Is TransDigm a Buy - NYSE:TDG Stock Analysis

Analyzing the Revenue Streams and Strategic Market Moves That Position TDG as a Leader in Aerospace Innovation | That's TradingNEWS

Financial Overview of TransDigm Group Incorporated (NYSE:TDG)

TransDigm Group Incorporated (NYSE:TDG) has demonstrated robust financial performance with a marked revenue growth, making it a standout in the aerospace sector. This analysis delves into the company's revenue streams, profitability metrics, and strategic initiatives, illustrating why TDG is a compelling study in resilience and innovation in its market.

Strategic Revenue Streams and Profitability Metrics

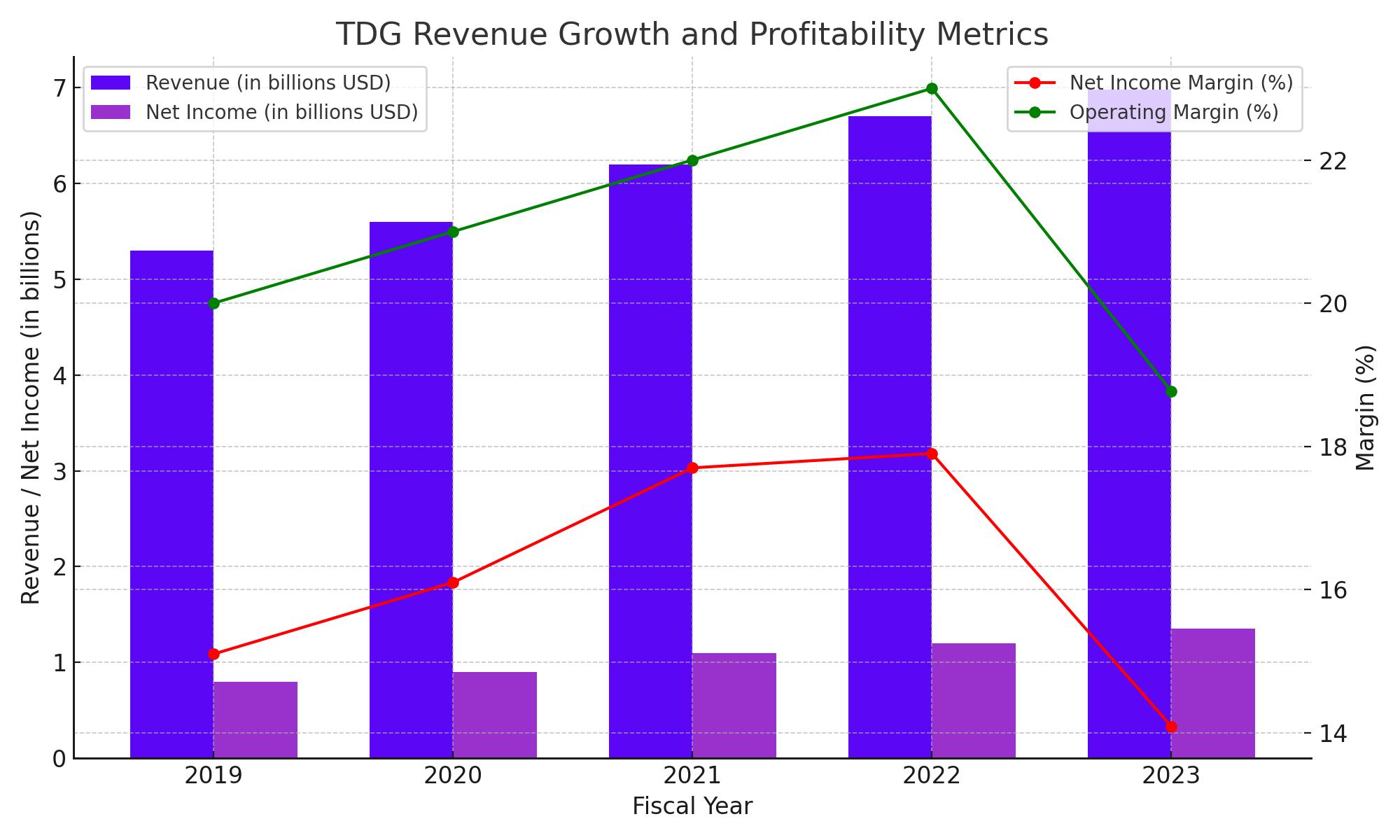

TransDigm's financial health is underpinned by its innovative business model and strategic market positioning. As of the latest fiscal year, the company reported a significant total revenue of $6.977 billion, an increase from the previous years, highlighting a consistent upward trajectory in its financial performance. This growth is a testament to TDG's strategic planning and its ability to adapt to market dynamics.

