Libya’s Oil Crisis: A Ticking Time Bomb for Global Oil Price

How Libya’s Production Halt and Rising Geopolitical Tensions Are Shaping the Future of Oil Prices | That's TradingNEWS

Libya's Oil Crisis: Impact on Global Markets and Price Volatility

Libya’s Political Turmoil Halts Oil Production

Libya, a significant player in the global oil market with a production capacity of around 1.2 million barrels per day (bpd), has recently plunged deeper into political chaos. The ongoing rivalry between the eastern and western governments has escalated, leading to the shutdown of several key oilfields. The Sarir oilfield, which was producing approximately 209,000 bpd, has nearly halted all production due to the standoff over the leadership of the Central Bank of Libya. This move follows the declaration of “force majeure” by the eastern government, effectively stopping all oil production and exports.

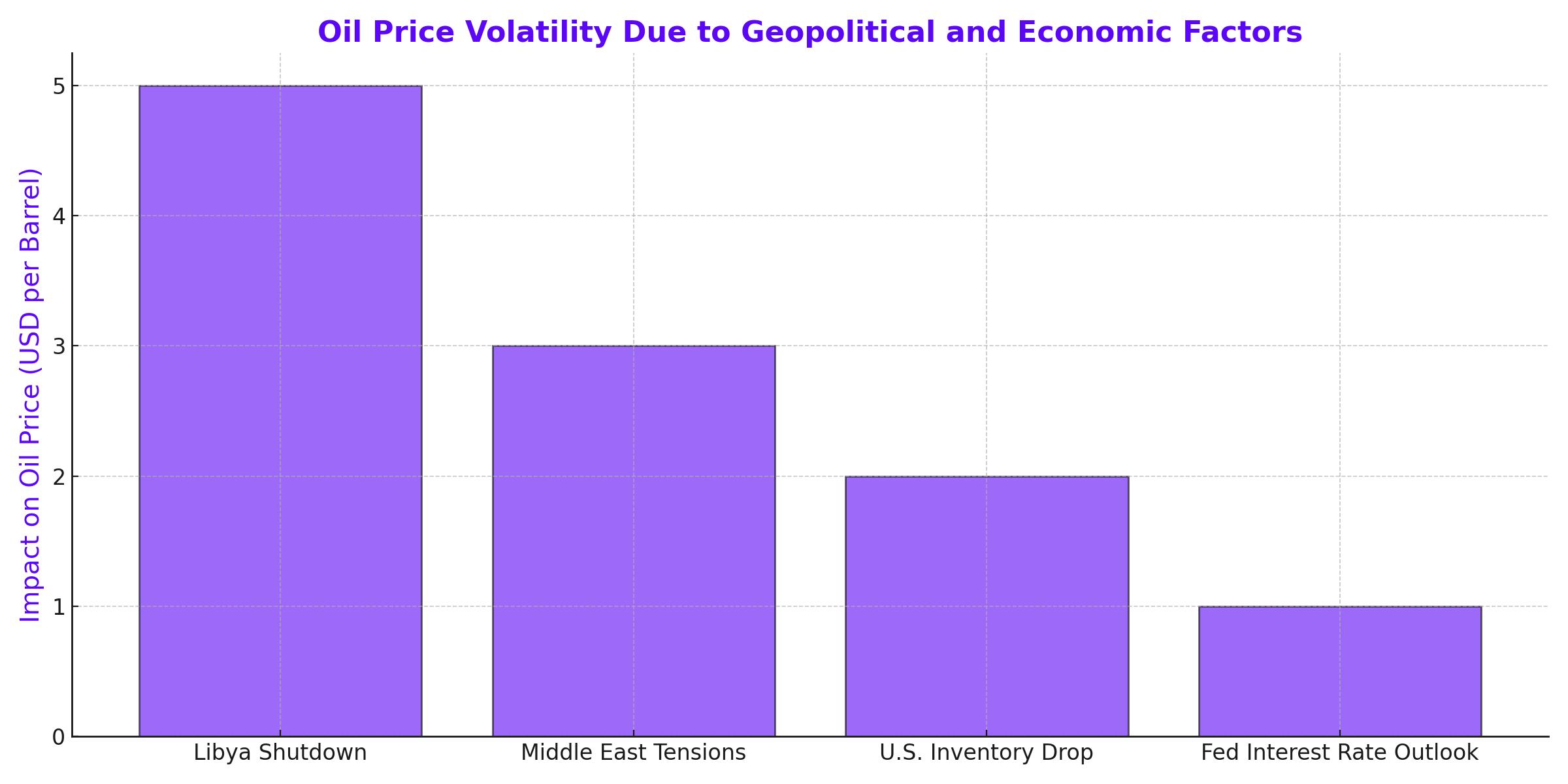

The impact of these shutdowns is profound, given that Libya’s oil exports are a vital part of the global supply chain. With most of Libya’s oilfields under the control of the eastern government, backed by military leader Khalifa Haftar, the country’s oil production is at a significant risk. The political struggle over control of the Central Bank, which manages Libya’s oil revenues, has turned into a broader geopolitical issue, affecting the global oil market.

