV model, put the company on track for significant delivery growth in 2025, with expectations for a 20-30% increase.

Despite this incredible growth, risks are inevitable. The stock's rise has led to concerns about potential profit-taking, especially after Tesla’s 93% increase in 2024 alone. Additionally, competition in the electric vehicle and autonomous driving spaces continues to intensify, particularly from companies like Waymo and Chinese manufacturers.

However, these risks are far outweighed by Tesla’s robust fundamentals. The company’s gross margin of 19.8% in Q3 reflects its ability to maintain profitability amidst rising competition. With a solid growth outlook, especially in China, and a regulatory environment poised to benefit its self-driving ambitions, Tesla’s stock remains one of the most attractive investment opportunities in the market.

Looking forward, analysts have raised their price targets to $515, with a potential bull case pushing TSLA to $681, if Tesla can scale its FSD and autonomous operations. At $479.86, there’s still significant upside potential for Tesla’s stock, making it an enticing option for investors willing to bet on its technological leadership and long-term vision.

For real-time updates on Tesla’s stock performance, visit the Tesla Real-Time Chart.