Micron Technology Stock NASDAQ:MU - Investment Opportunities and Risks

Evaluating Micron Technology's Recent Performance, Market Dynamics, and Future Outlook | That's TradingNEWS

Business Overview: Micron Technology (NASDAQ:MU)

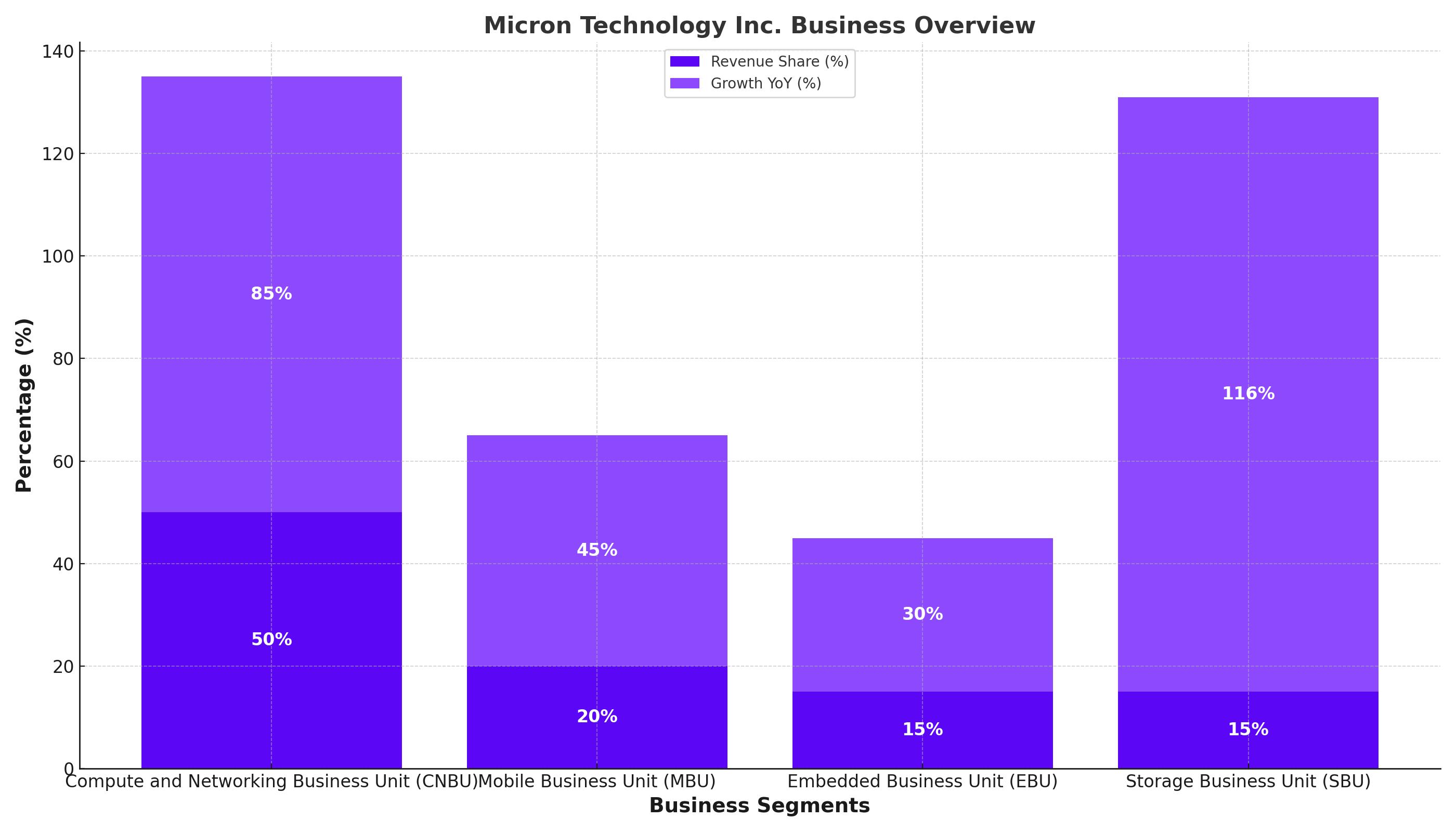

Micron Technology, Inc. (NASDAQ:MU) has experienced significant growth over the past year, buoyed by the booming demand for AI applications. The company designs, develops, manufactures, and sells memory and storage products worldwide through four primary segments: Compute and Networking Business Unit (CNBU), Mobile Business Unit (MBU), Embedded Business Unit (EBU), and Storage Business Unit (SBU). CNBU accounts for the largest share of revenue, followed by MBU. In 2023, Micron faced a challenging environment with a 49% decline in revenues, largely due to geopolitical tensions impacting its Chinese and Hong Kong markets.

Latest Results: Strong Recovery Amidst Challenges

In Q3 FY24, Micron reported a notable rebound with revenues reaching $6.8 billion, a substantial 82% YoY increase and a 17% sequential growth. The CNBU segment alone grew 85% YoY, while the Storage SBU surged 116%. Despite these impressive numbers, the stock experienced a 20% pullback post-earnings due to conservative guidance. Micron achieved a gross margin of 28% and a positive EPS of $0.62 for the quarter. The company projects Q4 revenues of $7.6 billion, a gross margin increase to 34.5%, and an EPS of around $1, reflecting around 11% quarterly growth.

AI-Driven Growth and Future Projections

Micron has significantly benefited from AI-driven demand, particularly in the data center segment. The company expects AI-related growth to continue, forecasting substantial revenue increases in FY25. Micron's strategic focus includes enhancing its product portfolio to meet the rising demand for AI PCs and smartphones, which are anticipated to drive revenue and margin improvements. The company's guidance highlights expected revenue growth and margin expansion, underscoring confidence in delivering a substantial revenue record in FY25.

Competitive Landscape: Micron vs. Nvidia

While Micron is riding the AI wave, it doesn't rival Nvidia in terms of growth and profitability. Nvidia's net margin stands over 53%, with consistent growth, contrasting with Micron's more volatile margins. Micron faces intense competition from major players like Samsung, impacting its market share and profitability. Despite these challenges, Micron's strategic investments in capital expenditures, including a $100 billion mega fab in New York and an $825 million facility in India, aim to position it better in the competitive landscape.

