Marathon Digital Holdings' Path in the Cryptocurrency Revolution

A comprehensive review of Marathon Digital Holdings' (NASDAQ: MARA) operational achievements, financial milestones, and strategic positioning ahead of the pivotal Bitcoin halving event and the rise of Bitcoin ETFs | That's TradingNEWS

Marathon Digital Holdings: A Deep Dive into Performance and Future Prospects

Overview of Marathon Digital Holdings

Marathon Digital Holdings (NASDAQ: MARA) stands as a pivotal player in the realm of cryptocurrency mining, operating at the forefront of digital currency innovation. With a robust fleet of 210,000 mining rigs by 2023, Marathon has carved out a significant niche within the fast-evolving cryptocurrency landscape. This detailed analysis delves into Marathon's financial performance, operational strategies, and market positioning amidst the dynamic shifts in Bitcoin's valuation and the broader digital currency ecosystem.

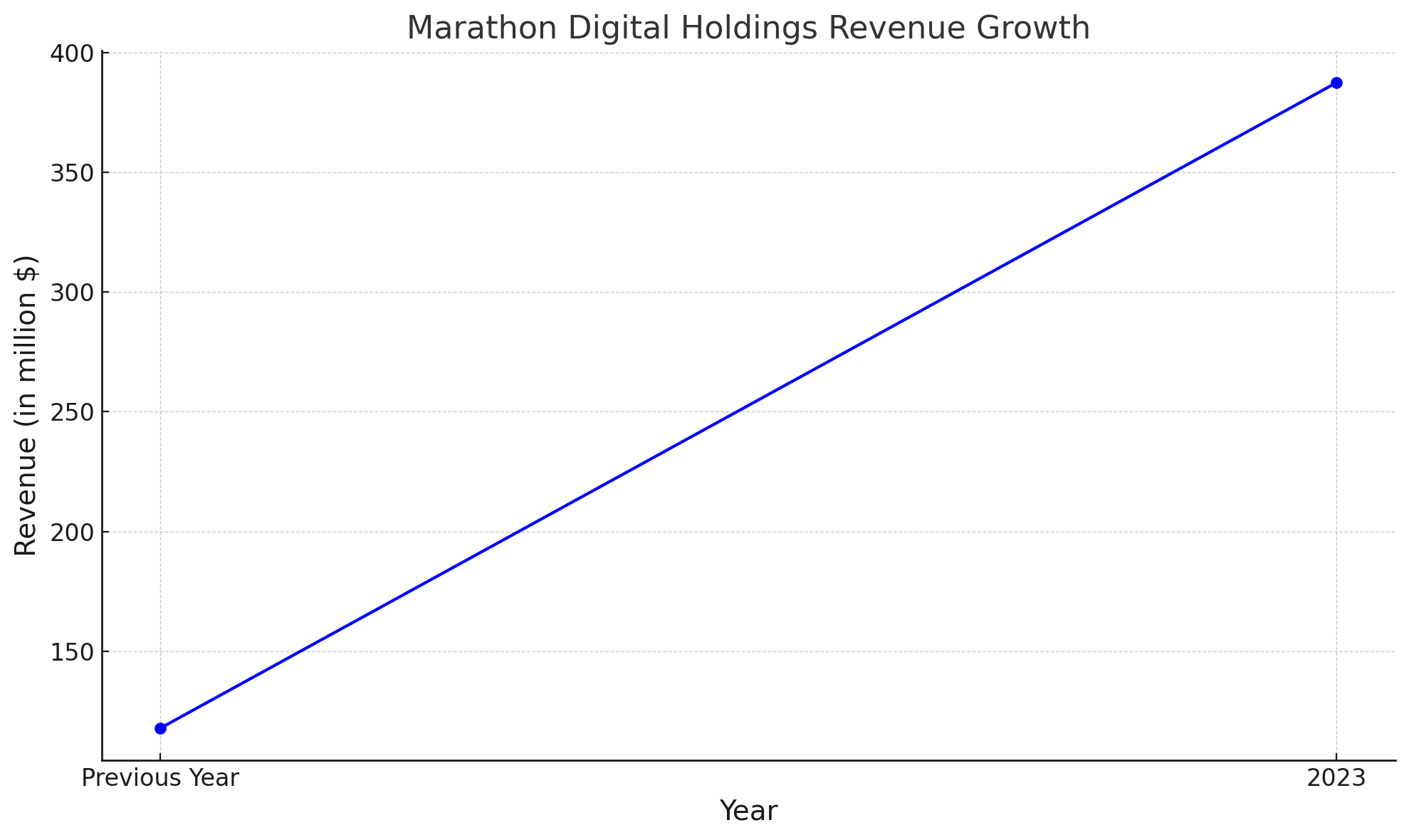

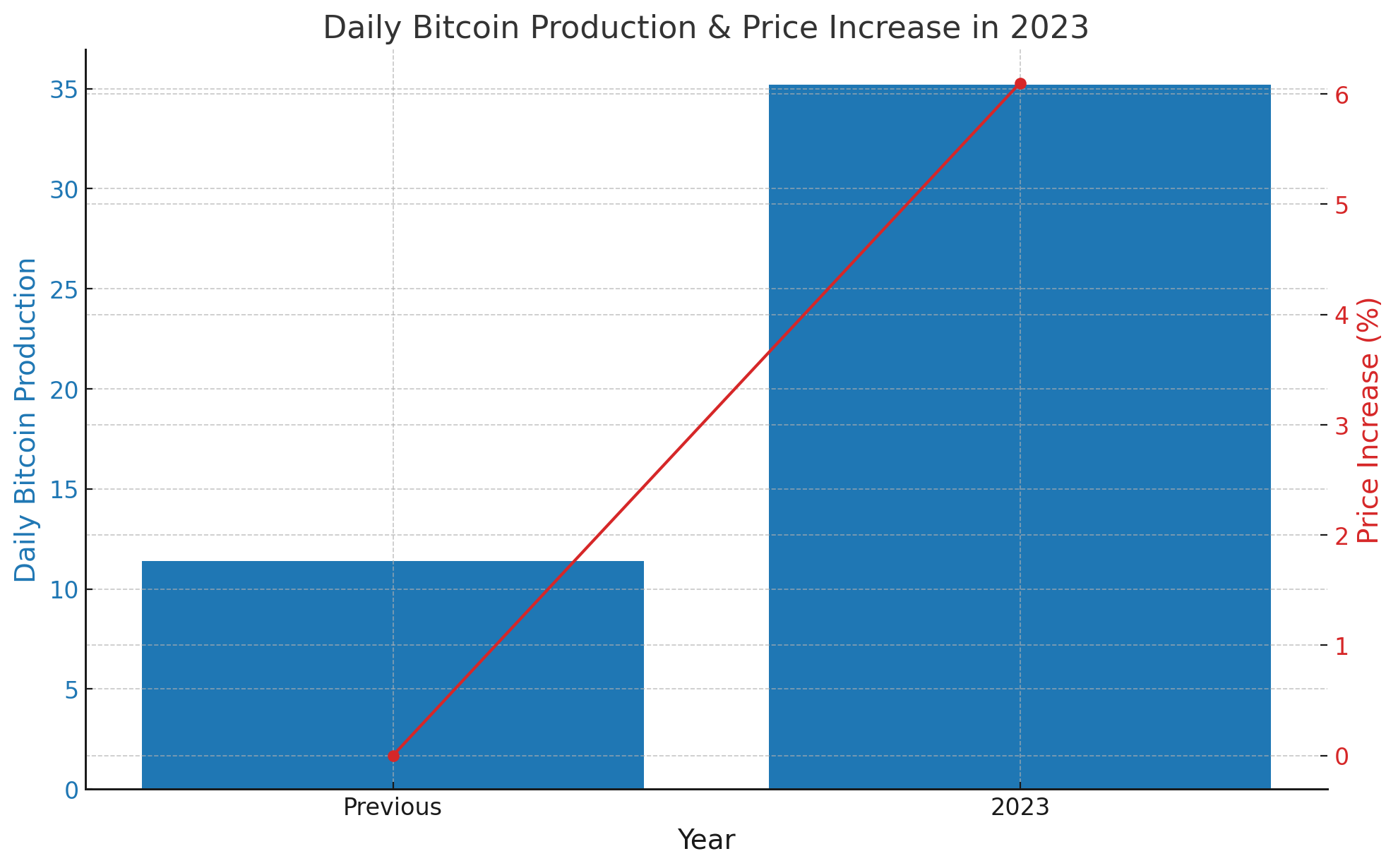

Financial Performance and Market Dynamics

In 2023, Marathon reported a remarkable revenue surge to $387.5 million, a 229% increase from the previous year, propelled by a substantial rise in Bitcoin production and the escalating price of Bitcoin itself. Despite the inherent volatility of the cryptocurrency market, Marathon managed to enhance its bitcoin production substantially, from 11.4 to 35.2 daily, amidst a 6.1% rise in Bitcoin prices during the period. This financial upturn underscores Marathon's adeptness at scaling operations and capitalizing on favorable market trends.

Operational Excellence and Expansion Initiatives

Marathon's strategic expansion into new data center locations in Kearney, Nebraska, and Granbury, Texas, for $179 million highlights its commitment to enhancing operational efficiency and sustainability. This move not only grants Marathon greater control over power management and utilization but also aligns with its broader goals of optimizing energy use through innovative approaches, including the potential harnessing of landfill methane and biofuels for powering mining operations.

Insider Transactions and Stock Profile Insights

For investors and market watchers, the insider transactions and stock profile of Marathon provide critical insights into the company's internal dynamics and future potential. The detailed stock profile and insider transaction data available at Trading News offer a comprehensive view of the strategic decisions made by those at the helm, further illuminating Marathon's market strategy and investment potential.

The Bitcoin Halving Phenomenon and Its Impact

The anticipated Bitcoin halving in April 2024 is set to have a profound impact on the cryptocurrency mining sector, including Marathon. By halving the reward for Bitcoin mining, this event may intensify the competition among miners while potentially driving up Bitcoin's price due to reduced supply. Marathon's focus on acquiring the most efficient mining machines positions it well to navigate the challenges and opportunities presented by the halving event.

