Micron Technology (NASDAQ:MU): AI Wave Amid Cyclical Market Fluctuations

Leveraging AI-Driven Demand for Sustained Growth While Navigating Market Cyclicality | That's TradingNEWS

Micron Technology (NASDAQ:MU): Navigating the Cyclical Ups and Downs of the Memory Chip Market

AI-Driven Demand Boosts Micron's Revenue

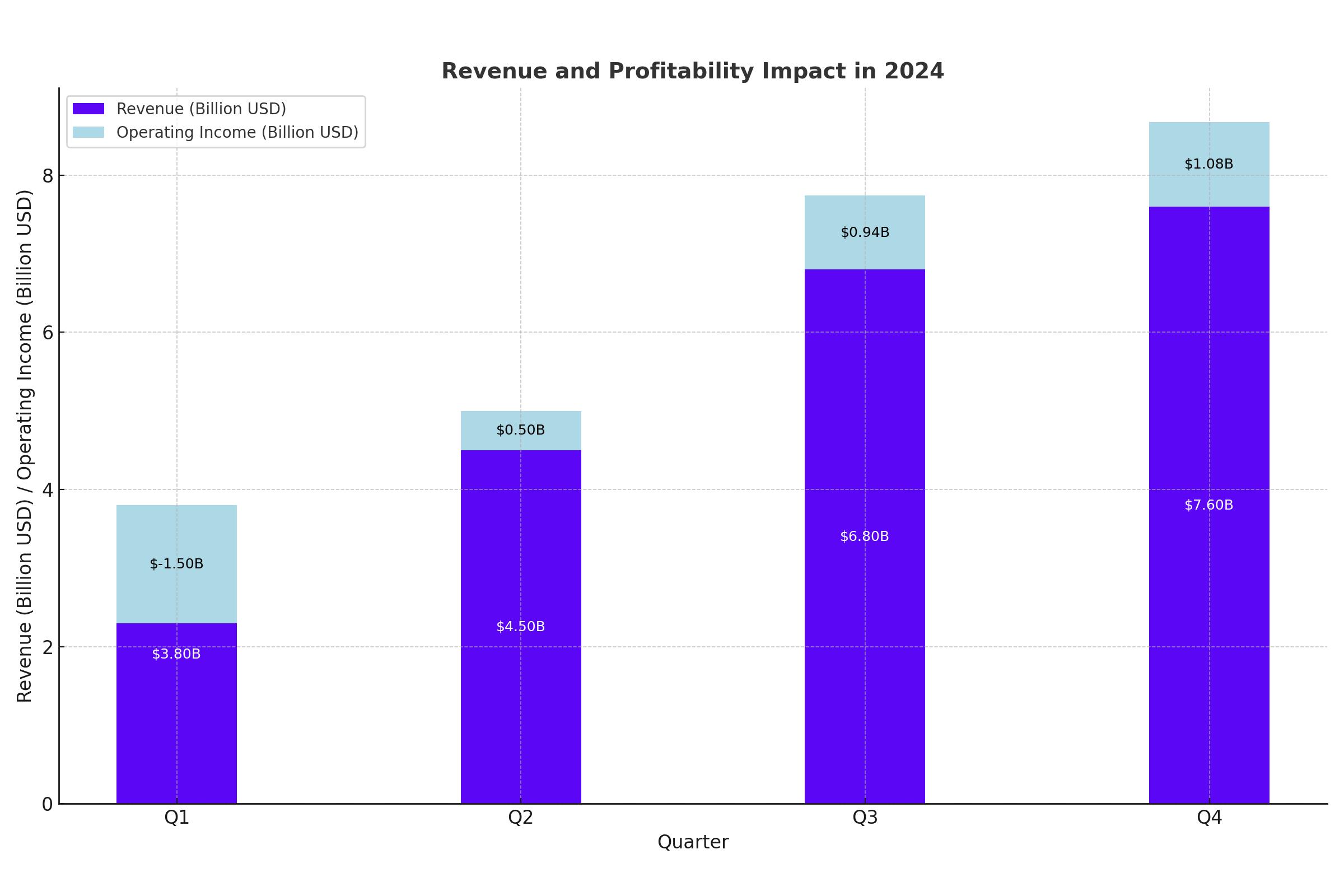

Micron Technology (NASDAQ:MU) has experienced a significant upswing in its stock price over the past year, driven by the soaring demand for high-speed memory used in AI accelerators. The company’s earnings report for the third quarter of fiscal 2024 exceeded expectations, with revenue hitting $6.8 billion, an 81% increase from the same period last year. This impressive growth is largely attributed to the rising sales of AI servers, which require substantial amounts of DRAM and NAND memory chips.

