iShares US Tech ETF (IYW): Performance, Holdings, and Future Trends

A Closer Look at IYW's Impressive Growth, Key Holdings, and How Technological Evolution Positions It for Future Success | That's TradingNEWS

Comprehensive Market Analysis: iShares U.S. Technology ETF (IYW)

Introduction to the Tech Investment Landscape

The technology sector stands at the forefront of innovation and economic growth, offering unprecedented investment opportunities. The iShares U.S. Technology ETF (IYW) captures this essence by providing investors exposure to a broad range of tech companies. With technology continuously evolving and shaping the future, IYW presents an attractive proposition for those looking to tap into the sector's dynamic growth.

In-Depth Performance Metrics and Market Position

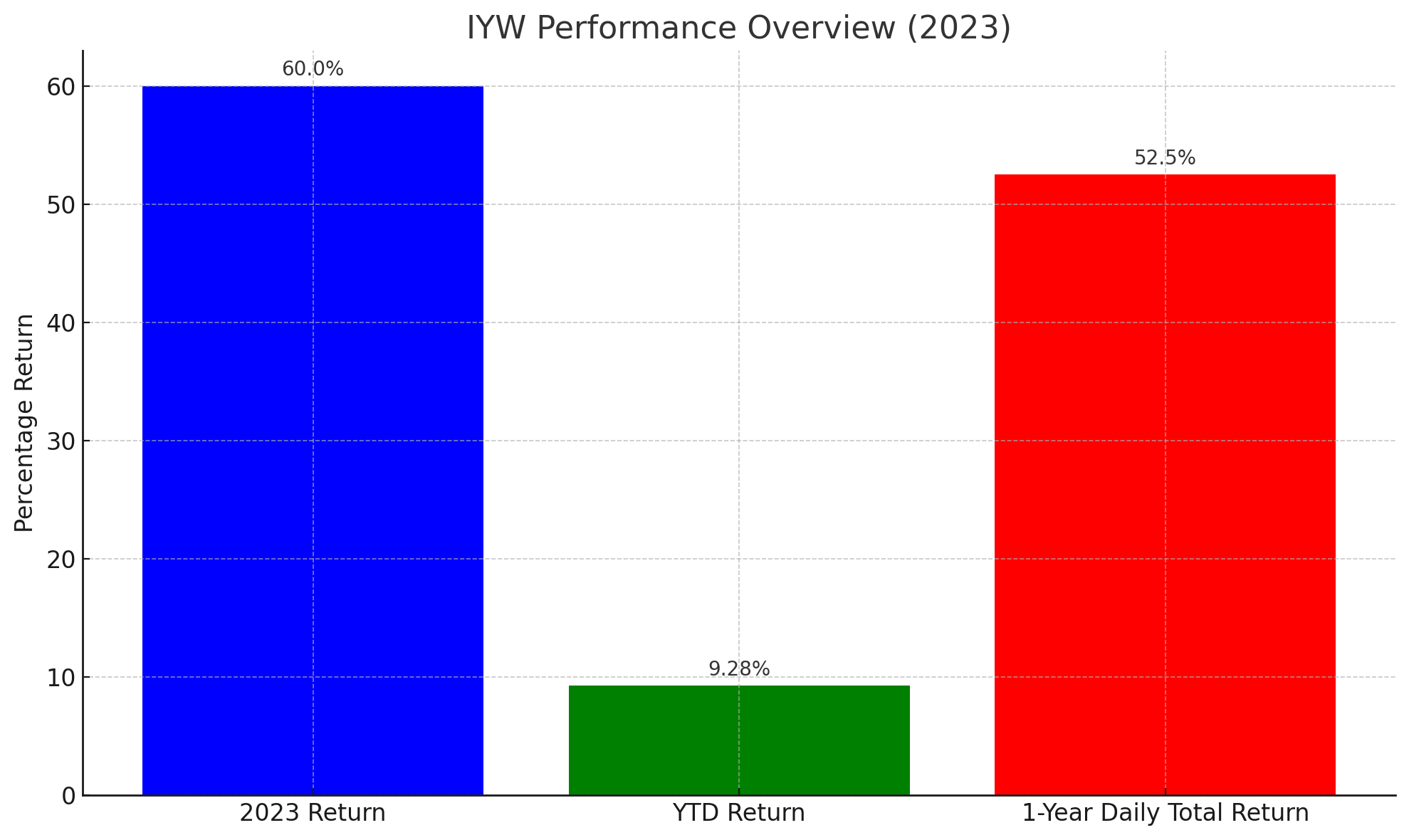

IYW's performance over the past year has been nothing short of remarkable, boasting a return of nearly 60% in 2023. This is a testament to the robustness of the technology sector, even in times of market volatility. As of the latest data:

- Price Dynamics: IYW's trading price has seen fluctuations, with a slight decline of -0.08% at $134.03, emphasizing the ETF's stability amidst market shifts.

- Asset Overview: With net assets amounting to $15.75 billion and an average volume indicating high liquidity, IYW stands as a heavyweight in the ETF arena.

- Historical Performance: The ETF's year-to-date return of 9.28%, coupled with a 52.50% 1-year daily total return, underscores its strong market position and investor confidence.

