Microsoft (NASDAQ:MSFT): Racing Toward $500 on AI and Gaming Explosion

With AI revenue smashing $10B and cloud dominance surging, Microsoft sets the stage for a $500 stock price and unstoppable momentum! | That's TradingNEWS

Microsoft (NASDAQ:MSFT) Powers Ahead Amid Growth, Innovation, and Challenges

Microsoft’s Essential Business Model and Robust Growth

Microsoft Corporation (NASDAQ:MSFT) remains one of the most indispensable technology companies in the world, supporting global industries with essential tools like Microsoft Office, Azure, Windows, and the recently integrated Activision gaming portfolio. Its business model, anchored in high-recurring revenues and immense scalability, has driven consistent growth for over a decade. With a 10-year revenue compound annual growth rate (CAGR) of 10.9%, alongside free cash flow growth at 10.47% over the same period, Microsoft showcases unparalleled financial strength. Its return on equity (ROE) averages 34.6%, while its return on invested capital (ROIC) reaches 24.7%, reflecting disciplined capital allocation and effective scaling of business lines.

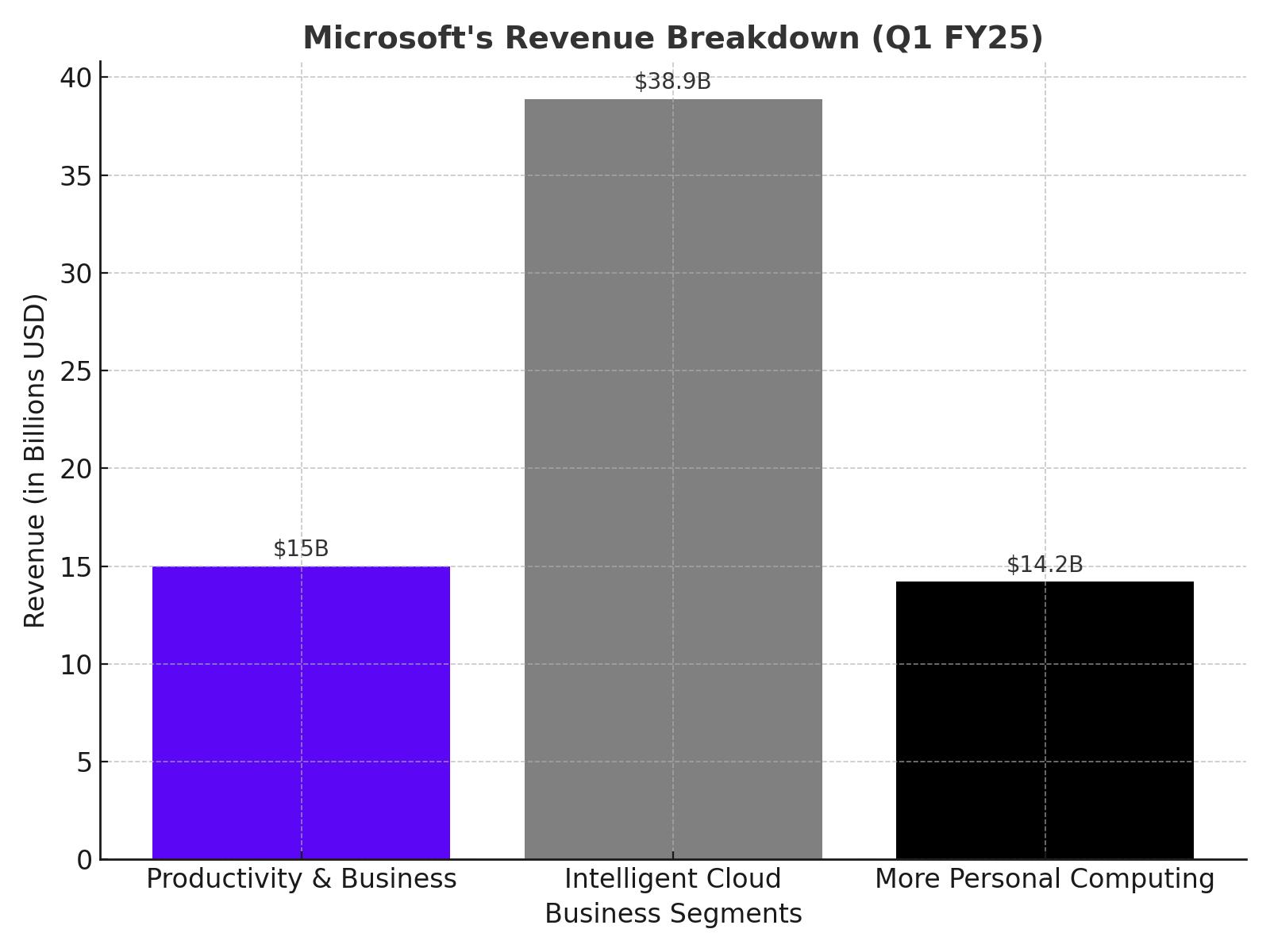

In Q1 FY25, Microsoft's revenue streams exhibited strong performance across segments: Productivity and Business Processes rose 12% year-over-year, Intelligent Cloud grew 20%, and More Personal Computing expanded 17%. This growth was complemented by a 14% rise in operating income and an operating margin of 47%, affirming Microsoft’s efficiency despite increased capital expenditures in its cloud division. As Microsoft continues to deepen its cloud footprint, management forecasts decelerating CapEx growth while cloud revenues accelerate—a bullish indicator for long-term profitability.

Cloud and AI Drive Future Expansion

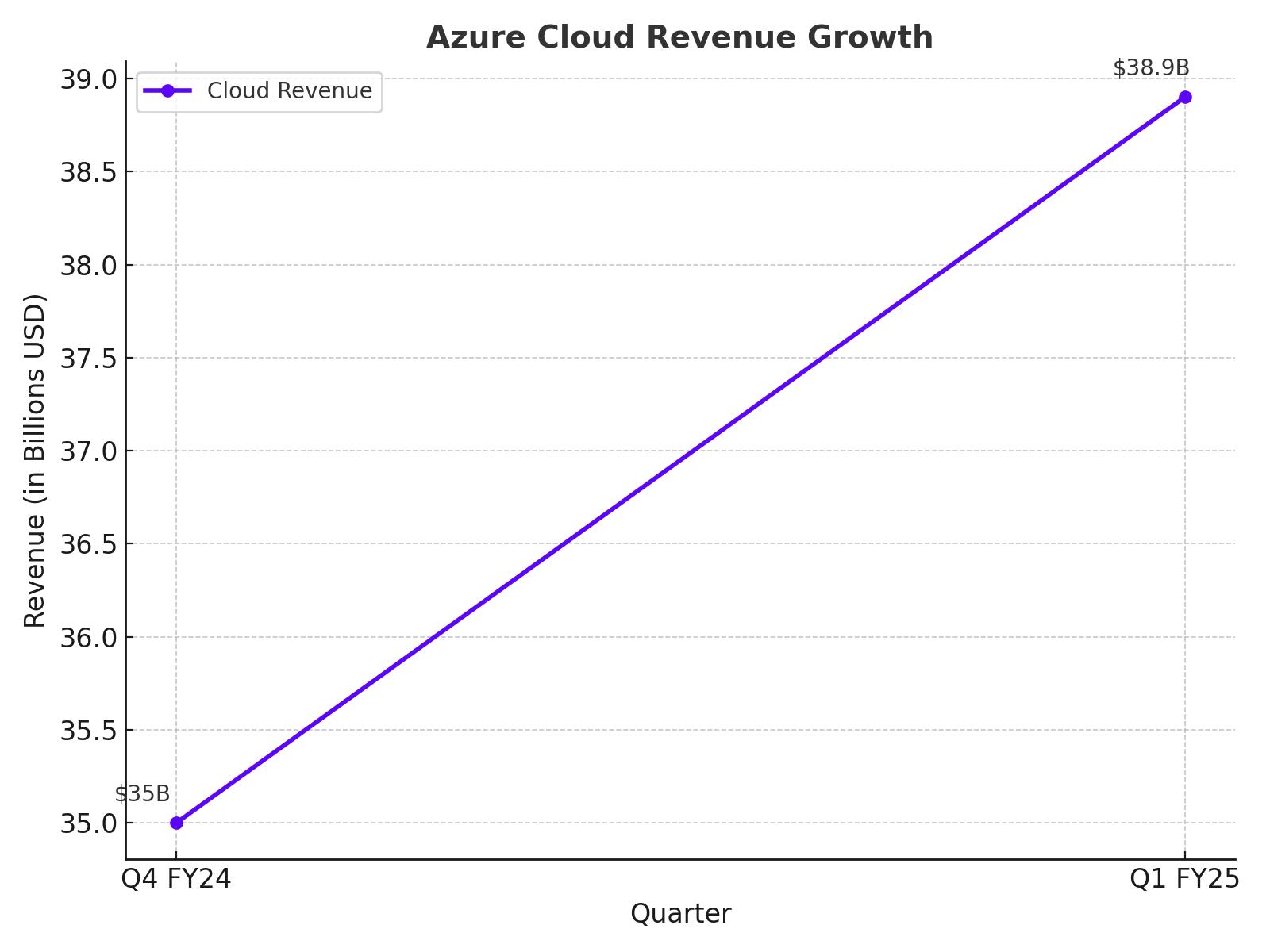

Microsoft’s Azure has solidified its leadership in the cloud computing market, capturing 20% of the global market share as of Q3 2024. The Intelligent Cloud division, which includes Azure, reported $38.9 billion in revenue in the latest quarter—a year-over-year increase of 22.3%. This momentum stems from increased customer adoption of AI-driven solutions, including Azure OpenAI services, Microsoft Security Copilot, and enhanced collaboration tools within Microsoft 365.

The integration of AI across Microsoft's product suite has positioned the company as a transformative leader in the artificial intelligence ecosystem. AI-related revenues are projected to contribute $10 billion annually, setting a record pace for any new revenue stream in Microsoft’s history. The management's investments in OpenAI, including a multi-billion-dollar stake, further reinforce Microsoft’s role in advancing generative AI capabilities.

Activision Acquisition Fuels Gaming Ecosystem Growth

The $69 billion acquisition of Activision Blizzard marks a critical step in expanding Microsoft’s presence in the gaming sector. By integrating Activision’s content, Microsoft has bolstered its Game Pass subscription service, creating a more robust ecosystem of gaming and cloud offerings. Gaming revenue increased by 10% in Q1 FY25, underscoring the success of this strategic move.

Microsoft’s gaming ambitions are part of a broader diversification strategy. With gaming now contributing a meaningful share to total revenue, Microsoft strengthens its moat in an increasingly competitive sector. The alignment of gaming with its cloud strategy also opens pathways for further monetization through streaming and AI-driven gaming solutions.

Navigating Regulatory Challenges