-

Net Income and Profit Margins: TDG's profitability, as indicated by a net income of $1.351 billion and a net income margin of 14.09%, showcases its efficacy in converting sales into actual profit. The company’s operating margin stands impressively at 18.77%, reflecting efficient management of operating expenses despite the high costs associated with aerospace manufacturing and R&D.

-

Earnings Per Share (EPS): The EPS of $23.61 signals strong earnings potential relative to the share price, bolstering investor confidence in TDG’s operational success and market strategy.

Innovation and Market Adaptation

TransDigm has excelled in integrating advanced technologies and developing market-driven strategies to expand its revenue streams beyond traditional aerospace products:

-

Digital Sales and Microtransactions: A significant portion of TDG's revenue is derived from digital sales, including proprietary software and systems crucial for aerospace operations. This segment benefits from higher margins compared to physical product sales.

-

Recurring Revenue Model: TDG has effectively implemented a recurring revenue model through after-sales services and parts, which not only ensures steady income but also strengthens customer loyalty.

Navigating the Competitive Aerospace Landscape

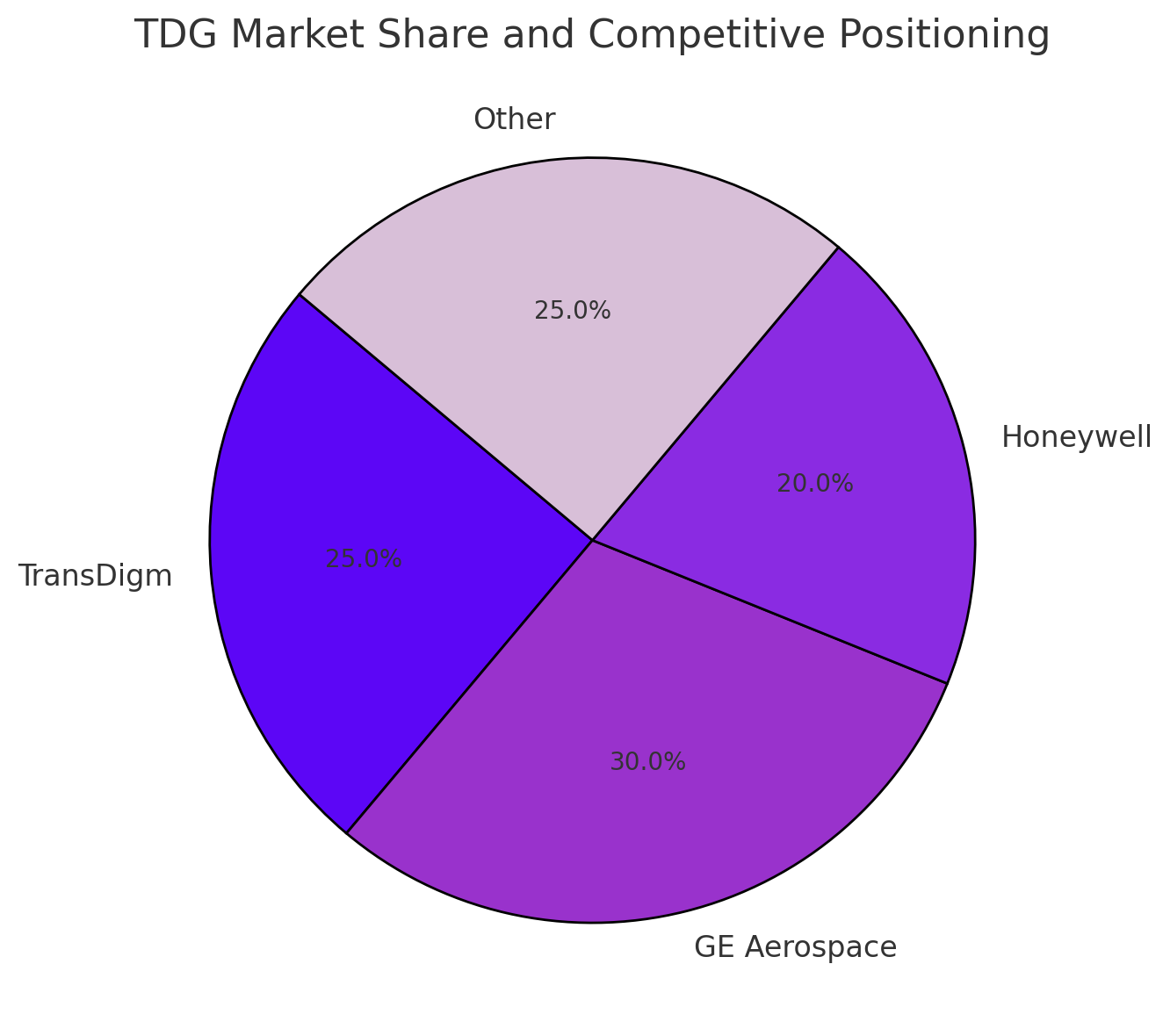

TransDigm Group Incorporated (NYSE:TDG) stands out in the aerospace industry with its unique offerings and proactive market strategies. However, it navigates a fiercely competitive arena characterized by both well-established aerospace giants and innovative startups.

-

Market Share and Strategic Positioning: TDG has carved out a substantial niche in the aerospace sector, holding a formidable market share. This is largely due to its targeted acquisitions and specialized product portfolio, which include essential aerospace components that are often sole-sourced or proprietary. Despite this, maintaining market dominance demands relentless innovation and strategic agility to stay ahead of competitors like GE Aerospace and Honeywell, who are also expanding their technological and market footprints.

