JEPQ VS. QQQ: Which ETF Delivers for Your Portfolio Strategy?

JEPQ offers stability and income with a 9.2% yield, while QQQ captures explosive Nasdaq growth | That's TradingNEWS

JEPQ vs. QQQ: A Comprehensive Performance Analysis

Comparing Objectives and Core Strategies

The JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) and the Invesco QQQ Trust ETF (QQQ) represent distinct strategies tied to the Nasdaq 100. While both focus on this tech-heavy index, their investment goals diverge significantly. JEPQ emphasizes high-income generation and reduced volatility through covered call strategies executed via Equity-Linked Notes (ELNs). This allows JEPQ to transform market volatility into steady monthly income while minimizing sharp market swings. In contrast, QQQ offers direct exposure to the Nasdaq 100, focusing purely on growth by investing in the largest tech-driven companies like Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA). This growth-centric approach makes QQQ inherently more volatile but also positions it to capitalize on exponential market gains.

Historical Performance: Growth vs. Income

QQQ has proven its mettle as a growth powerhouse, leveraging the Nasdaq’s strongest performers. From January 2021 to December 2024, QQQ achieved an impressive annualized total return of 17.5%, driven by the tech boom and innovation in AI, cloud computing, and semiconductors. Over this period, companies like Nvidia surged by over 500%, directly contributing to QQQ’s stellar performance.

JEPQ, launched in May 2022, takes a different route, focusing on consistent income. Its annualized total return since inception stands at 10.2%, primarily fueled by its reliable monthly distributions averaging $0.41 per share, equating to an annual yield of 9.2%. While it sacrifices some growth potential, JEPQ’s reduced volatility ensures steady returns, even during market turbulence.

Key Metrics Breakdown

Total Return Comparison

-

2023:

-

QQQ: Achieved a total return of 38.2%, buoyed by the AI rally and recovery in tech stocks.

-

JEPQ: Delivered a total return of 18.1%, a blend of income generation and limited participation in the tech rally.

-

-

Year-to-Date 2024 (as of December):

-

QQQ: Up 22.5%, driven by Nvidia’s 120% gain and robust earnings from Microsoft.

-

JEPQ: Returned 12.4%, maintaining consistent monthly payouts despite lower capital appreciation.

