NYSE:JPM Stock: Robust Profits and Deregulation Fuel 48% Rally

JPMorgan Chase thrives on $42.7B in Q3 revenues and Trump-era deregulation optimism—will the gains continue? | That's TradingNEWS

NYSE:JPM Stock Analysis: Positioned for Strength Amid Deregulation Tailwinds

Robust Performance in Q3 2024: Strong Revenue Growth

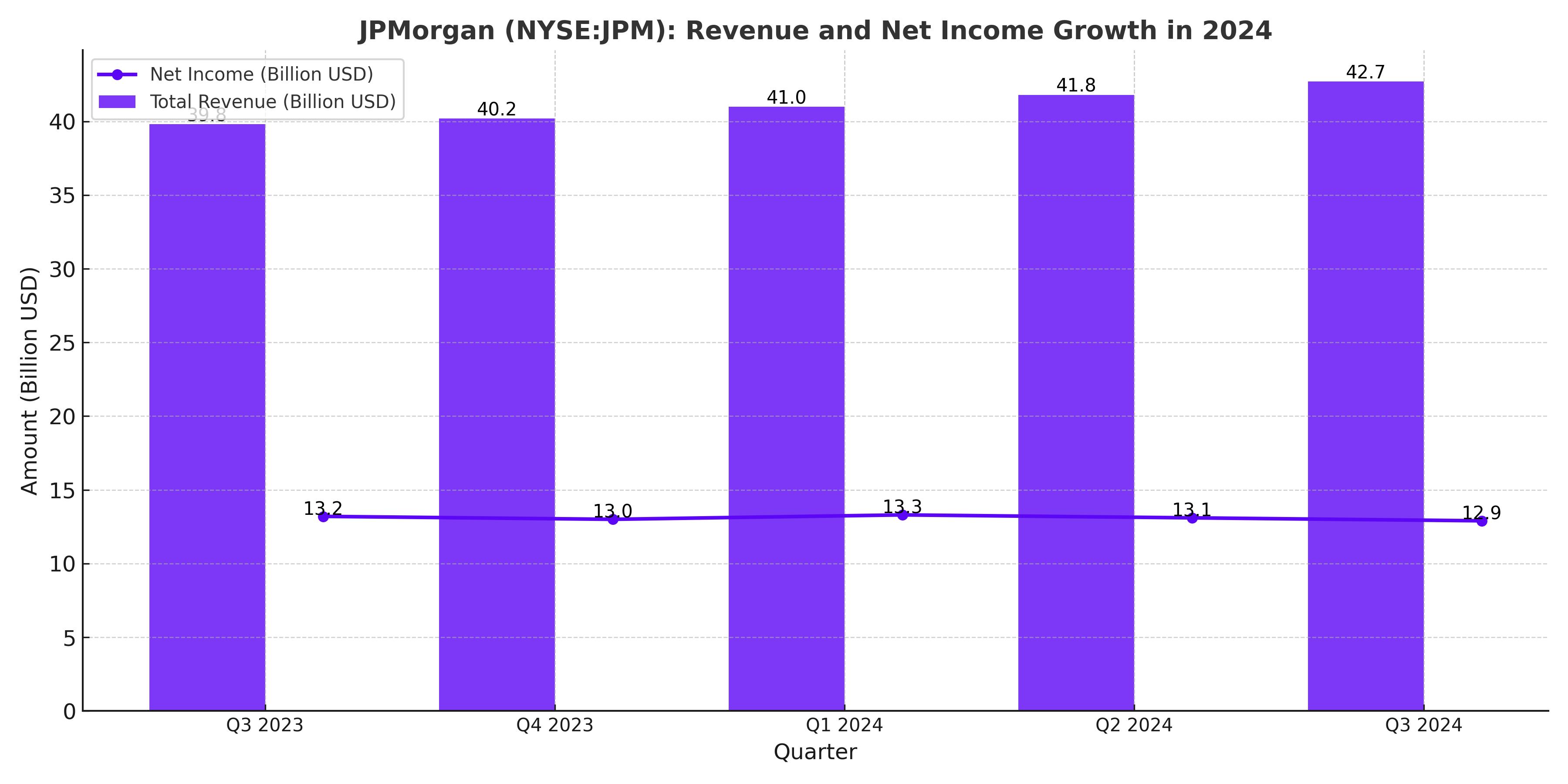

JPMorgan Chase (NYSE:JPM) reported exceptional Q3 2024 results, showcasing its resilience and profitability amid challenging macroeconomic conditions. Total revenues reached $42.7 billion, a 7% year-over-year increase, driven by robust growth in both net interest income and non-interest revenue. Net interest income benefited from changes in the balance sheet mix, higher credit card balances, and wholesale deposits. Non-interest revenue grew by an impressive 17%, bolstered by asset management fees and an upswing in investment banking activity, as deal-making and capital markets activity began to recover.

Despite the strong topline performance, net income dipped slightly by 2% to $12.9 billion, primarily due to higher provisions for credit losses, which increased to $3.1 billion. However, JPMorgan's ability to manage these provisions while maintaining profitability reflects its strong operational framework and risk management capabilities.

Profitability Metrics and Competitive Edge

JPMorgan’s profitability remains a standout among financial peers. The bank reported a return on equity (ROE) that is 66% higher than the sector median, highlighting its operational efficiency and strong capital deployment. Its common equity tier 1 (CET1) capital ratio stands at 15.3%, showcasing its financial strength and ability to absorb economic shocks.

Additionally, the bank continues to lead the industry with a balance sheet exceeding $4.1 trillion in total assets. Cash and interest-bearing deposits with banks totaled $434.3 billion at the end of Q3, underlining its liquidity strength. With an asset-to-equity ratio of 12.17x, well below its historical averages, JPMorgan has ample room to expand its lending and investment activities.

Deregulation: A Major Catalyst for Growth

The re-election of Donald Trump and the Republican majority in Congress are expected to usher in significant deregulation across the financial sector. This includes the potential rollback of the Basel III endgame proposal, which mandates higher capital reserves. A more lenient regulatory environment could free up substantial capital for JPMorgan to deploy in areas such as lending, share buybacks, and acquisitions, further enhancing profitability.

