Market Volatility Sparks Surge in VIX ETFs: Time for Strategic Investment

Recent spikes in the CBOE Volatility Index (VIX) highlight investment opportunities in VIX ETFs amidst economic and geopolitical uncertainty | That's TradingNEWS

Overview of VIX Movements

The CBOE Volatility Index (INDEXCBOE: VIX), commonly known as the market's fear gauge, has experienced notable fluctuations recently. On a particularly volatile Monday, the VIX recorded its largest-ever intraday jump, reaching a peak of 65.73 before the market opened. This spike, marking the third-highest level since 1992, represented a dramatic 42-point increase from the previous Friday's close. Despite closing at 38.57—its highest since October 2020—the significant intraday difference highlighted the extreme market volatility and growing economic concerns.

Rate Hikes and Employment Data

Several factors have contributed to the recent spike in the VIX. One major influence was the Bank of Japan's unexpected rate hike, which, along with the unwinding of the yen carry trade, created substantial market turbulence. Additionally, weaker-than-expected U.S. employment data has exacerbated fears of a looming recession. The July Nonfarm Payrolls report showed that only 114,000 jobs were added, significantly below the expected 175,000. This cooling job market has heightened anticipation of a more dovish stance from the Federal Reserve, potentially involving rate cuts in the upcoming months to support the economy.