HBM revenue was a standout, surpassing $100 million in the third quarter. Micron anticipates generating several billion dollars in HBM revenue by fiscal 2025, with demand so high that it is sold out through the end of 2025. This surge in demand has propelled the company's data center segment revenue by over 50% sequentially.

Balancing Booms and Busts in the Memory Market

Despite the current boom, the memory chip industry is notorious for its cyclical nature. During periods of high demand, prices and profits soar, prompting manufacturers to ramp up production. Eventually, this leads to an oversupply, causing prices and profits to plummet. Micron's stock price has recently dipped from its highs, reflecting investor concerns about potential future gluts in the market.

Micron's recent earnings report highlighted a significant improvement in profitability, with operating income reaching $941 million, up from a $1.5 billion loss a year ago. The company's guidance for the fourth quarter points to continued growth, with an expected adjusted profit of $1.08 per share on $7.6 billion in revenue, representing a 90% year-over-year increase.

AI: A Catalyst for Sustained Growth

The demand for AI-related memory products is a crucial growth driver for Micron. The company's high-bandwidth memory (HBM) chips are integral to AI servers, which require large amounts of DRAM for high-speed computing. Micron's data center revenue, fueled by AI demand, shot up 50% quarter-over-quarter. The company projects substantial HBM revenue growth, with forecasts suggesting the market could double annually through 2026, reaching $30 billion.

Micron’s AI-driven growth is expected to continue, with analysts forecasting nearly 50% revenue growth in fiscal 2025. The company generated $17.3 billion in revenue in the first nine months of fiscal 2024, and its fourth-quarter guidance indicates it is on track to finish the year with nearly $25 billion in revenue, a 61% increase over the previous year.

Challenges and Market Dynamics

However, the memory chip market's inherent volatility remains a challenge. The cyclical nature of the industry means that today's high demand could lead to tomorrow's oversupply. Micron's stock, trading at 19 times forward earnings, reflects high expectations, making it a risky bet despite the current boom.

Micron’s profitability has rebounded significantly, with gross margins improving due to rising memory prices. The company’s third-quarter operating margin reached 14%, up from a negative 39% a year ago. This improvement has been driven by strong demand for its AI-related products, including high-capacity DIMMs and data center SSDs.

Capital Expenditures and Long-Term Outlook

Micron is ramping up its capital expenditures to meet the surging demand for its products. The company plans to spend $8 billion in capital expenditures this year, a $1 billion increase from 2023. This investment is crucial to support the growth of its HBM products, which are used in Nvidia’s GPUs.

The outlook for the high-bandwidth memory market is particularly bullish. HBM shipments and sales are expected to soar more than 150% in 2024, driven by the demand for AI chips. Micron’s HBM capacity is already sold out for 2024 and 2025, reflecting the strong demand for these products.

Valuation and Investor Sentiment

Despite its recent pullback, Micron remains relatively undervalued. The stock trades at a price-to-sales ratio of 5.5, lower than the semiconductor peer group average of 7.5. Wall Street analysts are bullish on Micron, with 35 out of 37 analysts rating it as a buy. The median price target for the stock is $160, suggesting a 19% upside from its current price.

Investors should be aware of the cyclical risks inherent in the memory chip market. However, Micron’s strong position in the AI market and its aggressive investment in capital expenditures make it a compelling long-term investment. The company’s revenue and earnings are expected to grow significantly over the next year, driven by robust demand for its high-bandwidth memory products.

Insider Transactions and Market Sentiment

For detailed insider transactions, visit Micron Insider Transactions.

Micron’s stock performance has been impressive, with a 135% increase since late 2022. The stock’s compound annual growth rate (CAGR) is around 64%, and analysts expect high double-digit growth over the next 1.5 years. This growth is driven by the AI-led demand for HBM and the anticipated recovery of the PC and smartphone markets in 2025.

Conclusion

Micron Technology (NASDAQ:MU) is well-positioned to benefit from the booming demand for memory products, particularly those used in AI applications. Despite the cyclical nature of the memory chip market, Micron’s strong revenue growth, improving profitability, and aggressive investment in capital expenditures make it a compelling investment opportunity. Investors should consider adding Micron to their portfolios, taking advantage of any pullbacks to initiate or increase their positions.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex