Mastercard (NYSE:MA) Stock Analysis: Growth Through Cashless Transactions

Analyzing Mastercard's Financial Performance, Market Share Expansion, and Future Growth Potential Amid Evolving Consumer Trends and Technological Integration | That's TradingNEWS

Mastercard (NYSE:MA): An In-Depth Stock Analysis

Overview of Mastercard's (NYSE:MA) Business Model

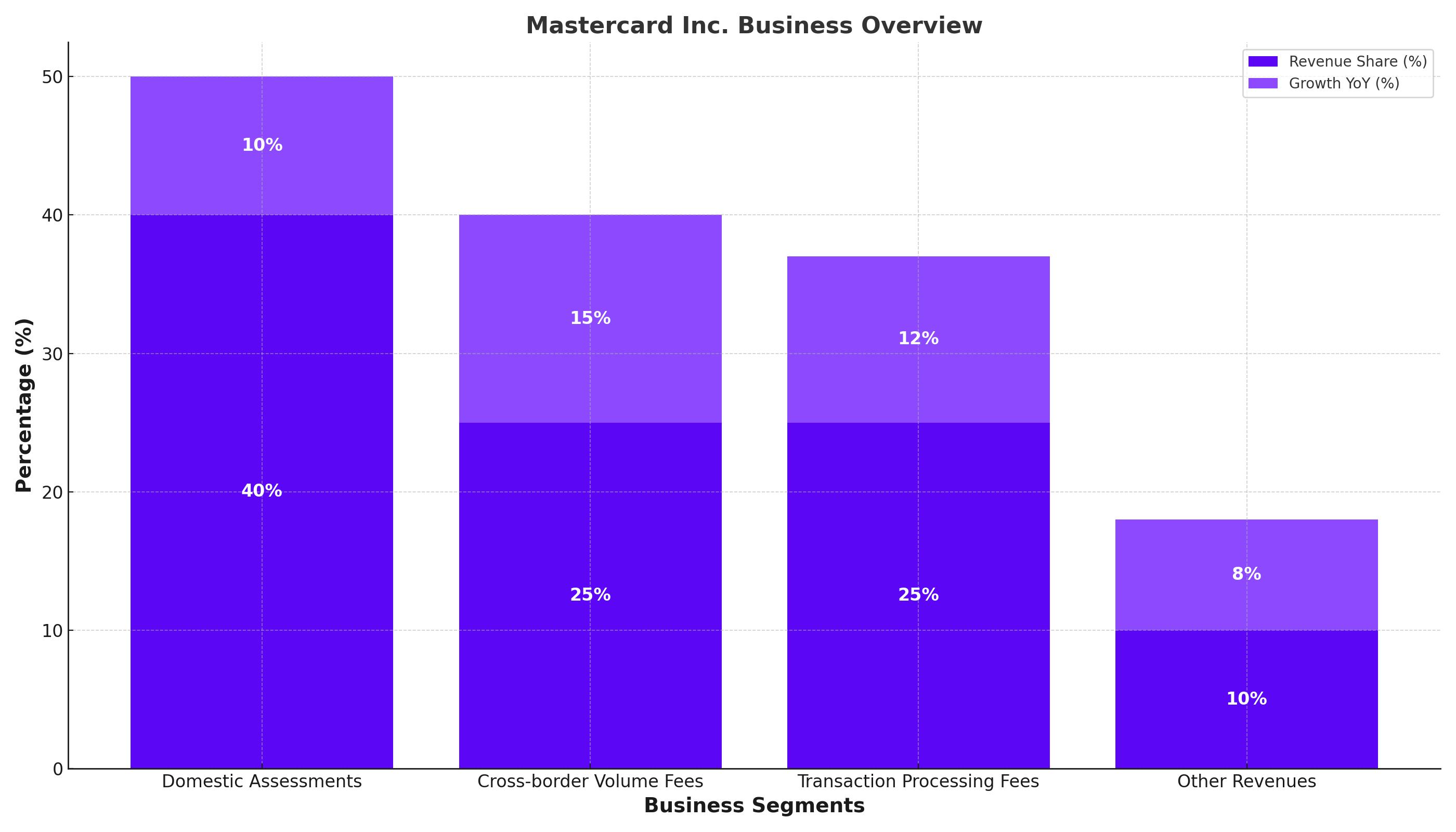

Mastercard Incorporated (NYSE:MA) stands as a prominent player in the global financial services industry, primarily facilitating electronic forms of payment. The company operates through several segments, including Domestic Assessments, Cross-border Volume Fees, Transaction Processing Fees, and Other Revenues. These segments collectively contribute to Mastercard's diversified and resilient revenue streams, positioning it well to capitalize on the ongoing transition to a cashless economy.

Recent Financial Performance

Q1 2024 Results

In Q1 2024, Mastercard reported a robust financial performance, marked by a 10% year-over-year (YoY) growth in gross dollar volume (GDV), amounting to $6.3 billion. This growth was slightly boosted by the leap year. The company saw net revenue rise by 10.4% YoY, driven by higher transaction volumes and increased cross-border activities. Operating income grew by 11% YoY due to effective cost management and operational leverage, resulting in an 18% increase in earnings per share (EPS) to $3.31.

