Microsoft (NASDAQ:MSFT) Rises as AI Leadership Secures Long-Term Growth - 870$ Stock Price Target 2030

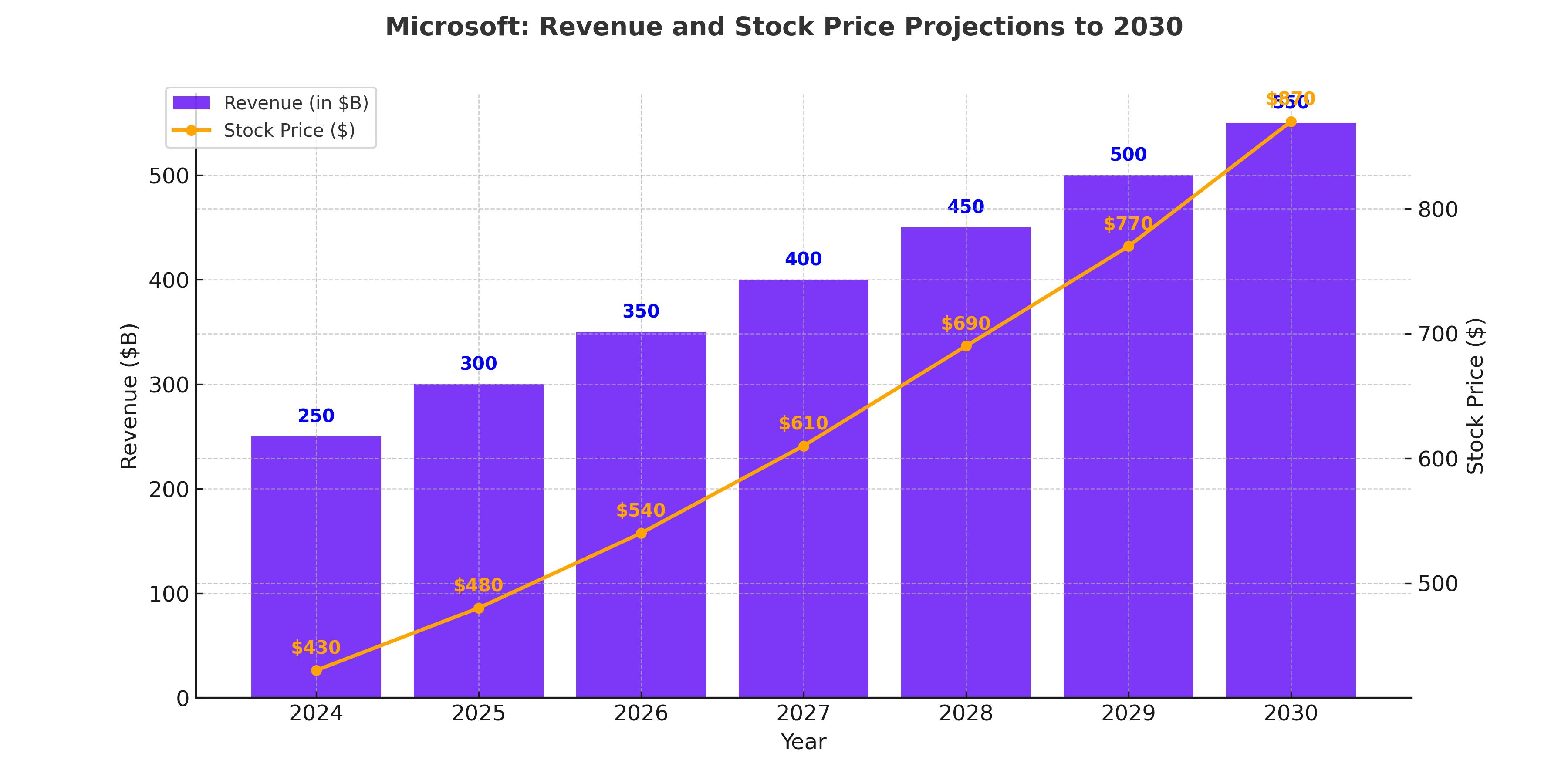

Microsoft Corporation (NASDAQ:MSFT) continues to dominate the tech sector with strategic leadership under CEO Satya Nadella, leveraging AI, cloud computing, and gaming to sustain robust growth. At its current price of $430, MSFT is poised for significant upside potential, with a projected price target of $870 by 2030, reflecting a compound annual growth rate (CAGR) of 15%. Backed by $500 billion in revenue projections by FY2030, its long-term growth outlook remains intact, solidified by investments in AI through OpenAI and its Azure cloud platform.