Market Dynamics: Memory Demand and Supply Trends

Micron is well-positioned to capitalize on the sustained AI investment cycle, which is expected to drive memory prices higher over the next several years. Key markets include data centers, PCs, mobile devices, and automotive sectors. The impending end-of-life for Windows 10 and the launch of Windows 12 are expected to spur significant PC upgrades, benefiting Micron. The normalization of data center inventories and the robust demand for AI applications are driving memory prices up, with DRAM and NAND ASPs increasing by approximately 20% sequentially in Q3.

Financial Health: Valuation and Key Metrics

Wall Street analysts project Micron to achieve an EPS of $9.53 in FY25, driven by a 54% YoY revenue growth to $38.6 billion. This positions Micron at a 13.7x FY25 P/E, making it an attractive buy under a ~15x P/E ratio. Despite its recent rally, Micron's valuation remains reasonable given the projected upcycle in the memory market fueled by AI and other demand drivers. The company's gross margin improved significantly from -16% in Q3 FY23 to 28% in Q3 FY24, with net income reaching $702 million compared to a loss in the previous year.

Technical Analysis: Navigating Market Trends

Micron's weekly chart shows a bearish divergence in the RSI, and the MACD is nearing a bearish crossover, indicating potential short-term weaknesses. Historically, the months of July, August, and September have been weak for Micron, suggesting possible further pullbacks. The 20 EMA has provided strong support, currently around $115, presenting a potential entry point for investors. Monitoring insider transactions via Micron Insider Transactions can provide additional insights into internal confidence in the company’s future performance.

Conclusion

Micron Technology, Inc. (NASDAQ:MU) offers a mixed investment opportunity. The stock has benefited from AI-driven demand, but its cyclical nature and competitive pressures warrant cautious optimism. Investors may find attractive entry points on pullbacks, particularly around the $115 level, supported by strong fundamentals and favorable long-term projections. For real-time updates and detailed stock performance, visit Micron Real-Time Chart.