Marvell Stock (NASDAQ:MRVL): The AI Player Everyone’s Overlooking

With AI demand skyrocketing, Marvell Technology (NASDAQ:MRVL) is quietly positioning itself as a major contender—here’s how it could pay off big | That's TradingNEWS

Marvell Technology (NASDAQ:MRVL): A Deep Dive into the AI Powerhouse

Unpacking Marvell's Strategic Position in the AI Revolution

Marvell Technology Group Ltd (NASDAQ:MRVL) has emerged as a key player in the rapidly expanding AI and data center markets. The company has skillfully positioned itself to capture a significant share of the surging demand for high-performance computing infrastructure driven by artificial intelligence. This strategic positioning has not gone unnoticed, with Deutsche Bank recently reiterating its Buy rating on Marvell, accompanied by a robust price target of $90.00. This target is supported by the firm’s projection that Marvell’s revenue for fiscal year 2025 could exceed $1.5 billion, thanks to its strong presence in the data center and AI-related sectors, particularly in optics, switching, and custom silicon.

The company’s AI-related revenue is projected to account for nearly 30% of its total revenue by 2025, highlighting its significant exposure to one of the fastest-growing segments in the technology sector. This growth is primarily fueled by Marvell's dominance in the electro-optics market, where it commands a substantial market share with its PAM4 DSP products, and by its expanding custom silicon business. Key partnerships with industry giants like Amazon (NASDAQ:AMZN), Google (NASDAQ:GOOGL), and Microsoft (NASDAQ:MSFT) further reinforce Marvell’s strategic importance in the AI ecosystem.