Revenue by Segment

Mastercard's revenue growth is underpinned by its extensive network of cardholders and merchants. The total cardholder base grew by 8.3% to nearly 3.4 billion as of March 31, 2024. This growth, coupled with steady consumer spending and inflationary pressures, drove a 10% increase in GDV during the first quarter. The company’s transaction processing fees and cross-border volume fees contributed significantly to the revenue, reflecting the global increase in travel and international transactions.

Guidance and Projections

Mastercard's management has provided optimistic guidance for the upcoming quarters. For Q2 2024, the company expects high-single-digit revenue growth, with low-double-digit growth on a currency-neutral basis. For the full year, Mastercard anticipates low-double-digit revenue growth, maintaining a positive outlook despite the challenging economic environment. Consensus estimates forecast non-GAAP EPS of $14.30 for 2024 and $16.60 for 2025, representing annual growth rates of 16.6% and 16.1%, respectively.

Strategic Growth Drivers

Cashless Transition

Mastercard continues to benefit from the secular trend towards cashless transactions. Despite the maturity of this trend in developed markets, there remains significant potential in emerging markets. Management highlighted that countries like Italy and Indonesia still have substantial cash usage, presenting opportunities for growth. The company’s efforts to expand its cardholder base and merchant acceptance network are pivotal in driving this transition.

Market Share Gains

Mastercard is steadily capturing market share from its primary competitor, Visa (NYSE:M). The company’s aggressive client incentives strategy, although costly, has proven effective in attracting more issuers and merchants. This strategic approach has enabled Mastercard to maintain strong growth rates and expand its market presence. Mastercard’s ability to outpace Visa in certain markets underscores its competitive edge and growth potential.

New Flows and Value-Added Services

Mastercard is diversifying its revenue streams through its New Flows and Value-Added Services segments. New Flows encompass transactions beyond traditional consumer-to-merchant payments, including business-to-business (B2B), business-to-consumer (B2C), and government-to-consumer (G2C) transactions. This segment saw a 40% increase in transactions year-over-year, reflecting its growing importance.

Value-Added Services, which include fraud prevention, data analytics, consulting, marketing, and loyalty programs, accounted for 38% of Mastercard’s revenues in Q1 2024, growing 16% YoY. These services leverage Mastercard’s extensive data and relationships with financial institutions, providing a competitive advantage that is difficult to replicate.

Technological Integration and AI

Mastercard is leveraging artificial intelligence (AI) to enhance its service offerings and operational efficiency. AI is being used to improve fraud detection, streamline transaction processing, and enhance customer service. These technological advancements not only improve Mastercard’s operational capabilities but also strengthen its competitive positioning in the market.

Valuation and Investment Outlook

Current Valuation

As of the latest data, Mastercard is trading at approximately 15x sales and 31x earnings, below its historical averages of 17x sales and 41x earnings, respectively. This presents a compelling entry point for investors, given the company’s strong growth prospects and robust financial performance. The stock’s recent period of underperformance provides an attractive opportunity for new investors to enter at a favorable valuation.

Future Growth Potential

Analysts project that Mastercard will achieve EPS of $14.30 in 2024 and $16.60 in 2025, representing annual growth rates of 16.6% and 16.1%, respectively. This growth is expected to be driven by continued expansion in its core payments business, significant contributions from New Flows and Value-Added Services, and increasing operating leverage.

Risk Factors

Despite its strong market position, Mastercard faces several risks. Regulatory challenges, such as the potential rejection of the $30 billion swipe fee settlement, could impact its financial performance. Additionally, competition from fintech companies and potential cybersecurity threats pose significant risks. Economic volatility could also affect consumer spending and transaction volumes, impacting Mastercard’s revenue growth.

Insider Transactions and Shareholder Returns

Insider Transactions

Mastercard’s insider transactions - For detailed insider transaction data, visit Mastercard Insider Transactions.

Shareholder Returns

Mastercard has a strong track record of returning capital to shareholders through share repurchases and dividends. In Q1 2024, the company spent $2 billion on share repurchases and $616 million on dividends, reflecting its commitment to enhancing shareholder value. The company’s ability to generate substantial cash flow supports its shareholder return program, making it an attractive investment for long-term investors.

Conclusion

Mastercard (NYSE:MA) remains a highly attractive investment opportunity, offering robust growth prospects, strong financial performance, and a compelling valuation. The company continues to benefit from the secular shift towards cashless transactions, expanding its market share, and leveraging technological advancements to enhance its service offerings. Despite potential risks, Mastercard’s diversified revenue streams, strategic growth initiatives, and strong shareholder return program position it well for sustained growth. Investors seeking a high-quality, growth-oriented stock should consider adding Mastercard to their portfolios. For real-time stock performance and updates, visit Mastercard Real-Time Chart.

That's TradingNEWS

Read More

-

QDVO ETF: 11% Yield And AI Heavyweights Keep This Fund Near Its $30.40 Peak

26.12.2025 · TradingNEWS ArchiveStocks

-

XRPI at $10.66 and XRPR at $15.13 as XRP ETFs Build $1B+ Exposure Around $1.84 XRP-USD

26.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Near $4.34 Tests How Strong The $4.00 Winter Floor Really Is

26.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 156 Range Trapped Below 158 as BoJ 0.75% Hike Clashes with Fed Cuts

26.12.2025 · TradingNEWS ArchiveForex