iShares Home BATS: ITB ETF Positioned for Major Upside as Housing Market Heats Up

Unlocking the Growth Potential of iShares U.S. Home Construction ETF in Today’s Thriving Real Estate Market | That's TradingNEWS

Overview: BATS: ITB Riding the Homebuilding Wave

The iShares U.S. Home Construction ETF (BATS: ITB) has remained a formidable player in the U.S. housing market, reflecting the sector's overall performance amidst fluctuating economic indicators. As of the latest trading data, ITB is trading at $115.31 per share, with a market capitalization of $2.93 billion. The ETF's price-to-earnings (P/E) ratio stands at 11.56, indicating a relative undervaluation compared to broader market indices like the S&P 500, which trades at a much higher P/E of 19.47. This metric is particularly attractive for value investors looking to tap into the homebuilding sector's potential upside.

Sector Dynamics: Demand and Supply Constraints Shaping ITB’s Performance

Despite the broader economic challenges, including rising interest rates and inflation, demand for housing remains robust. This is primarily due to demographic shifts, with millennials entering their prime homebuying years, and the ongoing trend of urbanization. The BATS: ITB has benefited significantly from this demand, which is further fueled by the chronic undersupply of homes in the U.S. market.

According to the U.S. Census Bureau, housing starts in July 2024 dropped by 5.4% month-over-month, reflecting the tight supply conditions exacerbated by high construction costs and labor shortages. Despite this decline, the overall demand for housing has kept homebuilders like D.R. Horton (DHI) and Lennar Corporation (LEN), which are key components of ITB, in a strong position. D.R. Horton, for instance, reported a 5.3% year-over-year increase in revenue for the third quarter of 2024, driven by a 7% rise in home sales. Lennar Corporation also showed resilience with a 4.8% increase in quarterly revenue, indicating strong demand across various markets.

Economic Indicators: Interest Rates and Their Impact on ITB

The recent economic data paints a complex picture for the housing market. The Federal Reserve’s anticipated interest rate cut in September has been a focal point for investors. Currently, the market is pricing in a 76% probability of a 25-basis-point rate cut, with some analysts predicting an even deeper cut of 50 basis points. The 30-year fixed mortgage rate, which is closely tied to Fed policy, has hovered around 6.73% as of August 1, 2024, down slightly from 6.90% a year ago but still relatively high compared to pre-pandemic levels.

This high-interest rate environment has certainly put pressure on housing affordability, yet the demand for new homes remains strong, as evidenced by the consistent performance of BATS: ITB. If the Federal Reserve follows through with a rate cut, it could provide a significant boost to the housing market by making mortgages more affordable, thereby increasing the purchasing power of prospective homebuyers. This potential shift could further solidify ITB's position as a leading investment vehicle in the home construction sector.

