Micron Technology (NASDAQ:MU) Surges on AI Growth—Is $119 Next?

With Micron Technology leveraging AI-driven DRAM demand, will its stock break $119? | That's TradingNEWS

Micron Technology (NASDAQ:MU): Navigating AI Growth Amid Volatility

AI-Driven Growth and Revenue Expansion for NASDAQ:MU

Micron Technology (NASDAQ:MU) has emerged as a central player in the semiconductor sector, leveraging its advanced DRAM and NAND memory solutions to capitalize on AI-driven demand. The company’s latest performance reflects both the opportunities and challenges inherent in this rapidly evolving market. After a sharp pullback to $85 following its earnings announcement, MU’s stock recovered to approximately $105, fueled by robust results in its AI-related segments. The company reported fiscal Q1 revenue of $8.71 billion, exceeding expectations by $11.74 million, while non-GAAP EPS reached $1.67, surpassing forecasts by $0.11. Despite this, weak guidance for fiscal Q2 tempered investor enthusiasm, highlighting the cyclicality and complexity of the memory chip market.

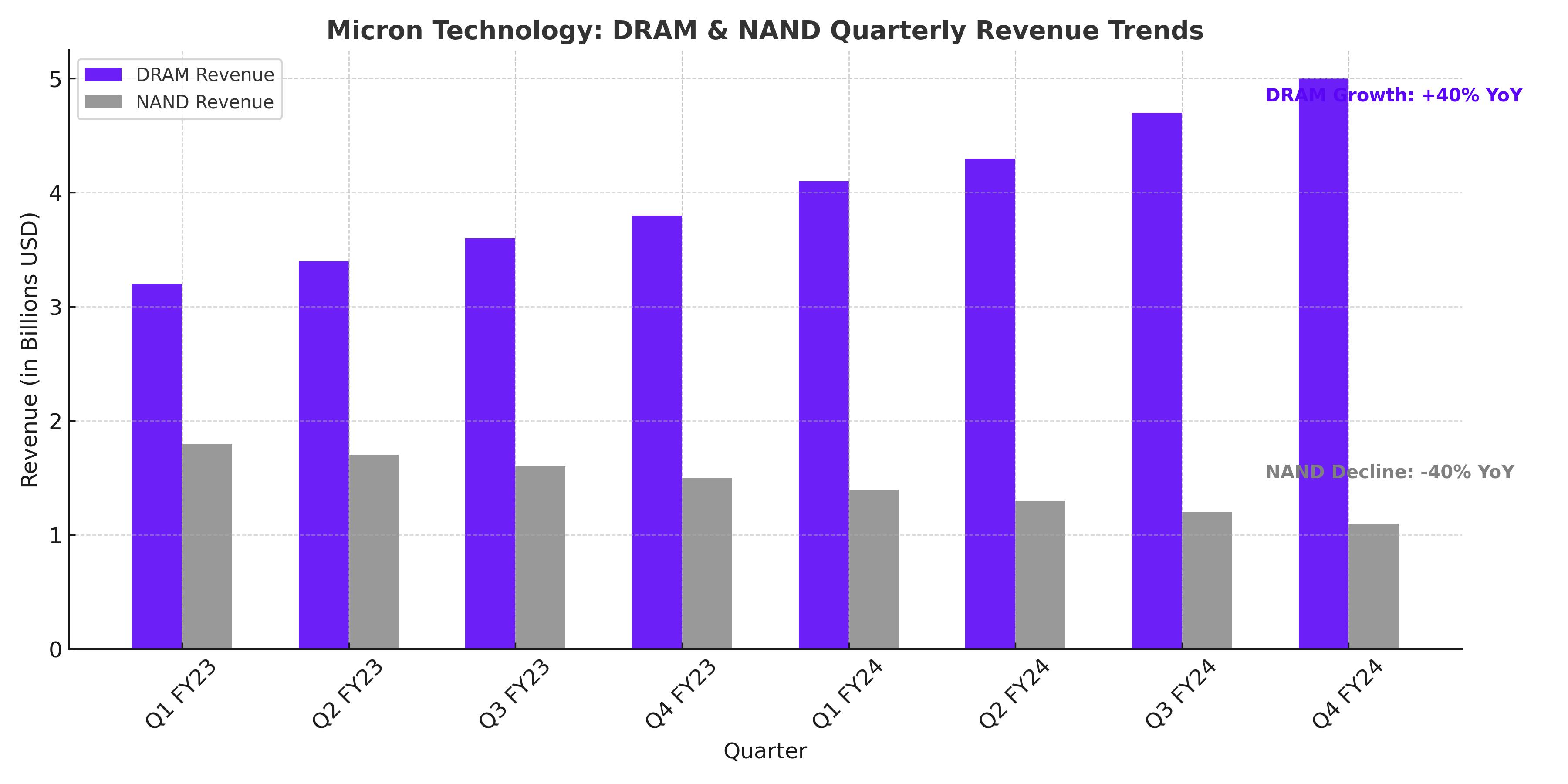

Micron’s DRAM and HBM Segments Drive Revenue Strength

Micron’s DRAM business continues to be a dominant contributor, accounting for 73% of total revenue, up from previous levels due to subdued performance in NAND. DRAM sales are bolstered by the surging demand for high-bandwidth memory (HBM) in AI and data center applications. In fiscal Q1, Micron’s HBM revenue doubled sequentially, supported by strong sales of its HBM3E modules, which are featured in NVIDIA’s Blackwell platforms. The broader HBM market is expected to grow from $16 billion in 2024 to over $100 billion by 2030, positioning Micron for sustained growth. This segment’s performance contrasts with NAND, which saw a 5% sequential decline due to weaker demand and inventory adjustments.

NAND Performance and Prospects

Micron’s NAND revenue experienced an 82% year-over-year increase, but near-term growth has been hampered by lower demand in consumer devices and data center SSDs. Management forecasts low-double-digit percentage growth in NAND bit demand for 2024 and 2025, down from previous expectations. Nevertheless, long-term recovery is anticipated as NAND-based SSDs gain traction over traditional HDDs, particularly in data center applications. The upcoming PC refresh cycle, driven by the expiration of support for older Windows 10 models, is expected to contribute to a rebound in NAND demand in the latter half of fiscal 2025.

Financial Metrics and Valuation Analysis for NASDAQ:MU

Micron’s intrinsic valuation suggests upside potential for investors. Using a discounted cash flow (DCF) analysis, the stock’s fair value is estimated at $119.19 per share, representing a 13% premium over the recent closing price. Key drivers include projected revenue growth to $44.62 billion by 2026, supported by expanding DRAM and HBM sales. The company’s gross margin, currently at 38.5%, is expected to improve as NAND inventories stabilize and HBM sales drive higher profitability.