Oil Prices Under Pressure Amidst Global Geopolitical Tensions

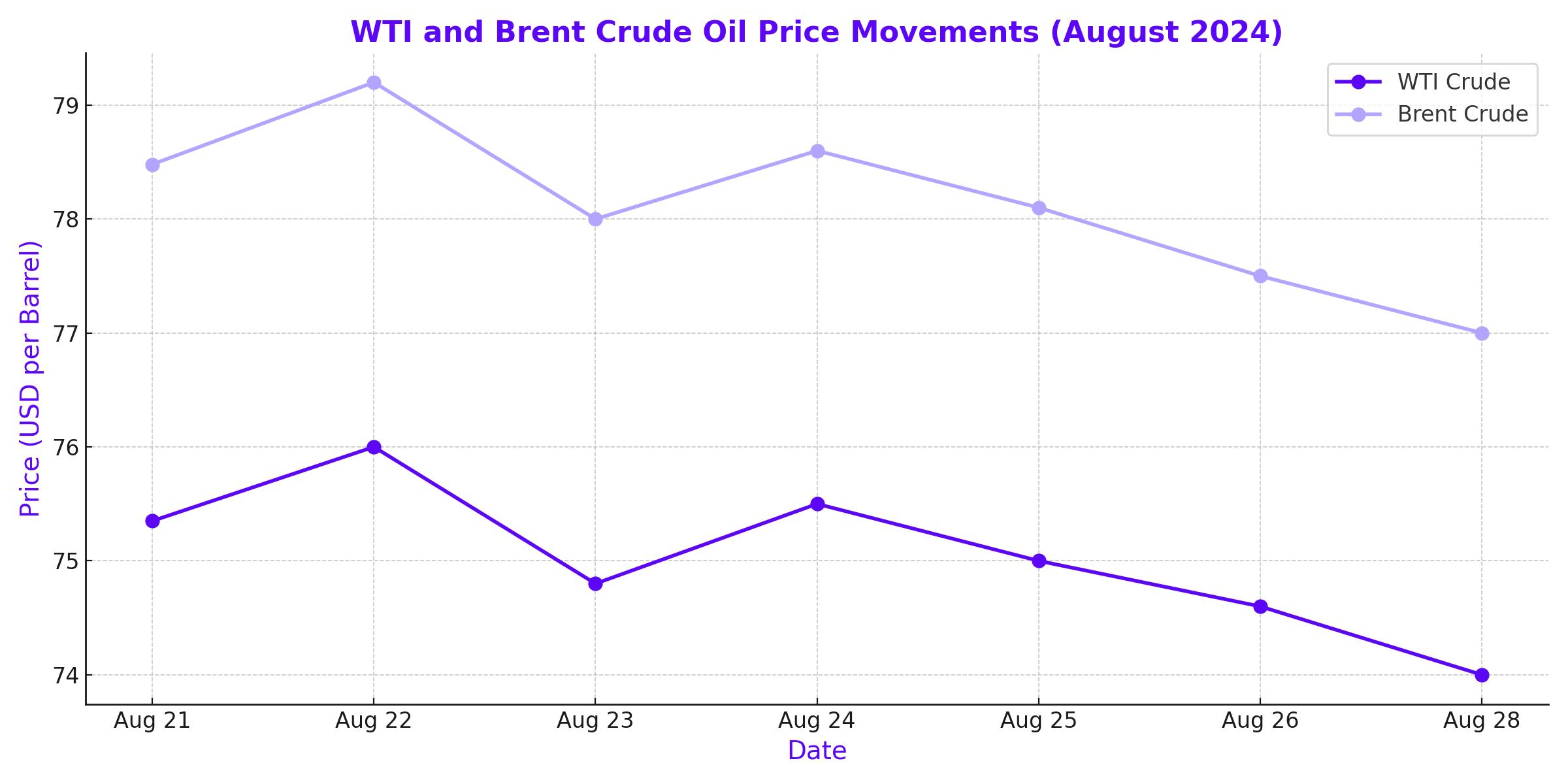

The disruptions in Libya have not gone unnoticed in the global markets. Oil prices have fluctuated significantly, reflecting the uncertainty in supply. Brent crude, the international benchmark, was trading at $78.48 per barrel, while West Texas Intermediate (WTI) was down slightly to $75.35 per barrel. Despite these declines, the situation remains volatile, with the potential for further price increases if the Libyan crisis deepens or if other geopolitical tensions escalate.

The ongoing conflict between Israel and Hezbollah adds another layer of complexity to the oil market. The exchange of fire over the weekend has threatened to derail ceasefire negotiations, keeping the market on edge. These geopolitical risks, combined with the uncertainty in Libya, have created a challenging environment for traders and investors, who are trying to balance supply risks with demand concerns.

Impact of U.S. Economic Data and Federal Reserve Decisions

Adding to the complexity, recent economic data from the United States and the Federal Reserve’s stance on interest rates are influencing oil prices. Fed Chair Jerome Powell’s speech at the Jackson Hole symposium hinted at possible interest rate cuts by the end of the year, which could have a significant impact on the oil market. Lower interest rates typically boost economic activity, which in turn increases demand for oil. However, weaker-than-expected macroeconomic data from the U.S. has raised concerns about the strength of demand, particularly as Chinese demand remains subdued.

The American Petroleum Institute (API) reported a 3.4 million barrel drop in U.S. crude oil inventories, which was higher than the market’s expectation of a 3 million barrel draw. This reduction in inventories indicates stronger domestic demand and has provided some support to oil prices. However, if the Energy Information Administration (EIA) confirms these figures, it could lead to further price increases.

Libya’s Strategic Role in the Global Oil Market