Holdings and Sector Composition: ITB’s Strategic Asset Allocation

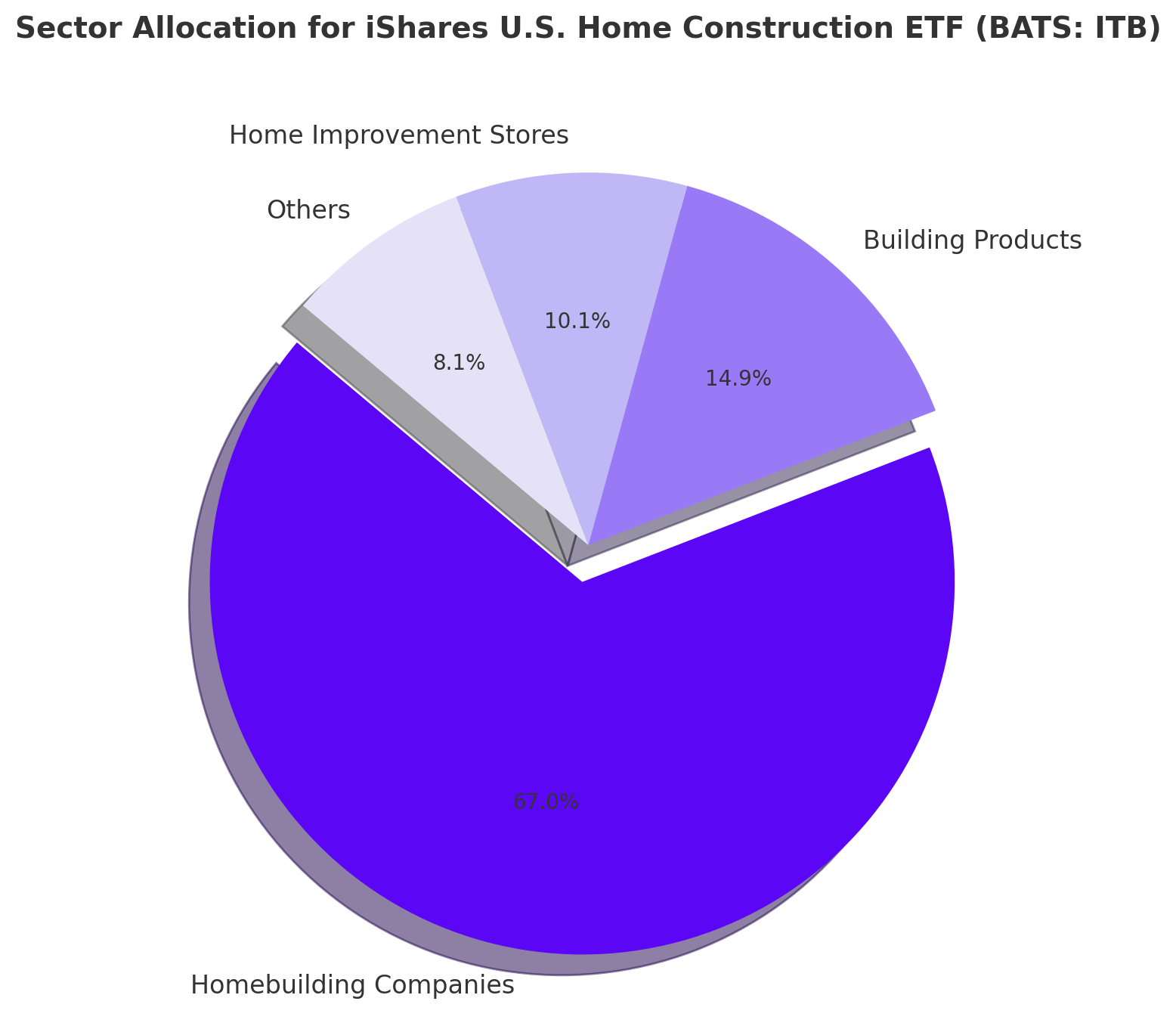

The BATS: ITB ETF is heavily weighted towards homebuilding companies, which account for 66.99% of its total assets. The top holdings include D.R. Horton (DHI), Lennar Corporation (LEN), NVR Inc. (NVR), PulteGroup Inc. (PHM), and The Home Depot (HD). D.R. Horton, the largest homebuilder in the U.S., commands the lion’s share of the portfolio, reflecting its dominant position in the market. Lennar Corporation, known for its innovative homebuilding solutions and strategic acquisitions, is another heavyweight in the ETF, further enhancing its exposure to the robust U.S. housing market.

Beyond homebuilders, ITB also invests in companies that are integral to the housing ecosystem. 14.85% of the ETF’s assets are allocated to building products, while 10.05% are invested in home improvement stores. This diversified exposure allows ITB to benefit from various stages of the homebuilding process, from raw material suppliers to companies like The Home Depot, which sell finished products to consumers. This broad sector composition reduces the ETF’s vulnerability to company-specific risks and provides a more balanced exposure to the housing market.

