Is Tesla Inc. (NASDAQ:TSLA) Worth Its $1.4 Trillion Valuation?

Tesla Inc. (NASDAQ:TSLA): Analyzing its growth potential, challenges, and whether its $1.4 trillion valuation is justified in 2025 | That's TradingNEWS

Tesla Inc. (NASDAQ:TSLA): A Comprehensive Breakdown of Performance, Opportunities, and Risks

NASDAQ:TSLA - A Stock Beyond Valuation Metrics

Tesla Inc. (NASDAQ:TSLA) has long defied traditional valuation metrics, solidifying its reputation as one of the most polarizing and closely followed stocks in the market. With its market capitalization exceeding $1.4 trillion and a forward price-to-earnings ratio hovering around 125, the stock's valuation reflects investor confidence in Tesla’s long-term potential. Despite skepticism about its high valuation, Tesla's growth trajectory and diversified portfolio, including energy storage, artificial intelligence, and robotics, justify its premium.

Tesla's stock has surged nearly 32,000% since its initial public offering, with a recent high of $427.77. This performance is not only attributed to its innovative EVs but also its ability to lead in areas such as autonomous driving, energy solutions, and AI-driven robotics. Even after a 25% correction from its peak, the stock has significant upside potential as it consolidates between $350 and $450, positioning itself for another breakout in 2025.

Deliveries and Financial Performance of NASDAQ:TSLA

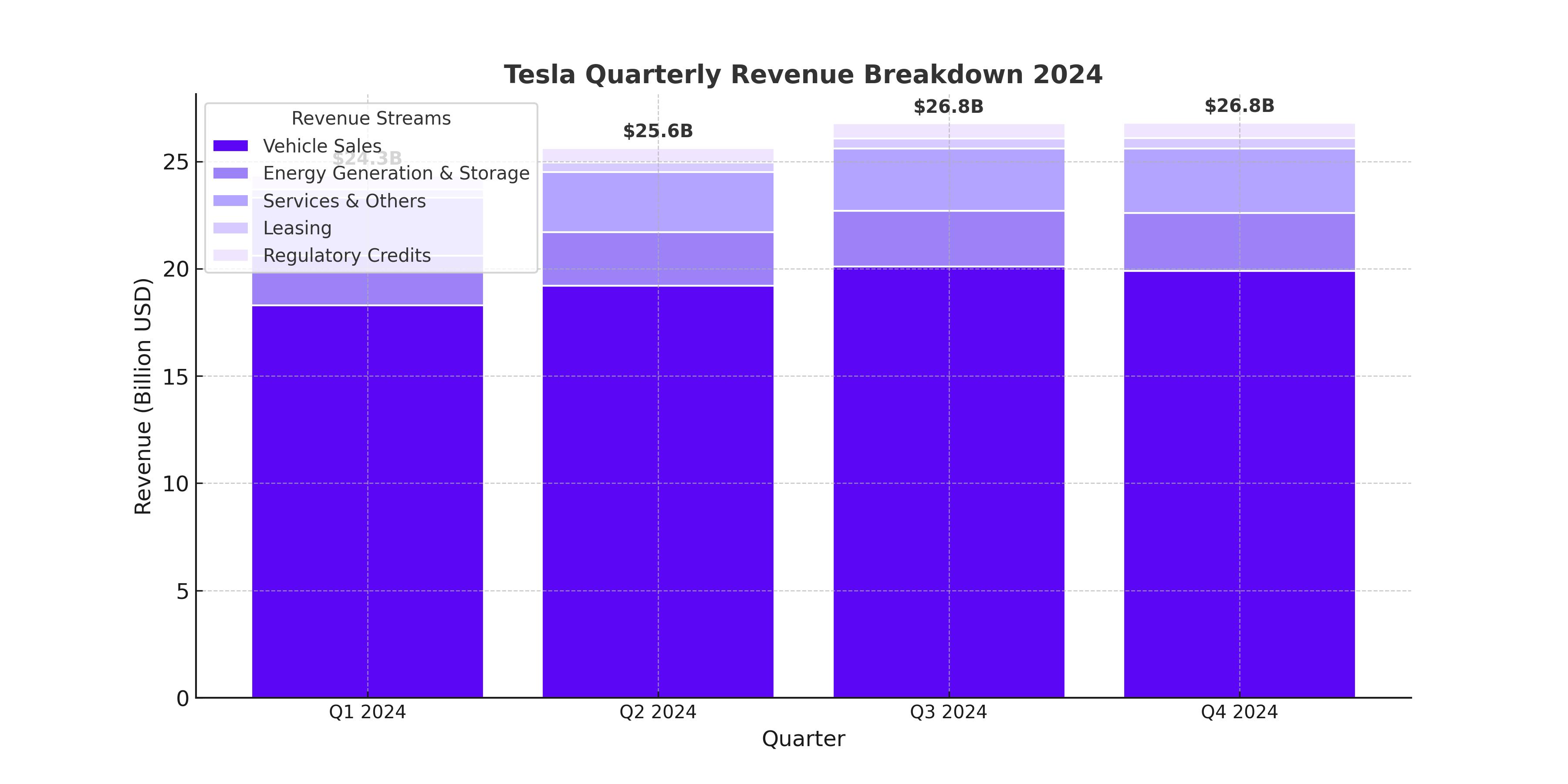

Tesla's vehicle delivery numbers for Q4 2024 highlight its operational efficiency and market demand. Deliveries reached 471,930 units for the Model 3/Y, accounting for approximately $17.71 billion in revenue, based on an average selling price (ASP) of $39,500. The higher-end Model S/X and Cybertruck contributed an additional $2.22 billion from 22,222 units sold, with an estimated ASP of $100,000.