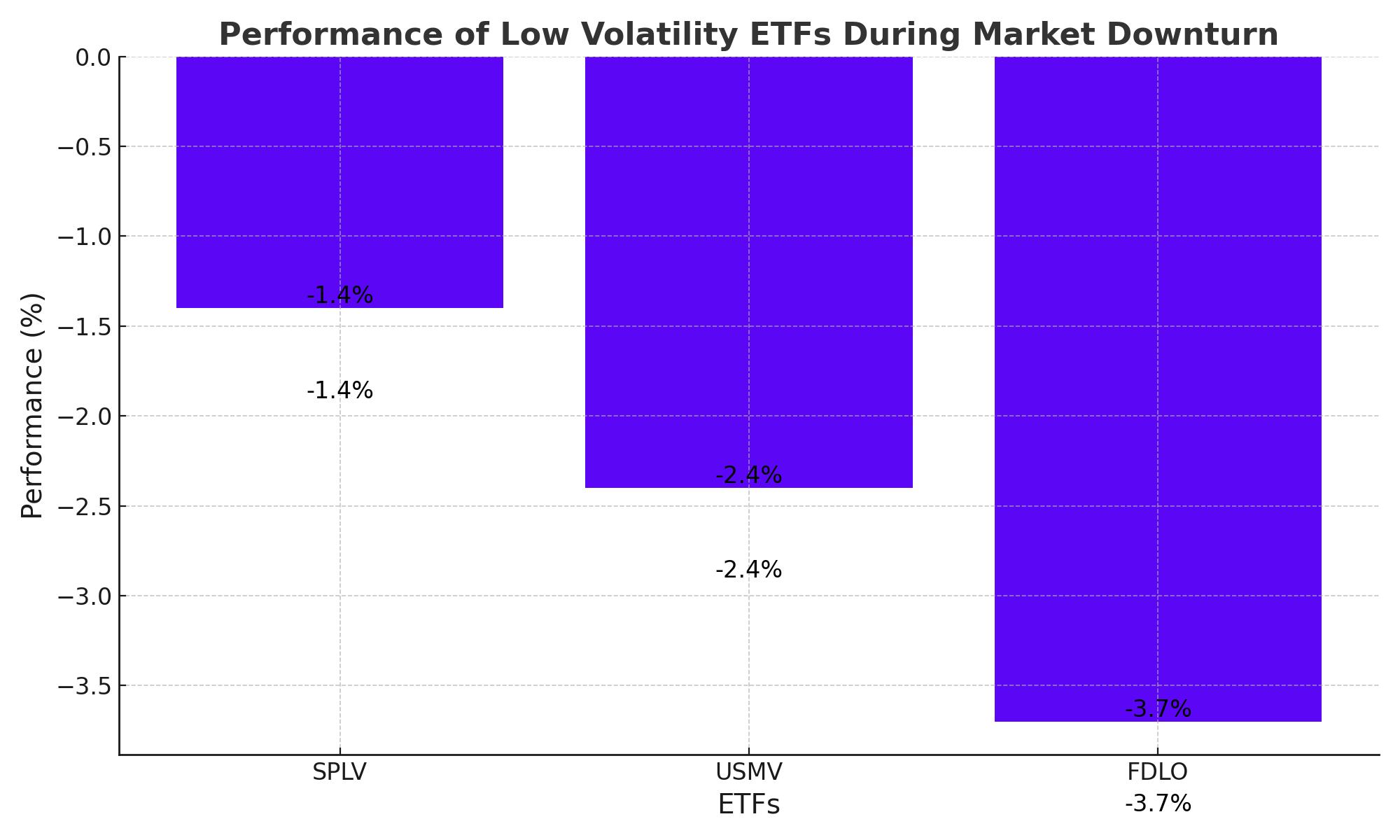

Safeguarding Gains with Low Volatility ETFs

During periods of heightened volatility, low volatility ETFs have proven effective in safeguarding gains and mitigating risks. Notable ETFs include the Invesco S&P 500 Low Volatility ETF (SPLV), iShares MSCI USA Min Vol Factor ETF (USMV), and the Fidelity Low Volatility Factor ETF (FDLO). From July 31 to August 5, while the S&P 500 fell over 6%, SPLV limited losses to just 1.4%. Similarly, USMV and FDLO declined by 2.4% and 3.7%, respectively, outperforming the broader market. These ETFs hold stocks that are less volatile, providing a cushion during market downturns.

Significant Activity in Leveraged and Inverse ETFs

Leveraged and inverse VIX ETFs have seen substantial activity amid recent market volatility. The ProShares Short VIX Short-Term Futures ETF (SVXY), which bets on a return to market calm, experienced an influx of $233 million as equities tumbled, despite its shares dropping over 21% during the selloff. Conversely, the 2x Long VIX Futures ETF (UVIX) surged 84%, highlighting the high-risk, high-reward nature of these instruments. These ETFs are designed for short-term trading strategies and can provide significant returns during periods of extreme market movements.