-

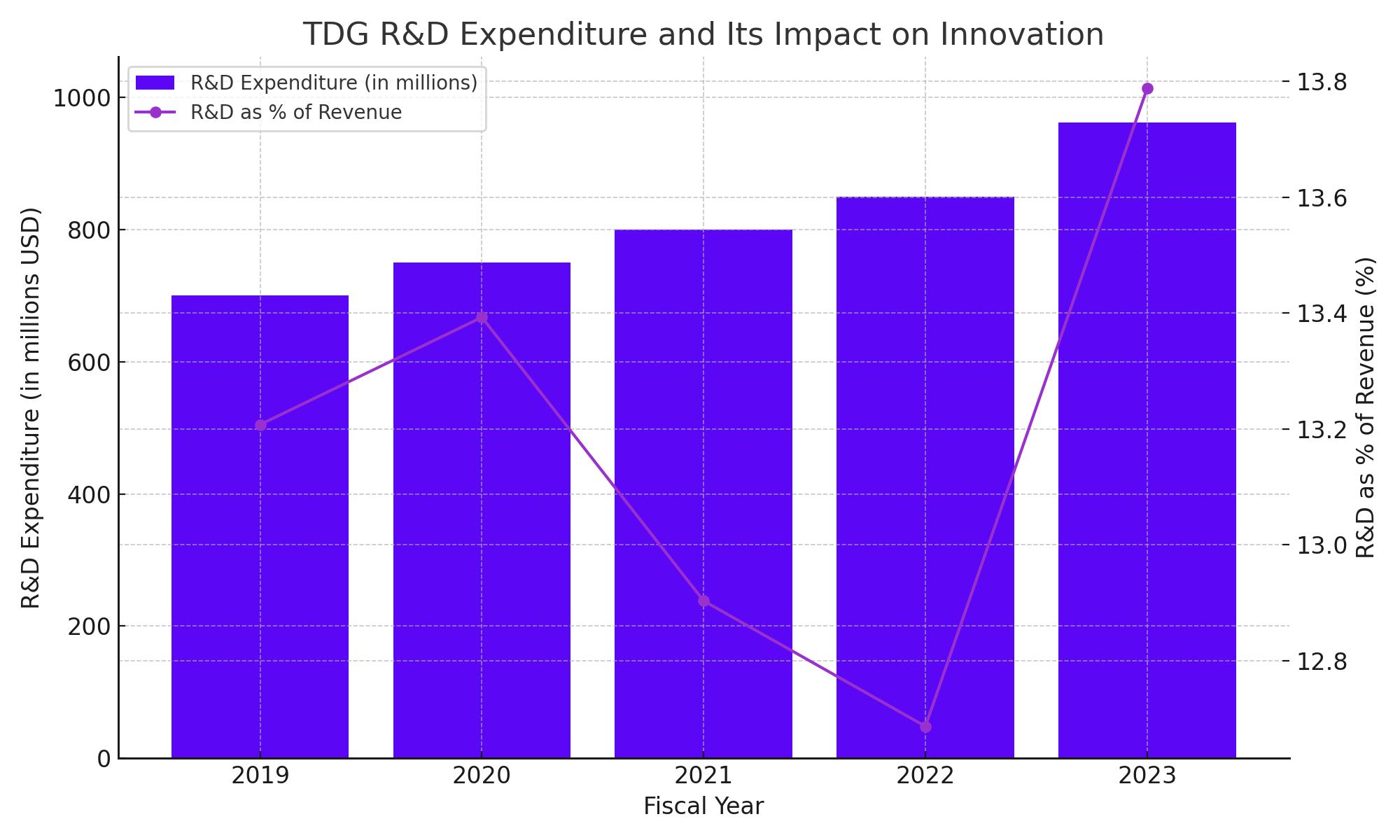

Research and Development Expenditure: In the fiscal year 2023, TDG invested heavily in research and development, with expenditures reaching approximately $962 million, representing a significant portion of its revenue. This investment is crucial in fostering technological advancements and sustaining long-term growth, even though it may impact short-term profitability.

Leveraging Technology for Operational Excellence

TDG’s strategic investments in technology underscore its commitment to maintaining a competitive edge through operational efficiency and enhanced product offerings:

-

Operational Efficiency through Technology: By integrating AI and machine learning, TDG has significantly enhanced its manufacturing processes. These technologies have facilitated more efficient supply chain management and production workflows, leading to reduced operational costs and improved margins.

-

Enhancing User Experience: Technological enhancements have not only elevated the quality of TDG's aerospace components but have also improved interactions with end-users. Advanced simulations and interactive systems have made TDG’s products more appealing to both existing customers and new prospects within the aerospace industry.

Strategic Initiatives for Revenue Growth

With a focus on expanding market reach and user engagement, TDG is aggressively pursuing new avenues for revenue growth:

-

Global Market Expansion: TDG is actively expanding its global footprint by diversifying its product offerings and entering new geographic markets. For instance, in the last fiscal year, TDG's international sales saw an uptick, contributing significantly to its total revenue pool. The company aims to tap into high-growth markets in Asia and Europe, where aerospace demand is expanding rapidly.

-

Innovative Revenue Streams: TDG is pioneering in areas such as immersive advertising and strategic digital partnerships, which represent a departure from its traditional revenue models. For example, the company's venture into digital marketing within aerospace platforms presents a novel way to engage users and opens up new streams of advertising revenue. This strategy is instrumental in reducing dependency on direct product sales and adapting to the digital transformation within the industry.

Is NYSE:TDG stock a Buy ? Investment Consideration: Hold

Given TDG’s robust portfolio and strong market presence, there is a clear potential for growth. However, the high operational costs and competitive market landscape present significant challenges:

-

Bullish Factors: TDG’s proactive strategy in technology and market expansion, coupled with its solid brand reputation, suggests a strong growth trajectory.

-

Bearish Considerations: High R&D expenditures and fierce competition could hinder profitability, making it essential for potential investors to adopt a cautious approach.

Considering these factors, a 'Hold' recommendation is advised, allowing investors to monitor TDG's ongoing ability to translate strategic initiatives into sustained profitability amidst fluctuating market conditions. Investors should keep a close watch on future financial reports and market trends to make well-informed decisions aligned with their investment goals.