MercadoLibre (NASDAQ:MELI): A $1,680 Powerhouse Poised for Explosive Growth

With 35% revenue growth, a booming fintech division, and a $105 billion market opportunity, MercadoLibre is a long-term buy despite current macroeconomic headwinds | That's TradingNEWS

MercadoLibre (NASDAQ:MELI): A Compelling Investment Opportunity for 2025

Introduction: A Regional Titan in E-Commerce and Fintech

MercadoLibre (NASDAQ:MELI) has emerged as the dominant force in Latin American e-commerce and fintech, proving its resilience and growth potential through challenging macroeconomic environments. With a market cap of $87.6 billion, MELI operates in three of the fastest-growing regions: Brazil, Mexico, and Argentina, contributing 96% of its revenue. Despite recent stock pullbacks and geopolitical risks, MELI's aggressive investments in logistics, fintech, and customer engagement set it apart as a long-term investment opportunity.

Robust Financial Performance: Solid Growth Metrics

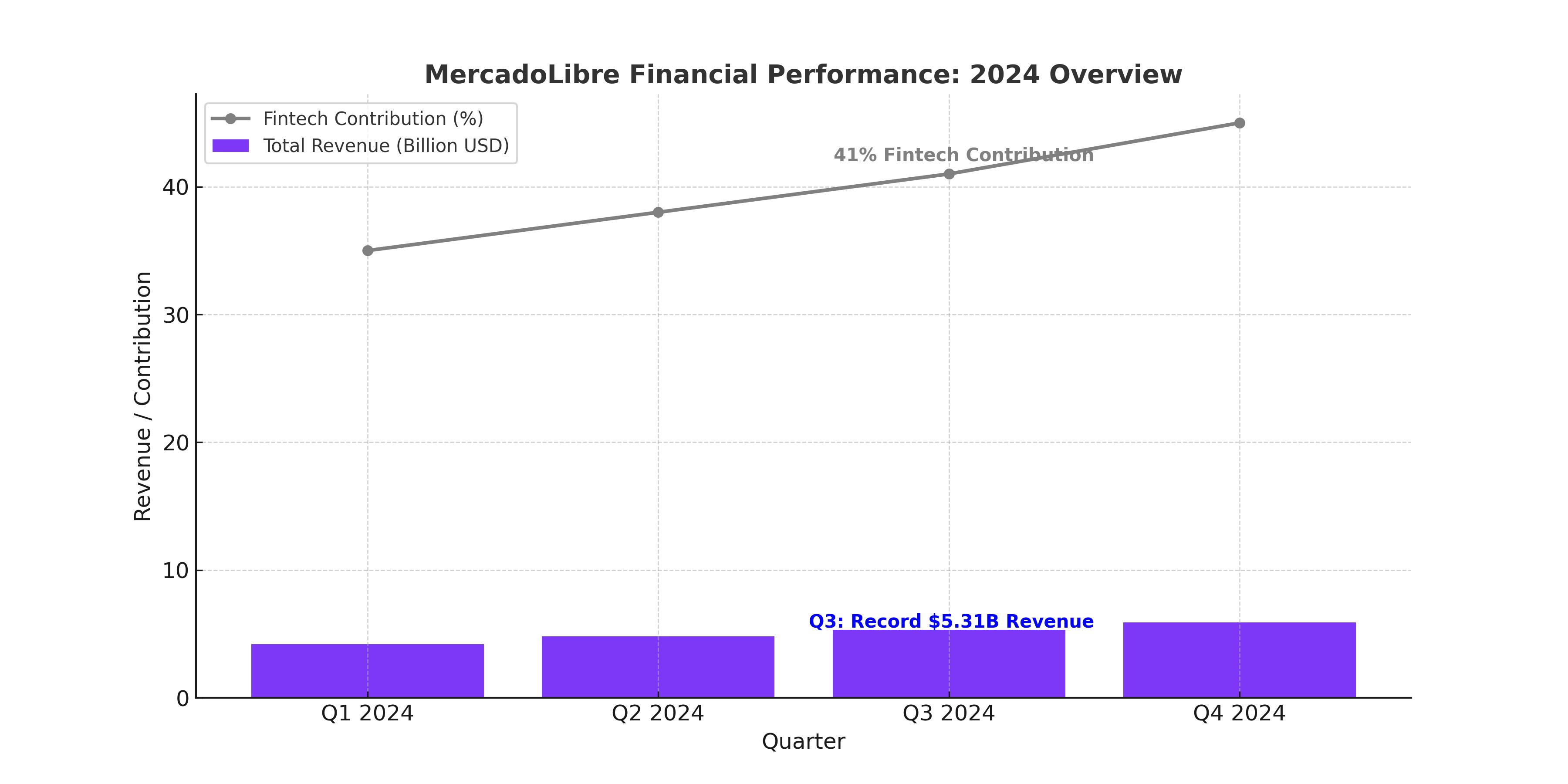

MercadoLibre reported total revenue of $5.31 billion in Q3 2024, up 35.1% year-over-year (YoY), and an astounding 103% on an FX-neutral basis. Monthly active users (MAUs) in its fintech division grew by 35% YoY, reaching 56.2 million. The company’s total credit portfolio expanded by 77% YoY to $6 billion, while its e-commerce platform added 7 million new buyers. With EPS of $28.34 over the trailing twelve months and an 18.9% gross profit margin, MELI has demonstrated its ability to scale profitably.

E-Commerce Expansion: Logistics and Market Penetration

E-commerce remains MELI's core business, contributing a significant share of its revenue. With 7 million new buyers added in Q3 2024 and a projected $350 billion Latin American e-commerce market by 2027, MELI's dominance is set to grow. The company plans to double its fulfillment centers in Brazil by 2025, enabling a 40% increase in same-day deliveries to 63% of Brazilian cities. This investment ensures a competitive edge in speed and efficiency, a critical driver for customer retention in online retail.

GMV (Gross Merchandise Volume) increased by 14% YoY, with FX-neutral growth of 71%, reflecting robust underlying demand. While inflation in Argentina and currency headwinds from the Brazilian real have affected reported numbers, MELI sold 28% more items YoY, underscoring its operational strength.

Fintech Leadership: Mercado Pago’s Explosive Growth

Mercado Pago, MELI's fintech arm, has become a standout growth driver, contributing 41% of consolidated revenue in Q3 2024. The platform’s AUM (Assets Under Management) surged 93% YoY to $8 billion, while credit card TPV (Total Payment Volume) grew 166%. With 1.5 million new credit cards issued in Q3 alone, Mercado Pago is not only expanding its footprint but also enhancing customer loyalty through integrated financial solutions like cashback and higher yields via the Mercado Pago app.