-

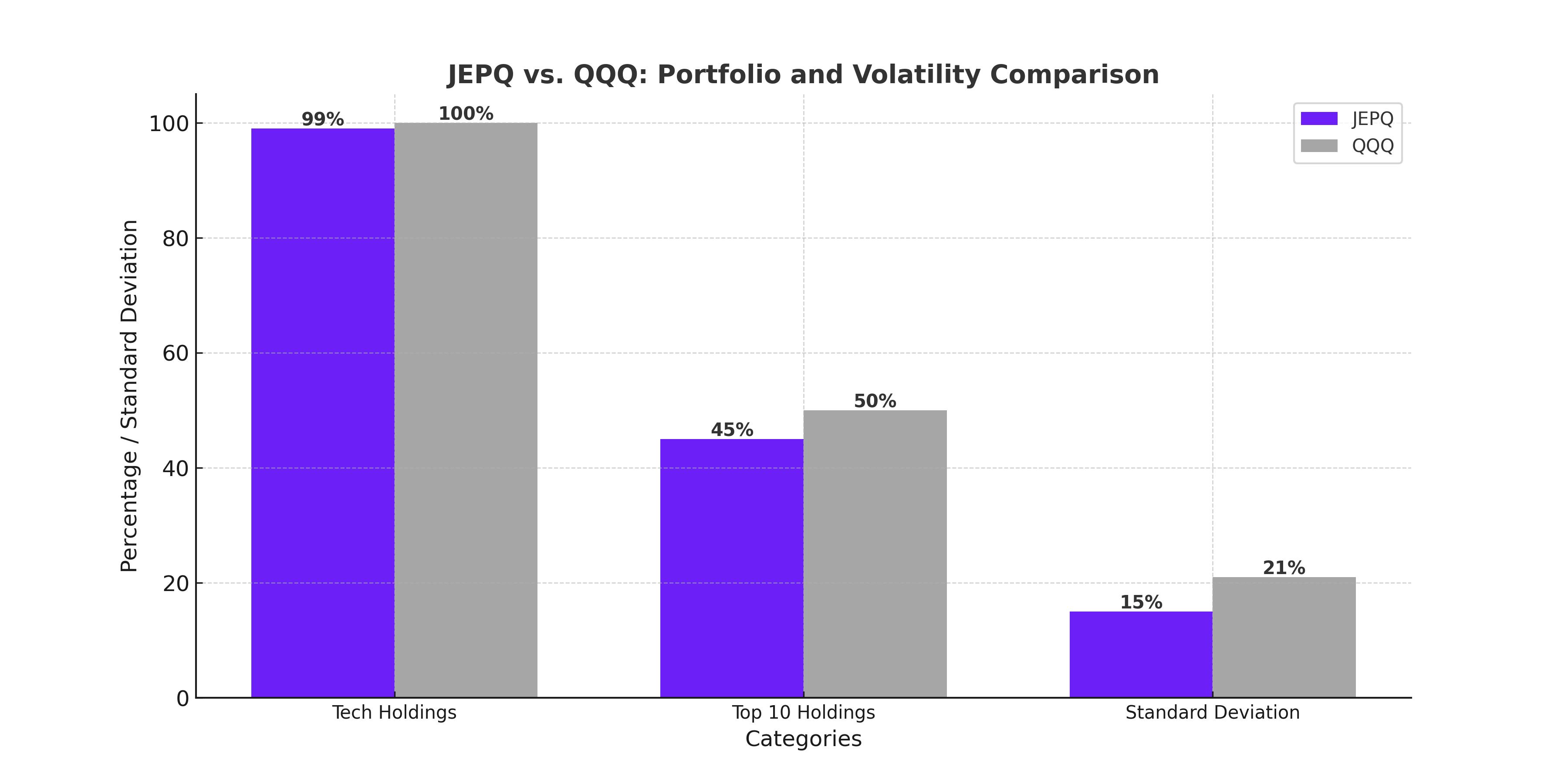

Volatility and Risk Metrics

-

Beta:

-

QQQ: 1.08, indicating higher volatility relative to the S&P 500.

-

JEPQ: 0.74, reflecting reduced risk through its ELN strategy.

-

-

Standard Deviation (3-Year Annualized):

-

QQQ: 22.3%

-

JEPQ: 15.2%, showing significantly smoother performance.

-

-

Sharpe Ratio (Risk-Adjusted Return):

-

QQQ: 0.98

-

JEPQ: 1.12, indicating better risk-adjusted performance.

-

Income Stability

Income-seeking investors are drawn to JEPQ’s reliable payouts. Over the past 12 months, it distributed an average monthly yield of $0.41 per share, translating to a robust annual yield of 9.2%. This consistency appeals to retirees and conservative investors seeking steady cash flows. By comparison, QQQ’s dividend yield remains negligible at 0.7%, emphasizing its focus on capital appreciation rather than income.

Sector Allocation and Portfolio Composition

Both ETFs derive their core exposure from the Nasdaq 100, but JEPQ actively manages its portfolio, reducing exposure to high-volatility names.

-

QQQ: Concentrates over 50% of its portfolio in the top five holdings: Apple, Microsoft, Nvidia, Amazon, and Alphabet. These giants drive QQQ’s performance but also contribute to its higher volatility.

-

JEPQ: Diversifies its holdings, typically allocating 85% to selected Nasdaq 100 stocks and 15% to ELNs. This approach ensures downside protection during market sell-offs.

Stress Testing: How They Perform in Market Extremes

-

March 2023 Banking Crisis:

-

QQQ: Declined by -12%, reflecting sensitivity to market-wide sell-offs.

-

JEPQ: Dropped only -7%, with income distributions partially offsetting losses.

-

-

2022 Bear Market:

-

QQQ: Fell by -33.2%, as tech valuations faced pressure from rising interest rates.

-

JEPQ: Declined by -14.7%, benefiting from income stability and reduced volatility.

-

Tax Efficiency and Implications

JEPQ’s income focus comes with tax considerations. Most of its distributions are taxed as ordinary income, which can impact after-tax returns for investors in high tax brackets. By contrast, QQQ’s lower dividend payouts and higher reliance on capital gains may offer greater tax efficiency in taxable accounts. However, holding JEPQ in a tax-deferred account like an IRA can mitigate these disadvantages.