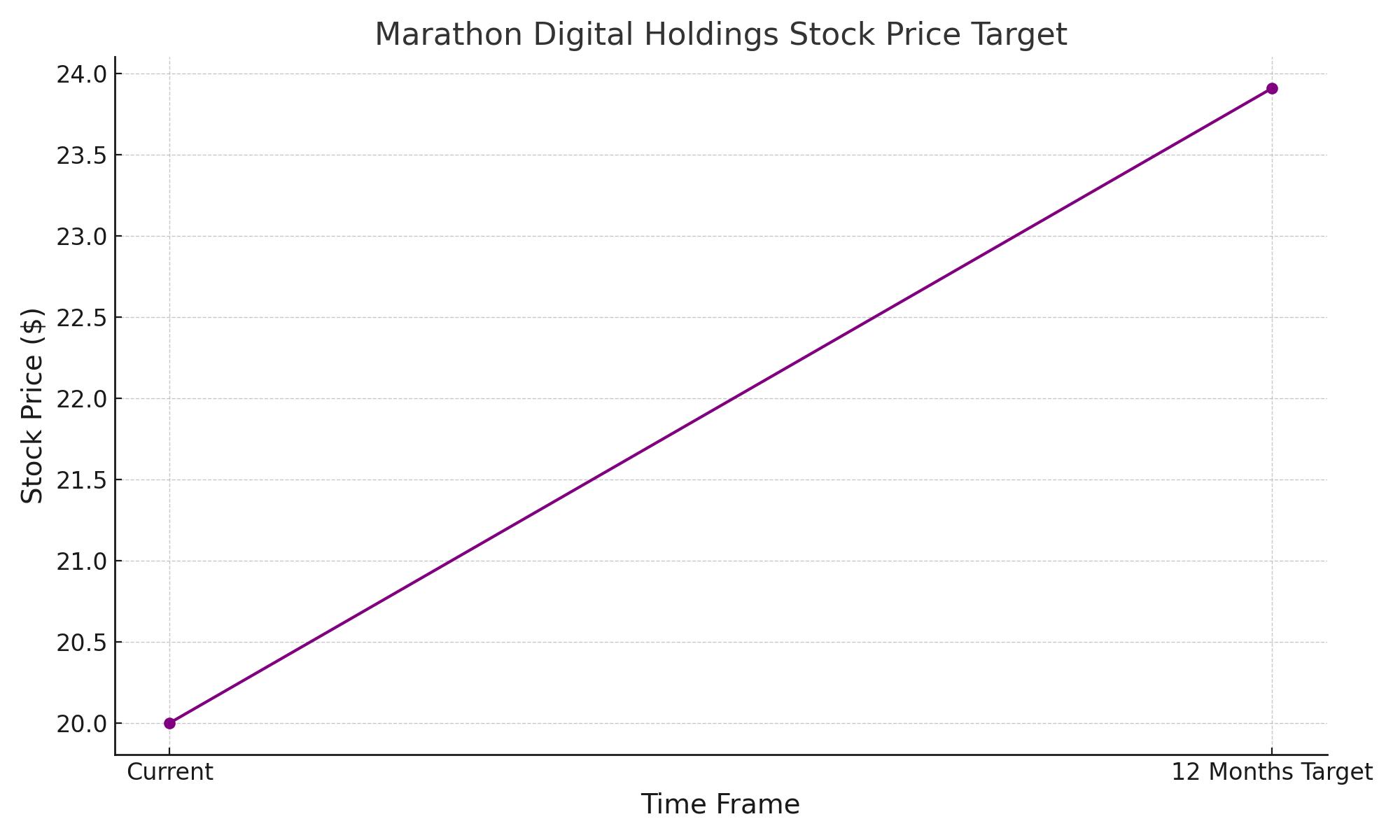

Valuation and Investment Outlook

Considering Marathon's significant operational improvements and strategic positioning within the fast-paced cryptocurrency mining industry, the company presents a compelling case for investors. However, the valuation of Marathon shares, with a 12-month target of $23.91, suggests a cautious outlook, reflecting the inherent uncertainties and volatilities of the cryptocurrency market. Moreover, the advent of Bitcoin Exchange Traded Funds (ETFs) and the shift towards direct Bitcoin ownership through these instruments pose additional considerations for Marathon's stock valuation.

Conclusion

Marathon Digital Holdings emerges as a key player in the cryptocurrency mining sector, demonstrating strong financial performance, strategic operational expansion, and resilience in navigating the complex dynamics of the Bitcoin ecosystem. While the future landscape of cryptocurrency mining remains uncertain, particularly with the upcoming Bitcoin halving, Marathon's strategic investments in efficiency and sustainability, coupled with a nuanced understanding of market trends, position it well for continued growth and investor interest. As the cryptocurrency market evolves, Marathon's trajectory offers a compelling lens through which to assess the opportunities and challenges inherent in this rapidly evolving industry.

That's TradingNEWS

Bitcoin Price Outlook: Can BTC-USD Break Past $90,000 in 2025?