Microsoft (NASDAQ:MSFT): Strong Buy with 25% Upside Potential

Analysts see Microsoft stock as a strong buy, forecasting 25% upside driven by continued dominance in AI, cloud computing, and resilient financial performance | That's TradingNEWS

Microsoft (NASDAQ:MSFT) Demonstrates Resilience Amid Market Challenges

Rebounding from the CrowdStrike Setback

Microsoft (NASDAQ:MSFT) recently faced a significant challenge when a software update from cybersecurity firm CrowdStrike (NASDAQ:CRWD) caused disruptions across over 8.5 million devices globally. The event, which particularly impacted critical sectors like healthcare and transportation, led to a temporary dip in Microsoft’s stock, dropping over 6%. However, the swift recovery of the stock within a week highlights the robustness of Microsoft’s position in the market.

Historically, Microsoft has shown an ability to navigate through various crises, including antitrust battles and product failures. This incident is no different, as the company has already initiated discussions on improving system stability by potentially restricting third-party access to the Windows kernel. This proactive approach ensures that Microsoft remains focused on long-term growth and stability, even in the face of unexpected setbacks.

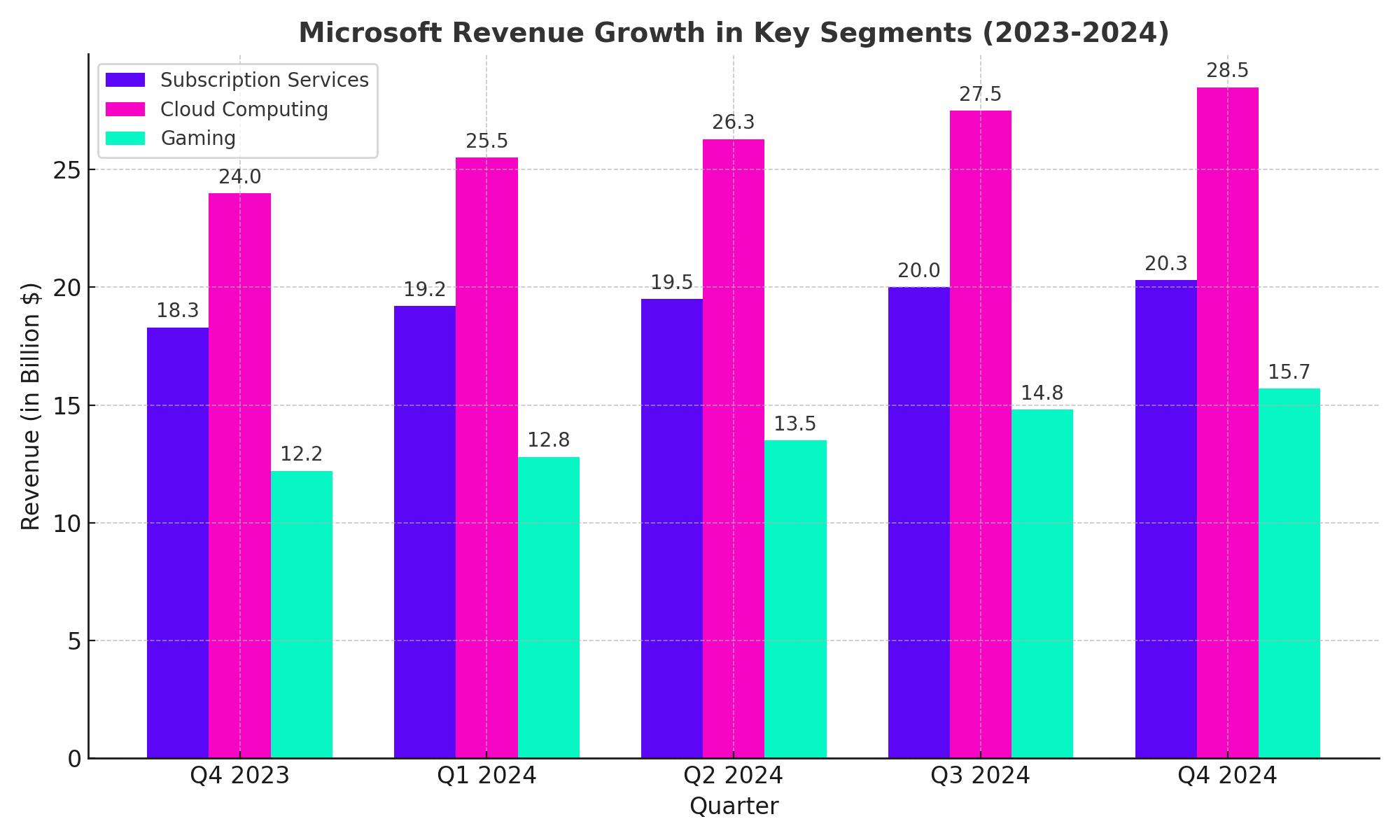

Three Pillars of Growth: Subscriptions, Cloud Computing, and Gaming

Microsoft's recent fiscal Q4 2024 earnings report underscored the company's strength across its three core business pillars: subscription services, cloud computing, and gaming. Revenue surged 15% year-over-year to $64.7 billion, driven by these key segments.