Microsoft’s AI Leadership: A $13 Billion Investment Driving Growth

Microsoft’s $13 billion stake in OpenAI has catalyzed its leadership in artificial intelligence. This strategic investment is paying off, with AI services generating $10 billion in annual recurring revenue (ARR) by Q2 FY2025. Integration of OpenAI’s GPT technology into Microsoft 365 Copilot has redefined enterprise productivity, enabling businesses to streamline operations and optimize outcomes. Azure’s 31.5% constant currency growth further underscores Microsoft’s success in capitalizing on AI demand, solidifying its competitive edge.

Azure’s position as the second-largest cloud platform, commanding 20% market share, makes it indispensable for enterprises. The platform seamlessly integrates with Microsoft 365, providing unparalleled value through a unified ecosystem. With its cloud services driving revenue growth, Microsoft is leveraging its technological infrastructure to meet AI-driven market needs, ensuring long-term relevance.

Activision Blizzard Acquisition: A Transformative Growth Catalyst

Microsoft’s $69 billion acquisition of Activision Blizzard is reshaping its gaming segment. The addition of iconic franchises like Call of Duty and World of Warcraft has strengthened its position in the $350 billion global gaming market. Gaming contributed $2 billion in additional revenue in FY2024, with cloud gaming expected to unlock further opportunities as Activision titles integrate into Microsoft’s ecosystem. This acquisition positions Microsoft as a leader in gaming-as-a-service, a burgeoning industry with significant growth potential.

Despite initial integration costs, including a $440 million operating loss due to restructuring, Activision’s alignment with Microsoft’s cloud infrastructure will drive future profitability. By leveraging Azure for cloud gaming, Microsoft is setting a new standard in how gaming is accessed and delivered globally.

Valuation: $870 Price Target by 2030

Microsoft’s valuation reflects its growth potential. By FY2030, the company is projected to achieve $500 billion in revenue, supported by its AI and cloud expansions. With a 37.5% net margin and an anticipated $26 EPS, the stock is poised to reach $870 at a forward P/E ratio of 33.5x. Even with conservative assumptions, Microsoft offers a substantial margin of safety, with intrinsic value estimated at $530.

Azure’s continued expansion, driven by $80 billion in planned data center investments, underscores its critical role in Microsoft’s growth strategy. These investments aim to enhance data center capacity, meeting escalating demand for AI workloads. Such strategic moves ensure Microsoft’s continued dominance in the AI and cloud sectors.

Risks and Mitigation

While Microsoft’s fundamentals are strong, risks remain. Competition from Google’s Gemini AI and Amazon’s AWS could impact Azure’s market share. Additionally, the $80 billion CAPEX plan raises questions about short-term profitability. However, Microsoft’s robust free cash flow of $122 billion annually mitigates these concerns, ensuring financial flexibility to sustain aggressive investments.

Another potential risk is regulatory scrutiny, particularly in the wake of the Activision Blizzard acquisition. Antitrust challenges could influence Microsoft’s operational strategy. However, the company’s ability to navigate complex regulatory landscapes underscores its resilience.

Conclusion: A Buy with Strong Long-Term Potential

Microsoft (NASDAQ:MSFT) remains a top-tier investment with its strategic focus on AI, cloud, and gaming. The company’s leadership in AI, powered by its OpenAI investment, and its Azure platform’s growth trajectory position it as a market leader. The Activision Blizzard acquisition further diversifies its revenue streams, aligning with its broader strategic goals.

With a projected price target of $870 by 2030, representing a 15% CAGR, Microsoft offers a compelling mix of stability and growth. Its focus on innovation, coupled with strong financial fundamentals, makes MSFT an essential component of any long-term investment portfolio.