In addition to regulatory relief, the potential for corporate tax cuts under the new administration could provide a further boost to JPMorgan’s bottom line, enabling the bank to deliver even stronger shareholder returns.

Expanding Digital and Investment Banking Operations

JPMorgan continues to invest heavily in digital technology to streamline operations and enhance customer experiences. These efforts are expected to drive long-term efficiency and deepen client relationships. The bank’s investment banking division is also well-positioned to benefit from a more favorable macroeconomic environment, with increased equity issuances, M&A activity, and debt markets expected in 2025.

Valuation and Risks

At $245 per share, JPMorgan is trading at over 2.5x its tangible book value, reflecting a premium valuation compared to its historical averages. While its price-to-earnings (P/E) ratio of 13.56x remains below the sector median, the recent rally has stretched valuation metrics. Dividend yields, currently at 2.07%, offer some downside protection but remain below the 4-year average, signaling a potential overvaluation in the short term.

However, the stock's elevated valuation is justified by its strong fundamentals, robust profitability, and the potential for growth under deregulation. Risks remain, including heightened loan loss provisions due to a slowing economy, elevated valuations, and competition from peers such as Bank of America (NYSE:BAC) and Wells Fargo (NYSE:WFC), which are also capitalizing on deregulation tailwinds.

Future Outlook: Buy, Sell, or Hold?

JPMorgan’s dominant position, supported by strong liquidity and profitability, positions it well for continued growth. The combination of regulatory relief, robust earnings power, and strategic investments in technology and investment banking makes JPMorgan a strong candidate for long-term investors.

However, given its stretched valuation at $245 per share, prospective investors should exercise caution and consider accumulating shares on pullbacks. For existing shareholders, the stock remains a hold, with the potential for further upside as deregulation and macroeconomic tailwinds come into play. For real-time technical and fundamental updates, track JPMorgan’s stock performance here.