Financial Performance: Navigating a Complex Landscape

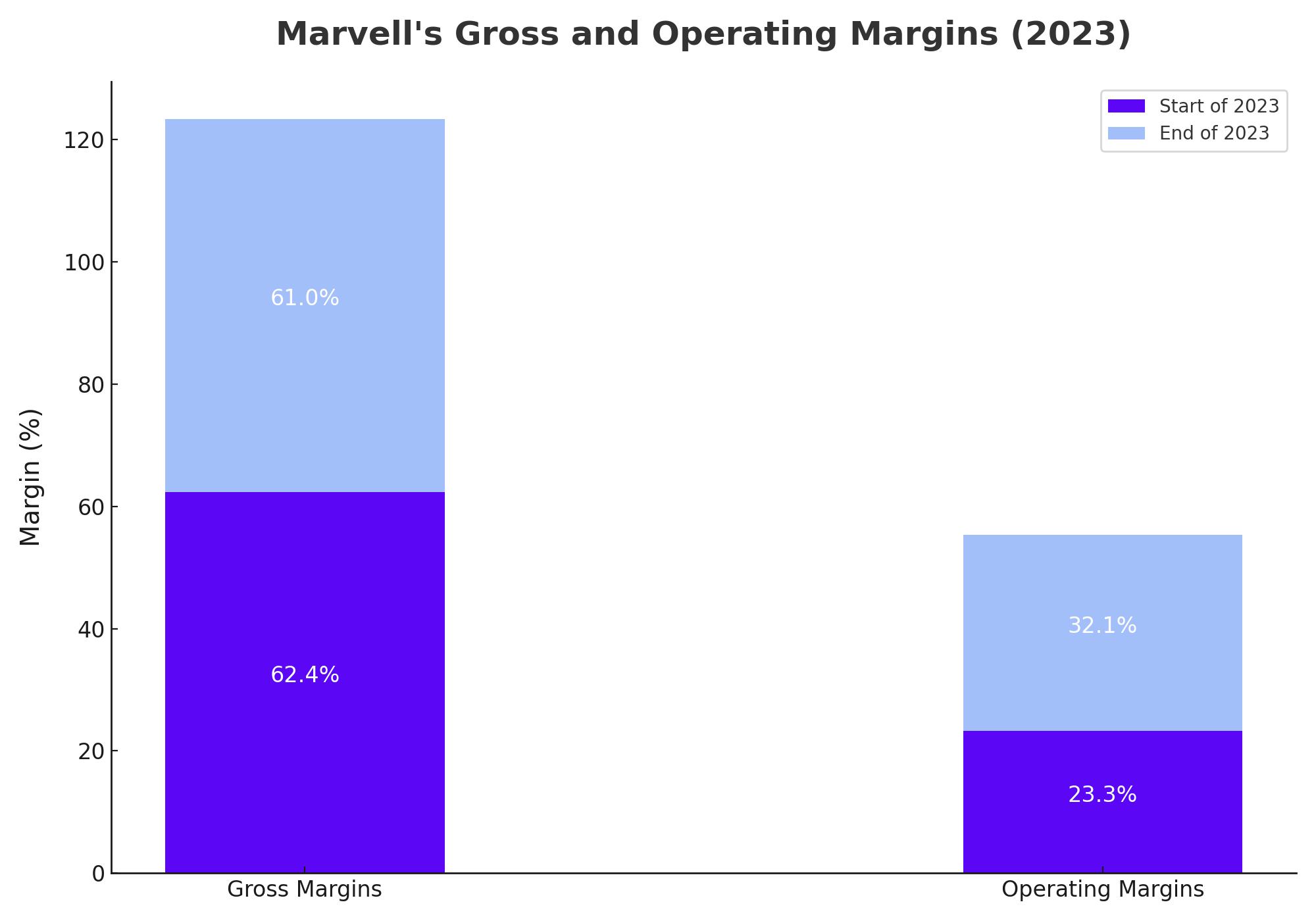

Despite the rapid expansion in AI-driven markets, Marvell is navigating a challenging financial environment, characterized by both opportunities and pressures. The company’s gross margins are anticipated to decline slightly from 62.4% at the beginning of 2023 to around 61.0% by the end of the year. This margin compression is largely due to the ramp-up in custom silicon production, particularly as Marvell scales up operations to meet the demands of major clients like Amazon and Google.

However, this margin pressure is expected to be offset by significant improvements in operating margins. Deutsche Bank forecasts that Marvell’s operating margins could rise from 23.3% at the start of the year to an impressive 32.1% by year-end. This improvement is likely to contribute to a notable increase in earnings per share (EPS), providing a solid foundation for future growth.

Looking at recent market performance, Marvell’s stock has shown resilience, delivering a 10.9% return over the past month, outpacing the S&P 500’s 2.2% gain during the same period. This performance is particularly notable given the broader challenges facing the technology sector, including slowing growth and supply chain disruptions. Despite a reported decrease in sales for the April quarter, which saw revenue decline to $1.16 billion—a 12.2% year-over-year drop—analyst sentiment remains bullish. Firms like CFRA and Stifel have maintained their positive outlooks, with price targets as high as $94.00, reflecting confidence in Marvell’s long-term prospects.

Strategic Acquisitions and Market Leadership

Marvell’s strategic acquisitions have played a critical role in its ability to capitalize on the AI boom. The acquisition of Inphi Corporation, a leader in high-speed data interconnect solutions, has been particularly transformative. This acquisition has not only bolstered Marvell’s capabilities in electro-optics—a crucial technology for AI and data centers—but has also solidified its leadership position in the PAM4 DSP market, where it holds over 70% market share.

Moreover, Marvell’s history with custom ASICs, further strengthened by the acquisition of Cavium, has positioned the company as a formidable competitor in the custom silicon market. This market is becoming increasingly important as major tech companies like Google and Amazon seek customized solutions to optimize their AI workloads. Marvell’s ability to deliver high-performance, tailor-made silicon solutions has made it a preferred partner for these tech giants, allowing it to capture significant market share in a space that had long been dominated by Broadcom (NASDAQ:AVGO).

Marvell’s custom silicon and electro-optics businesses are expected to contribute equally to its AI-related revenue, with both segments poised for substantial growth. The company’s electro-optics products are already integral to the AI infrastructure of industry leaders such as Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOGL), Amazon, Meta Platforms (NASDAQ:META), and Microsoft. Notably, Marvell has enjoyed a 100% market share with Nvidia’s DGX H100, underscoring its dominance in this high-demand area. While competition from Broadcom is expected to intensify, particularly with the upcoming Blackwell product cycle, Marvell’s technological leadership and strong customer relationships position it well to maintain its market share.

Valuation and Market Performance: A Strategic Investment Opportunity

Marvell’s stock has seen a significant surge, rising approximately 60% since the beginning of the year. This impressive performance reflects the market’s recognition of Marvell’s strategic positioning in the AI revolution. However, with the stock now trading at elevated levels, investors are faced with the question of whether Marvell can continue to deliver the growth needed to justify its current valuation.