Despite regulatory scrutiny from the Federal Trade Commission (FTC) over its licensing and cloud business practices, Microsoft’s fundamentals remain resilient. The stock trades at $422.89 as of the latest session, representing a modest 3% gain over the past month, even amid regulatory uncertainties. Analysts like Wedbush’s Daniel Ives maintain an “Outperform” rating with a $550 price target, arguing that the FTC probe will likely have minimal impact under a potential new chair.

Furthermore, Barclays’ $475 price target highlights the limited financial exposure Microsoft faces from Bing-related antitrust issues. Bing comprises just 5% of Microsoft’s projected 2024 revenue, mitigating risks from ongoing Department of Justice (DOJ) investigations.

Valuation and Shareholder Returns

Microsoft’s valuation reflects its growth potential, trading at a forward price-to-earnings (P/E) ratio of 32x—aligned with its historical averages. While its FWD PEG ratio of 2.42x suggests a slight premium compared to peers like Amazon and Alphabet, the company's unmatched diversification, operational efficiency, and cash flow generation justify this valuation.

Shareholder returns have been a cornerstone of Microsoft’s strategy. With a 10% CAGR in dividends per share over the past decade, Microsoft provides stable income alongside growth. Additionally, its $49.48 billion LTM CapEx investment underscores its commitment to long-term value creation.

Bullish Outlook Amid Key Catalysts

Looking ahead, Microsoft’s strategic initiatives position it for sustained growth. The company’s guidance suggests accelerating Azure growth in H2 FY25, supported by expanded AI capacity and the ongoing NVIDIA production ramp. The long-term prospects of AI monetization, coupled with robust multi-year RPO growth of 23.1% year-over-year, indicate a clear path to achieving the consensus price target of $555.80.

Microsoft’s cloud dominance, AI leadership, and operational excellence ensure it remains a reliable investment for long-term growth. While short-term regulatory challenges may create noise, the company’s innovation and execution provide a compelling case for maintaining a bullish stance on NASDAQ:MSFT. Explore more about Microsoft’s real-time performance here.