Microsoft's Potential Upside - A Comprehensive Investment Outlook

Unveiling Microsoft's potential in AI and cloud sectors, highlighting its financial strengths and the promising upside of its stock amidst technological advancements | That's TradingNEWS

Microsoft (NASDAQ:MSFT): Investment Outlook and Strategic Growth Prospects

Expanding Horizons in Cloud and AI

Microsoft is solidifying its leadership in the technology sector, particularly through expansions in its Azure cloud services and artificial intelligence (AI) capabilities. Noteworthy is the company's strategic investment focus, highlighted by a significant increase in capital expenditures, reaching $14 billion in the recent fiscal quarter. These investments are primed to enhance Microsoft's long-term growth, particularly in its AI operations, which are becoming central to its service offerings.

Robust Financial Performance and Stock Valuation

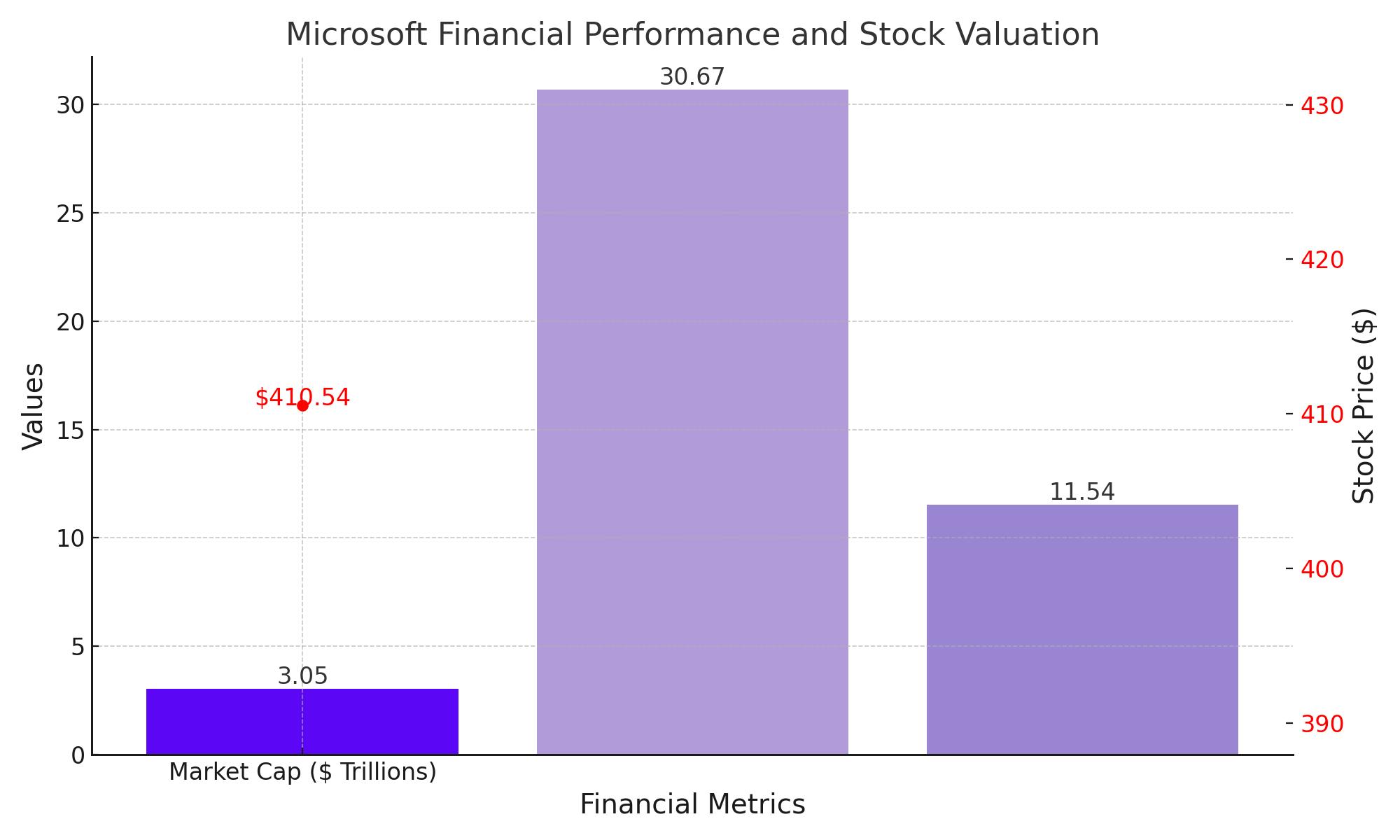

Microsoft's stock currently trades at approximately $410.54, showing a positive uptrend with an 18% increase year-to-date. The company boasts a forward Price-to-Earnings (P/E) ratio of 30.67, indicating a reasonable valuation given its growth trajectory and industry positioning. With a market capitalization nearing $3.051 trillion and earnings per share (EPS) of $11.54, Microsoft demonstrates significant financial health and consistent profitability.