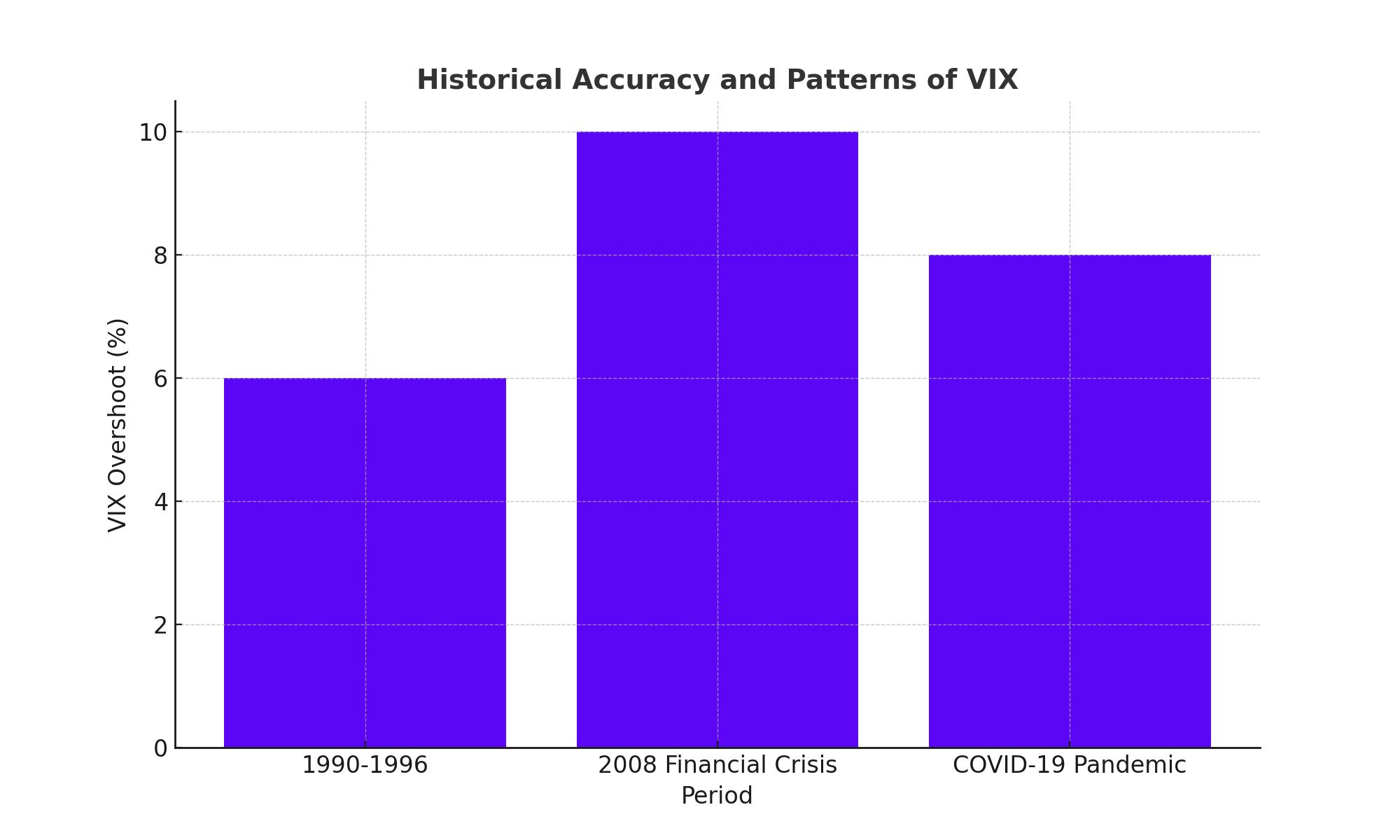

Historical Accuracy and Patterns

Historically, the VIX has tended to overestimate realized market volatility. On average, from 1990 to 1996, the VIX overshot realized volatility by approximately 5 to 7 percentage points. This pattern persisted during major crises like the 2008 financial meltdown and the COVID-19 pandemic. During these times, the VIX was initially slow to react but eventually overreacted once the volatility was recognized. For instance, in July 2008, realized volatility on a 30-day, forward-looking basis began to spike over the VIX, continuing until November 2008 when the VIX finally caught up.

Current Economic Outlook

Given the current economic outlook, including the Federal Reserve's potential rate cuts and ongoing geopolitical tensions, investors should prepare for continued market volatility. The CBOE Volatility Index (INDEXCBOE: VIX), which measures market expectations of near-term volatility, is currently reflecting heightened uncertainty. Historically, the VIX tends to overshoot during crises, which implies that although current elevated levels might normalize, the market is likely to experience further turbulence before stabilizing.

For example, on a notable Monday, the VIX spiked to 65.73, its third-highest level since 1992, before closing at 38.57. This intraday fluctuation illustrates the market's sensitivity to economic indicators and geopolitical events. The potential rate cuts by the Federal Reserve are anticipated to reduce borrowing costs, which could support economic growth but also increase market volatility in the short term. Additionally, geopolitical tensions, such as those in the Middle East, continue to influence investor sentiment and market movements.