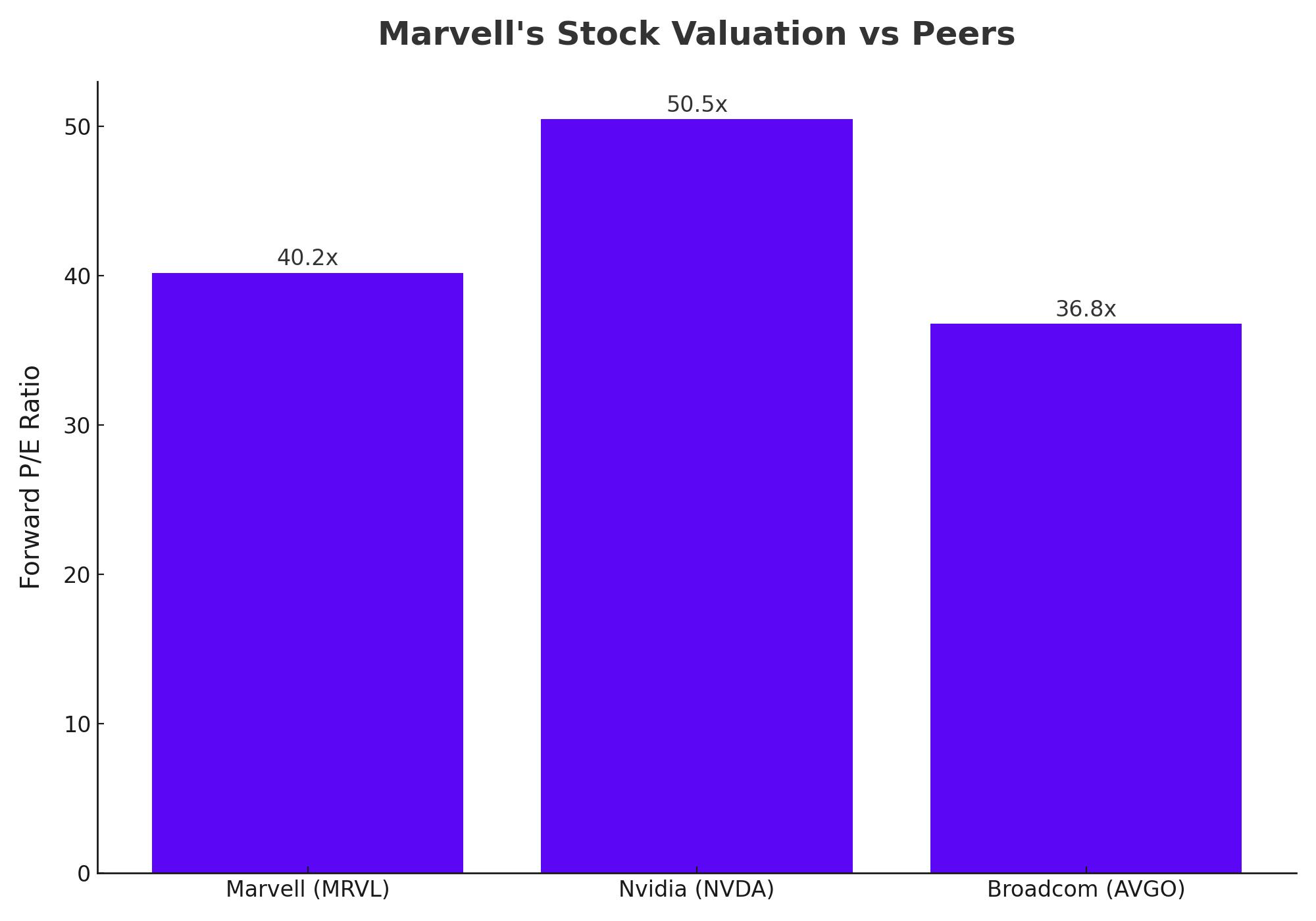

Marvell’s current market capitalization stands at around $60.08 billion, with the stock trading at a forward P/E ratio of 40.2x, based on projected earnings for the next 12 months. While this valuation is steep compared to traditional benchmarks, it is not out of line with other high-growth tech stocks, particularly those with significant exposure to AI. For example, Nvidia, another AI-driven chipmaker, is trading at a forward P/E of over 50x, reflecting the premium that investors are willing to pay for companies at the forefront of the AI boom.

Given Marvell’s expected revenue growth of 16% over the next five years, driven primarily by its AI and data center businesses, the stock’s current valuation appears justified. Furthermore, the company’s ability to expand its operating margins and generate high levels of free cash flow supports the case for continued stock price appreciation. Deutsche Bank’s price target of $90 suggests a potential upside of around 20% from current levels, making Marvell an attractive investment for those looking to capitalize on the AI revolution.

Conclusion: A Compelling Play on the AI Boom

In conclusion, Marvell Technology (NASDAQ:MRVL) presents a compelling investment opportunity for those looking to gain exposure to the AI and data center markets. The company’s strong market position, bolstered by strategic acquisitions and partnerships with leading tech companies, provides a solid foundation for future growth. While the stock’s high valuation and the competitive landscape pose risks, Marvell’s ability to deliver on its growth projections and expand its margins makes it a stock worth considering for investors with a higher risk tolerance.