Microsoft Corporation (NASDAQ:MSFT): Dominating Cloud and AI with $65.6B in Q4 Revenue

Azure’s 33% growth and AI’s $10B revenue milestone highlight Microsoft’s Q4 success, setting the stage for future innovation and market leadership | That's TradingNEWS

Microsoft Corporation (NASDAQ:MSFT) Analysis and Insights: A Long-Term Powerhouse Amidst Temporary Challenges

Microsoft Corporation (NASDAQ:MSFT) remains a cornerstone of the tech sector with its diversified portfolio and leadership in cloud computing, AI integration, and productivity solutions. The company’s Q4 FY2024 results showcased robust growth, with revenues surging 16% year-over-year to $65.6 billion and earnings per share climbing 10% to $3.30. These figures exceeded analyst expectations, reflecting Microsoft’s resilience and strategic positioning in high-growth markets like cloud computing and artificial intelligence.

Performance Highlights in Key Segments

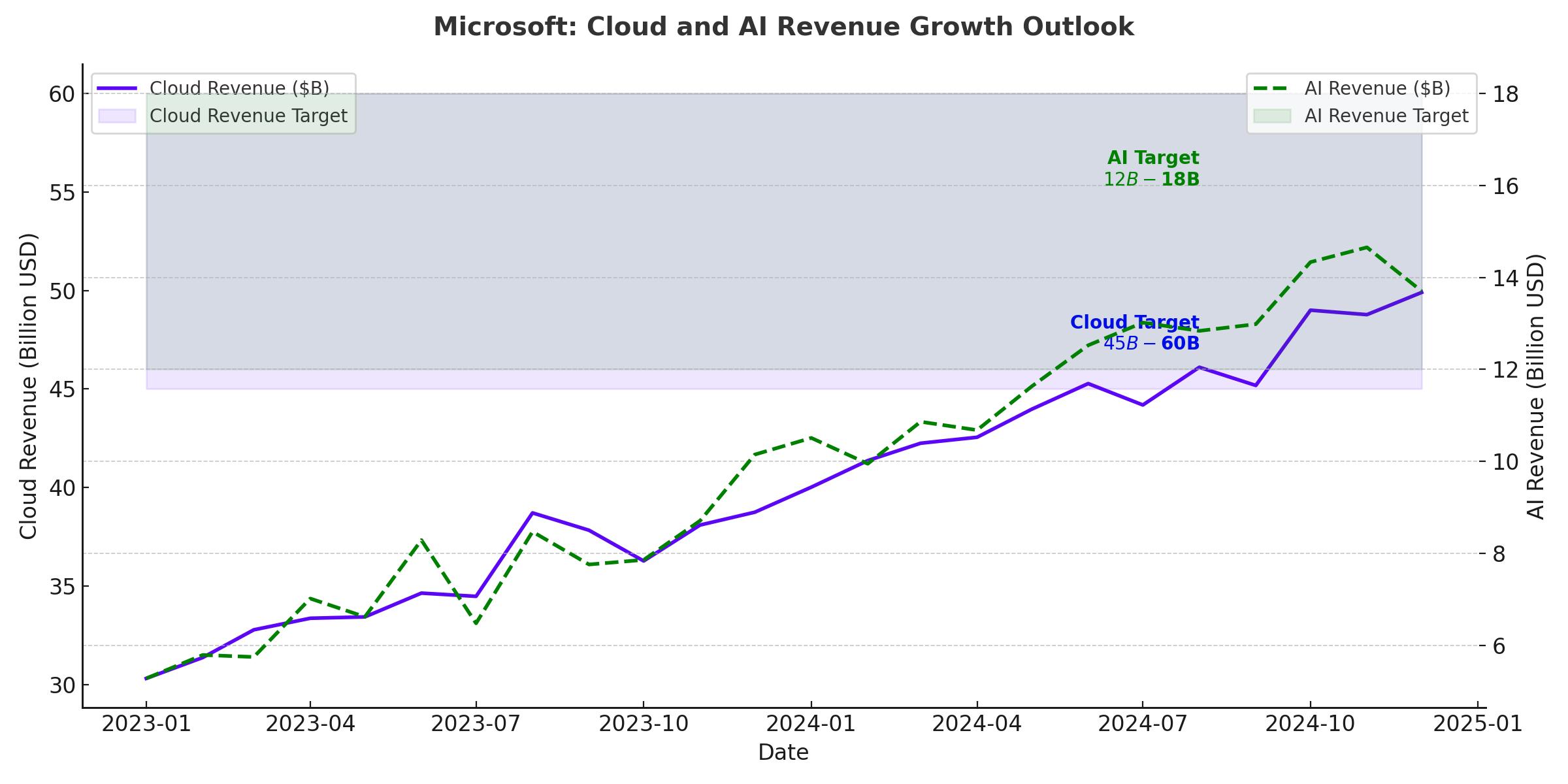

Microsoft Cloud continues to dominate, generating $38.9 billion in revenue for the quarter, a 22% increase compared to the prior year. Azure, the company’s flagship cloud service, grew by 33% in constant currency, with AI-related services contributing 12% of the growth. While Azure’s growth showed some deceleration due to capacity constraints, the company has plans to address these issues by expanding its data center footprint in the second half of FY2025. Notably, Microsoft’s AI initiatives, including its partnership with OpenAI, are projected to achieve a $10 billion annual revenue run rate next quarter.