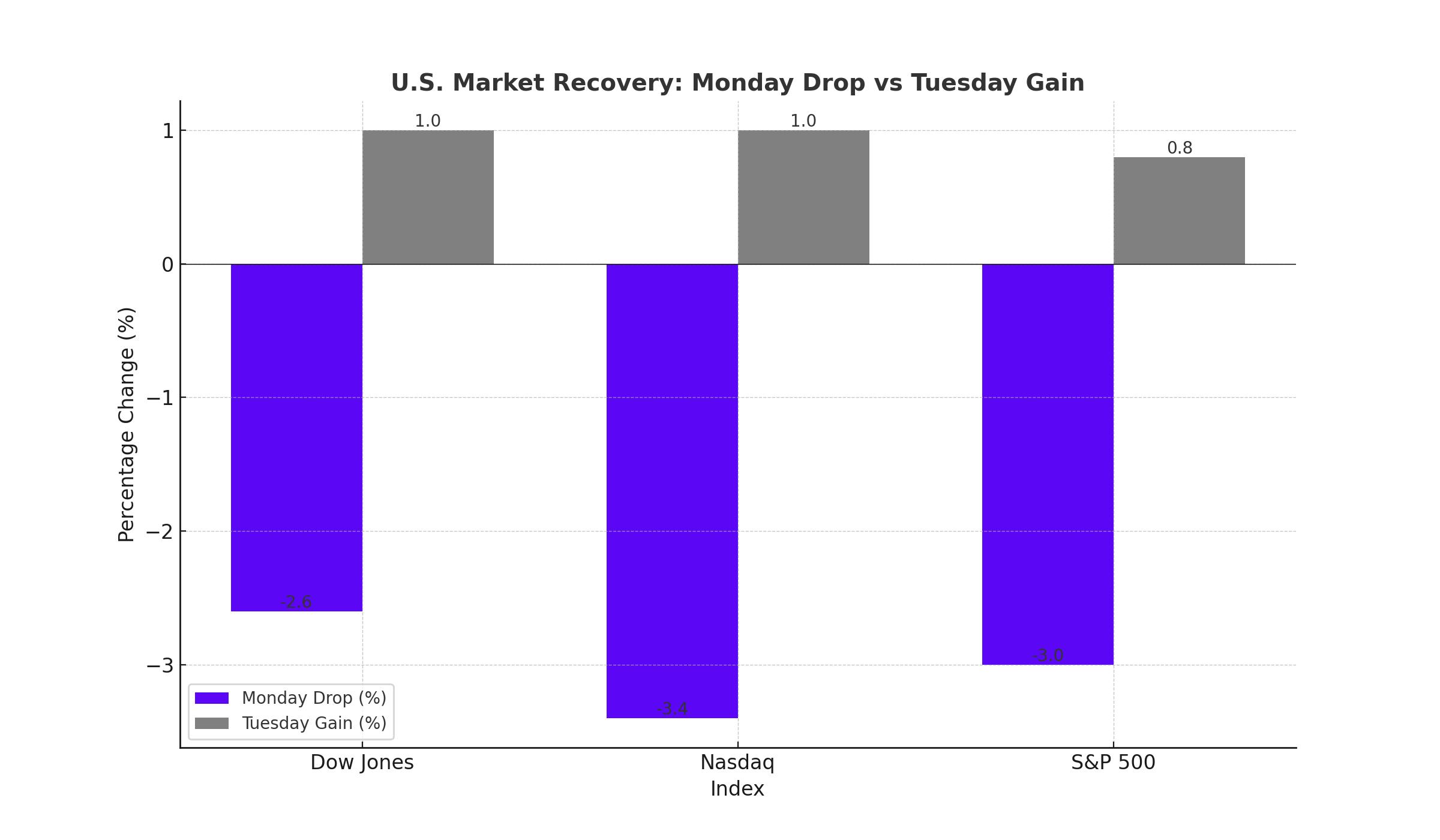

U.S. Market Recovery

On Tuesday, U.S. stocks managed to regain some of the ground lost after experiencing their worst one-day rout in nearly two years earlier in the week. The Dow Jones Industrial Average rose by over 1%, adding 293 points to close at 32,428. Meanwhile, the tech-heavy Nasdaq Composite Index also climbed by more than 1%, closing at 12,842. The S&P 500 increased by approximately 0.8%, ending the session at 4,140. These gains followed a tumultuous Monday, where the Dow plummeted 1,034 points (2.6%), the S&P 500 dropped by 3%, and the Nasdaq tumbled 3.4%.

Tuesday’s modest rebound can be attributed to several factors. Firstly, the market was reacting to the previous day’s overreaction to poor economic data and geopolitical concerns. The July Nonfarm Payrolls report had shown that only 114,000 jobs were added, significantly below the anticipated 175,000, stoking fears of a weakening U.S. economy. Additionally, disappointing earnings from Big Tech and an unexpected interest rate hike by the Bank of Japan added to the market's woes, causing widespread sell-offs.

By midafternoon on Tuesday, the Nasdaq and S&P 500 had gained more than 2% before retreating slightly in the final hour of trading. This pullback highlights the market's continued volatility and the cautious optimism among investors. Quincy Krosby, chief global strategist for LPL Financial, noted that while the market appeared calm in the morning, the underlying concerns that triggered the sell-off had not entirely dissipated.

Global Market Reactions

The ripple effects of the U.S. market's volatility were felt globally, with varied reactions across different regions. Japan’s benchmark Nikkei 225 index experienced a significant rebound on Tuesday, surging by 10.23% (3,217.04 points) to close at 34,675.46. This recovery came after a historic sell-off on Monday, triggered by the Bank of Japan’s decision to raise its short-term policy rate to 0.25% on July 31. The rate hike led to the unwinding of the yen carry trade, exacerbating market declines.

Elsewhere in Asia, markets showed mixed results. China’s Shanghai Composite Index inched up by 0.23%, closing at 3,369.43. South Korea's Kospi index rose by more than 3%, ending the day at 2,600. Meanwhile, Hong Kong’s Hang Seng Index experienced a slight decline of 0.31%, closing at 26,261.56, after falling by 1.46% on Monday. Australia’s S&P/ASX 200 also saw a modest increase of 0.41%, closing at 7,136.50.

In Europe, markets showed resilience with modest recoveries. London’s FTSE 100 rose by 1.1%, closing at 7,256.40, and Germany’s DAX increased by 0.9%, ending the session at 15,600. These rebounds followed sharp declines on Monday, reflecting the interconnected nature of global financial markets.