Subscription Services: The Productivity and Business Processes segment, which includes Office 365, saw an 11% increase in sales, reaching $20.3 billion. Office 365 alone grew by 13%, demonstrating the critical role of subscription services in providing stable, recurring revenue.

Cloud Computing: Azure, Microsoft's cloud computing platform, continues to be a strong growth driver. Despite some challenges, Azure posted a 29% increase in sales, contributing to a 19% overall growth in the Intelligent Cloud segment, which now generates $28.5 billion in revenue. This growth is crucial as Microsoft continues to gain market share in the cloud industry, competing closely with Amazon Web Services (AWS).

Gaming and Metaverse: Microsoft's acquisition of Activision Blizzard has significantly bolstered its position in the gaming and metaverse markets. Xbox content revenue jumped by 61%, even as hardware sales declined. This shift towards a focus on gaming software and subscriptions reflects Microsoft's strategic pivot to high-growth areas.

Azure’s Growth and the Future of AI

Azure's performance in Q4 highlighted the importance of AI in driving future growth. Despite experiencing slower-than-expected growth, with revenue rising 29% compared to the previous quarter's 31%, Azure remains a critical component of Microsoft's long-term strategy. The company’s heavy investment in AI-related technologies, including partnerships with companies like OpenAI and substantial capital investments in data centers, positions Azure as a leader in the AI space.

Microsoft’s AI capabilities have also helped Azure increase its market share to 25%, up from approximately 19% three years ago. While AWS continues to lead with a 31% market share, Azure’s rapid growth underscores its potential to become the dominant player in the cloud industry.

Strategic Investments and Financial Strength

Microsoft's financial health remains robust, with a $75 billion cash reserve providing significant flexibility for acquisitions and investments. The company’s levered free cash flow reached $12.4 billion in Q4, even after a $5 billion year-over-year increase in capital expenditures (CAPEX). This financial strength enables Microsoft to continue its aggressive investment in AI and cloud infrastructure.

The company's recent partnership with Palantir Technologies (NYSE:PLTR) to enhance AI and analytics capabilities for U.S. defense and intelligence communities further emphasizes Microsoft's commitment to expanding its AI footprint. This collaboration, along with ongoing investments in data centers and AI hubs globally, reflects Microsoft's strategic focus on capitalizing on the growing demand for AI-driven solutions.

Valuation and Market Position

Despite its strong performance, Microsoft’s valuation remains a point of discussion among investors. The stock trades at a forward P/E ratio of 30x, which, while high, is justified by the company’s leading position in high-growth markets like AI and cloud computing. Comparatively, Amazon (NASDAQ:AMZN) trades at a P/E of 34.3x, and Apple (NASDAQ:AAPL) at 31.5x, making Microsoft’s valuation competitive given its diversified revenue streams and strong margins.

Wall Street analysts maintain a bullish outlook on Microsoft, with a consensus rating of "Strong Buy." The stock’s average price target of $503.19 implies a 25% upside potential, reflecting confidence in Microsoft’s long-term growth prospects, particularly as AI investments begin to translate into tangible revenue gains.

Risk Factors and Competitive Landscape

While Microsoft’s outlook remains positive, investors should be aware of potential risks. The recent global service outage, though linked to CrowdStrike, has highlighted the cybersecurity risks associated with large tech companies like Microsoft. Additionally, the intense competition in the AI and cloud markets, particularly from Google’s (NASDAQ:MSFT) rapidly growing cloud services, presents a challenge. Google Cloud’s 28.8% revenue growth in Q2 indicates that Microsoft cannot afford to be complacent.

Furthermore, Microsoft faces ongoing antitrust scrutiny, particularly in Europe, where it has been charged with anti-competitive practices related to its Teams app. These regulatory challenges could result in substantial fines and affect the company’s bottom line.

Conclusion

Microsoft (NASDAQ:MSFT) continues to demonstrate remarkable resilience and growth potential, driven by its strong position in subscription services, cloud computing, and gaming. While recent challenges, including the CrowdStrike incident and slower-than-expected Azure growth, have raised concerns, the company’s strategic investments in AI and its robust financial health make it well-positioned for long-term success. Investors should remain confident in Microsoft’s ability to navigate market challenges and capitalize on future growth opportunities.