Micron’s weighted average cost of capital (WACC) of 8.06% reflects its balanced risk profile, while a terminal growth rate of 3% aligns with the broader semiconductor industry’s growth trajectory. Despite the cyclical nature of the sector, Micron’s strategic investments in AI-related technologies position it for resilient performance.

Insider Transactions and Strategic Positioning

Recent insider transactions provide additional insights into Micron’s stock dynamics. While insider sales have occurred at levels above $120, the company’s ongoing investments in advanced memory solutions indicate confidence in its growth prospects. Explore insider transactions here.

Risks and Challenges Facing Micron Technology

Micron operates in a highly cyclical market, with demand fluctuations significantly impacting profitability. The memory chip market remains intensely competitive, with key rivals such as SK Hynix and Samsung commanding substantial market shares. Moreover, the potential for overcapacity in AI-related capital expenditures by hyperscalers could dampen long-term growth prospects.

Geopolitical risks, including trade tensions and policy shifts, add another layer of uncertainty. The company’s dependence on international markets underscores the importance of monitoring global economic conditions and regulatory developments.

Strategic Outlook for NASDAQ:MU Investors

Micron Technology presents a compelling investment opportunity for those seeking exposure to the AI-driven transformation of the semiconductor industry. With its leadership in HBM and DRAM technologies, the company is well-positioned to benefit from the ongoing demand for high-performance memory solutions. Current valuations suggest room for upside, particularly as NAND market conditions stabilize and AI-related revenues grow.

For investors considering NASDAQ:MU, the stock’s recent volatility offers a potential entry point. As the company navigates the challenges of its cyclical market, its strategic focus on innovation and operational efficiency should drive long-term value. View the real-time stock chart for MU.

Final Thoughts

Micron Technology (NASDAQ:MU), currently trading near $105 per share, stands as a testament to the dynamic interplay between innovation and market realities. The company’s leadership in High-Bandwidth Memory (HBM), with revenues doubling sequentially in fiscal Q1 2025, underscores its critical role in driving AI-driven advancements. While DRAM, comprising 73% of revenue, continues to power growth with surging data center demand, challenges in the NAND segment, including a 5% quarterly decline, highlight the complexities of a volatile semiconductor market. Micron’s proactive measures, such as reducing wafer starts and optimizing costs, aim to stabilize margins and position the company for a recovery in the second half of fiscal 2025. The HBM market’s projected growth to over $100 billion by 2030 presents a significant long-term opportunity. Investors must weigh risks like cyclicality and competitive pressures but are presented with an attractive potential upside, as analysts estimate an intrinsic value of $119 per share. Micron’s strategic adaptability and commitment to innovation secure its place as a pivotal force in the rapidly evolving semiconductor industry, offering a compelling blend of resilience and growth potential in a data-driven era.