MicroStrategy (NASDAQ:MSTR): Riding Bitcoin’s Wave or Teetering on Risk?

With over 450,000 BTC and a stock price climbing 609% YTD, is MSTR the ultimate crypto stock? | That's TradingNEWS

MicroStrategy’s (NASDAQ:MSTR) Bitcoin-Driven Evolution

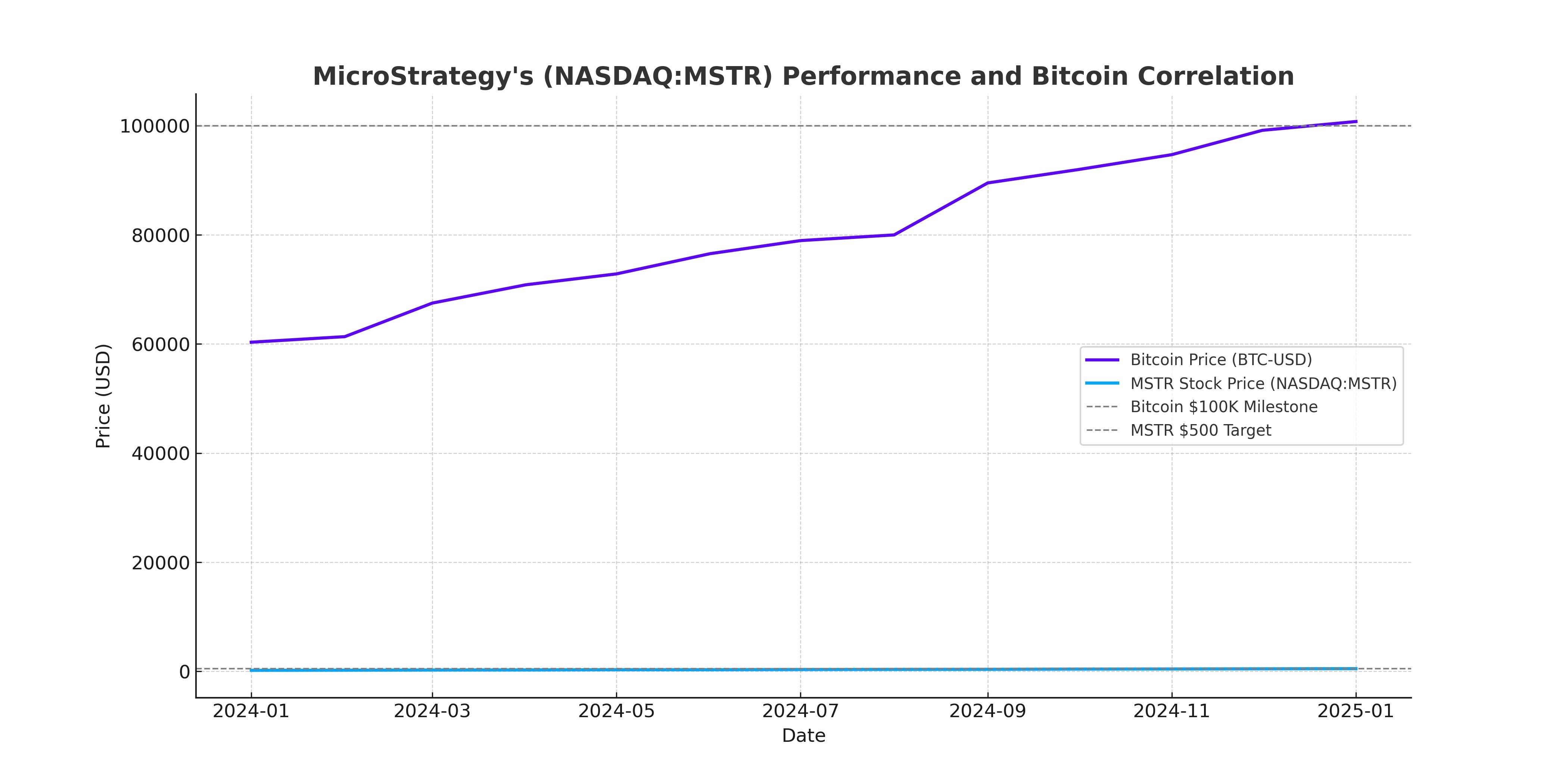

MicroStrategy Incorporated (NASDAQ:MSTR), renowned for its software and business intelligence solutions, has redefined its identity through an aggressive Bitcoin acquisition strategy. With over 450,000 BTC held at an average purchase price of $62,473 per coin, the company’s valuation has become deeply intertwined with Bitcoin’s performance. At a current market price of approximately $95,972 per BTC, this strategic reserve is valued at over $43.68 billion, underscoring the significant correlation between Bitcoin trends and MSTR's stock trajectory.