Insider Transactions and Institutional Holdings

Institutional investors have increasingly turned to JEPQ for its income-generation capabilities, with JPMorgan’s latest filings showing $4.2 billion in net inflows during 2024. Insider transactions reveal bullish sentiment, with portfolio managers adding to their holdings during periods of market uncertainty. In contrast, QQQ continues to dominate institutional portfolios as a growth vehicle, with $270 billion in AUM as of December 2024.

Performance in Rising vs. Falling Markets

-

Upside Capture Ratio:

-

QQQ: 126%, capturing more gains during bull markets.

-

JEPQ: 89%, sacrificing upside for income stability.

-

-

Downside Capture Ratio:

-

QQQ: 132%, amplifying losses during downturns.

-

JEPQ: 61%, effectively buffering against declines.

-

Expense Ratios and Cost Efficiency

JEPQ’s expense ratio stands at 0.35%, a reasonable fee for an actively managed ETF. QQQ, as a passive fund, has a lower expense ratio of 0.20%. Investors seeking cost efficiency may favor QQQ, but JEPQ’s active strategy justifies its slightly higher fees.

Who Should Invest JEPQ VS. QQQ ETF ?

JEPQ is tailored for income-focused investors prioritizing consistent cash flows with reduced market volatility. Its strategic blend of income-generating Equity-Linked Notes (ELNs) and diversified Nasdaq 100 exposure makes it particularly attractive to retirees or those looking for predictable monthly payouts. The ETF has consistently delivered an average annualized yield of approximately 9.0%, making it a strong candidate for conservative portfolios seeking stability. Investors concerned about downside protection during market turbulence will appreciate JEPQ’s reduced beta of 0.74, which reflects its smoother performance compared to traditional growth-heavy ETFs.

QQQ, on the other hand, caters to growth-oriented investors who are willing to endure higher market volatility for the promise of significant long-term capital appreciation. Tracking the Nasdaq 100 directly, QQQ is built for younger investors or those with a long investment horizon, aiming to capture the exponential growth of companies like Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). Its historical annualized returns of approximately 17.5% make it a powerful vehicle for wealth creation. However, QQQ’s beta of 1.08 underscores its heightened sensitivity to market fluctuations, requiring investors to have a higher risk tolerance.

Final Thoughts: Buy, Hold, or Sell?

JEPQ stands out as a compelling choice for income-seeking investors. Its strategic design combines consistent yield, averaging $0.41 per share in monthly distributions, and reduced volatility, which protects portfolios during economic downturns. The ETF’s ability to provide regular income even in bear markets is a testament to its robust structure. During the 2022 bear market, while the Nasdaq 100 fell by -33.2%, JEPQ limited its decline to -14.7%, highlighting its resilience and stability. Investors looking to secure income without sacrificing peace of mind will find JEPQ a valuable addition to their portfolio.

Conversely, QQQ remains an unmatched growth powerhouse, consistently outperforming in bull markets. With a staggering upside capture ratio of 126%, it thrives during periods of market optimism, as evidenced by its 38.2% total return in 2023, fueled by the AI-driven rally. However, this comes at a cost during downturns, as its downside capture ratio of 132% indicates amplified losses in bearish phases. For those with the patience and risk appetite to weather such volatility, QQQ offers unparalleled potential for long-term capital appreciation, supported by its exposure to innovation leaders.

In conclusion, the decision between JEPQ and QQQ depends entirely on your investment priorities. If stability, reduced volatility, and regular income are your primary goals, JEPQ emerges as the clear winner, especially for retirees or risk-averse investors. On the other hand, if you’re chasing growth and willing to endure market swings, QQQ remains the premier choice for capturing the Nasdaq 100’s innovation-driven upside.

That's TradingNEWS

Read More

-

DGRO ETF Price: Is DGRO at $69.17 Still the Better Dividend-Growth Bet?

17.12.2025 · TradingNEWS ArchiveStocks

-

XRP Price Stuck Below $2 As XRPI at $10.74 and XRPR at $15.26 Ride $1B+ ETF Inflows

17.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Steady Near $4 as TTF Jumps on Colder Forecasts and LNG Outage Risk

17.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: USDJPY=X 155.50 Pivot Before BoJ Hike and US CPI

17.12.2025 · TradingNEWS ArchiveForex