The Productivity and Business Processes segment, which includes Microsoft 365, LinkedIn, and Dynamics 365, recorded $28.3 billion in revenue, up 12% year-over-year. Microsoft 365 Commercial Cloud saw a 16% revenue increase, bolstered by strong adoption of Copilot subscriptions, which are now utilized by 70% of Fortune 500 companies. LinkedIn also posted a 10% revenue growth, driven by higher engagement and increased demand for B2B advertising. Dynamics 365 revenue grew by 18%, showcasing the robust demand for AI-centric business applications.

More Personal Computing, which encompasses Windows, Surface, and Gaming, delivered $13.2 billion in revenue, up 17% year-over-year. Gaming led the charge with a 43% revenue surge, partly due to the successful integration of Activision Blizzard and the strong performance of Xbox Game Pass. However, the devices segment faced challenges, with declining revenues attributed to execution issues in the commercial sector.

Financial Strength and Shareholder Returns

Microsoft’s operational efficiency remains a standout feature, with a 47% operating margin and $34.2 billion in operating cash flow during the quarter. Despite a 7% decline in free cash flow to $19.3 billion, primarily due to increased capital expenditures for cloud and AI investments, the company returned $9 billion to shareholders through dividends and buybacks. These capital allocations highlight Microsoft’s commitment to balancing growth investments with shareholder value creation.

AI and Cloud: Strategic Investments for Long-Term Growth

Microsoft’s leadership in AI and cloud computing is reinforced by its ability to integrate these technologies across its product portfolio. GitHub Copilot has revolutionized software development, while Dynamics 365 Copilot is enhancing CRM and ERP processes. Security Copilot is addressing cybersecurity challenges, and the upcoming Copilot+ PCs promise to deliver advanced AI capabilities directly to consumers.

The company’s partnership with OpenAI and its intensified data center investments underscore its commitment to capitalizing on the generative AI boom. Azure’s reacceleration in the second half of FY2025 is expected to further solidify Microsoft’s cloud leadership.

Valuation and Growth Outlook

While Microsoft’s forward P/E of 34x may appear high, its robust growth prospects justify the premium valuation. Analysts project a 14.4% compound annual growth rate (CAGR) in revenue and a 14.6% CAGR in earnings per share through FY2027. With Azure and AI driving future growth, the company is well-positioned to exceed these conservative estimates.

Risks and Challenges

Microsoft Corporation (NASDAQ:MSFT) operates within a highly competitive and dynamic landscape, presenting several risks that investors must carefully consider. Azure’s capacity constraints, which caused a slowdown in growth to 31-32% for Q2 FY2025, underscore the strain on Microsoft’s infrastructure. The delay in third-party data center leases has further highlighted the need for better supply chain management. These limitations could cap Azure’s ability to fully capitalize on the generative AI boom in the near term.

Competition from industry giants such as Amazon Web Services (AWS) and Google Cloud remains intense. AWS maintains a dominant 33% share of the global cloud market compared to Azure's 20%, and Google Cloud, while smaller at 10%, is expanding rapidly with a 10.8% operating margin. This rivalry increases pricing pressure and necessitates continuous innovation to maintain market share.

Regulatory scrutiny adds another layer of complexity. Microsoft’s acquisitions, like Activision Blizzard, have faced global regulatory challenges, potentially slowing its strategic expansion. Furthermore, the company’s reliance on capital expenditures, which surged 55.8% year-over-year to $49.48 billion over the last 12 months, emphasizes its long-term growth strategy but also exposes execution risks. Delays or inefficiencies in deploying these assets could impact financial performance.

Investment Decision: A Compelling Buy

Despite these challenges, Microsoft’s robust fundamentals and long-term growth potential make it a standout opportunity for investors. In Q4 FY2024, Microsoft reported $65.6 billion in revenue (up 16% YoY) and $3.30 in earnings per share (up 10%), exceeding Wall Street expectations. These results underscore the company’s ability to execute even in a challenging environment.

Azure, despite its short-term constraints, remains a growth engine, with AI services contributing 12% of its recent growth. Microsoft’s AI revenue is on track to reach a $10 billion annual run rate, demonstrating the company’s leadership in monetizing generative AI. Its Productivity and Business Processes segment, which includes Microsoft 365 and LinkedIn, saw 12% growth year-over-year, with Microsoft 365 Commercial Cloud growing 16%. The company’s gaming segment also delivered impressive results, with revenue surging 43% year-over-year, supported by the acquisition of Activision Blizzard.

Microsoft’s valuation reflects its growth prospects. With a forward P/E of 34x and consensus projections for 14.4% annual revenue growth through FY2027, the company’s premium pricing is justified by its market leadership and operational excellence. However, the current price could present buying opportunities on pullbacks, particularly as Azure’s growth reaccelerates in the second half of FY2025 with new data center capacity coming online.

For long-term investors, Microsoft remains a compelling buy. Its $34.2 billion in quarterly operating cash flow and consistent capital returns, including $9 billion in dividends and buybacks last quarter, reflect financial strength and shareholder commitment. As the company continues to expand its AI and cloud offerings, it is well-positioned to deliver substantial value, making it a cornerstone investment for a diversified portfolio.

For up-to-date insights, explore Microsoft Real-Time Chart and Insider Transactions.