Credit provisioning has been a concern for some investors, with NIMAL (Net Interest Margin After Losses) dropping to 24.2% from 39.8% YoY. However, MELI’s pivot toward higher-income customers and longer loan durations indicates a deliberate strategy to balance risk and growth.

Strategic Investments: Leveraging Scale and Technology

MercadoLibre's investments in logistics, fulfillment centers, and its loyalty program, Meli Más, are designed to fortify its ecosystem. Meli Más, akin to Amazon Prime, offers tiered subscription benefits like free shipping, cashback, and content partnerships with Disney+ and Deezer. These initiatives create a flywheel effect, boosting both e-commerce and fintech usage.

The company also invests in innovative tools, such as AR-powered beauty product trials and auto parts delivery to mechanics. Such enhancements not only attract new users but also deepen engagement with existing customers, supporting MELI’s long-term growth.

Valuation: A Deeply Undervalued Leader

At $1,680 per share (as of Q3 2024), MercadoLibre trades at 14.9x free cash flow, historically low compared to its EV/gross profit multiple of 9.35x. The forward P/E ratio of 53.47x, paired with projected 47.11% EPS growth for 2024, yields a PEG ratio of 1.13—indicating fair valuation relative to its growth potential.

Considering the $350 billion Latin American e-commerce market by 2027 and MELI's 30% market share, the company could capture $105 billion in revenue from e-commerce alone. Applying a conservative 4x EV/sales multiple, MELI’s market cap could surpass $420 billion, representing a nearly 5x upside from current levels.

Risks: Navigating Macroeconomic and Geopolitical Headwinds

MELI faces challenges from political instability and economic volatility in Latin America. Currency devaluations in Brazil and Argentina remain significant headwinds. However, MELI’s diversification across geographies and its ability to adapt through local partnerships and strategic pricing mitigate these risks.

Short-term profitability concerns may also arise from its aggressive investment strategy. Yet, these expenditures are aligned with capturing long-term market share, as evidenced by MELI’s consistent ability to outperform during periods of macro uncertainty.

Conclusion: A Long-Term Buy with Compelling Upside

MercadoLibre (NASDAQ:MELI) offers a unique blend of high-growth e-commerce and fintech opportunities in a rapidly modernizing Latin American market. With projected 25% revenue growth in 2025, MELI’s investments in logistics, fintech, and technology position it for exponential gains. Trading at a valuation that discounts its growth potential, MELI remains an attractive buy, with a target price of $2,000–$2,200 per share over the next 12–18 months.

Investors seeking exposure to Latin America’s digital revolution and a company that has consistently outperformed should consider MELI a cornerstone holding for 2025 and beyond.