The week’s market volatility has been described by analysts at BMI, a unit of Fitch Solutions, as a “perfect storm of macro and market shocks.” They highlighted that risk assets were already overbought and overstretched, which made them particularly vulnerable to the series of adverse economic indicators and geopolitical events.

The global sell-off began with a panic on Sunday night, leading to significant declines in the value of stocks, currencies, and cryptocurrencies. This was exacerbated by disappointing U.S. jobs data and rising geopolitical risks in the Middle East. U.S. employers added fewer jobs than expected in July, with the Nonfarm Payrolls report showing just 114,000 new jobs, well below the forecast of 175,000. The unemployment rate also rose to 4.3%, its highest level in almost three years, raising concerns about the health of the U.S. economy.

In response to the market turmoil, Japanese Finance Minister Shunichi Suzuki stated that the government would continue to monitor financial markets closely, working in coordination with the Bank of Japan. The impact of the Bank of Japan’s policy shift on interest rates and the economy is being carefully assessed to ensure stability.

This week's fluctuations are seen as part of the market’s short-term supply and demand dynamics. Despite the volatility, economists and analysts believe that the underlying economic fundamentals remain strong, suggesting that markets may stabilize once the immediate panic subsides.

Monitoring VIX ETFs

Key VIX ETFs to consider include:

- Short Term Volatility Funds: iPath Series B S&P 500 VIX Short Term Futures ETN (VXX) and ProShares VIX Short-Term Futures ETF (VIXY).

- Medium Term Volatility Funds: iPath Series B S&P 500 VIX Mid-Term Futures ETN (VXZ) and ProShares VIX Mid-Term Futures ETF (VIXM).

- Leveraged Volatility Funds: ProShares Ultra VIX Short-Term Futures ETF (UVXY), ProShares Short VIX Short-Term Futures ETF (SVXY), and 2x Long VIX Futures ETF (UVIX).

These funds offer various exposure levels to the VIX, allowing investors to tailor their strategies based on their risk tolerance and market outlook.

Strategic Outlook for VIX Investors

Given the recent surge in the CBOE Volatility Index (INDEXCBOE: VIX), which peaked at 65.73 before closing at 38.57, investors need to stay agile and ready to adapt their strategies as market conditions evolve. The VIX's sharp movements underscore the necessity for comprehensive analysis and strategic planning to navigate these turbulent times effectively.

The dramatic fluctuations in the VIX, driven by factors such as the Bank of Japan's unexpected rate hike and disappointing U.S. employment data, highlight the market's sensitivity to economic and geopolitical developments. For instance, the July Nonfarm Payrolls report showing only 114,000 new jobs against an expected 175,000 has fueled recession fears, prompting speculation of potential Federal Reserve rate cuts. These economic indicators significantly impact the VIX, reflecting heightened market uncertainty.

Diversified Investment Approaches

To mitigate risks and capitalize on potential market corrections, investors should consider a diversified approach, balancing positions in VIX-related ETFs with other asset classes. Leveraging funds like the ProShares Ultra VIX Short-Term Futures ETF (UVXY) can provide substantial gains during periods of extreme volatility, as evidenced by UVXY's 84% surge on a particularly volatile day. Similarly, the ProShares Short VIX Short-Term Futures ETF (SVXY), which experienced a $233 million influx during a selloff, highlights the high-risk, high-reward nature of these instruments.

Conclusion

The recent activity in the INDEXCBOE: VIX ETF underscores the importance of understanding market volatility and strategically positioning investments to navigate periods of uncertainty. By leveraging low volatility ETFs and closely monitoring key economic indicators, investors can better manage risk and capitalize on market corrections. The dynamic nature of the VIX and its historical patterns provide valuable insights for developing robust investment strategies amidst market volatility.

In summary, the VIX's current elevated levels suggest that investors should brace for continued market turbulence. However, with careful monitoring of economic indicators and strategic diversification, opportunities exist to manage risks and achieve favorable outcomes in this volatile environment.

That's TradingNEWS

Read More

-

CGDV ETF at $44.17 Targets $52 as Dividend Value and AI Leaders Drive 2026 Upside

07.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: $2.20 XRP and $1.6B Inflows Drive 2026’s Hottest Crypto Trade

07.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Rebounds to $3.48 as Market Eyes EIA Storage Shock

07.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.6 as BoJ Hawkish Shift Collides With Fed Cut Expectations

07.01.2026 · TradingNEWS ArchiveForex