NASDAQ:MSTR Stock Performance and Market Trends

MSTR has gained over 609% year-to-date, climbing to around $342.17 as of late January 2025. This remarkable rally highlights the company’s ability to leverage Bitcoin’s volatility for stock appreciation. Yet, this growth has not been without setbacks. Despite a stellar 2024, MSTR experienced a 15% dip in December while Bitcoin’s price remained relatively stable, reflecting concerns over the company’s evolving financial strategies.

The company’s trading volume also rivals major tech players, often exceeding that of Microsoft and Meta, further illustrating investor interest in its high-volatility profile. MicroStrategy’s implied volatility of 104 surpasses even Tesla’s, positioning it as a favorite for speculative trading.

Bitcoin’s Impact on MSTR’s Strategic Positioning

As the largest corporate Bitcoin holder, MicroStrategy’s success is inherently linked to the cryptocurrency market. The recent purchase of 2,530 BTC for $243 million showcases its commitment to this strategy. The firm’s 21/21 initiative—aiming to raise $21 billion in equity and debt—underscores its aggressive pursuit of Bitcoin acquisitions.

Despite the apparent alignment with Bitcoin’s upward momentum, challenges arise from the company’s high debt load, which now exceeds $4.2 billion. The potential for shareholder dilution remains a pressing concern, particularly with plans to increase authorized shares from 330 million to 10.33 billion.

Technical Analysis: Will MSTR Reclaim $1,000?

From a technical perspective, MSTR appears poised for further gains. The MACD indicator suggests a bullish crossover, while the RSI remains in neutral territory, leaving room for upward momentum. Key resistance levels include $400 and $613, with analysts from Cantor Fitzgerald projecting a price target of $613, signifying potential upside of over 70%. A breach of these levels could pave the way toward $1,000, supported by a resurgence in Bitcoin’s price.

Market Sentiment and Future Projections

MicroStrategy’s performance remains tightly intertwined with Bitcoin’s market trajectory. A potential breakthrough of the $100,000 threshold for Bitcoin could significantly boost MSTR’s value, given its extensive BTC holdings worth approximately $43.68 billion. However, heightened regulatory scrutiny under the Trump administration could introduce new challenges, especially if policy changes impact corporate crypto holdings or broader market sentiment. Moreover, rising interest rates could strain the company’s debt-heavy strategy, while shareholder dilution looms as an ongoing concern. Yet, these risks are balanced by the company’s innovative approach to maximizing its Bitcoin reserves, which positions it as a leader in corporate cryptocurrency adoption.

Strategic Risks and Opportunities

MicroStrategy’s outlook is inextricably tied to Bitcoin’s price movements and overall market dynamics. With Bitcoin currently trading around $95,972, any upward trajectory toward the pivotal $100,000 mark could significantly bolster MSTR’s stock performance. However, this dependence also introduces substantial risks. Regulatory shifts under the Trump administration, including potential policy changes targeting crypto-related companies, add an extra layer of uncertainty. Heightened scrutiny and the evolving regulatory environment could challenge MicroStrategy’s bold Bitcoin strategy. Nonetheless, the possibility of Bitcoin breaching the six-figure mark creates an unparalleled opportunity for MSTR to capture outsized gains, positioning itself as a leader in the corporate crypto space while navigating these challenges.

Final Considerations for NASDAQ:MSTR

MicroStrategy’s aggressive Bitcoin acquisition strategy offers a unique growth narrative, with the potential for its stock to significantly outperform if Bitcoin rallies further. At its current trading price of $359, MSTR presents an enticing opportunity for investors who share the company’s bullish stance on cryptocurrency. However, this comes with the inherent volatility of both Bitcoin and the equity markets. While the prospect of Bitcoin surpassing $100,000 could propel MSTR toward new highs, the associated risks require a thorough evaluation. For those willing to embrace volatility, MSTR remains a high-stakes, high-reward investment tied to the future of digital assets.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex