MercadoLibre (NASDAQ:MELI) Stock Nears $1,970 – Breakout or Pullback?

Will MELI stock surge past $1,977, or is a drop to $1,722 coming? | That's TradingNEWS

MercadoLibre (NASDAQ:MELI) Stock Analysis: Can It Justify Its Sky-High Valuation?

MercadoLibre's Explosive Growth – Is It a Smart Buy at $1,970?

MercadoLibre (NASDAQ:MELI) has become a dominant force in Latin America’s e-commerce and fintech industry, with its stock up over 140% since 2023. Despite posting strong financial growth, expanding its logistics and digital banking infrastructure, and maintaining robust profitability, the stock remains heavily priced with a forward P/E ratio of 57.81x, raising concerns about whether it is overvalued.

The company continues its aggressive expansion strategy, planning to double its distribution centers in Brazil and secure a banking license for Mercado Pago in Mexico. While this signals long-term revenue expansion, rising compliance costs, tax risks, and volatile Latin American markets could weigh on profitability.

After testing the $1,977 resistance level, MercadoLibre sits in a crucial price zone. Will it break out to new highs, or is a correction coming?

MercadoLibre's E-Commerce and Fintech Domination Continues

MercadoLibre is often referred to as the Amazon of Latin America, but it is much more than an e-commerce company. Its fintech arm, Mercado Pago, and its logistics network, Mercado Envios, make it a full-scale digital commerce ecosystem.

The company operates in 18 countries and boasts 60.8 million active buyers, with more than 76,000 employees. Its AI-driven logistics model has drastically improved delivery speeds, reducing priority item delivery in São Paulo and Mexico City to an average of 6.5 hours.

Mercado Pago has seen a 35% YoY increase in monthly active users, reaching 56 million. The platform's credit portfolio surged 172% YoY to $2.3 billion, and it is rapidly gaining market share in digital payments. As part of its 2025 expansion strategy, Mercado Pago is seeking a banking license in Mexico, which would allow it to offer savings accounts, commercial loans, and mortgages, further embedding itself into Latin America’s financial ecosystem.

MercadoLibre’s Logistics Expansion – A $2.5 Billion Investment

In an effort to strengthen its dominance, MercadoLibre is doubling its distribution centers in Brazil from 10 to 21, aiming to reduce delivery times in regions outside São Paulo. The company is also investing $2.5 billion in logistics infrastructure across Latin America, including the launch of new facilities in Mexico.

The company is implementing AI and robotics to enhance efficiency, with initiatives such as "Shelf to Person" robots in distribution centers, which have reduced order processing times by 20% and optimized space utilization by 15%. This focus on technological innovation strengthens MercadoLibre’s competitive edge against global giants like Amazon.

However, aggressive expansion raises short-term operational costs, and maintaining profitability while investing heavily in infrastructure could be a challenge.

Financials: Consistent Revenue Growth but at a High Price

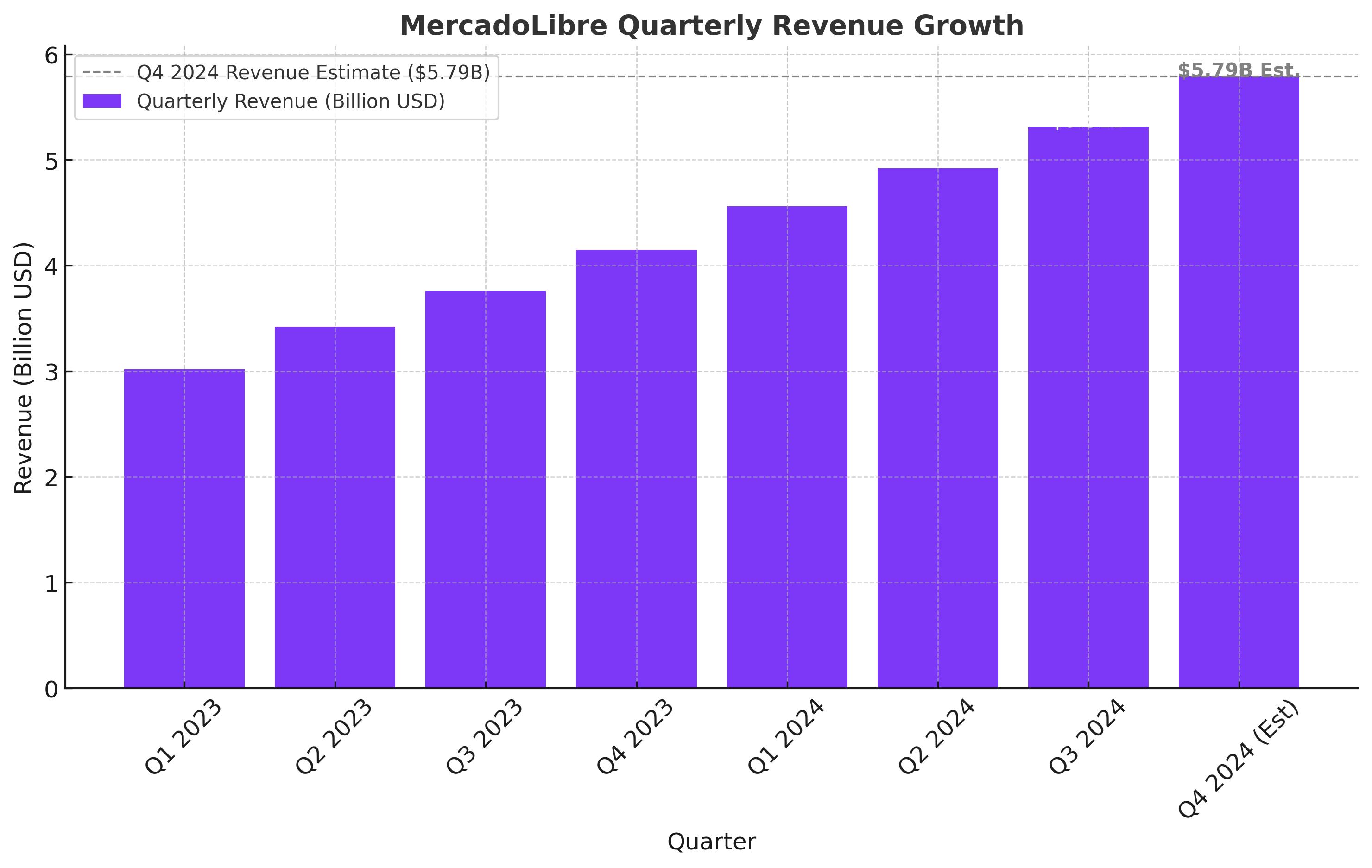

MercadoLibre reported Q3 2024 revenue of $5.31 billion, reflecting a 35.27% YoY increase, continuing its long-term trend of strong revenue expansion. Since 2022, the company has averaged 40.07% annual revenue growth, reinforcing its status as one of the fastest-growing e-commerce companies globally.

A linear regression analysis suggests that MercadoLibre’s Q4 revenue should reach at least $5.79 billion, given its average 9.09% quarter-over-quarter revenue increase. This steady revenue growth makes it one of the most resilient e-commerce players despite economic volatility in Latin America.

However, net income took a hit in Q4 2023 due to a one-time $351 million tax liability related to Brazilian DIFAL sales tax and other legal actions. Despite this, operating income surged 64% YoY, with operating margins expanding to 13.4%, confirming that the core business remains strong.

Looking at profitability metrics, MercadoLibre boasts a return on equity (RoE) of 42.62%, well above its industry peers’ average of 24.81%. This indicates that MELI is generating strong shareholder returns and efficiently utilizing capital, but the question remains—can it sustain this profitability amid rising costs?

Check MercadoLibre’s real-time stock chart here.

Valuation: Is MercadoLibre Overpriced at 57.81x Forward P/E?

While MercadoLibre’s revenue and profitability remain strong, its valuation is one of the most expensive in the e-commerce sector.

Historically, the company’s forward P/E ratio dropped from 161.29x in 2022 to 42.74x in 2023. However, it has steadily climbed back to 57.81x, significantly above the industry average.

When comparing MELI’s forward P/E ratio of 57.81x to its competitors:

- Amazon (NASDAQ:AMZN): 42.3x

- JD.com (NASDAQ:JD): 14.2x

- Coupang (NYSE:CPNG): 21.1x

- PDD Holdings (NASDAQ:PDD): 13.9x

MercadoLibre is trading at a substantial premium, reflecting investor confidence in its ability to dominate the Latin American market. However, such a high valuation limits upside potential, especially if revenue growth slows or macroeconomic risks materialize.

Technical Analysis: Can MELI Break the $1,977 Resistance?

MercadoLibre has been in a long-term uptrend since 2009, with a consistent rise except for the COVID-induced selloff. Over the past year, it has traded between $1,722 and $1,977, forming a crucial resistance zone at $1,977.

If MELI breaks past $1,977, it could rally toward $2,200 and potentially test its all-time high of $2,162. However, if it gets rejected, it may drop toward $1,722, a high-volume support zone.

Given its stretched valuation, macro risks, and resistance levels, MercadoLibre may remain range-bound in the near term unless a catalyst—such as strong Q4 earnings or regulatory approvals for Mercado Pago—triggers a breakout.

Risks: Latin American Volatility and Tax Concerns

MercadoLibre faces several key risks:

- Macroeconomic instability in Latin America could lead to weaker consumer spending and higher default rates in Mercado Pago’s credit business.

- Rising compliance costs as regulators scrutinize digital banking operations may reduce fintech margins.

- A potential increase in MercadoLibre’s effective tax rate from 20% to 34% could significantly impact net income.

- Intensifying competition from Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT) in Latin America could limit future growth.

Given these risks, MercadoLibre must maintain its profitability while navigating economic and regulatory challenges.

Check MercadoLibre’s latest insider transactions here.

Buy, Sell, or Hold?

MercadoLibre remains a dominant player in Latin America’s e-commerce and fintech space, with strong revenue growth, profitability, and aggressive expansion plans. However, its high forward P/E ratio, macroeconomic risks, and tax concerns raise caution for investors looking to enter at current levels.

The technical resistance at $1,977 is crucial—if MELI breaks out, it could rally to $2,200+. If it fails to break resistance, it may pull back toward $1,722, offering a better entry point.

For long-term investors, MercadoLibre is a solid hold, but for those looking for immediate upside, waiting for a pullback may be the smarter move.

Check MercadoLibre’s real-time stock chart here.