The company's other revenue streams also performed well. Energy generation and storage sales generated $2.7 billion, services and other revenue contributed $3 billion, and leasing added another $0.49 billion. Regulatory credits brought in $0.71 billion, showcasing Tesla's ability to monetize its environmental leadership.

- Q4 Revenue Estimates Total: $26.93 billion, slightly below the consensus estimate of $27.18 billion but still reflective of Tesla's strong positioning.

Tesla maintained a GAAP gross margin of 19.8%, higher than the 18% reported in the prior quarter, demonstrating its ability to control costs and scale efficiently. With operating margins at 11.85% and net income of $2.79 billion, Tesla's profitability underscores its leadership in high-margin sectors.

Expanding Ecosystem: Beyond EVs

Tesla is not just an automaker; it is a technology powerhouse building an interconnected ecosystem. Its extensive Supercharger network, proprietary software, and over-the-air updates give Tesla a distinct advantage over traditional automakers. Energy storage solutions, such as Powerwalls and Megapacks, continue to grow in demand, contributing to its diversified revenue base. Additionally, the upcoming Model Q, a lower-cost EV targeted for mass-market adoption, is expected to drive significant volume and revenue growth.

Tesla's autonomous driving initiatives, powered by the Dojo Supercomputer and Full Self-Driving (FSD) software, represent a potentially massive revenue stream. Industry projections estimate the robotaxi market could reach $50 billion by 2030, with Tesla poised to capture a significant share. Early access members of the FSD V13.2 program have reported substantial improvements, positioning Tesla as a leader in the self-driving space.

NASDAQ:TSLA’s Global Strategy: Focus on China

China remains a critical market for Tesla, accounting for substantial growth in EV adoption. November 2024 saw Tesla sell 78,856 vehicles in China, a 12% year-over-year increase. Weekly insurance registrations reached a second-highest figure of 21,900, reflecting robust demand in the region. The Shanghai Gigafactory continues to be a cornerstone of Tesla's manufacturing efficiency and global supply chain.

Risks and Challenges for NASDAQ:TSLA

Despite its strong performance, Tesla faces significant risks. The Cybertruck, while innovative, has seen slower-than-expected adoption due to its high price and niche appeal. Recalls and quality control issues also remain a concern. Additionally, geopolitical tensions and regulatory uncertainties in key markets like China pose potential headwinds.

The competitive landscape is intensifying, with established automakers like Volkswagen and General Motors ramping up EV production. Tesla's pricing strategy, including recent cuts in China and Germany, has put pressure on margins, though this has been partially offset by efficiency gains and economies of scale.

NASDAQ:TSLA Insider Transactions and Valuation Insights

Tesla insiders have demonstrated confidence through recent stock transactions, signaling a positive outlook. For detailed information on insider activities, visit Tesla Insider Transactions.

Valuation remains a contentious topic. At 14x forward sales, Tesla is significantly more expensive than peers like Rivian Automotive, which trades at a multiple of 3.1x. However, Tesla's leadership in innovation, scale, and profitability supports its premium valuation. The company's discounted cash flow (DCF) model estimates an intrinsic value of $430 per share, aligning with its current trading range.

Future Growth Catalysts

Tesla’s ability to innovate and adapt is unmatched. The rollout of robotaxis, expansion of the Model lineup, and monetization of the Supercharger network represent untapped growth opportunities. The company's investments in new technologies and factories are expected to drive long-term cash flow growth, despite a recent decline in free cash flow to $4.385 billion due to rising capital expenditures.

With gross margins projected to remain above 20% and delivery growth forecasted at 20–30% for 2025, Tesla is well-positioned to sustain its upward momentum. Regulatory changes under a pro-business administration in the U.S. could further bolster its autonomous vehicle ambitions and overall market performance.

Final Thoughts on NASDAQ:TSLA

Tesla Inc. (NASDAQ:TSLA) remains a dominant force in the EV market and beyond. Its diversified portfolio, strong financial performance, and innovative capabilities make it a top pick for long-term growth. While challenges exist, Tesla's ability to navigate complex markets and capitalize on emerging opportunities ensures its continued relevance and success. Investors should monitor developments closely, particularly in China and the autonomous driving space, as these will play pivotal roles in shaping Tesla’s future trajectory.