Diverse Revenue Streams and Operating Efficiency

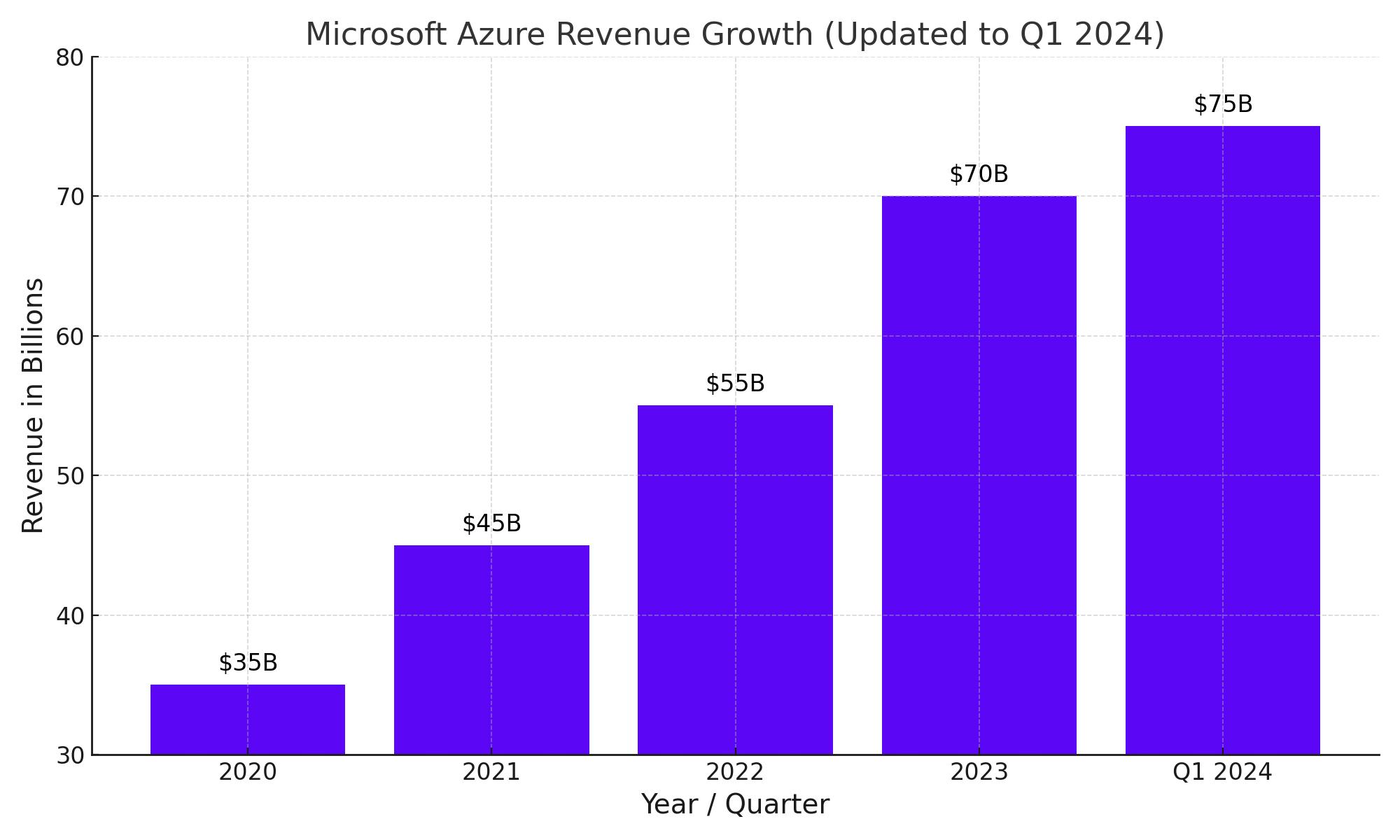

Microsoft's financial strength is further highlighted by its diverse revenue sources, especially from Azure, which has seen a revenue increase of 31% year-over-year, surpassing growth rates of competitors like AWS and Google Cloud. This growth emphasizes strong demand and efficient customer acquisition and retention strategies. The company's operating margin stands impressively at 44.59%, illustrating effective cost management and operational efficiency.

Investment Recommendation: Strong Buy

The investment case for Microsoft is compelling for several reasons:

- Continued Revenue Growth: Microsoft's aggressive expansion in AI and cloud computing is expected to drive significant revenue increases. Azure alone has established a $100 billion annual revenue run rate.

- Strategic Market Positioning: Continuous innovation and investment in AI position Microsoft to capitalize on emerging technological trends, securing its market dominance.

- Solid Financial Metrics: With a robust operating margin and a healthy balance sheet, Microsoft is well-equipped to sustain profitability and shareholder returns.

Price Target and Market Performance

Analysts maintain a bullish outlook on Microsoft, with a target price averaging $472.18 per share, reflecting confidence in its strategic initiatives and market execution. This price target suggests a potential upside from the current levels, based on Microsoft’s operational success and market expansion strategies.

In conclusion, Microsoft represents a strong buy opportunity based on its strategic market advancements, financial resilience, and substantial growth potential in pivotal areas like AI and cloud computing. Investors are advised to consider the long-term benefits of Microsoft's innovative platform and robust financial health, which are likely to deliver considerable returns.