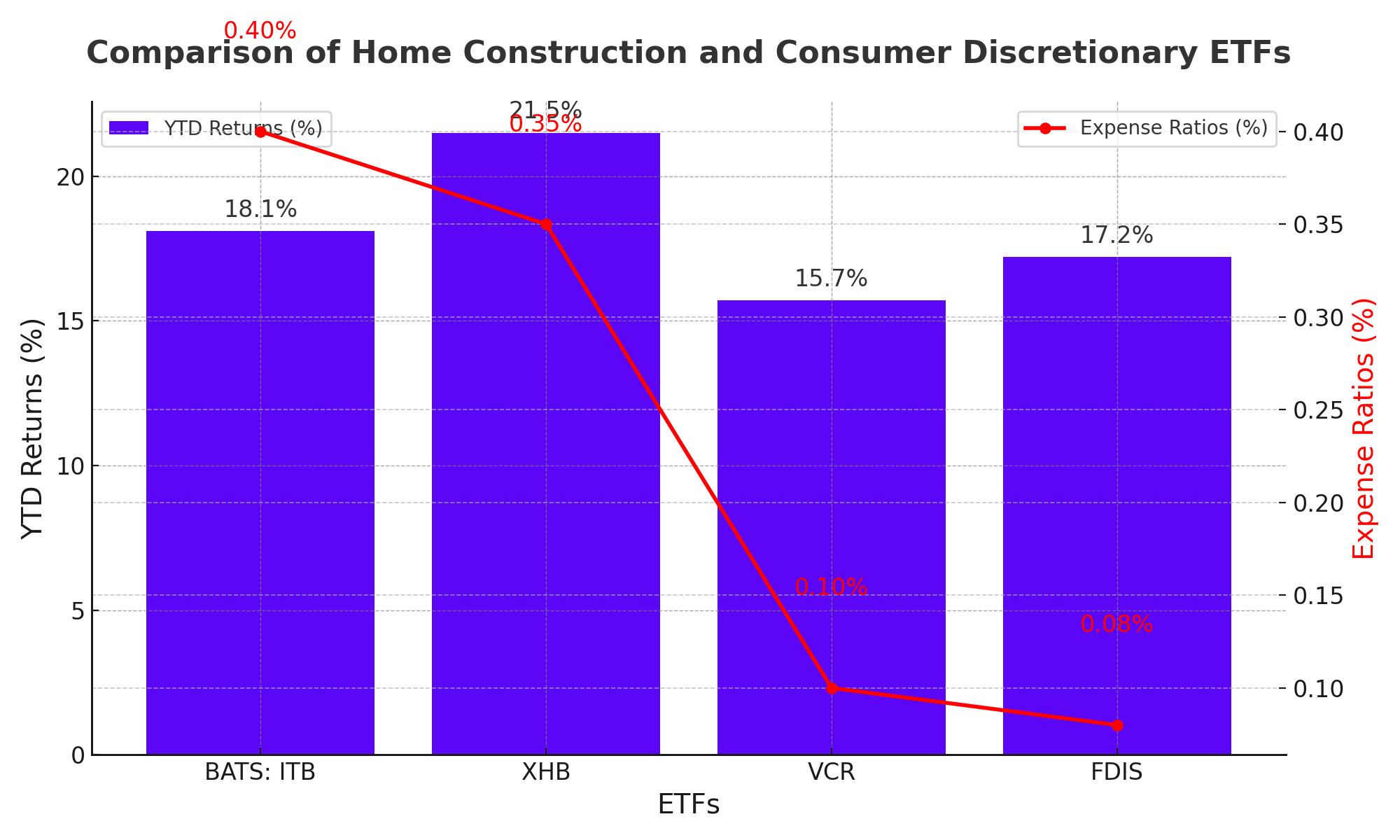

Comparative Analysis: ITB vs. XHB

When comparing BATS: ITB to the SPDR S&P Homebuilders ETF (XHB), which is another major player in the homebuilding sector, it's essential to note the differences in their focus and performance. While ITB has a more concentrated exposure to homebuilders, XHB includes a wider range of companies involved in building products and home improvement, making it less directly linked to the homebuilding sector alone.

Over the past year, ITB has delivered a year-to-date return of 18.1%, slightly underperforming XHB’s 21.5% gain. However, ITB’s more focused approach could provide stronger returns if the housing market continues to grow, particularly if interest rates decline as expected. Investors should consider these differences when choosing between the two ETFs, depending on their risk tolerance and investment objectives.

Insider Transactions and Institutional Movements

Recent institutional activity around BATS: ITB reflects a mixed sentiment. Brookstone Capital Management reduced its holdings by 38.6% in Q2 2024, possibly indicating concerns about short-term market volatility. On the other hand, BNP Paribas Financial Markets increased its holdings by 56.8% in Q1 2024, suggesting confidence in the sector’s long-term growth potential. This divergence in institutional behavior highlights the uncertainty in the market, driven by economic factors such as interest rates and housing supply constraints.

Earnings and Valuation: A Deeper Dive into ITB’s Holdings

Examining the earnings reports of ITB’s top holdings provides further insight into the ETF’s performance. D.R. Horton posted third-quarter earnings per share (EPS) of $3.70, surpassing the consensus estimate of $3.55. The company’s revenue for the quarter was $9.8 billion, a 6.5% increase from the previous year, reflecting strong demand across its markets. Lennar Corporation also delivered impressive results, with an EPS of $4.75 for Q3 2024, beating the estimate of $4.55. Lennar’s revenue grew by 5.2% year-over-year to $10.4 billion, supported by a robust pipeline of new home orders.

The valuation metrics for these companies remain compelling. D.R. Horton trades at a forward P/E of 10.5x, below the industry average, while Lennar Corporation has a P/E of 9.8x, indicating that these stocks are still relatively undervalued despite their strong performance. This undervaluation, coupled with solid earnings growth, makes ITB an attractive investment option for those looking to gain exposure to the homebuilding sector.

Conclusion: ITB’s Strategic Position in a Volatile Market

The iShares U.S. Home Construction ETF (BATS: ITB) remains a strong contender in the homebuilding sector, benefiting from high demand, strategic asset allocation, and solid earnings growth among its top holdings. While the housing market faces challenges from high-interest rates and supply constraints, the potential for a Federal Reserve rate cut in September could provide a significant boost to the sector.

Investors should carefully monitor economic indicators and institutional activity to gauge the ETF’s future performance. With a robust portfolio of homebuilders and related companies, ITB offers a compelling investment opportunity for those looking to capitalize on the ongoing demand for housing in the U.S. market. However, the risks associated with economic volatility and sector-specific challenges should not be overlooked, making it essential for investors to stay informed and consider their risk tolerance when investing in BATS: ITB.

That's TradingNEWS

Read More

-

NVIDIA Stock Price Forecast - NVDA at $192: Can AI Factories Outrun China’s H200 Roadblock?

30.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast; XRP-USD Under Pressure At $1.75 As Bears Target $1.70 Support

30.01.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: Trade Rich to a $60 Glut Anchor as Brent Breaks Above $70

30.01.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow, S&P 500 and Nasdaq Drop as Warsh Fed Pick Hits Gold

30.01.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast; Pound Holds Above 1.37 As Four-Year High Near 1.3850 Keeps 1.40 In Sight

30.01.2026 · TradingNEWS ArchiveForex