Libya’s oil production, while only accounting for about 4% of OPEC’s total output, plays a crucial role in the global oil market, particularly for Europe. The country’s oil is difficult to replace, and any prolonged disruption could have significant implications for global oil prices. The ongoing dispute over the Central Bank of Libya is not just a domestic issue but part of a larger geopolitical game, with Russia’s involvement adding to the complexity.

Russia’s support for the eastern government ensures that it maintains influence over Libya’s oil production, which aligns with its broader geopolitical interests. By keeping Libyan oil off the global market, Russia can drive up the price of its own crude, benefiting from higher revenues. This strategy also serves to weaken Western economies, particularly in Europe, which relies heavily on Libyan oil.

Technical Analysis of WTI and Brent Crude Oil

From a technical perspective, both WTI and Brent crude oil are facing significant support levels that could determine their near-term direction. WTI crude has fallen below the $75 level, with the $71.50 region expected to provide strong support. The market is likely to see continued volatility, with traders taking a cautious approach given the current geopolitical and economic uncertainties.

Similarly, Brent crude is facing support around the $75.50 level. The recent inventory data from the U.S. has put some downward pressure on prices, but ongoing tensions in the Middle East and the situation in Libya are likely to limit the downside. The market is expected to remain in a consolidation phase, with prices oscillating within a defined range until more clarity emerges on the geopolitical front.

Conclusion

The global oil market is navigating through a complex web of geopolitical tensions, economic uncertainties, and supply disruptions. Libya’s political crisis has already had a noticeable impact on oil prices, and any further escalation could lead to more significant price volatility. Meanwhile, the actions of the Federal Reserve and the state of the U.S. economy will continue to influence demand dynamics.