Strategic Portfolio Composition and Sector Insights

IYW's curated portfolio is its cornerstone, focusing on technology and select communication stocks, including industry leaders and emerging players. This strategic selection has been pivotal in IYW's impressive performance, driven by:

- Innovative Giants: Leading companies like Microsoft, Apple, NVIDIA, and Adobe form the backbone of IYW's portfolio, benefiting from trends like AI, cloud computing, and digital transformation.

- Sectoral Growth Drivers: The ETF benefits from the technology sector's broad themes, including AI advancements, software as a service (SaaS), and semiconductor innovation, positioning it well for future growth.

Analyzing the Economic and Financial Landscape in Depth

The broader economic indicators paint an optimistic picture for the technology sector and, by extension, for the iShares U.S. Technology ETF (NYSEArca: IYW). With GDP growth projections in the United States pointing towards a 2.4% increase in 2024, the underpinning economic stability is undeniable. This economic buoyancy is further complemented by a robust job market, where January alone saw an impressive addition of 353,000 jobs, far exceeding expectations. Such indicators not only reflect a healthy economy but also signal strong consumer spending capabilities, which directly benefits the tech sector.

Furthermore, the tech sector's earnings growth has been nothing short of phenomenal. In the fourth quarter, an astonishing 88% of technology companies outperformed earnings expectations, marking the highest percentage among S&P 500 sectors. This is not just a testament to the sector's resilience but also highlights its potential for sustained growth. For instance, the technology sector witnessed a remarkable 20% earnings growth in Q4, with projections suggesting a 16% increase into 2024. This financial robustness, when paired with strategic rate adjustments and nuanced monetary policy, bolsters a bullish outlook for tech investments and, by implication, for IYW.

Institutional Confidence and Market Movements Explored

The recent uptick in institutional investments into IYW shares underscores a burgeoning confidence in the ETF's strategy and the broader outlook of the technology sector. For instance, Nicolet Advisory Services LLC increased its holdings in IYW by 3.2% during Q3, signaling a strengthening faith in the ETF's potential. Similarly, D.A. Davidson & CO. upped its stake by 1.5% in Q2, while Patriot Financial Group Insurance Agency LLC augmented its IYW shares by 1.0% in Q3. These movements are indicative of a wider positive sentiment towards technology investments, suggesting strong market confidence in IYW's forward trajectory.

Forward-Looking Perspective: Navigating Future Trends

Looking ahead, IYW is strategically positioned to leverage the ongoing digital transformation sweeping across industries. With a diversified portfolio that encapsulates the crème de la crème of the tech world, including giants like Microsoft, Apple, NVIDIA, and emerging AI and cloud computing behemoths, IYW is poised for continued success. The tech sector's resilience and innovative drive suggest that IYW is well-equipped to capitalize on future technological advancements and market trends. This is further evidenced by IYW's impressive performance metrics, such as a nearly 60% return in 2023 and a 9.28% year-to-date return, laying a solid foundation for future growth.

Leveraging Technological Innovation: Spotlight on IYW's Leading Holdings

The iShares U.S. Technology ETF (IYW) stands as a pivotal force in the investment world, primarily due to its strategic assembly of holdings that comprise some of the most innovative and influential tech companies globally. These holdings, which include industry titans like Microsoft, Apple, NVIDIA, and Adobe, not only underscore the ETF's strong market position but also illuminate the path of technological evolution and its impact on the global economy.

Microsoft and Apple: Pioneering the Future

Microsoft and Apple, as cornerstones of IYW's portfolio, represent the epitome of technological advancement and market leadership. Microsoft's anticipated 19% earnings growth in fiscal 2024, powered by its cloud and Azure services, exemplifies how cloud computing continues to redefine the tech landscape. Similarly, Apple's consistent innovation and ability to dominate the consumer electronics market showcase the company's unrivaled capacity to adapt and thrive amidst changing technological trends.

NVIDIA and Adobe: Driving Innovation Forward

NVIDIA, a leader in graphics processing technology, and Adobe, renowned for its creative and digital marketing solutions, further highlight IYW's focus on companies at the forefront of technological innovation. NVIDIA's significant role in advancing AI technologies and data center capabilities aligns with the current trend towards AI and machine learning, marking a significant shift in computing paradigms. On the other hand, Adobe's robust earnings growth and record operating cash flow of $7.30 billion in 2023 reflect the growing importance of digital media and creative software in both personal and professional realms.

Sectoral Impact and Economic Contributions

The collective impact of these companies transcends individual success, contributing significantly to the broader technology sector's growth and, by extension, to the global economy. Their advancements in AI, cloud computing, digital media, and consumer electronics not only drive sectoral trends but also foster a conducive environment for innovation, creativity, and efficiency across various industries.

Conclusion: A Comprehensive Analysis

The iShares U.S. Technology ETF (IYW) stands as a beacon for investors seeking to tap into the dynamic landscape of the technology sector. With strategic portfolio management, stellar performance, and an economic backdrop that favors technological advancement, IYW is on a trajectory of continued growth. As technology continues to be the driving force behind global innovation and economic progress, IYW emerges as an enticing investment proposition for those poised to harness the sector's vast potential. This in-depth analysis not only highlights IYW's strengths and market positioning but also provides investors with a granular view of its growth outlook in the ever-evolving technology sector.